The Advisor Finder Report: Q4 2025

Welcome to the Q4 2025 issue of The Advisor Finder Report, a quarterly publication that surfaces the activity occurring on…

Tags

Investment banks specialize in complex financial transactions like raising capital and mergers and acquisitions (M&A). Their industry expertise helps identify trends and challenges that affect a company’s valuation. They structure deals to mitigate seller risk and maximize exit outcomes, anticipating roadblocks like confirming buyer financing for smooth deal closures. Their networks include investors/acquirers, accounting and tax specialists, and more.

That’s why partnering with the right investment bank or M&A advisor can:

But these results depend on finding the best investment bank for your business. You want advisors with relevant deal experience and pre-existing relationships with buyers who are a good fit for your business and exit goals. This is where owners struggle, as they don’t have a good method for finding and evaluating such investment banks. They either rely on word-of-mouth recommendations or do a lot of research on their own. Neither of those methods are ideal because you’re not making an informed decision based on the firm’s past deals and results.

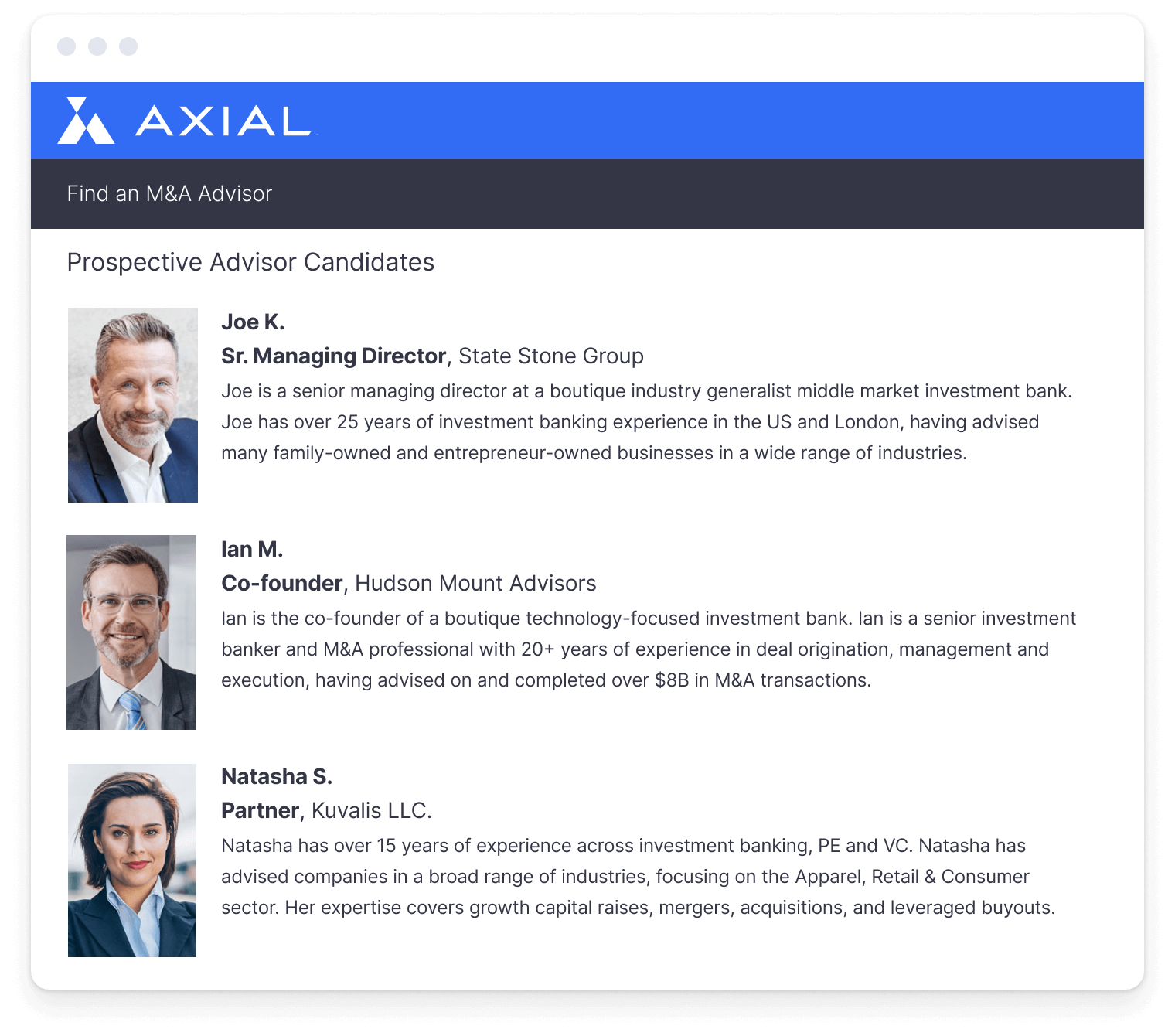

That’s where we come in at Axial. With more than 14 years of access to the small business M&A landscape, we have the largest network of pre-vetted investment banks and M&A advisors. This gives us access to extensive and insightful data on investment banks / M&A advisors, including the deals they’ve taken to market and their outcomes.

In this post, we take a close look at how we leverage that data to provide you with a curated list of 3–5 investment banks best equipped to help sell your business. We also share a success story from a business that increased buyer coverage and secured their ideal exit by partnering with an advisor we introduced them to.

Then, we cover 25 of the best investment banks for selling your business. These rankings come from our Lower Middle Market Investment Banking League Tables, which are published quarterly. We compile the list by evaluating each firm’s client quality, buyer targeting, process effectiveness, and deal outcomes, offering insight into the quality of the investment banks within our network.

Schedule a free consultation to get your curated shortlist of 3–5 Investment Banks and M&A Advisors.

