The Winning M&A Advisor [Vol. 1, Issue 3]

Welcome to the 3rd issue of the Winning M&A Advisor, the Axial publication that anonymously unpacks data, fees, and terms…

Axial is excited to release our Q1 2024 Lower Middle Market Investment Banking League Tables.

To assemble this list, we reviewed the deal-making activities of 378 investment banks and advisory firms that met the qualifications to be considered for league tables last quarter.

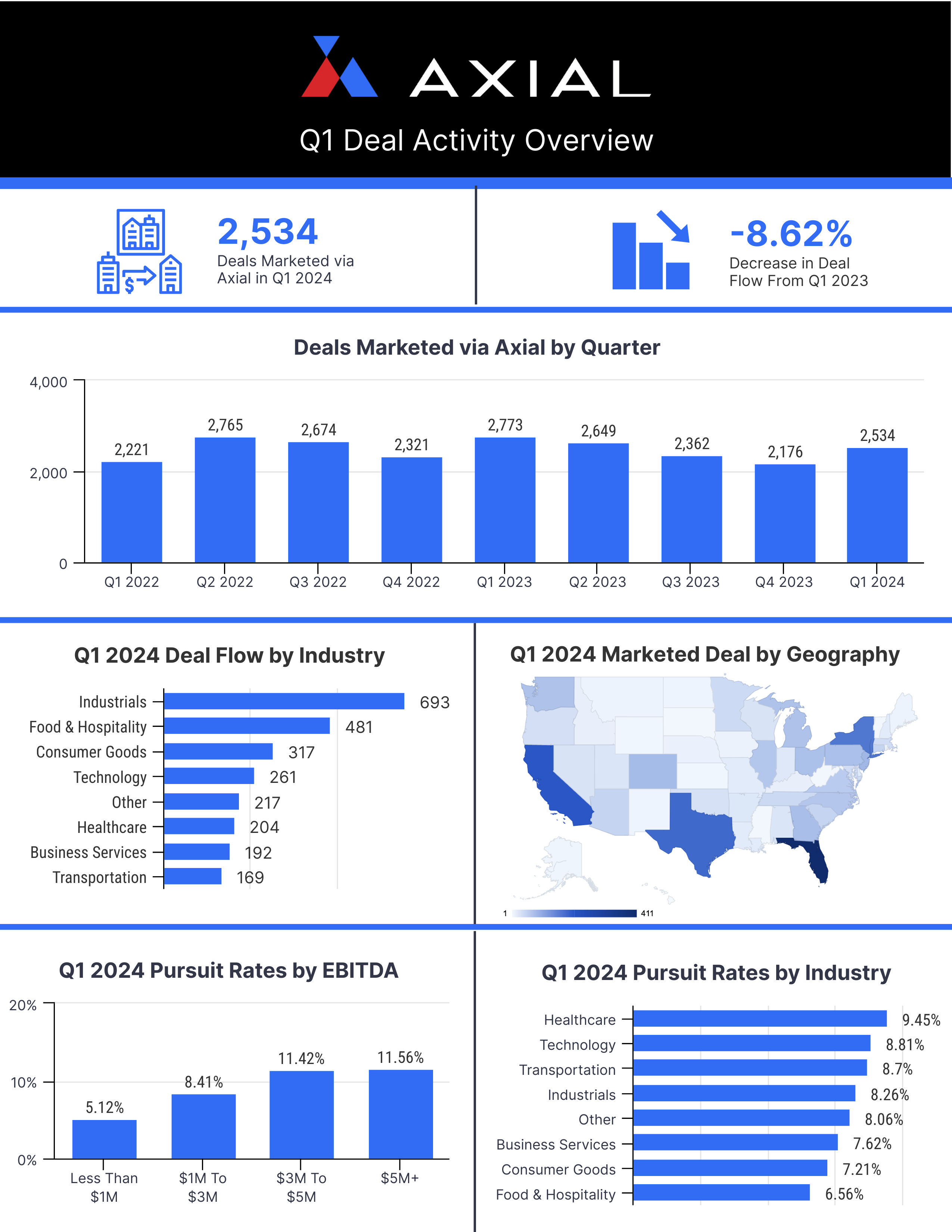

In Q1 of this year, the sell-side membership marketed 2,534 deals on the Axial platform, which is an increase over the past two quarters, but still an 8.62% decrease compared to the same period last year.

See below for an overview of last quarter’s deal activity. If you’re interested in diving deeper, check out Axial’s SMB M&A Pipeline series, which surfaces a top-of-the-funnel breakdown of the deal activity, sorted by industry category.

