The Winning M&A Advisor [Vol. 1, Issue 3]

Welcome to the 3rd issue of the Winning M&A Advisor, the Axial publication that anonymously unpacks data, fees, and terms…

In a market where interest rates remain high, deals are difficult to get done, and the gap in valuation expectations remains substantial, more and more business owners are entertaining raising minority equity or non-dilutive capital.

For owners, raising capital – versus selling a majority of the company – is an attractive alternative, enabling them to drive continued growth alongside an experienced partner with operational expertise and added resources.

Raising capital for investors to finance acquisitions can also be a critical factor in a deal crossing the finish line.

Axial members can connect with relevant minority equity or debt providers by creating a capital raise project. Below, we’ve included details on Axial capital raise activity over the last 12 months, as well as the prevalence of members looking to provide minority equity or debt to lower middle market businesses.

There are currently 172 active firms on Axial looking to provide minority equity and 126 firms looking to provide debt. See below for the breakdown by firm type.

To better understand the type of capital raise opportunities, we took a look at the platform activity for minority equity and debt transactions over the last 12 months.

In total, 674 capital raise projects have been confidentially brought to market via the Axial platform over the last 12 months. These transactions span 14 industry verticals. Technology and Industrials account for the highest amount, with 118 and 104, respectively.

Senior Lender Revtek Capital provided $10 million in credit to Gradient Cyber, supported by Auctus Capital Partners.

Gradient Cyber offers Managed Extended Detection and Response (MXDR) and other cybersecurity supporting services designed for the mid-market, focusing on comprehensive threat detection and response across network, endpoints, users, cloud, and applications.

Columbia Pacific Advisors provided a $9.5 million term loan to CGL Holdings, owner of Chicago Grade Landfill.

CGL Holdings used the funds to refinance existing debt on the non-hazardous municipal waste landfill and recycle center and distributed the proceeds to parent company Allos Environmental.

The transaction was advised by Investment Bank Corporate Fuel.

Elevate secured a $25M minority investment from Kayne Anderson Partners. Elevate is a global law company providing consulting, technology and services to law departments and law firms.

Middlemarch Partners served as Elevate’s financial advisor.

Lakeside Partners acted as the exclusive financial advisor to Weller Recreation on its recapitalization by affiliates of White Brush Capital.

Weller Recreation is a leading powersports dealership located in Kamas, UT.

If you’re actively looking for buyers or capital on Axial, then you probably noticed a smarter recommendation engine when it comes to evaluating who we recommend for you (and why) since our major platform overhaul in December.

Here are three features worth highlighting:

