M&A Fee Guide 2023-2024

For the third year running, Axial partnered with Firmex and Divestopedia on the annual M&A Fee Guide, the authoritative source…

But many of the reasons behind why they fail are preventable.

Last week, Axial CEO Peter Lehrman presented on this topic at Main Street Summit, a two-day event for SMB owners, operators, and investors. Peter presented on failed exits – when business owners that engage in a process to sell their business aren’t successful – and what business owners can do to prevent them.

Below are a few highlights from the presentation, assembled using Axial platform data and insights from Axial investment banking members.

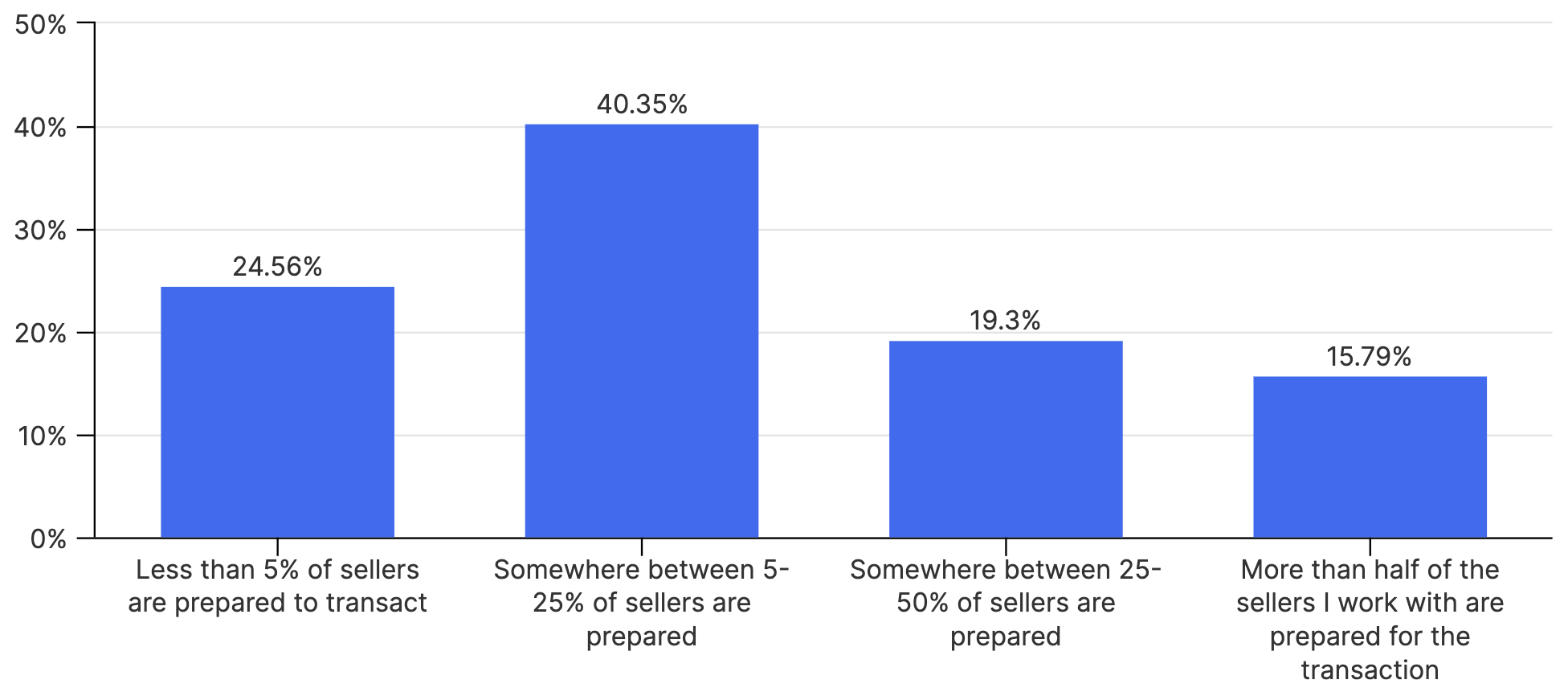

We recently surveyed our Investment Bank membership on the topic of Exit Preparation and will share the responses and various data points over the next couple months in our Exit-Ready newsletter.

