Find your next

- lender

- buyer

- advisor

- deal

- investor

Join 20,000+ financial investors, M&A advisors, and business owners who trust Axial to source deals, find buyers, and hire the perfect M&A advisor.

What Is Axial

Axial is a private deal network serving professionals who own, advise, and invest in North American lower middle market companies. Axial’s deal-sourcing and deal marketing tools are used to facilitate the discovery and execution of transactions that meet the following criteria:

- Geography: US & Canada based businesses

- Revenue: $2.5M – $250M

- EBITDA: $250K to $25M

- Transaction Types: M&A, Debt, Minority Equity, & Co-Investments

- Industry Verticals: Healthcare, TMT (Tech, Media & Telecom), Industrials, Consumer, Business Services, Food & Beverage, Transportation & Logistics, Financial Services, Energy, Education

How The Software Works

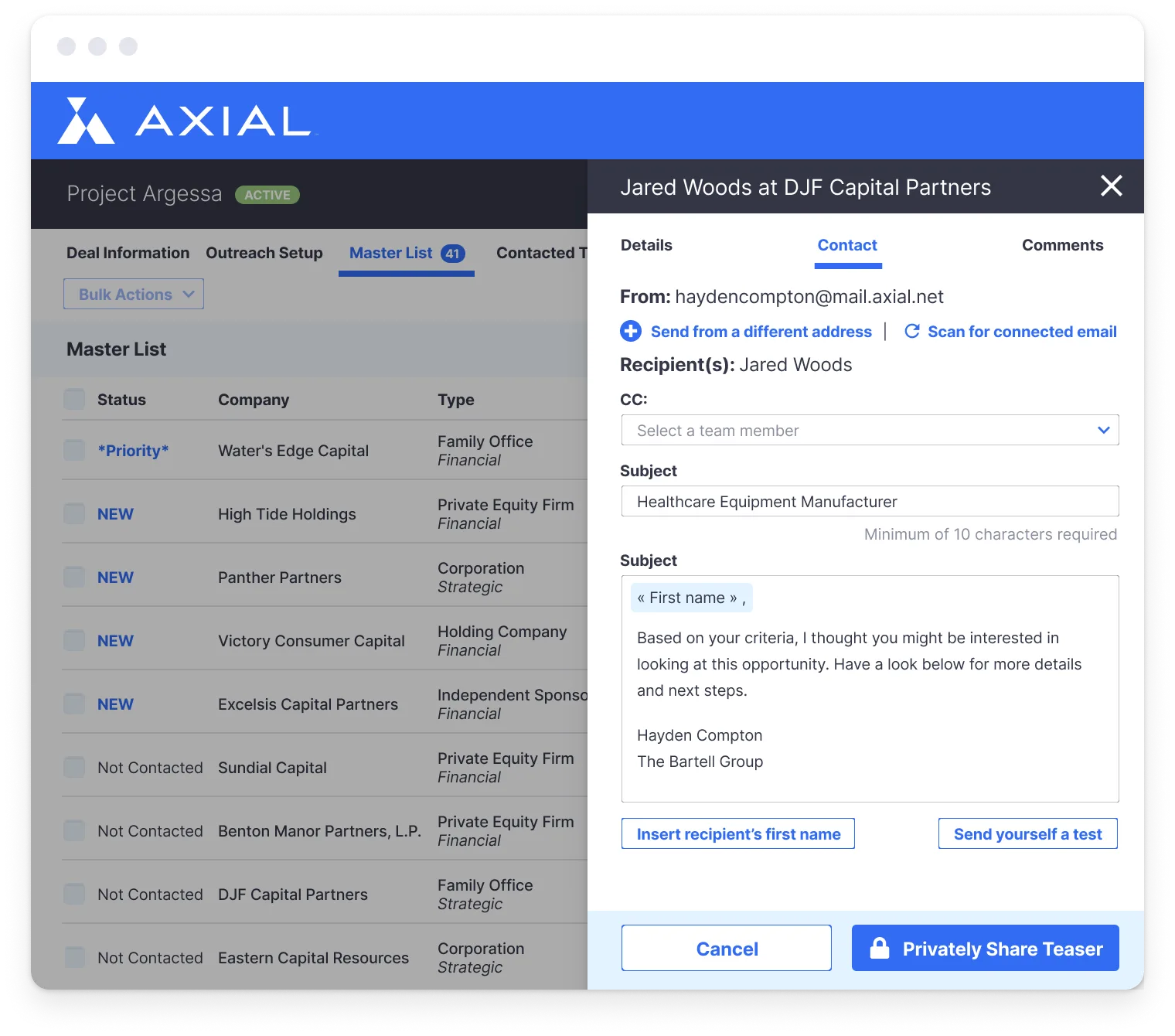

Axial’s platform reflects how lower middle market transactions get done — privately and confidentially. Unlike public deal listing sites, Axial sell-side members retain total control and confidentiality over whom, how, and when they approach the market.

- The buy-side granularly describes their criteria and interests.

- The sell-side inputs details of the company they’re working with or transaction they’re bringing to market [through a confidential, private research tool].

- Axial’s algorithms analyze each buy-side member’s deal criteria, and privately recommends matching parties for the sell-side to approach, ordered by relevance.

- The sell-side reviews each buy-side profile, selects who to engage, and can tailor each message and attachment. All sending on Axial is done directly – there are no public listing (or deal searching) capabilities through Axial’s platform.

- Buy-side recipients receive the deal opportunity to their email and Axial account, knowing it’s a fit for their preferences and sent from a qualified sell-side party.

To the sell-side, Axial is an incredibly efficient tool that helps discover and prioritize the right buy-side targets for any deal. To the buy-side, Axial maximizes coverage of relevant deal opportunities coming from lower middle market CEOs and 3,500+ boutique M&A advisory firms.

