Top 25 Lower Middle Market Investment Banks | Q1 2024

Axial is excited to release our Q1 2024 Lower Middle Market Investment Banking League Tables. To assemble this list, we…

Tags

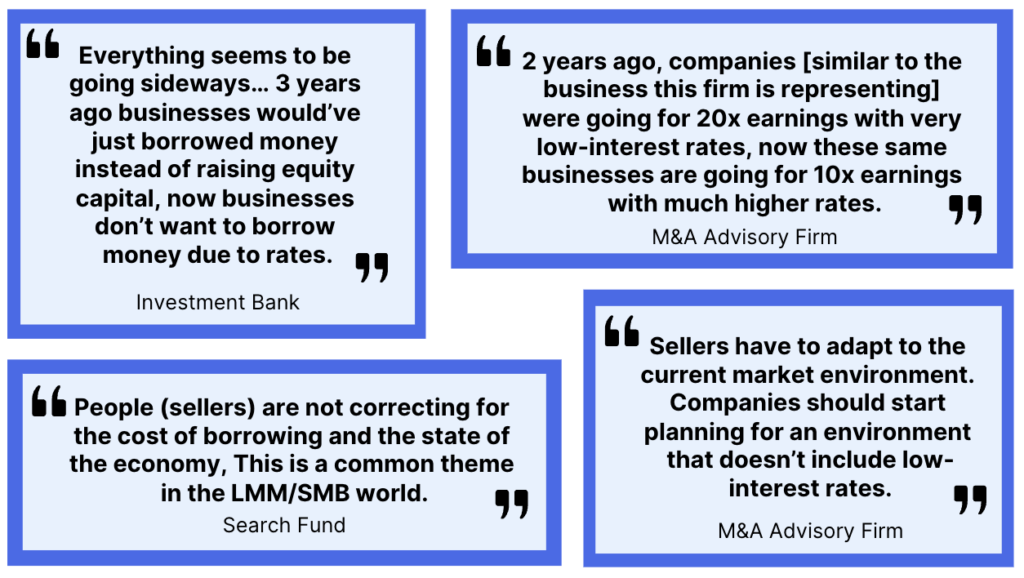

Over the past 6 months, the business development team at Axial held 5,301 calls and in-person meetings with our members across the buy and sell-side. In these conversations, we heard expert opinions on the shifting trends of the lower middle market.

This report analyzes calls with Axial’s top dealmakers and shares the rumblings of the lower middle market. The findings and insights from these conversations are summarized across a few key themes:

The tightening of credit markets has created significant challenges for borrowers, particularly as bank and non-bank lenders have increased rates and shortened term lengths for loans. Lenders have increasingly adopted a “risk off” mentality, becoming more cautious in their lending practices. This shift is largely in response to the anticipation of economic shifts, leading to more stringent underwriting strategies.

In light of this tightening, many borrowers are exploring different credit firms to better understand what rates and terms are available from private credit firms.

There are over 150 private credit firms on the Axial platform. To connect, get started here.

In 2023, elevated interest rates and economic uncertainty have put pressure on business valuations. This has led to a shift in supply-demand dynamics, which has impacted M&A activity. Anecdotally, buyers have become more cautious and have exercised more patience to seek out high-quality opportunities. On the sell-side, advisors reported that owners have been less eager to enter the market due to declining asset valuations.