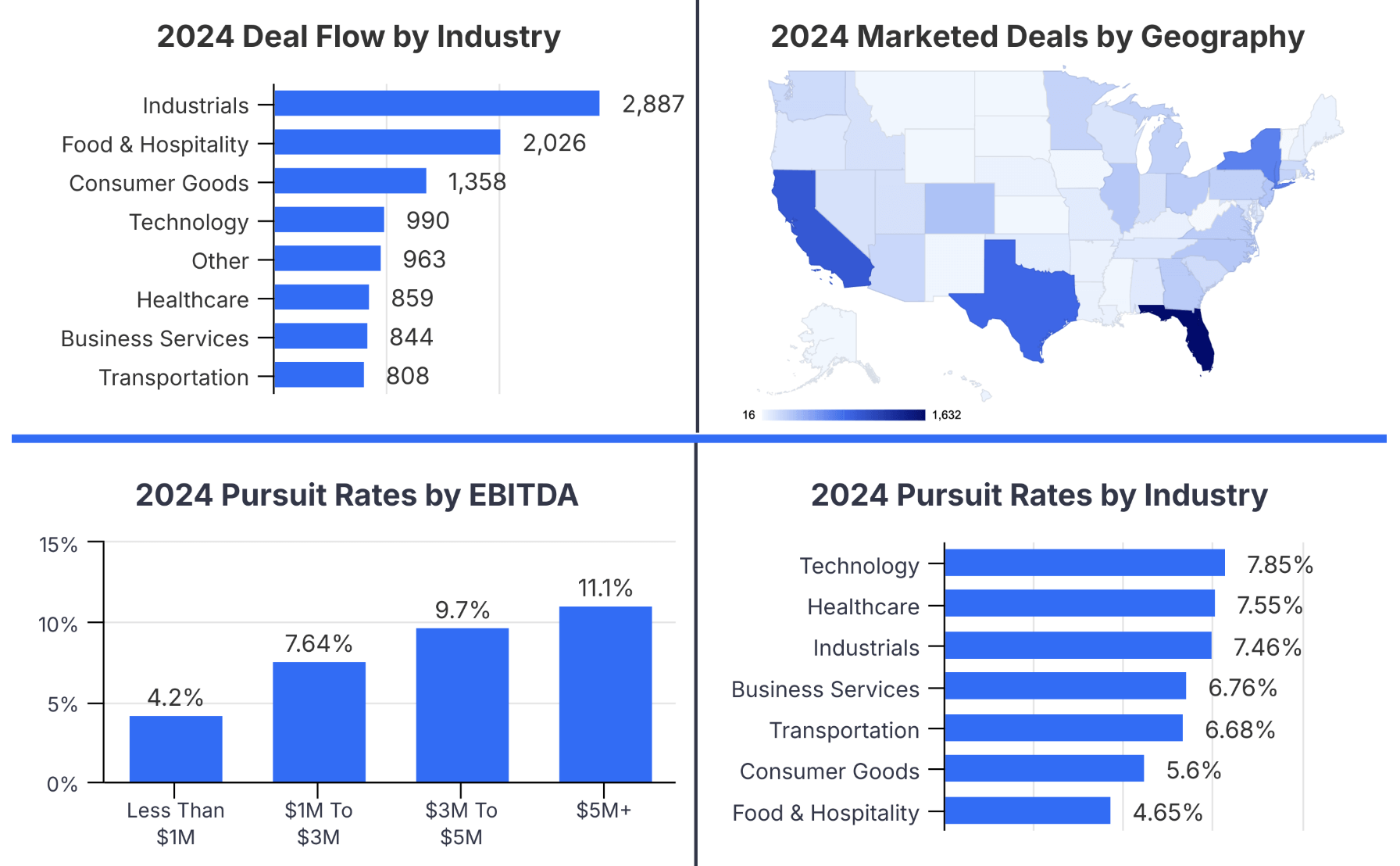

At Axial, we have an extensive amount of data related to buying and selling businesses due to our 14+ years of experience in mergers and acquisitions. For example:

*Pursuit rate: Pursuit rate reflects the ratio of prospective buyers engaging with a particular business relative to the overall number of buyers who were initially invited by the seller to explore the transaction.

We leverage this data and its insights to curate for you a shortlist of 3–5 Investment Bankers and M&A advisors. This lets you compare their engagement terms, cultural fit, and sell-side strategies, giving you peace of mind knowing that you found the best option amongst a highly-qualified and pre-vetted pool of professionals.