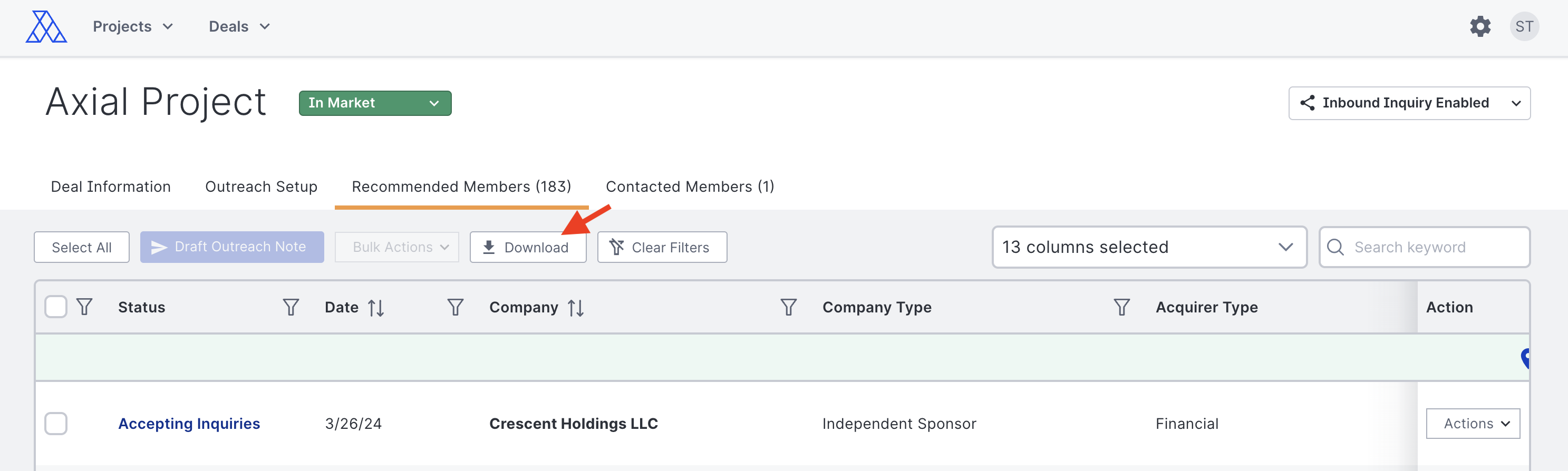

Now you can export all of the companies in your recommendation list as an Excel file with the click of a button, so you can easily manage your targets in whatever way makes sense for you.

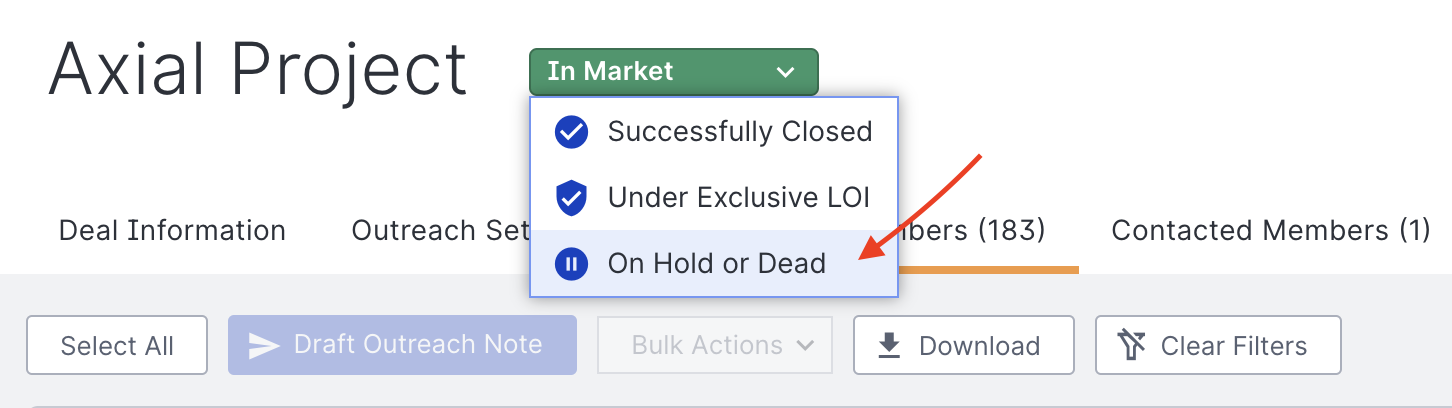

No longer actively pursuing buyers or investors? No problem – you can put your project (deal) on hold with one click and stay organized. If you archive it and decide you want to access it again later, we can help you do that.