Axial’s league table ranking methodology (detailed methodology available in the footnotes) is driven largely by four factors:

Congratulations to each of these investment banks and M&A advisory firms for their dealmaking achievements in Q1!

| Rank | Firm | HQ |

|---|---|---|

| 1 | Vertess Healthcare Advisors, LLC |

TX |

| 2 | Sun Mergers & Acquisitions | NJ |

| 3 | Woodbridge International | CT |

| 4 | Cornerstone Business Services, Inc. |

WI |

| 5 | Founder M&A | TX |

| 6 | New Direction Partners |

PA |

| 7 | Tower Partners | MD |

| 8 | FOCUS Investment Banking |

VA |

| 9 | Ad Astra Equity Advisors | MO |

| 10 | Vercor |

GA |

| 11 | Purpose Equity |

SC |

| 12 | Solganick & Co. | CA |

| 13 | Young America Capital, LLC | NY |

| 14 | Vesticor Advisors | MI |

| 15 | DelMorgan & Co |

CA |

| 16 | Liberty Ridge Advisors | WA |

| 17 | Premara Group | UT |

| 18 | TREP Advisors | FL |

| 19 | eMerge M&A, Inc. |

NY |

| 20 | Kratos Capital |

TX |

| 21 | Protegrity Advisors | NY |

| 22 | ACT Capital Advisors | WA |

| 23 | Bell Lap Advisors |

OR |

| 24 | Oberon Securities, LLC | NY |

| 25 | Peak Technology Partners LLC | CA |

| Firm | HQ |

|---|---|

| Mystic Capital Advisors Group | NY |

| Sequeira Partners | EB |

| Earned Exits | CO |

| FirePower Capital | ON |

| Madison Street Capital | TX |

| Firm | HQ |

|---|---|

| IEI Advisors | VA |

| CRI Capital Advisors |

AL |

| Kreshmore Group |

IL |

| Hext Capital Partners |

TX |

| Evangeline Securities |

LA |

| Firm | HQ |

|---|---|

| Capital Canada Limited | CAN |

| Vista Business Group |

KS |

| Sterling Point Advisors | VA |

| Kaulkin Ginsberg | MD |

| LB Transitions | MN |

| Firm | HQ |

|---|---|

| Mertz Taggart |

FL |

| RigSide Energy Partners | GA |

| IT ExchangeNet |

OH |

| M&A Healthcare Advisors | CA |

| SF&P Advisors | FL |

![]() – 1 closed deal on Axial |

– 1 closed deal on Axial | ![]() – 2 or more closed deals on Axial

– 2 or more closed deals on Axial

“VERTESS is a healthcare-focused Mergers + Acquisitions (M+A) advisory firm that helps owners increase their company’s financial value and negotiate the best price when they decide to sell their own company or grow through acquisition. Our expertise spans diverse healthcare and human service verticals, ranging from behavioral health and intellectual/developmental disabilities to DME, pharmacies, home care/hospice, urgent care, dental practices, life sciences, and other specialized services and products. Each VERTESS Managing Director has had executive experience in either launching or managing and ultimately successfully exiting a healthcare company.

VERTESS is headquartered in Dallas/Fort Worth, with additional offices in Phoenix, Tucson, Los Angeles, Denver, Boston, and Orlando.”

Visit Vertess Healthcare Advisors’ Profile

“Sun Mergers & Acquisitions is a full-service professional business intermediary firm specializing in all aspects of the confidential sale, merger, acquisition and valuation of privately held mid-market companies with a primary focus in handling the sale of entrepreneurial and family held companies. Sun M&A brings extensive, broad based expertise, yielding the greatest probability of a successful sale with a maximum net after-tax yield.”

Visit Sun Mergers & Acquisitions’ Profile

“Woodbridge International has been closing lower-middle-market M&A deals for 30 years. We closed 32 deals in 2022 in various industries, including manufacturing, distribution, e-commerce, logistics, consulting and healthcare; generating $619 million in liquidity for our clients.

We do ground-breaking, confidential global client marketing. We create powerful marketing videos showcasing our client’s companies. We have an innovative 150-day timeline-driven auction that establishes a closing date upfront, and all clients attend a 2-day virtual, Management Meeting Training Program. We are a technology-driven, fully virtual firm.

That’s why Woodbridge International is well-positioned to dominate the highly fragmented, underserved lower middle market.”

