Small Business Exits: M&A closed deal data from June

Welcome to the June edition of Small Business Exits, the monthly publication featuring fully anonymized deal data from a selection…

Finding the right buyer for your business is one of the biggest decisions you’ll ever make.

And finding the right M&A advisor will determine whether you find the right buyer.

If you make a mistake, the downside is serious. An advisor with inadequate experience can derail a deal with bad advice or poor judgment.

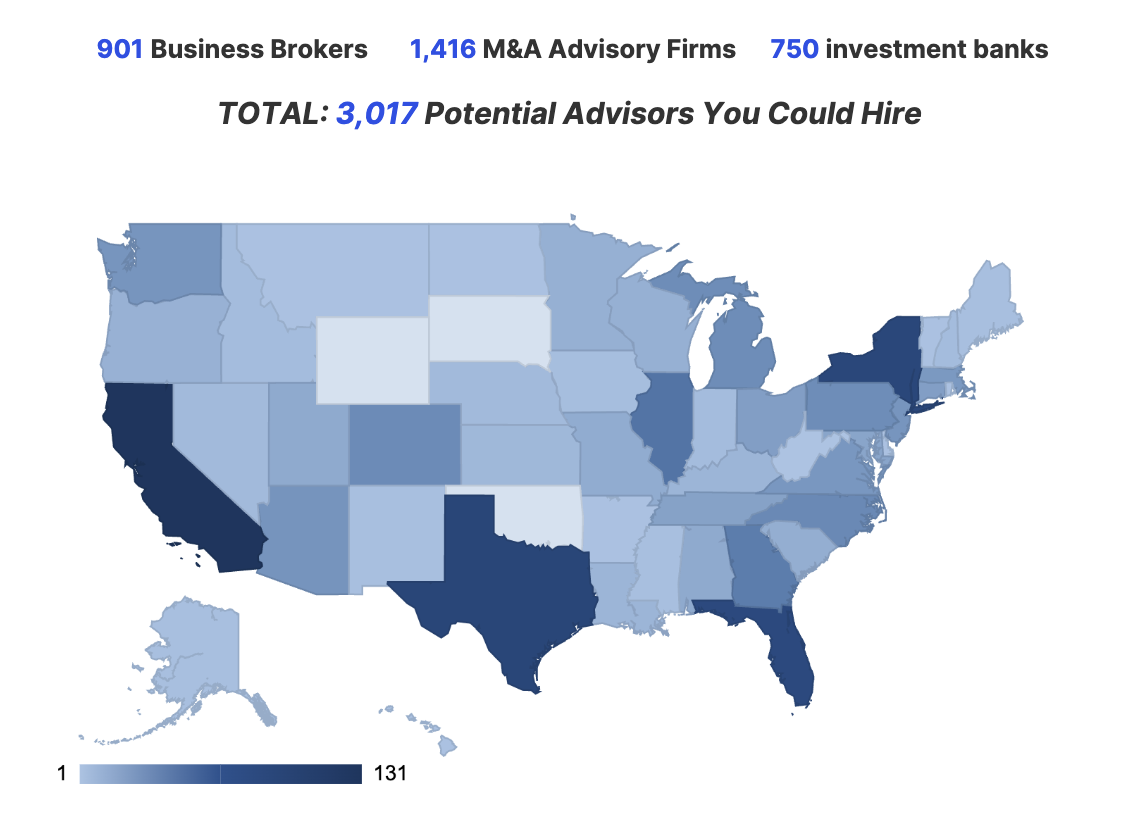

There are 3,000+ sell-side intermediaries on Axial. Reports online state that there are anywhere between 5,000 and 10,000 M&A intermediaries across the US.

Despite the wide array of options, most owners don’t run a comprehensive search to find the right advisor.

Why?

Owners may have personal relationships with one or two advisors. They may receive introductions to a handful of advisors from their accountant, lawyer, or fellow business owner. They may search online and find a few good fits. But exhausting these avenues is time intensive, and still risks the chance of missing out on a relevant advisor.

Axial’s Advisor Finder program provides curated introductions of relevant M&A advisors to business owners exploring a sale. There are thousands of advisors that actively market their engagements on the Axial platform, which allows business owners to get as close as possible to running a comprehensive search. Beyond comprehensiveness, they are able to do so efficiently and with minimal time commitment.

Revenue: $15M – $20M | EBITDA: $2M – $3M

Revenue: $250M – $300M | EBITDA: $20M – $25M

Revenue: $2M – $3M | EBITDA: $500K – $1M

For business owners, negotiating fair success fees and engagement terms is important. But even more important is the quality and integrity of the M&A advisor they choose to hire.

We recommend that all business owners solicit proposals from several M&A advisors – either through Axial’s Advisor Finder Program or on their own. Compare fees, engagement terms, experience and chemistry.

We’re here to help. Reach out to us here or learn more about our Advisor Finder service here.

Check out the eBook below for an in-depth overview of hiring an M&A Advisor.