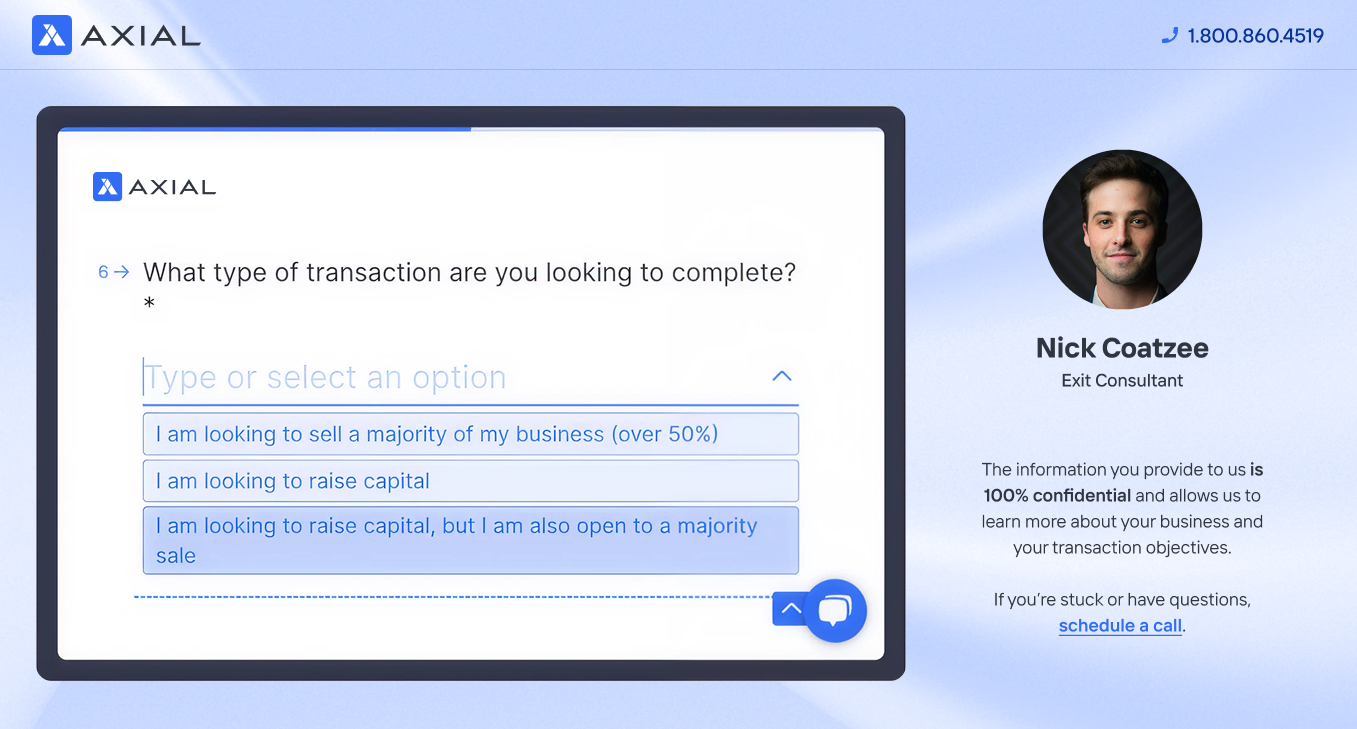

The process starts by pairing you with an Exit Consultant who gets to know your business and exit goals. From there, we analyze our network to create a shortlist of companies for your business.

We choose investment banks and M&A advisors for you based on their:

Your Exit Consultant then guides you through your choices and helps you prepare for the process of interviewing advisors.

Bob Falahee had two main goals in mind when looking to sell his business, SunPro Motorized Awnings & Screens, a wholesale manufacturer and supplier of sun protection products that he had run for 15 years:

In other words, he wanted a premium price but also a good amount of stewardship. He knew that if he got more interested buyers, he’d have a higher chance of getting the deal he wanted.

Bob Falahee came to Axial to find an advisor who could help him expand his reach outside of his home state and get more offers on the table. Based on his specific business and what he was looking for in an exit, we recommended that he partner with Peakstone Group.

Peakstone has been a trusted member of Axial since 2010 and has marketed 170 deals just within our network. We analyzed those 170 deals and found that Peakstone had extensive experience in marketing and selling businesses in Bob Falahee’s industry. Combined with our 13-year relationship with Peakstone, our analysis showed us that they were the right advisor to represent a business of SunPro’s size.

After going to market with Peakstone, SunPro was able to increase its buyer pool significantly.

Altogether, Peakstone helped SunPro receive:

Out of those 12 potential buyers, Bob Falahee was able to find one that offered him what he needed to exit the business and to do it on a timeline that worked for him.

If you’re looking to exit your business and achieve your exit goals, start by letting us find you the best investment bankers and M&A advisors to work with.