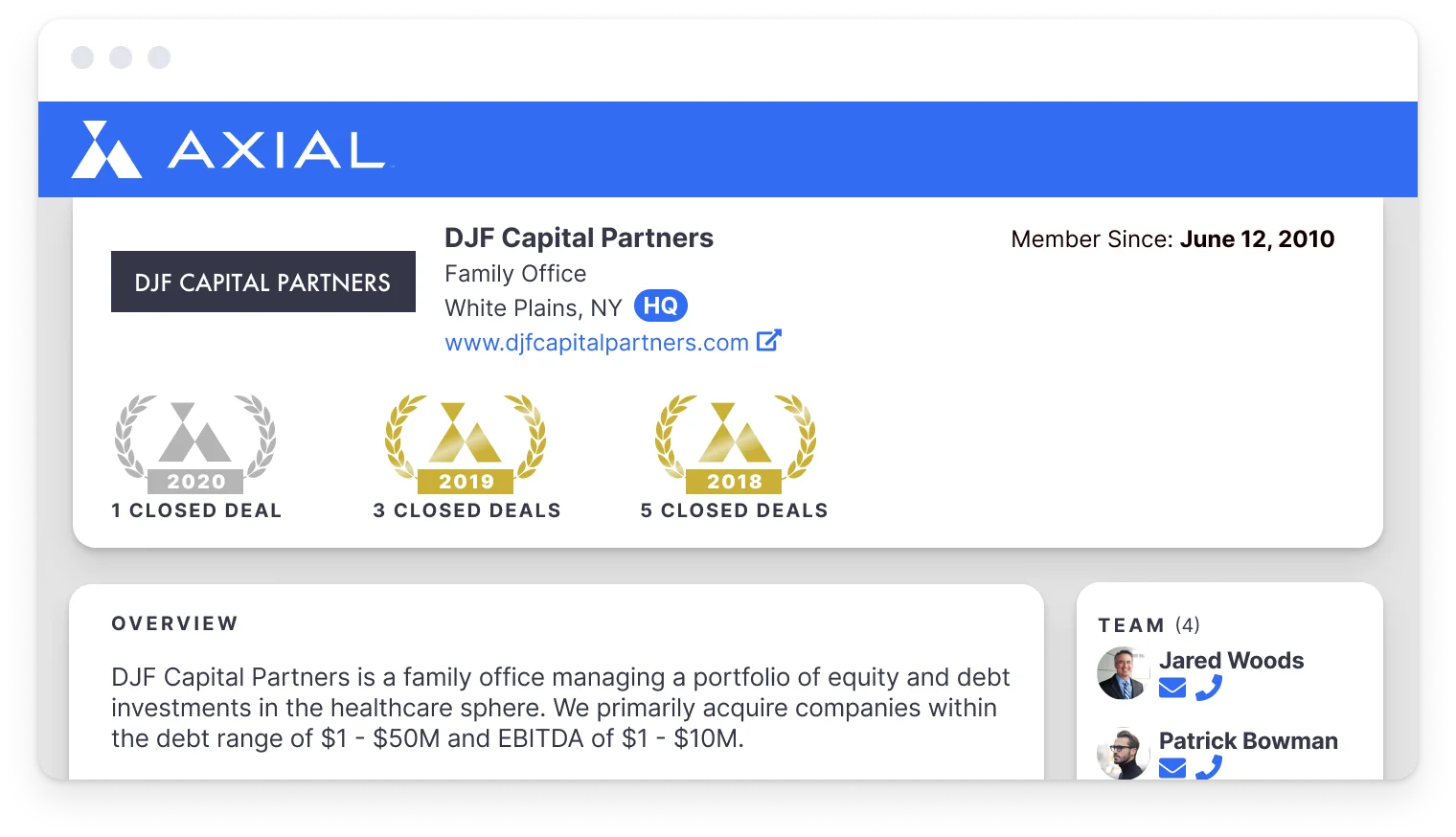

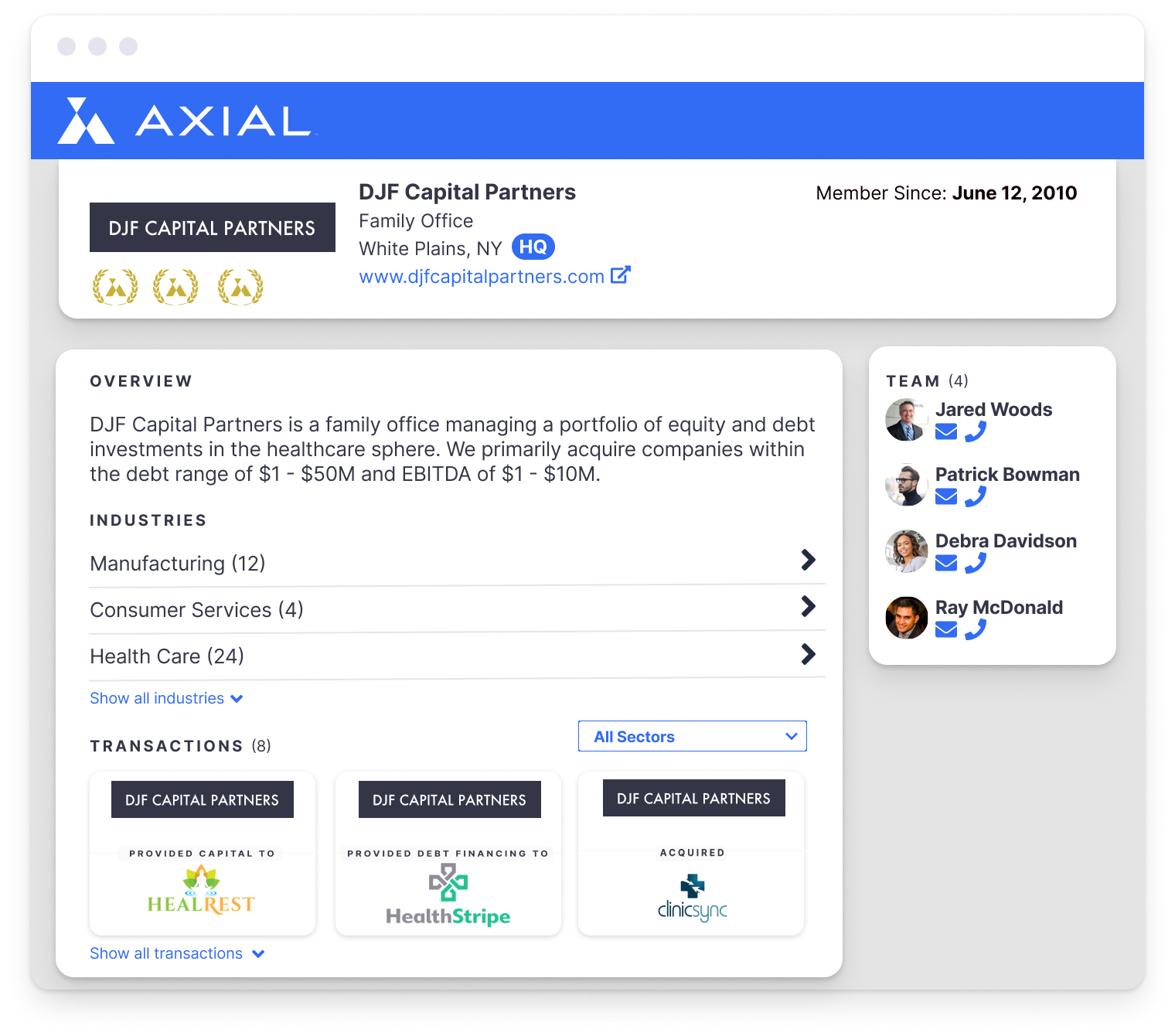

Reputation Data and Content Marketing

Axial shines a light on the lower middle market like never before. Our leaderboards, closed deal badges (pictured at the left), and publishing platforms help our members differentiate and distinguish themselves, making it easier for market participants to convey their own credibility and engage one another with the appropriate levels of trust and confidence.

