Sell-Side M&A and Raising Capital

Pinpoint the Right Capital Partner for Every Deal

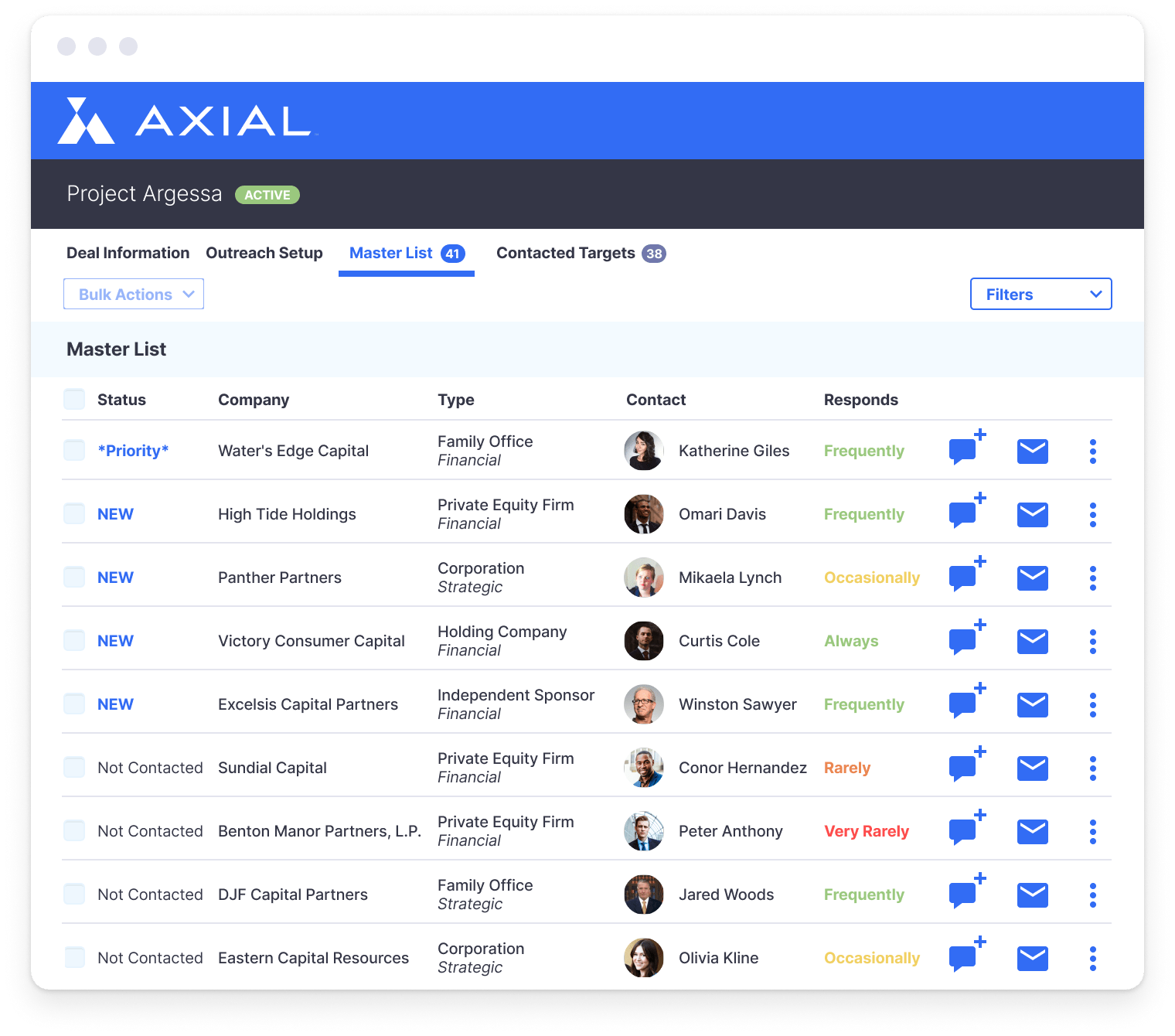

Axial puts the lower middle market’s capital partners at your fingertips. Research the buy-side by current deal criteria, transaction experience, and reputation, then confidentially reach out with complete control and discretion when it’s time to go to market.