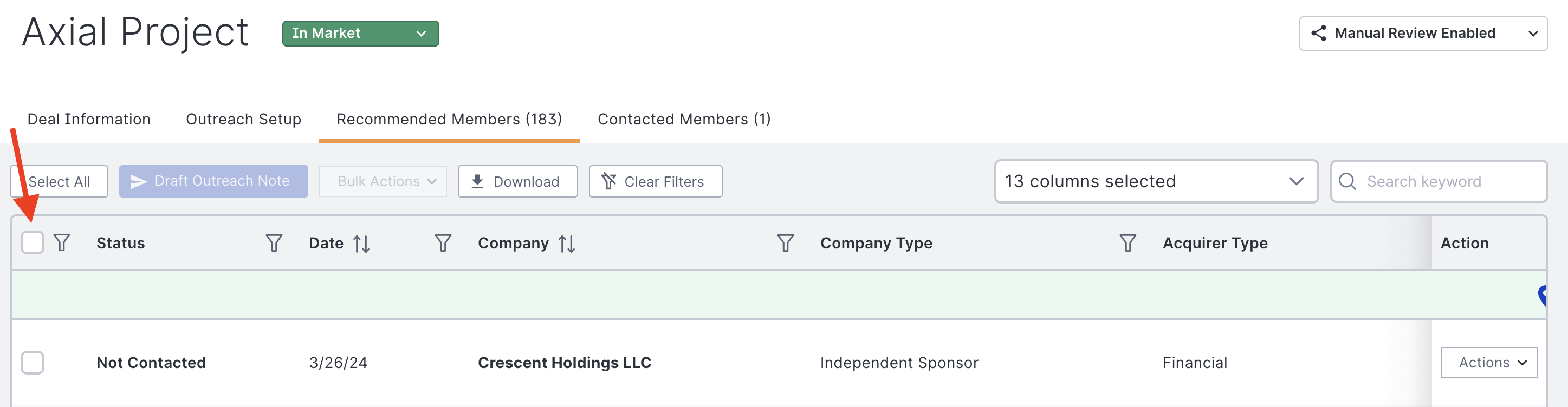

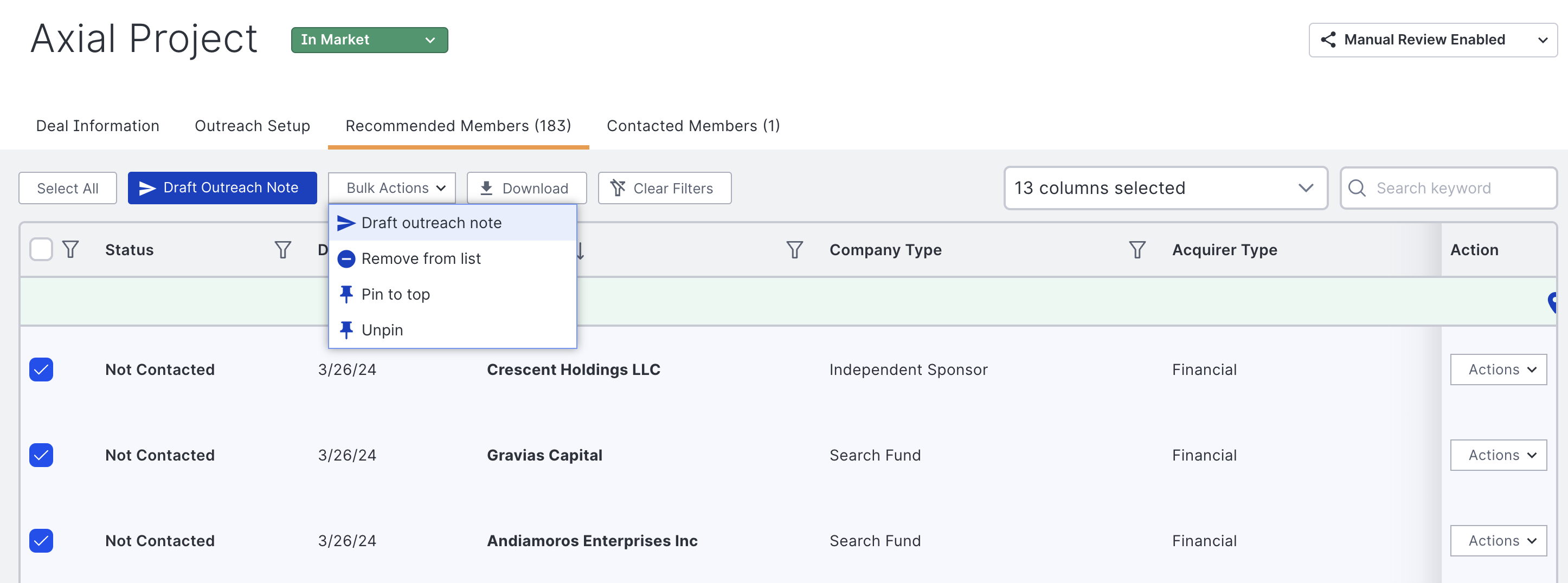

Be more time efficient when you’re trying to sell or raise capital with bulk actions on Axial. For example, when multiple recommended targets come in that fit your specific deal criteria, save yourself time by sending the ones you’d like to engage with your teaser – in one shot (rather than contacting each company individually). While this isn’t a new feature, some of you have expressed confusion around how to take action on multiple recommendations at the sane time (like sending a teaser to 5 investors in one step).

More to come!