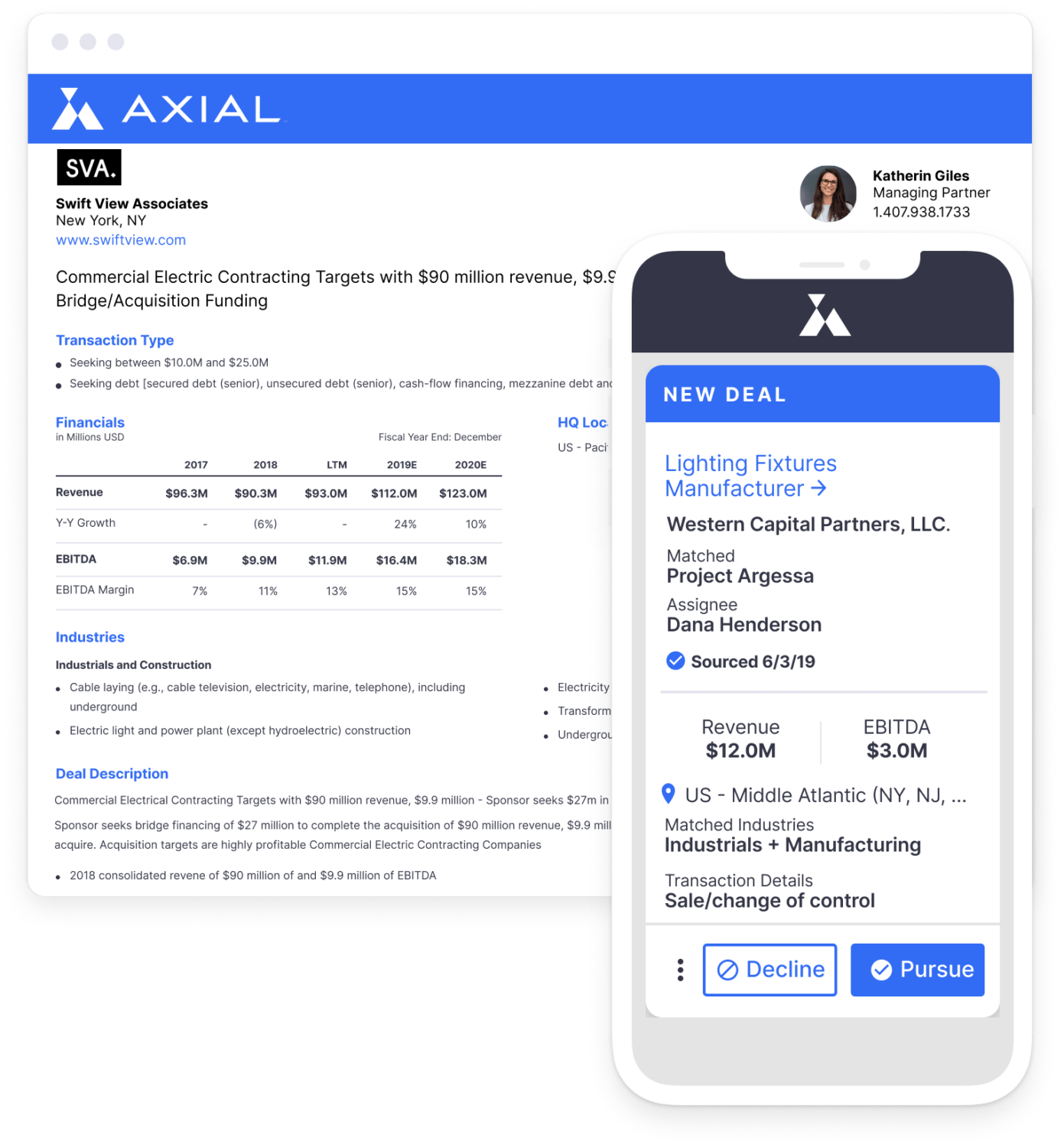

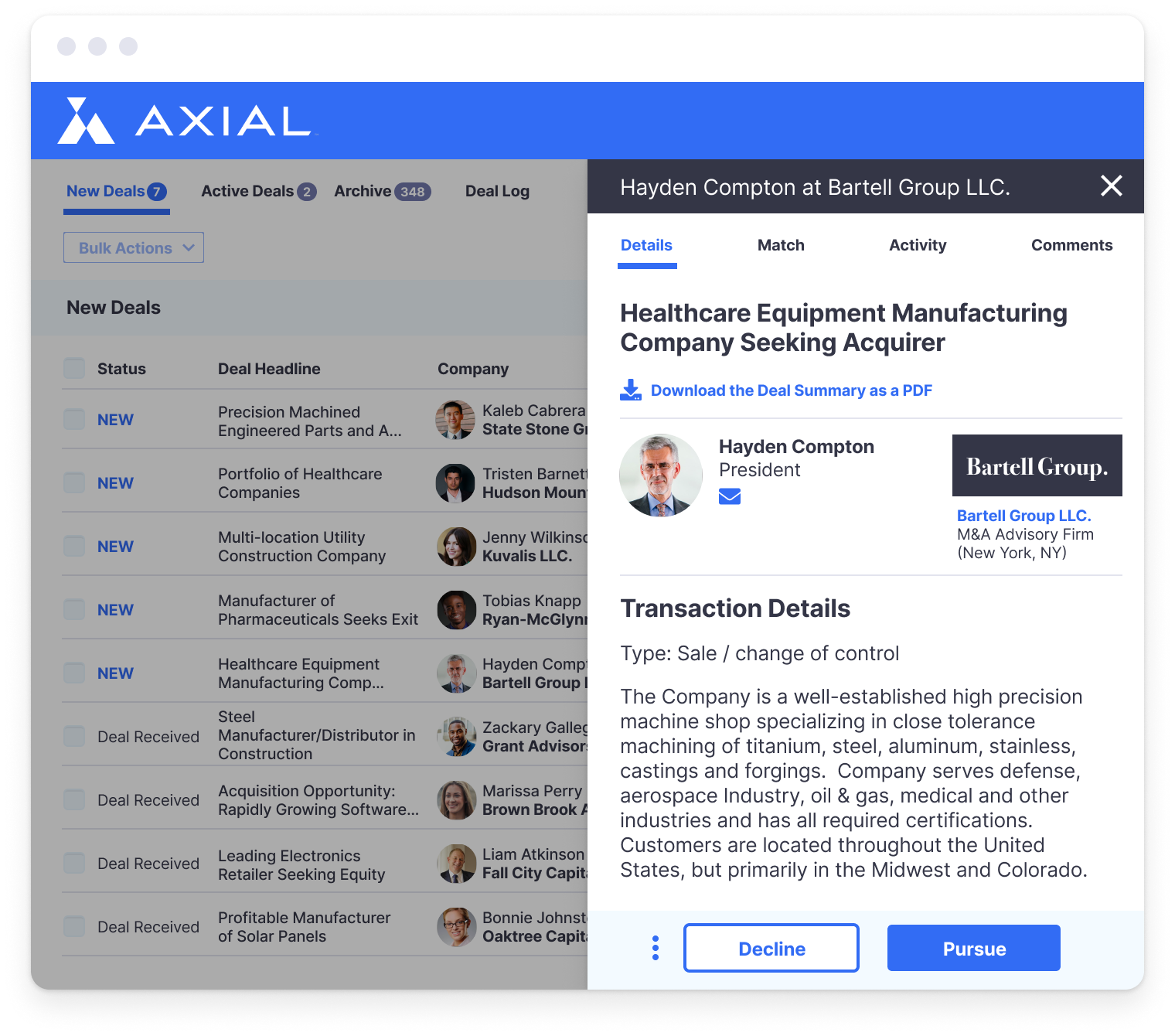

Source Relevant Deals Right as They Go to Market

Over 10,000 deals go to market every year on the Axial platform. Whether you are a generalist private equity investor or a niche strategic buyer, Axial makes it easy to articulate the exact types of investments you’re targeting.

- Geography: US & Canada based businesses

- Revenue: Up to $250M

- EBITDA: Up to $25M

- Transaction Types: M&A, Debt, Minority Equity

- Industry Verticals: Healthcare, TMT (Tech, Media & Telecom), Industrials, Consumer, Business Services, Food & Beverage, Transportation & Logistics, Financial Services, Energy, Education

Once you’ve laid out your deal criteria, you’ll start receiving opportunities from M&A advisors that align with your focus.

Review the teaser, voice interest in the deal, and get the conversation started – all from your inbox.

Efficiently Build New Relationships

Your Axial member profile is how you put your best foot forward with over 3,500 intermediaries, explaining why you and your firm are the right fit for the deals they are representing given your unique experience and positioning.

Use your customizable member profile to:

- Showcase your track record

- Articulate your deal criteria with sophisticated precision

- Prove your reputation as a responsive and capable capital partner

Save Time With Pragmatic Deal Management Tools

Streamline the repetitive parts of the deal process. Get to what’s important faster with our digital NDA tools, member-to-member messaging, and in-platform document sharing and storage.

Our CRM-style deal status updates make it easy for you and your team to keep your deal pipeline organized and up to date. Leave comments for colleagues who are on the road to make sure everyone is on the same page.

