The Seller’s Guide To Preparing For Life After Sale

Selling a company is a time-consuming and emotional process that often leaves little time for the owner and their business…

Advisors, Business Owners, Buyers

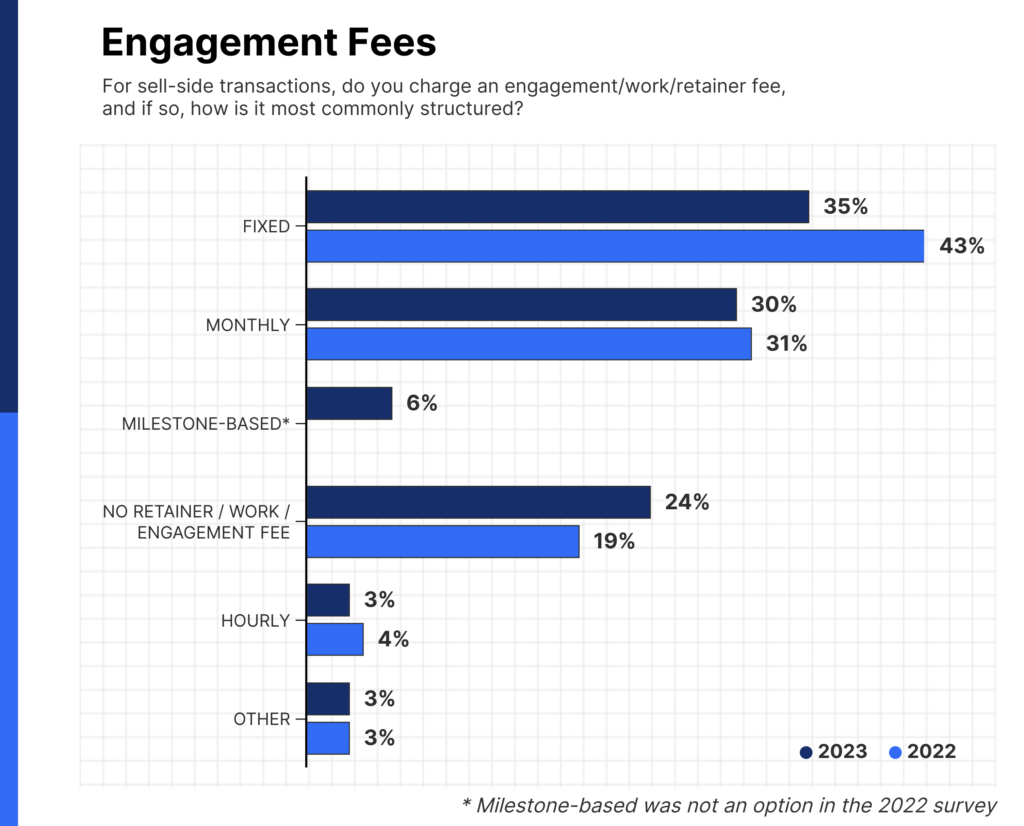

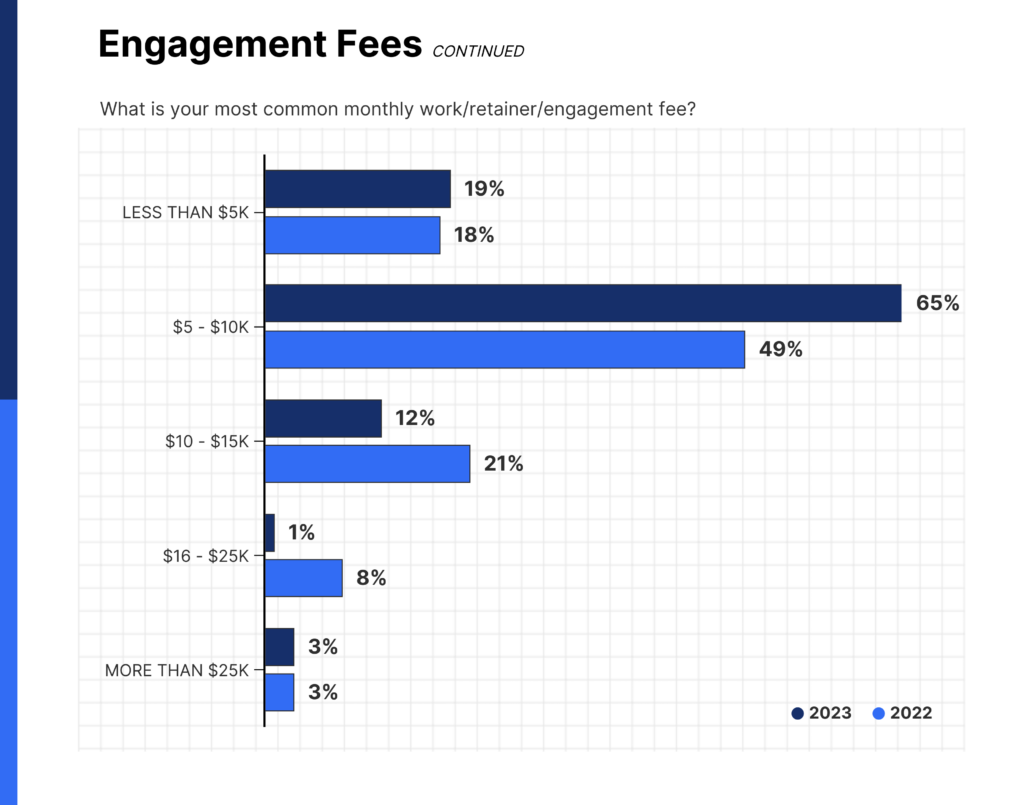

For the third year running, Axial partnered with Firmex and Divestopedia on the annual M&A Fee Guide, the authoritative source on M&A fees for sell-side engagements in the middle market.

Using data gathered from a survey of mid-market dealmakers—including more than 200 Axial members—the guide highlights key points of interest on M&A fees across geographies and deal sizes.

Alfredo Garcia, Director of Go-To-Market at Axial, reviewed the findings in this year’s M&A Fee Guide and shared his takeaways:

Alfredo Garcia, Director of Go-To-Market at Axial, reviewed the findings in this year’s M&A Fee Guide and shared his takeaways:

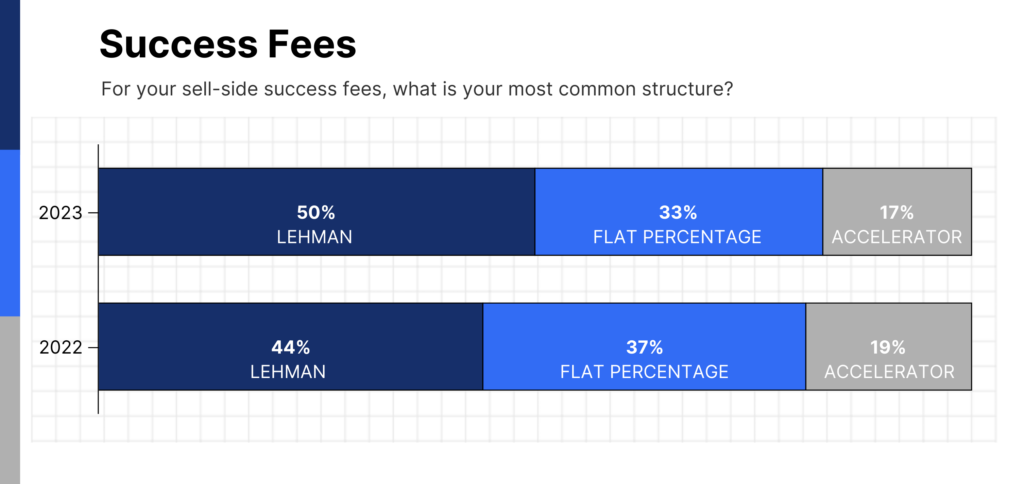

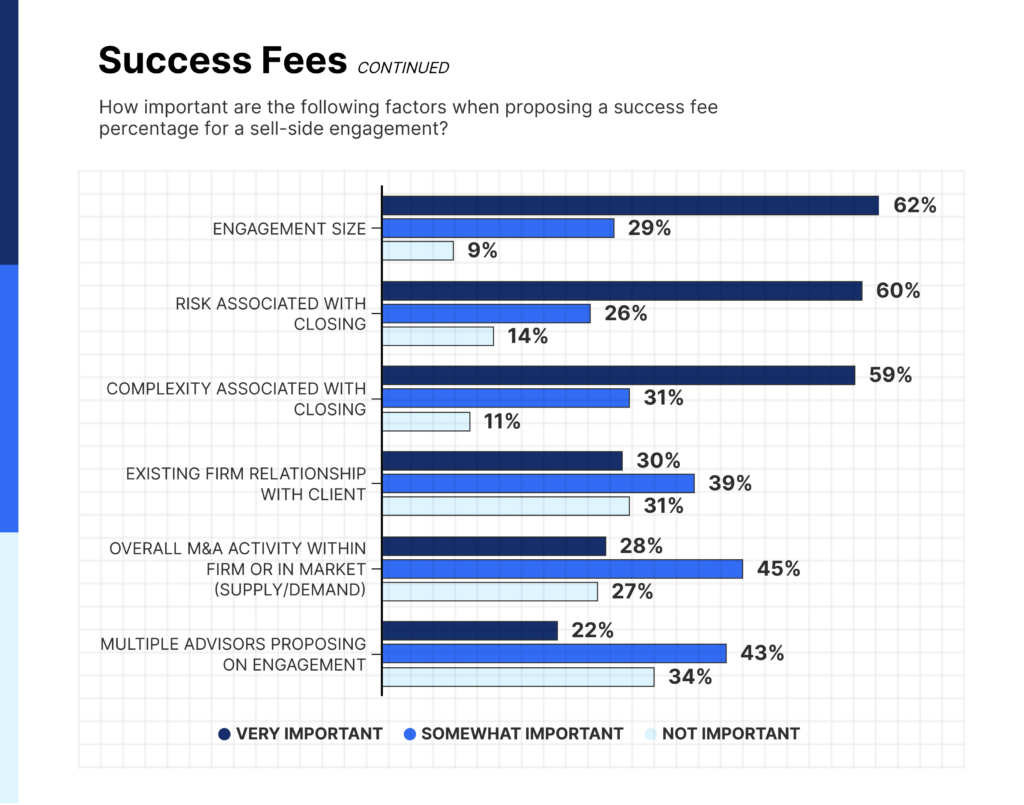

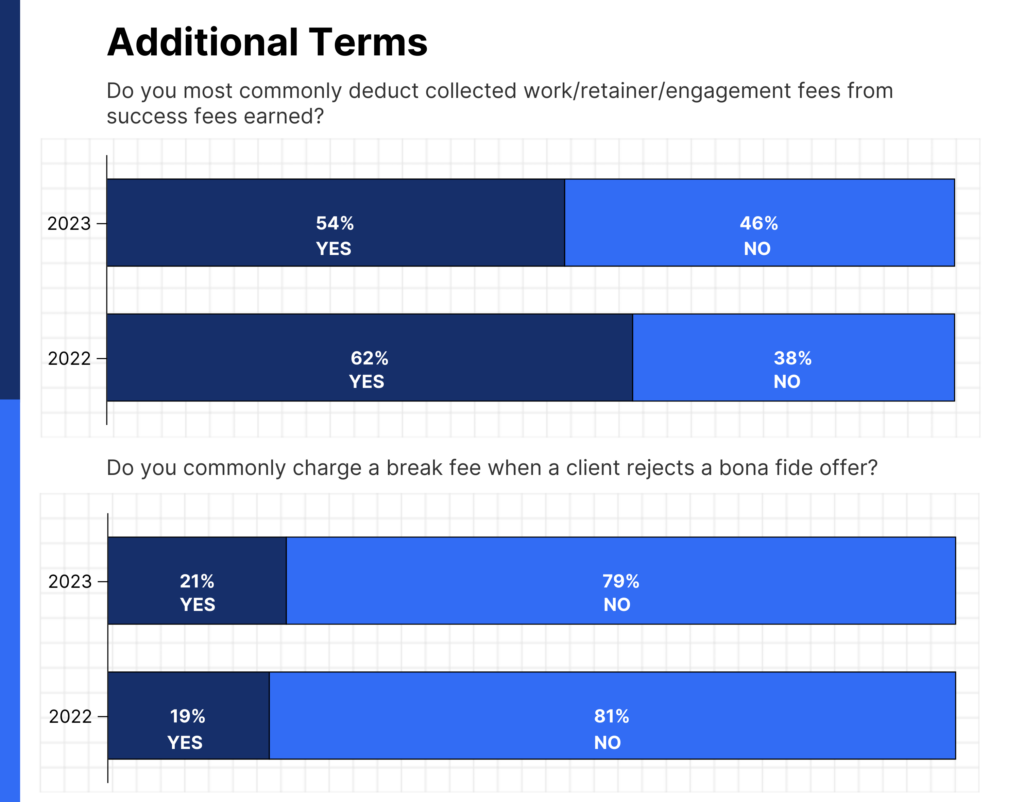

The 2024 M&A Fee Guide reveals evolving strategies in fee structuring from investment bankers as they proactively respond to a more uncertain and complex dealmaking environment. Looking ahead, business owners can expect investment bankers to continue to adapt their fee structures to meet the demands of a competitive and changing market. It is likely firms will continue to prefer fee models with retainer components to decrease their reliance on success fees. They will also continue to factor in more complicated deal terms necessary to get transactions done, which may be reflected in how they structure their success fee payouts.

These shifts offer more predictable revenue for investment banks and align fee structures with the effort and expertise required to complete more complex deals. The resiliency and adaptability of investment banks should be encouraging to business owners. In a dynamic market, expert advice can be critical for successful outcomes, and exit-minded owners should work proactively to identify the right investment banker who can bring experience in navigating challenging environments and know how to proactively align their own success with that of their clients.

Below are select 2022 vs. 2023 comparisons of advisors’ fee structures across retainers and success fees. See the end of this feature to download the ebook and review the full guide.