M&A Fee Guide 2023-2024

For the third year running, Axial partnered with Firmex and Divestopedia on the annual M&A Fee Guide, the authoritative source…

We recently surveyed the Axial Investment Bank membership on the topic of exit preparation and will be sharing the results and responses over the next couple of months in our Exit-Ready newsletter series.

Today, we are diving into valuation expectations between buyers and sellers and the different contributing factors that can lead to misalignment.

We are grateful to all the Investment Bankers who contributed their insights and provided useful color for this series on exit preparation. The 10 Investment Bankers below are quoted in this today’s feature.

When it comes to valuation expectations, buyer and seller misalignment can arise from a number of various factors, often stemming from differences in perspectives, goals, information, or external circumstances. Since sell-side intermediaries work with both sides of the transaction, they are in a unique position to provide insight on this topic in today’s market.

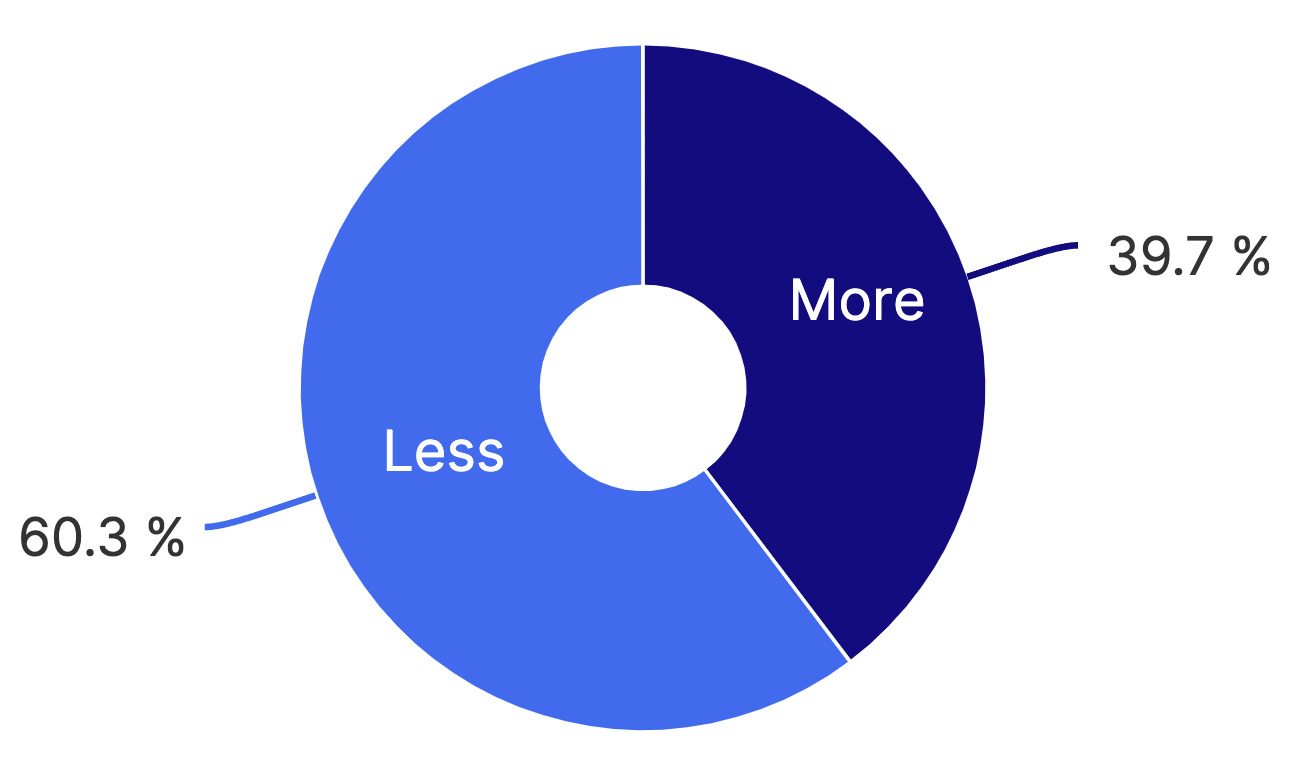

In your experience, have sellers had more or less realistic valuation expectations in 2023?