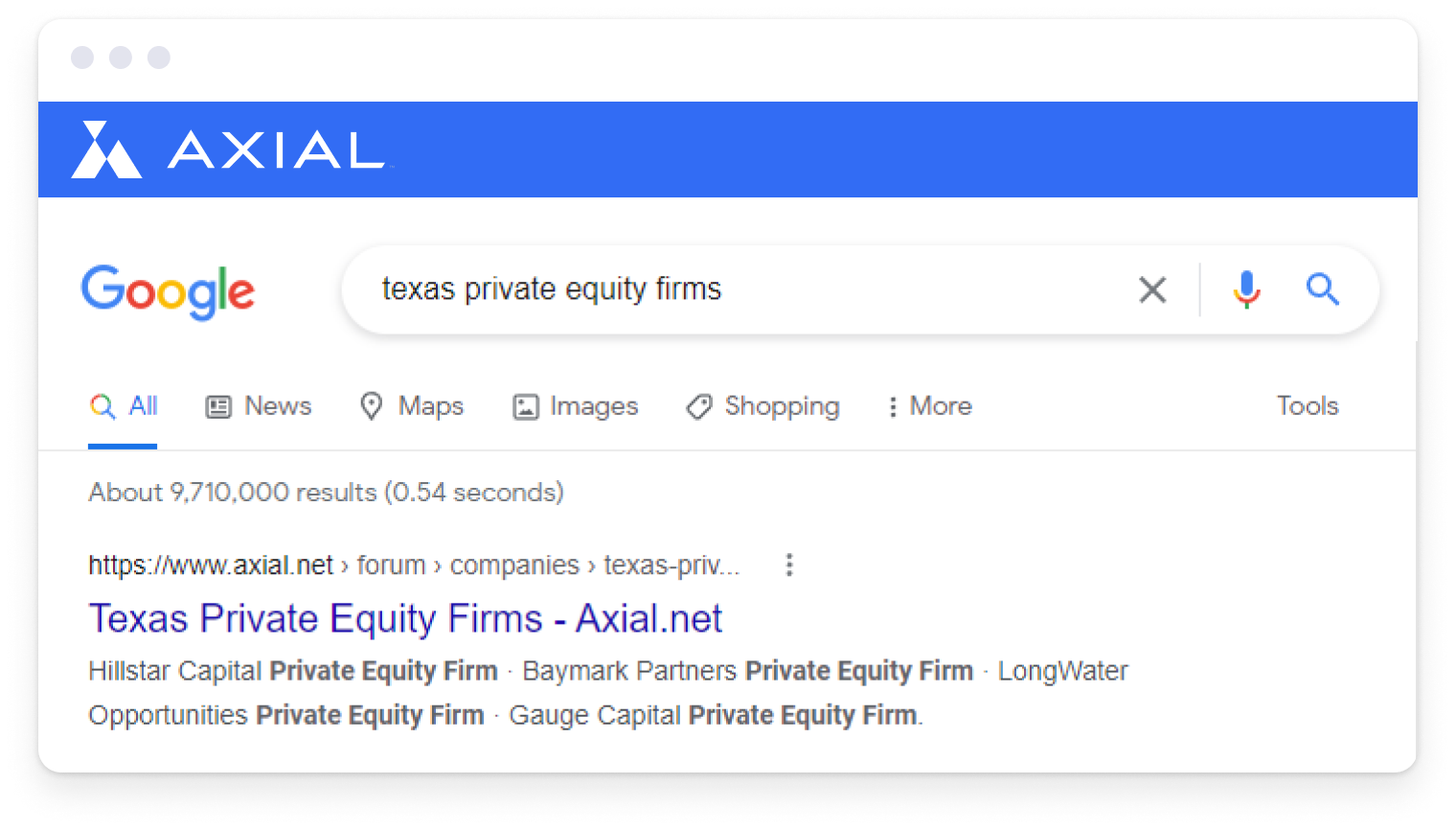

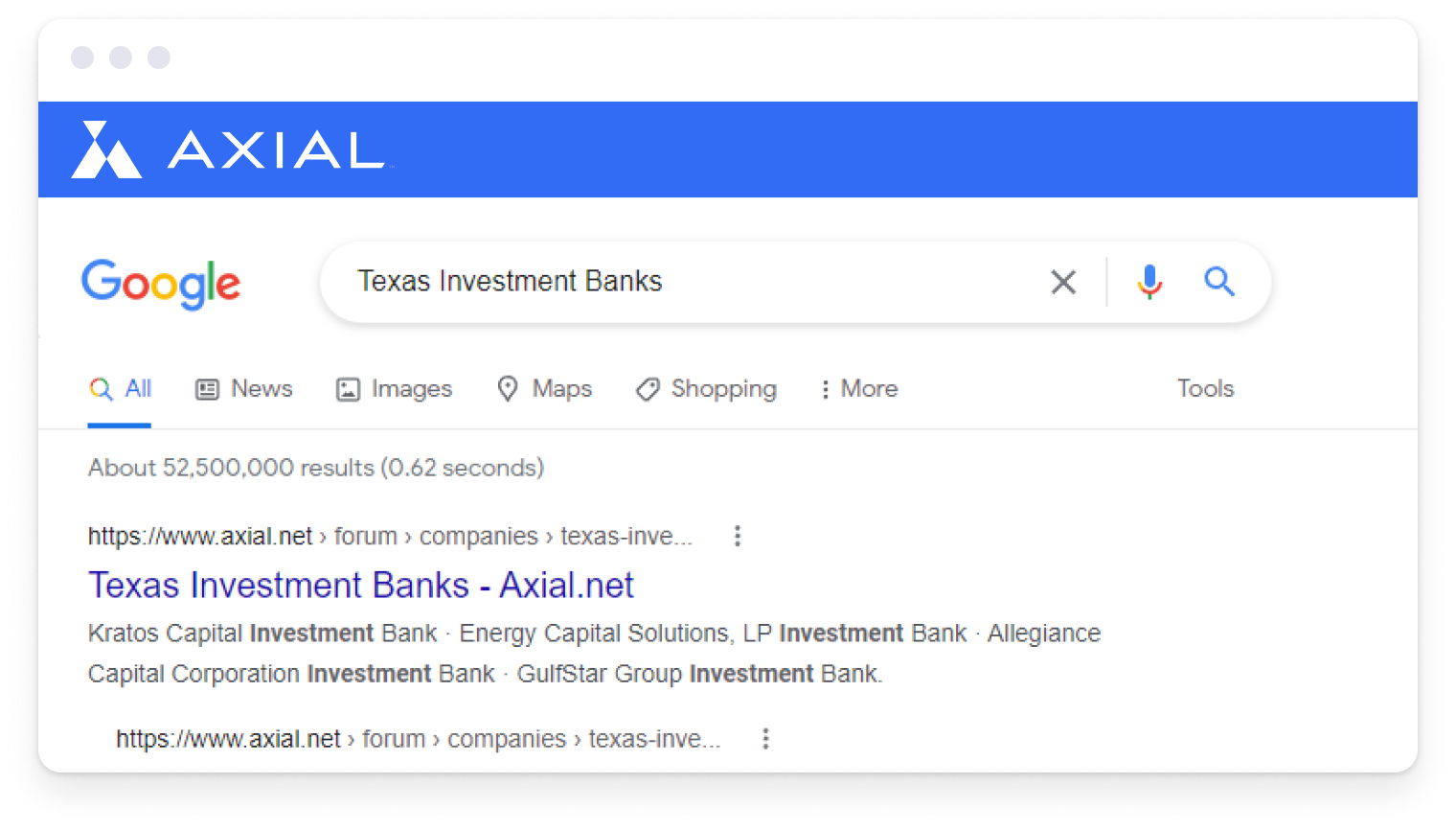

Get Found by Key Target Audiences

Generating over 1 million page views of targeted traffic each year, Axial’s lower middle market directory is a critical digital destination. Our free member profile tools make it easy for you to maximize your visibility with exit-minded business owners, dealmakers assembling buyer lists, and investment and operating talent.

Unrivaled Coverage of the Lower Middle Market

Over 4,500 financial investors and corporate acquirers target lower middle market investments on Axial every year.