Visit Woodbridge International’s Profile

“Cornerstone Business Services is a boutique investment bank serving the lower middle market of mergers & acquisitions. We’re based in the Midwest but work throughout North America, and are a founding member of the Cornerstone International Alliance. We create value through acquisition searches, company sales, and valuations, with a focus on businesses with annual revenue from $5 million to $150 million.

Cornerstone uses a team approach on each transaction along with our proprietary Assurance 360™ process which typically generates multiple offers, a high likelihood to close and maximizes value. We work really well with first time sellers that value an advisor’s role and want to ensure the largest financial transaction of their life is done right.”

Visit Cornerstone Business Services’ Profile

“We are a sell-side focused advisory firm operating in a broad array of business industry sectors. Our team has decades of transaction advisory and consulting experience and has completed numerous transactions in the lower-middle market. Founder M&A is a collective group of M&A professionals who strive to provide maximum value for business owners looking to exit or complete a private equity recapitalization.

With our professional merger and acquisition advising, we offer business owners and leaders a proven formula of success for navigating the arduous transaction process. Founder M&A specializes in transacting businesses with annual revenues from $10m to $150m.”

“New Direction Partners provides advisory services in investment banking, valuation, financial advisory and management consulting. Our partners have unparalleled experience, with involvement in over 200 sales and mergers since 1979. We specialize in providing services to the printing, packaging and allied graphic arts industries with an emphasis on mergers and acquisitions.”

Visit New Direction Partners’ Profile

“Tower Partners is a leading Private Investment Bank and Advisory Firm providing premier service to the middle market. Our team of industry veterans have advised sell-side and buy-side engagements with over $15 billion in value for entrepreneurs, family-run businesses and financial sponsors.

We are a national firm with a global reach, supporting clients throughout the United States with headquarters in Columbia, MD and offices in Baltimore, MD, Denver, CO, and New York, NY. Our entrepreneurial roots and years of experience have solidified our will to charge forward when others might quit.”

“With more than three decades of experience, FOCUS Investment Banking is a trusted name in M&A advisory services with a nationwide footprint and a global reach. Headquartered in the Washington, DC metro area, FOCUS also has corporate offices in Atlanta and the Los Angeles metro area. Its team of 35+ senior bankers is supported by more than a dozen analysts, senior advisors and support staff. Each FOCUS banker maintains a core practice in one of the 12 industry verticals comprising the firm’s current areas of specialization, keeping FOCUS abreast of developments in today’s rapidly changing market environments.”

Visit FOCUS Investment Banking’s Profile

“AAE is a boutique merger and acquisition advisory firm located in the Kansas City area. We offer M&A advisory services as sell-side advisors. We guide business owners through strategic planning, marketing, and closing of a deal to transition their company. Ad Astra has successfully closed a combined $500 million of transaction value.

Our team works with owners across the nation, of varying sizes, across several industries, with each owner having unique goals. We are well equipped to understand a business owner’s wants and needs, and converting those goals into our unique deal process becomes our roadmap to their ideal outcome.”

Visit Ad Astra Equity Advisors’ Profile

“VERCOR, a leading middle market mergers and acquisitions firm, serves business owners who are interested in selling all or part of their company or who are seeking a private equity recapitalization. Our team manages the entire process – business valuation, assessing the market value of a company, pre-sale planning, marketing, negotiations, and closing the best possible deal. VERCOR brings national and international resources to the job of selling a business in the mid-size market. VERCOR merger and acquisitions consultants provide worldwide resources usually available only to companies with revenues in excess of $100,000,000. VERCOR Investment Banking Serves Business Owners Who Are Interested In: Selling all or part of their business Private equity recapitalization Management Buyouts.”

“Purpose Equity simplifies the complicated process of transitioning your business, providing you with the information you need to make the best decision possible—leaving you with peace of mind and no regrets.”

Visit Purpose Equity’s Profile

“Founded in 2009, Solganick & Co. is a data-driven investment bank and M&A advisory firm focused exclusively on software, healthcare IT, and tech-enabled services companies. Offices are located in Austin, Dallas, Los Angeles, and San Francisco. Our deal team has completed over $20 billion in M&A transactions to date.”

Visit Solganick & Co’s Profile

“Young America Capital leverages strong relationships with banks, venture-capital and private-equity funds, family offices, fund-of-funds, foundations, hedge funds, Fortune 500 M&A executives and large employers’ retirement systems to facilitate clients’ goals. Advisor to: Investment managers in the alternative-asset classes, including venture capital, private equity, and hedge funds. YAC provides advisory services in the areas of fund structuring, fund-raising/marketing, LP relations, and back-office operations. Advisor to: Businesses seeking seed stage, early stage, and mezzanine debt and/or equity working capital.”