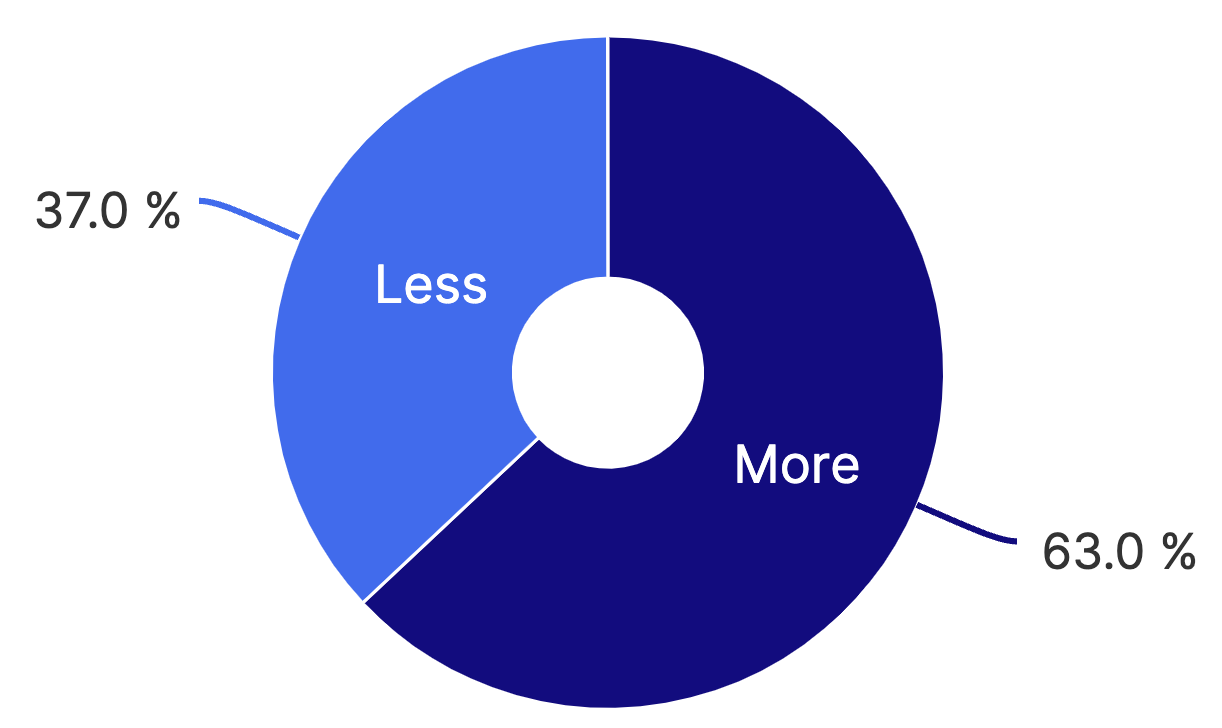

In your experience, have buyers had more or less realistic valuation expectations in 2023?