- 250+ Family Offices

- 500+ Private Equity Firms

- 1500+ Acquisitive Portfolio Companies

- 2000+ Independent Sponsors & HNWIs

- 100+ Lenders and Private Credit Investors

The buy-side member base ranges from brand name private equity firms and corporations that are difficult to penetrate, to family offices and boutique investors that can’t be found in directories or databases.

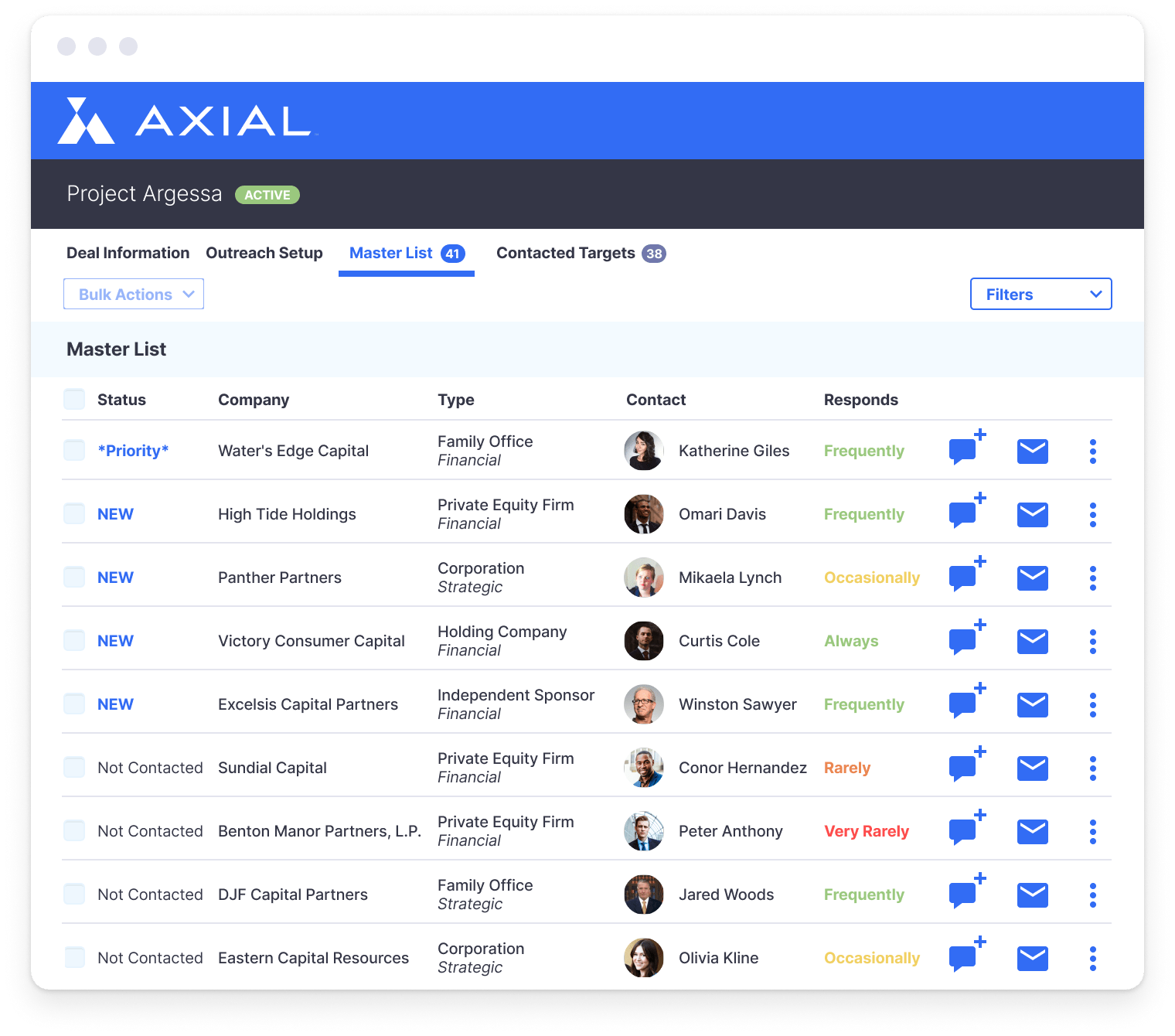

Sophisticated Deal Marketing & Tracking Tools

With Axial, you get:

- A powerful deal marketing system built around privacy, customization, control, and seller confidentiality.