Visit Young America Capital’s Profile

“Vesticor Advisors was founded on the principle that owner-operated companies in the lower middle market are unique and require specialized attention and advice when considering strategic investment and exit opportunities.

Vesticor Advisors provides M&A and capital raising advisory services exclusively to founder and owner-operated companies. We support clients with the expertise needed to build their business through growth acquisitions, optimize value in an exit or sale, transition ownership to family or management, divest non-core assets, or raise capital. After founding, building and exiting our own businesses, the partners at Vesticor came together under a shared vision: to build an M&A firm that helps other business owners achieve their dreams of growth, expansion, legacy and financial independence.”

Visit Vesticor Advisors’ Profile

“With over $300 billion in successfully completed transactions in over 80 countries, the professionals at DelMorgan & Co. provide world-class financial advice and assistance to companies, institutions, governments, and individuals in the US and around the world. DelMorgan’s unique approach to business has grown out of its dedication to its core principles and the experience of its professionals over the course of decades working on some of the most challenging, most rewarding, and highest profile transactions.

DelMorgan & Co. brings significant intellectual firepower to each client situation. We treat each engagement as a new and exciting opportunity to be capitalized on, never following a “standard approach” but rather tailoring our approach to each situation.”

Visit DelMorgan & Co’s Profile

“Liberty Ridge is the most difficult and treacherous trek on the Pacific Northwest’s iconic Mt. Rainier. As founders, with deep roots in the Pacific Northwest, we consider Liberty Ridge the perfect metaphor to represent the challenging yet rewarding endeavors that a merger or acquisition can be for business owners.

The final summit, for any private business owner, is to achieve hard earned liquidity and successfully exit the business on one’s own terms. Even the most experienced climbers understand that it’s a team effort and would never dare to summit Liberty Ridge without the aid of an experienced, results-focused guide. Likewise, we believe that when the stakes are high and the potential rewards are grand, no business owner, regardless of how experienced or savvy, should attempt the difficult and challenging journey of exiting their business without partnering with experienced advisors.”

Visit Liberty Ridge Advisors’ Profile

“Our mission is to help business owners maximize their outcome during a liquidity event. As operators with a combined 25+ years of experience running all sizes of businesses, we are uniquely positioned to help business owners with sales and financial operations early in the process all the way through to the closing of a transaction. We utilize technology and specialized services to implement the best solutions for our clients.

Our primary focus is on lower middle market transactions in the high tech and eCommerce space. Our team of advisors has experience running the types of companies we represent. This means we understand the nuances associated with trying to acquire or sell a business. We have experience running large teams in Fortune 100 organizations and early stage startups with less than 10 employees.”

“TREP Advisors is an advisory firm focused on succession solutions for business owners. At TREP Advisors we know you want to be an owner who understands the future options for your business. In order to do that, you need a succession plan that fulfills your desires and addresses all the issues of estate planning and taxes. The problem is you are so busy with running the company that it makes you feel confused about addressing the issues of a succession plan.

We believe every owner is truly unique and that your succession plan is the single most important business decision you will make to achieve the freedom you deserve. We understand the struggles and opportunities you face every day because we have walked in your shoes, which is why we have been able to help owners like yourself sustain control over their business while liquidating equity in their business for financial security.”

“Originally founded in 1989, our mission is to provide a level of expertise, knowledge, and execution not typically available to owners of privately-held middle market companies. We get to know the owners’ personal goals and we get them there. We dig in and get to know the owner’s company almost as well as they do in order to provide the highest level of detail and execution. We work for owners selling their companies – and them alone.

With offices in New York, Florida, Texas, North Carolina and California, eMerge M&A is perhaps the most experienced and data rich M&A firm serving this market segment. No one has more experience with privately-held companies. No one.”

Visit eMerge M&A, Inc’s Profile

“We work with clients of all sizes in many industries in all parts of the country including South America and Canada. For middle market companies who wish to start the sale or divestiture process, KC’s Value Enhancement model is an M&A capability that maximizes shareholder value. Unlike business brokers and other M&A firms, KC utilizes proprietary analytical technology and which help institutionalize your company during the process, to help ensure rapid exit with maximum returns to the stakeholders.

Advance planning of the exit process is a key factor in determining the ease and overall outcome of the transition. Planning ahead allows sufficient time to enhance profits, improve your marketability, and time the execution of the sale based on external economic and market factors. Hiring an expert to help you plan in advance and evaluate your goals and expectations can mean the difference between you walking away from the closing table extremely satisfied, or you walking away very disappointed. Kratos Capital (KC) is an M&A firm dedicated to ensuring our client’s goals and expectations are met, and often times exceeded. With over 100 years of combined experience in the M&A industry, we take pride in being experts at planning, facilitating, and executing exit strategies with extremely favorable results.”