An Additional Employee

At No Additional Cost

Axial helps you find lesser-known targets such as family offices, strategic acquirers, and newly emerged financial sponsors to complement existing buy-side targets you have in mind.

Axial is like having an additional employee at no additional cost. The platform gives us a continuously updated and relevant list of recommended buyers and investors who are looking for deals like ours right now, with no research on our end. It’s opened up a whole new universe of potential buyers and investors in an organized and efficient way.![]()

Get Started Today

Case Studies

TMT-focused Investment Bank Progress Partners Finds a Lender and a New Client

- Transaction Type Debt Financing

- Industry Digital Media

- Location New York, NY

Progress Partners, which specializes in the technology and digital marketing spaces, has been an Axial member since 2011. Founder Nick MacShane says that Axial has “supercharged” the firm’s buyer network and also helped bring in CEO clients. In 2016, Progress Partners connected with fellow Axial member Gibraltar Business Capital to help secure a $6 million ABL line of financing for its client, media tech company CPXi.

“We’ve essentially supercharged our buyer network through Axial. We’ve been able to engage a broader universe of buyers and financial partners for particular deals, namely private equity funds and strategic companies that may not have been in our network previously."

Axial events have also helped bring in new CEO clients. "One of our associates attended last year’s Axial Concord in New York City, and met an entrepreneur there who owns a marketing technology company in St. Louis and was looking to sell. He hired us, and now we’re on third base trying to get him a closed transaction."

Provides Financing To

Advised By

Boutique Investment Bank 41 North Closes 4 Deals with Axial Buyers

- Transaction Type Acquisition

- Industry Environmental Services

- Location Williston, ND

41 North is a 5-person boutique investment bank out of Newport Beach, California. Being a lean team that runs large, tailored limited processes with buyers and investors, the directors were looking for technology-based solutions to generate more competition for their clients.

Over the course of their 7+ year membership to date, 41 North has closed 4 deals with Axial buyers - 2 with Hillstar Capital, a Texas-based Private Equity Firm that the firm discovered through Axial.

"Axial is like having an additional employee at no additional cost. The platform gives us a continuously updated and relevant list of recommended buyers and investors who are looking for deals like ours right now, with no research on our end. It’s opened up a whole new universe of potential buyers and investors in an organized and efficient way."

Acquired

Advised By

Dane Manufacturing Secures Financing to Hit Their Goal of 3X Revenue in 3 years.

- Transaction Type Acquisition Financing

- Industry Heating & Cooling

- Location Troy, MI

In 2015, Dane Manufacturing CEO and president Troy Berg and COO Mike Lisle set the audacious goal of growing the company 3x in 3 years — from $10 to $30 million. By 2016, it was clear that Dane would need some serious inorganic growth to reach their goal.

Dane decided to join Axial in August 2016. In March 2017, Mike was contacted by an advisor representing Dantherm Cooling, a division of Dantherm A/S, a publicly traded Danish company originally formed in Spartanburg, SC in 1998. They fell in love with the opportunity, and soon realized that if they could close Dantherm, they’d get to ring the bell at 3X.

“It was more challenging to find the right deal financing than it had been the right target.” In May 2018, Mike, ran a search on Axial and found Crestmark Bank, an asset-based lender with a strong presence in Chicago, just a few hours away from Dane’s headquarters. Within two weeks, Dane had closed with Crestmark. “It was lightning speed for a $3 million line of credit facility. You had a motivated team in Dane Manufacturing and a motivated bank in Crestmark, and Axial brought us together.”

Provided Acquisition Financing to

To Acquire