- Deal management tools that expedite NDA execution and other core deal process workflows.

- Unique data sets to help you understand the deal criteria, transaction experience, responsiveness, and reputation of any counter party you might engage on the Axial platform.

Axial’s platform reflects how lower middle market transactions get done — privately and confidentially. Unlike public deal listing sites, Axial members looking to sell or raise capital retain total control and confidentiality over whom, how, and when they approach buy-side targets.

Get Found by Key Target Audiences

Generating over 1 million page views of targeted traffic each year, Axial’s lower middle market directory is a critical digital destination. Our free member profile tools make it easy for you to maximize your visibility with exit-minded business owners, potential job candidates, and private equity firms looking for investment banks to represent their portfolio companies.

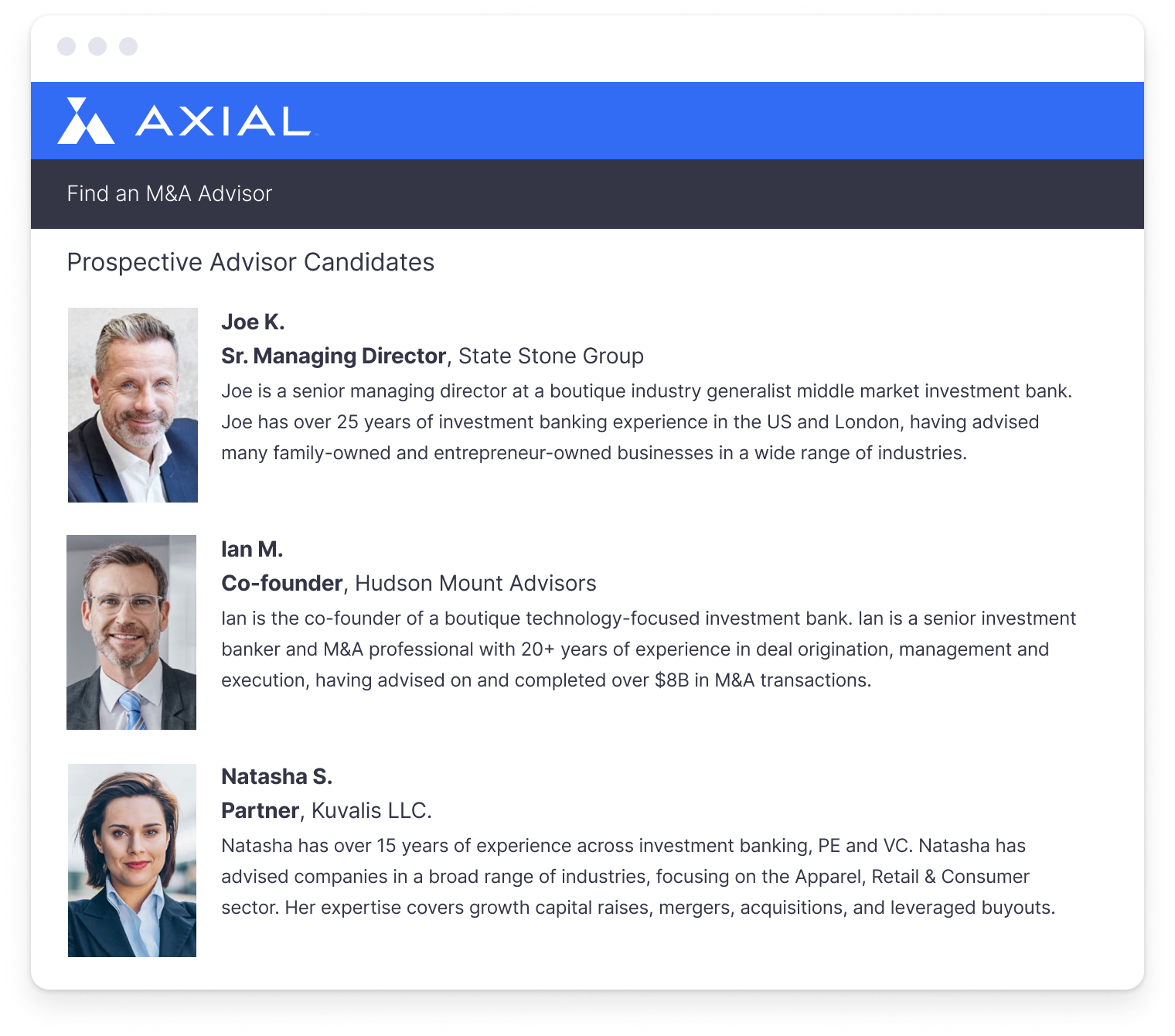

Confidentially Connect With Vetted M&A Advisors

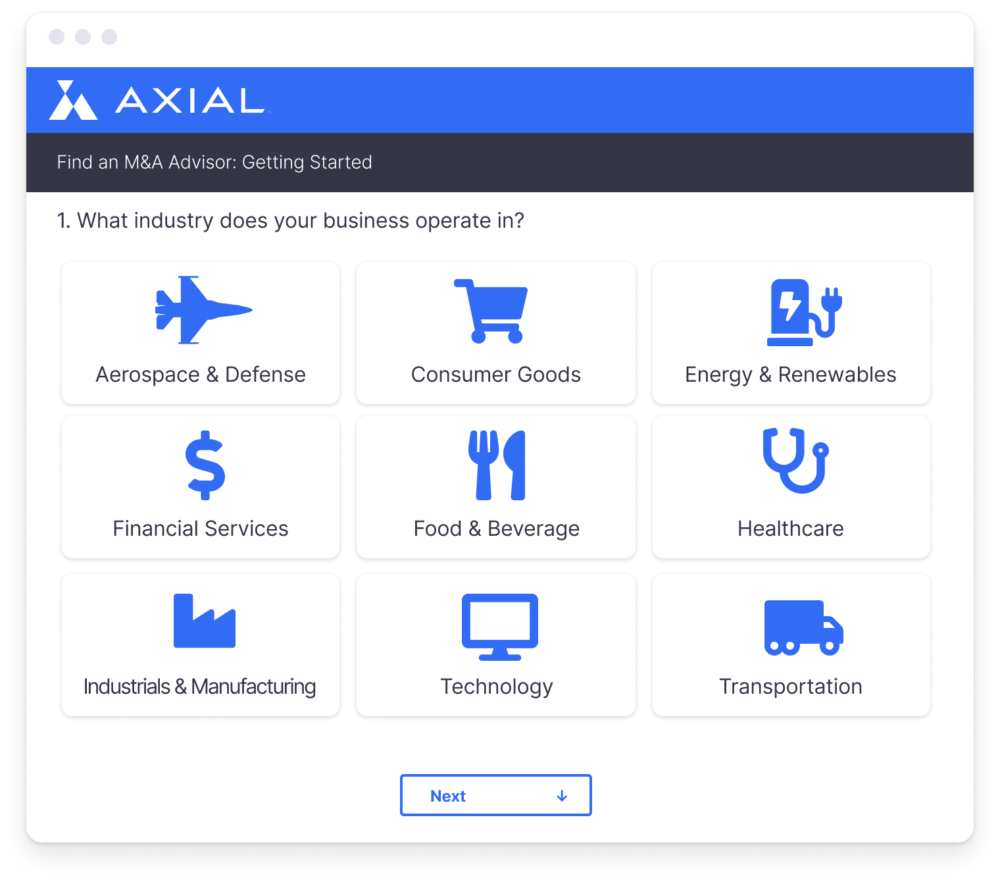

Choosing the right M&A Advisor should not be left up to chance. Axial’s Advisor Finder program was created to arm business owners and executives with the information needed to make confident advisor hiring decisions.

- The process begins with a brief survey and consultation with a member of the Axial team to better understand your transaction priorities and goals.

- We use that information to create a short list of advisor candidates who best fit the needs of your business, from a pool of thousands of qualified candidates.

- Your identity and information will remain 100% private and confidential at all times.

Maintain Control Throughout the Entire Process

Your Axial consultant will guide you through the M&A Advisor selection process. Privately review detailed profiles of M&A Advisors who have proven experience working with businesses like yours. You choose who to contact and when.

Our comprehensive process ensures that your identity remains confidential while you compare advisor candidates, their experience, fee structures, and general suitability for the project. The ball is in your court, and we stay right there by your side throughout the entire process.

Trusted All Across The Lower Middle Market

Case Studies

Levine Leichtman Portfolio Company Trinity Consultants Expands Into Adjacent Sectors

- Transaction Type Acquisition

- Industry Business Services

- Location San Ramon, CA

Trinity Consultants, an air quality consulting firm based in Dallas, has made more than 20 acquisitions in the past 12 years. The majority of these deals were in the air quality space, a sector Trinity has been deeply involved in since its founding in 1974.

In 2012, Trinity entered the toxicology space when it acquired SafeBridge Consultants, a consulting firm that serves clients in the life sciences sector. “We aren’t known as buyers in the life sciences space. We haven’t had decades to canvass the landscape of logical extensions in the sector.”