Visit Kratos Capital’s Profile

“Protegrity Advisors is a leading regional M&A advisory firm serving multiple business sectors in the lower middle market ($5 million to $100 million in revenue). Our deal team members have all completed business divestitures, acquisitions and finance transactions as CEOs, General Counsel, and senior business executives. We employ a lean business model that makes our fee structure significantly more competitive than traditional M&A advisory firms. Currently our clients are primarily located in New York City, New Jersey, Connecticut, and on Long Island; however, our access to private equity, corporate and strategic buyers as well as acquisition opportunities extends across the United States and internationally.”

Visit Protegrity Advisors’ Profile

“ACT Capital Advisors has been helping owners sell their businesses since 1986. Through hundreds of transactions, we’ve developed a strategic process that’s highly effective in closing deals. Unlike other M&A companies that hand you off to various specialists throughout the stages of a sale, you’ll work with one team at ACT, a group of hand-selected individuals familiar with your industry. They’ll be with you from start to finish, working toward your goals and looking out for your best interests.”

Visit ACT Capital Advisors’ Profile

“Bell Lap Advisors is the leading M&A advisor for the outdoor recreation industry. Typical deals are between $5-150 million USD in transaction size, and the firm has closed deals with buyers and sellers located in the USA, CAN, EU, AUS, TW, and China. We have experience selling to strategic buyers (both private and publicly-traded), private equity funds, high net worth individuals, and Family Offices.

Our focus areas include cycling, eBikes, overlanding, adventure vans, fishing, paddle sports, running, rock climbing, mountaineering, backpacking, camping, powersports and moto, ski and snowboard, wind sports, surf, skate, adventure travel, gear storage. We have experience with businesses offering hard goods, soft goods, footwear, services, and experiences.”

Visit Bell Lap Advisors’ Profile

“Oberon Securities is a New York based boutique investment bank that addresses the financial needs of emerging and mid-size businesses across a broad range of industries. Our company was founded in 2001 by senior professionals who have extensive Wall Street experience in investment banking, venture capital and research. Oberon provides customized financial solutions to emerging and middle market companies that are seeking assistance with their M&A and financing needs. Oberon’s professionals have an average of more than 15 years on Wall Street; that combined experience and our small and middle market focus allow us to bring a level of service and expertise normally available only to large companies.

Our firm emphasizes simplicity, creativity and speed and has developed a reputation for providing clients with innovative solutions that enable them to address their needs. We help our clients evaluate their strategic alternatives, define key business issues and find the right solutions. The Oberon team has a wealth of experience raising growth capital, acquisition financing and debt capital, as well as facilitating mergers, acquisitions and divestitures.”

Visit Oberon Securities, LLC’s Profile

“We are a boutique investment bank specializing in M&A and capital raise transactions for high-growth technology companies.

The PEAK team has been advising technology companies on critical financing and strategic transactions for over 50 years and has successfully completed over 175 financing and M&A transactions with a combined deal value of over $100 billion. The firm has prior experience with both bulge and middle-market investment banks, including Goldman Sachs, Morgan Stanley, Lehman Brothers, Barclays Capital and Arbor Advisors

Peak specializes on assisting founder-led, high-growth technology companies with a transaction values between $5 million and $250 million.

We are exclusively sell-side investment bankers, representing only founders, never investors or buyers. Our founders-only focus gives us perfect alignment of interests and optimizes results…and it’s results that matter.”

Visit Peak Technology Partners LLC’s Profile

Unlike traditional league table structures that have remained the same for years, where firms are assessed against deal activity and deal dollar volume, Axial league tables surface data on investment banks that reveal their client quality, ability to manage a sell-side process, and down funnel effectiveness for their client.

The investment banks at the top of the Axial League Table are leaders across the following categories:

Together, the top 25 investment banks are those who work with the most in-demand clients; balance breadth, selectivity, and accuracy in the buyers they engage; and generate the largest number of positive outcomes for their clients.

Axial is the trusted deal platform serving the lower middle market ($2.5-$250M TEV).

Over 3,500 advisory firms and 3,000 corporate and financial buyers have joined Axial to efficiently connect with relevant capital partners, source actionable deals, and build new relationships.

Visit the Member Closed Deals page to see selected transactions that have been sourced and closed via Axial.