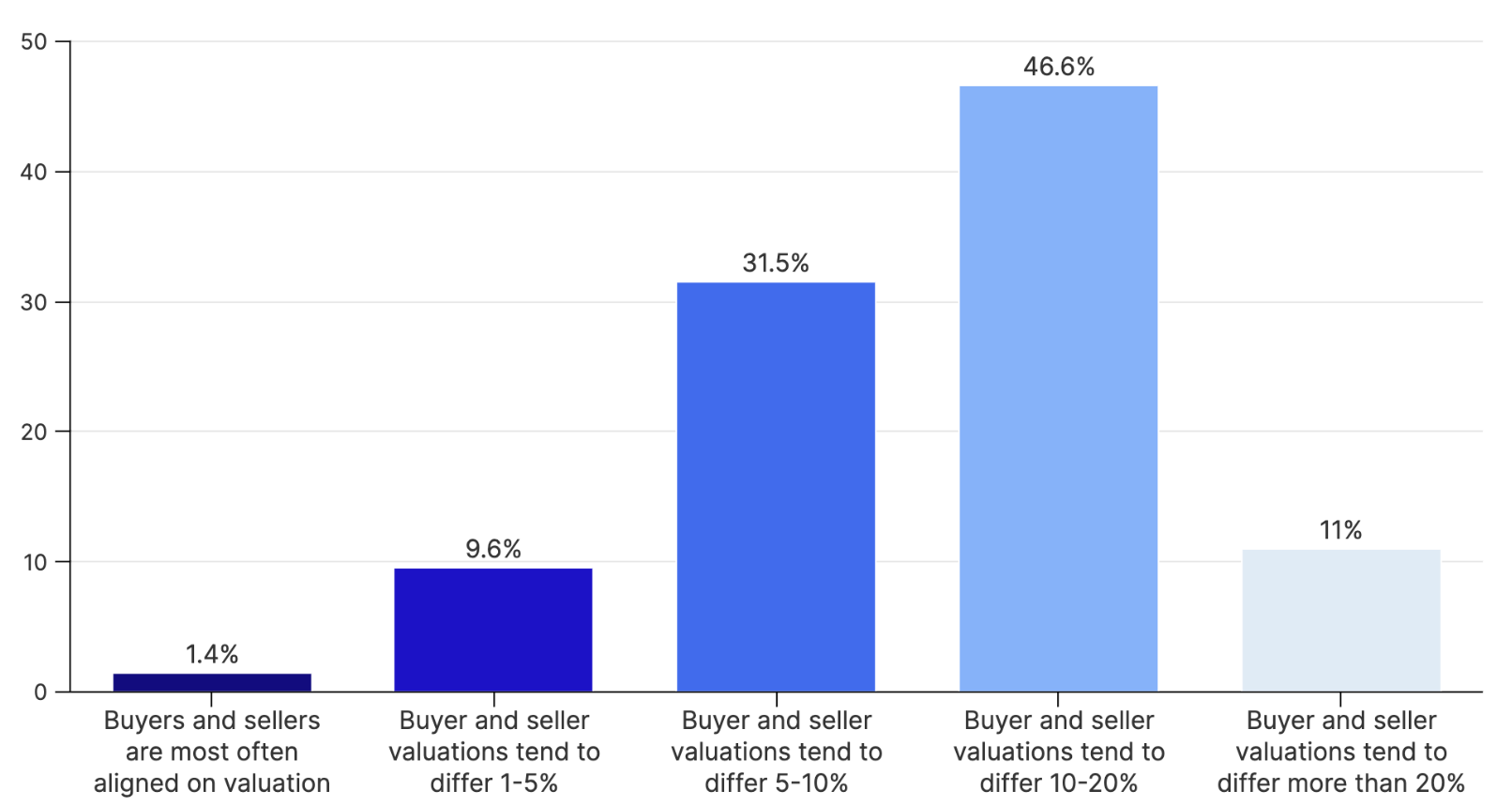

We recently surveyed the Axial Investment Bank membership on the topic of exit preparation. Out of the 73 investment bankers who participated in the survey, only 1.4% indicated a frequent alignment between buyers and sellers on valuation, and more than 56% expressed the belief that valuations commonly deviate by 10% or more.

On average, how large is the valuation gap between buyers and sellers in today’s market?