| Ranking | Name | HQ |

| 1 | Peakstone Group* | IL |

| 2 | Founder M&A | TX |

| 3 | Ad Astra Equity Advisors | KS |

| 4 | Hill View Partners | RI |

| 5 | FOCUS Investment Banking* | VA |

| 6 | Vertess Healthcare Advisors, LLC** | TX |

| 7 | Meritage Partners, Inc** | CA |

| 8 | Solganick & Co | CA |

| 9 | TREP Advisors | FL |

| 10 | Protegrity Advisors | NY |

| 11 | Cornhusker Capital** | NE |

| 12 | Vesticor Advisors** | MI |

| 13 | Madison Street Capital** | TX |

| 14 | ACT Capital Advisors | WA |

| 15 | Venture North Group** | AK |

| 16 | SDR Ventures* | CO |

| 17 | Premara Group | UT |

| 18 | American Healthcare Capital | CA |

| 19 | New Direction Partners* | PA |

| 20 | Sun Mergers & Acquisitions** | NJ |

| 21 | Vercor** | GA |

| 22 | Confederation M&A | PE |

| 23 | The Bloom Organization, LLC** | FL |

| 24 | True North M&A** | MN |

| 25 | Corum Group** | WA |

* 2 or more deals closed within Axial

** 1 deal closed within Axial

When ranking the best investment banks, we evaluated firms based on the following criteria:

The Peakstone Group has an impressive track record of selling businesses in the middle market. They’ve closed deals in many sectors, including aerospace, retail, food and beverage, technology, industrials, and logistics. At the time of this writing, they’ve represented more than 184 different businesses via the Axial platform.

The average Peakstone MD has 25 years of experience, and their team of over 40 investment banking professionals has completed hundreds of successful transactions with a broad global network of buyers. Their advisors work on the principle that there’s no standard “playbook” for every transaction, keeping their work entirely client-focused. This lets them understand their client’s wants and needs so they can develop thoughtful, creative solutions.

The Peakstone Group has substantial expertise to represent businesses with revenues of between $10 million and $500 million, whether that’s for M&A or capital raises.

The Peakstone Group has offices in: —

Interested in working with Peakstone? Request an introduction.

Founder M&A is a dynamic advisory firm specializing in sell-side transactions across diverse industry sectors. Backed by decades of transactional expertise, their seasoned team has orchestrated numerous successful deals in the lower-middle and middle markets. At the time of this writing, they’ve represented 18 businesses via the Axial platform, including:

The advisors at Founder M&A will work diligently as your partner in maximizing value for your business, whether you’re seeking exits or recapitalizations.

Their approach is grounded in a proven formula for success, tailored to guide business owners and leaders through the complexities of the transaction journey.

Founder M&A excels in facilitating deals for businesses with annual revenues ranging from $5 million to $25 million, ensuring smooth transitions and optimal outcomes for all parties involved.

Their office is located in Burleson, Texas, with satellite locations in Austin, Texas, and Orlando, Florida.

Interested in working with Founder M&A? Request an introduction.

Ad Astra Equity Advisors is a boutique merger and acquisition advisory firm that offers sell-side advisors. They guide business owners through strategic planning, marketing, and closing a deal to transition their company. Ad Astra has successfully closed a combined $500 million of transaction value.

Ad Astra Equity combines its network of hundreds of buyers with its ability to creatively position a business — ultimately negotiating the highest enterprise value available with the best partner.

They represent businesses in industries such as:

The Ad Astra Equity team learns what a business owner wants and needs before converting those goals into their unique deal process, which becomes a roadmap for their ideal outcome.

They don’t charge any up-front fees, monthly fees, or cancellation fees. Instead, they only get paid when a transaction is completed.

Plus, there is no required contract length to work with Ad Astra Equity. They set up this structure to help ensure they only get paid if they add value by bringing an acceptable offer to their client.

Their office is located in Kansas City, MO.

Interested in working with Ad Astra Equity Advisors? Request an introduction.

Hill View Partners provides Mergers & Acquisitions and Capital Advisory services to privately-held family, entrepreneur, and small investment group-owned companies generating $1 million to $10 million in EBITDA (or Pre-Tax Cash Flow).

They assist companies in selling or exiting their business (or a division of it) and in sourcing capital, whether through traditional bank financing or more creative funding solutions to support growth, acquisitions, partial monetization, or other strategic initiatives.