Trinity turned to Axial to tap into deals in new industries and from sources they wouldn’t otherwise have known about. “Axial brings deals to us and helps us think about the realm of possibilities that could make sense.” One of these deals was ADVENT Engineering, a life sciences engineering consultancy with resources across the U.S., Canada, and Singapore. ADVENT was represented by CEO Ally, a Pittsburgh, PA-based advisory firm. “Without Axial, there’s no reason the company or their banker would have heard of us, and no reason we would have heard of them.”

Acquired

Advised By

Family Office of Ex-XEROX CEO Makes Inaugural Investment in a Colorado Brewery

- Transaction Type Minority Equity Investment

- Industry Food & Beverage

- Location Denver, CO

When Ann Mulcahy exited her post as the CEO of Xerox, she created a family office and joined Axial looking to partner with lower middle market entrepreneurs.

“For us, being a new family office, it was about at-bats — how many deals could we see to get a sense of what the marketplace is doing. Joining Axial made sense because we knew the network would help us figure out what kind of opportunities might be available in the lower middle market. Our team comes from more enterprise backgrounds across the board and Axial became our guide to finding partners we could work with. We initially narrowed our search on Axial to technology with a focus on business services and light manufacturing with a focus on consumer goods and food and beverage.”

Reg McGaugh, a banker from Auctus Group, sent me a deal for a queso fresco factory in the Midwest. I didn’t think we were the best fit, but we got on the phone anyway and he said he was working with a client in Denver, a craft brewing company in the super early stages, that he thought might be a good fit for us. That ended up being Renegade, a deal we closed on several months later. How fortunate that we took the time because it provided Silver Fox with not only our first investment, but an opportunity that I don’t think we would have seen otherwise.”

Invested In

Advised By

Investment Bank Progress Partners Finds a Lender and New Client

- Transaction Type Debt Financing

- Industry Digital Media

- Location New York, NY

Technology & Media focused investment bank Progress Partners has been an Axial member since 2011. Founder Nick MacShane says that Axial has “supercharged” the firm’s buyer network and also helped bring in CEO clients. In 2016, Progress Partners connected with fellow Axial member Gibraltar Business Capital to help secure a $6 million ABL line of financing for its client, media technology company CPXi.

“We’ve essentially supercharged our buyer network through Axial. We’ve been able to engage a broader universe of buyers and financial partners for particular deals, namely private equity funds and strategic companies that may not have been in our network previously.

Axial events have also helped bring in clients to the firm. For example, one of our associates attended last year’s Axial Concord in New York City, and met an entrepreneur there who owns a marketing technology company in St. Louis and was looking to sell. He hired us, and now we’re on third base trying to get him a closed transaction.

Provided Debt Financing To

Advised By