Read more on the survey findings here – Valuation Expectations | Buyers vs. Sellers

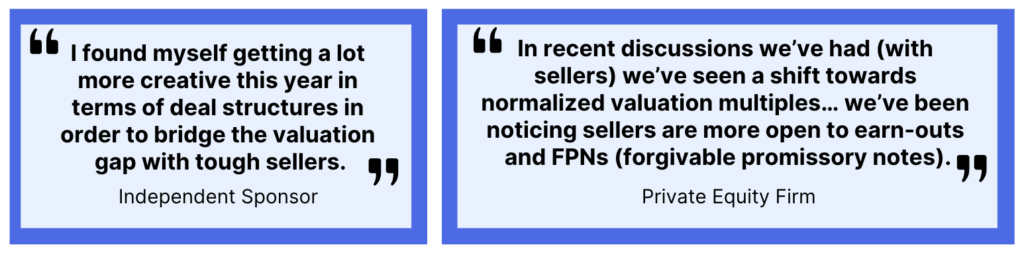

The M&A landscape is witnessing a shift towards more highly structured deals. This movement is characterized by increases in seller financing and earnouts – both strategies that help offset cash required at closing when working with sellers who maintain high valuation expectations in the current market. In light of tighter credit markets and higher interest rates, buyers are more inclined to conserve upfront cash. Structured deals allow them to defer a significant portion of the payment, easing immediate financial strain.

We recently compiled the first 25 issues of The Winning LOI – the Axial newsletter series that anonymously reveals small business M&A valuation data and certain key deal terms associated with winning LOIs. The move toward more highly structured deals was evident in the 25 LOIs reviewed.

The Winning LOI eBook | Vol. 1, No. 1-25

If you’d like to review the details of each of the 25 LOIs, please enter your email below.

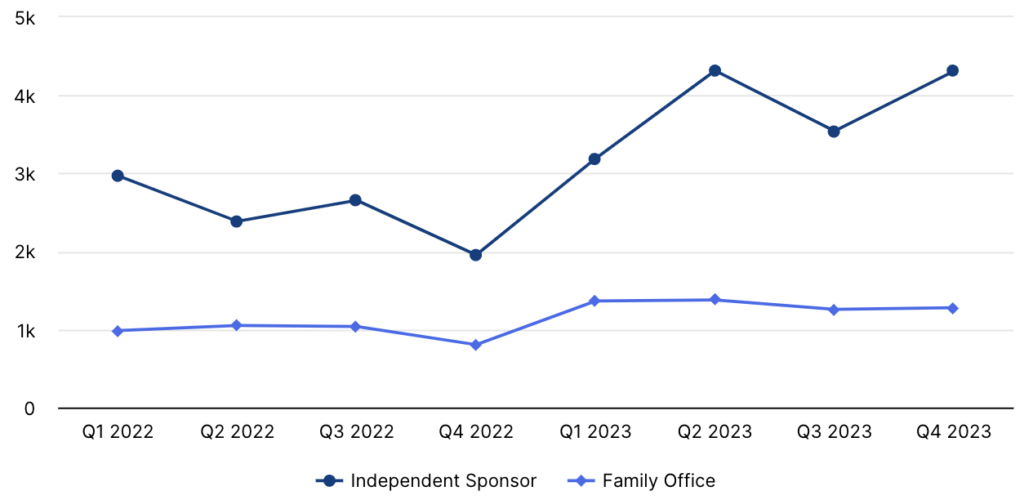

In the wake of the most aggressive rate hiking cycle since the early 1980s, we’ve noticed an uptick in activity (pursuits and bids) from Family Offices and Independent Sponsors. Often more flexible and less constrained by rigid investment mandates than larger institutions, these firm types can take advantage of market dislocations and volatility. Longer-term investment horizons allow Family Offices and Independent Sponsors to absorb short-term market fluctuations and focus on long-term value creation.

This year, Axial debuted a new member ranking series for our buyside membership, with each publication highlighting the 25 most active firms within a specific buyer type. Independent Sponsors and Family Offices were the first two buyer types selected. Check out the rankings with the associated reports below.

Check out these additional features:

Interested in learning about other market trends? Please email [email protected] with your suggestions!