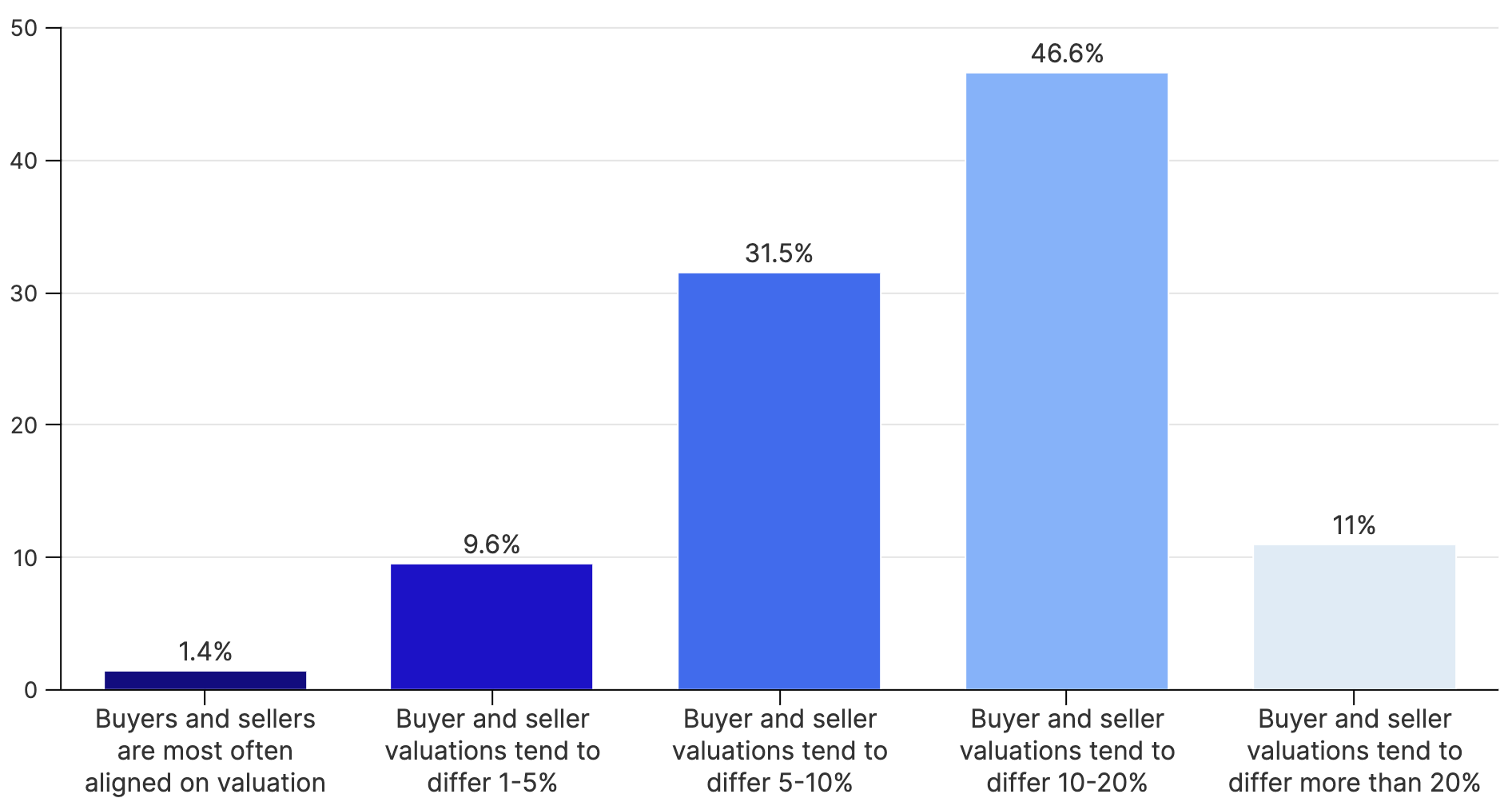

Out of the 73 investment bankers who participated in the survey, only 1.4% indicated a frequent alignment between buyers and sellers on valuation and more than 56% expressed the belief that valuations commonly deviate by 10% or more. We delved further into the factors contributing to this misalignment and have include select responses below.

| What are the biggest contributors to buyer/seller valuation misalignment? | |

|---|---|

| Sellers do not understand fully how bank financing affects valuation. Ken Miller BlackRose Group | Success in the past vs. perception of the future and the investments needed to grow. Ramsey Goodrich Carter Morse & Goodrich |

| Sellers riding the COVID wave in some cases have an inflated perspective of their market value. Buyers are less willing to stretch on valuation due to perceived risk regarding company stability going froward. This along with the increased rates on debt are yielding lower valuations in some cases. Brandon Maddox CRI Capital Advisors | Buyer anxiety about macro-economic expectations. Reliability of future earnings is often questioned by buyers even when sellers are confident. Buyers typically want to base value only on historical performance while sellers naturally want credit for what has been built and will be fulfilled in the near future. William McDonald McDonald Dalton Capital Partners |

| Access to financing from the credit markets is very soft, not just in terms of interest rates, but in terms of the amount of debt that lenders are willing to underwrite. Scott Mitchell SDR Ventures | Sellers relying on ""word of mouth"" valuations from 2021 and 2022, and expecting them to remain the same into 2023. Greg DeSimone Beacon Equity Advisors |

| We have coined the term "slope of hope" to describe the gap in which today, sellers are hoping that valuations return to the level their expectations are sitting while the buyers are a notch lower, primarily due to interest rate increasing and sellers not seeing the impact on real estate or the stock market valuations. Michael Gravel iMerge Advisors Inc. | I believe much of the gap is driven by higher multiples in prior years and misinformation to prospective sellers. Unfortunately many sellers only know rumors of valuation multiples and what they hear from peers (i.e. "big fish stories"). Most don't understand the underlying factors that drive multiples, they only hear numbers "3, 4, 6, 8x". Aaron McCambridge Citadel Advisory Group |

| Interest rates, Medicare/Medicaid reform Bradley Smith VERTESS Healthcare | Sellers being misinformed on market multiples. Jay Jung Embarc Advisors |