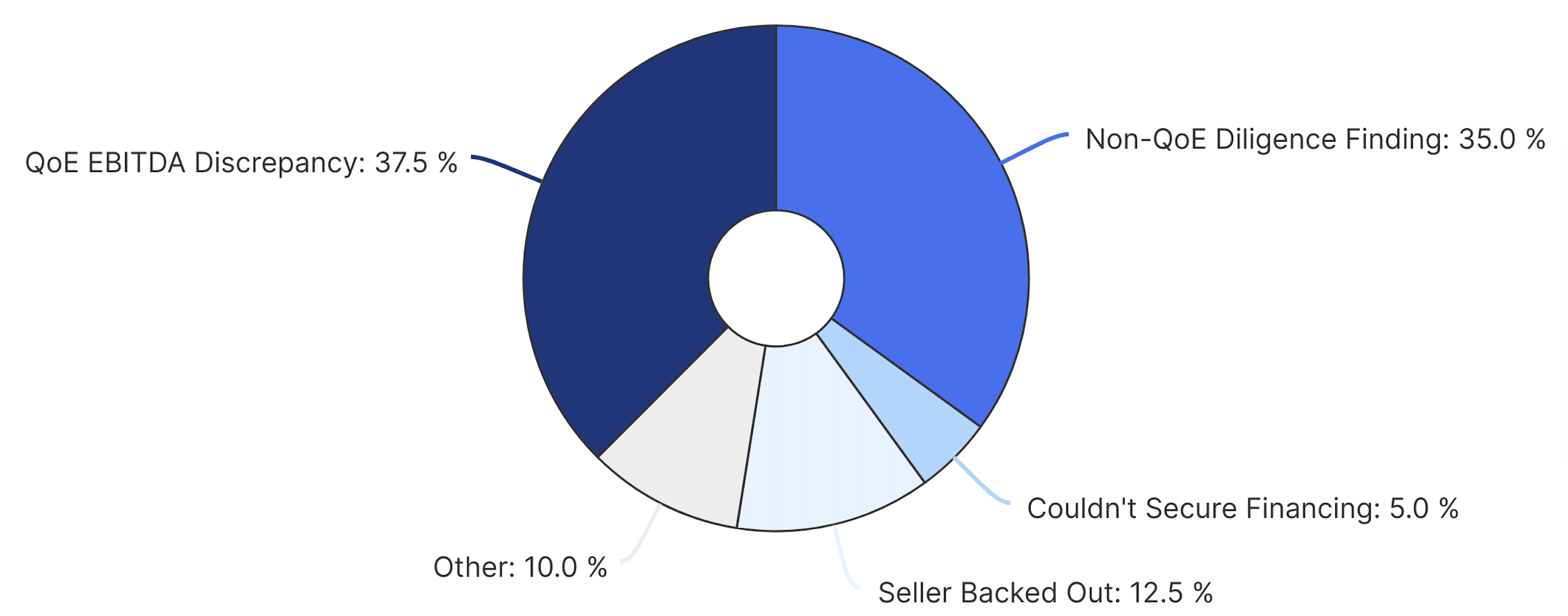

Below are three deals that were sourced via the Axial platform and subsequently fell through for various reasons.

Business Underperformance During the Sale Process

Due Diligence Discoveries and Delays

Seller Readiness and Advisor Quality

Axial’s Advisor Finder program provides curated introductions of relevant M&A advisors to business owners exploring a sale. Thousands of advisors actively market their engagements on the Axial platform, which allows business owners to get as close as possible to running a comprehensive search. Beyond comprehensiveness, they are able to do so efficiently and with minimal time commitment.