Hill View Partners has represented 28 businesses via the Axial platform, including:

Hill View Partners uses its tenure and wisdom of over $1 billion of transaction experience to support and work alongside businesses and owners. They are experts in communicating the value proposition of their clients to the broader M&A and Capital Markets, producing results with optimal values and terms, minimal distraction, and unrivaled responsiveness and expediency.

Hill View Partners continues its growth through trusted relationships with their clients and a track record of exceptional outcomes.

Their office is located in Providence, Rhode Island.

Interested in working with Hill View Partners? Request an introduction.

With more than three decades of experience, FOCUS Investment Banking is a trusted name in middle market M&A advisory services.

FOCUS is considered a subject matter expert for 11 industries in the US and Europe, but they are especially known for their focus on managed service providers, including the most active and successful MSP team in North America.

Over the past 36 months, they’ve catapulted ten MSPs into “New Platforms” for private equity sponsors and advised MSP transactions with 55 different buyers and sellers.

For companies in the middle market who want an advisor with a proven track record, FOCUS has the expertise to advise sellers and manage the process of raising capital for company growth — all with an emphasis on meeting their clients’ strategic and financial objectives.

They have offices in:

Interested in working with Focus Investment Banking? Request an introduction.

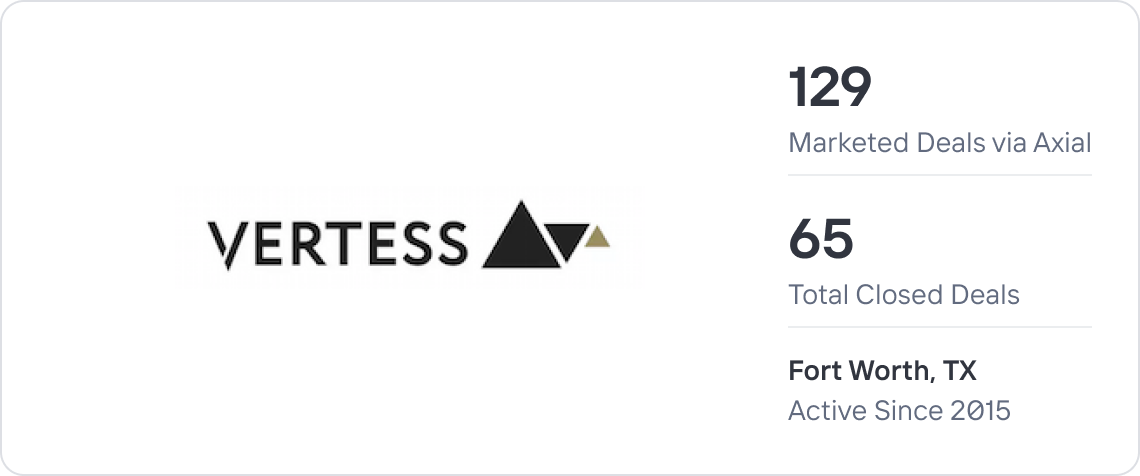

Vertess is a healthcare-focused M&A advisory firm. They specialize in middle-market healthcare companies and stand out for their industry expertise.

Vertess was founded by dedicated healthcare entrepreneurs who are also accredited M&A professionals. The team includes experts with previous experience as the founder of an innovative DME company, the COO of an international healthcare concern, and the owner of a pharmacy and home infusions provider.

We recently introduced Vertess to a professional nutrition consulting and staffing business. Our data suggested they had represented at least six similar healthcare-related staffing businesses via Axial. This industry experience is critical, as there are unique factors to consider when selling a healthcare company, such as evolving healthcare regulations.

The firm has been in business for over 10 years, guiding business owners on how to enhance the value of their healthcare companies while keeping them informed about M&A trends in the healthcare market.

Through Axial’s process, your Exit Consultant may suggest this firm if your company focuses on medical devices, pharmacy, home health, hospice, urgent care, dental, health IT, or another specialized service or product in the healthcare industry. Vertess’s deep-rooted healthcare M&A expertise helps them create a tailored approach that’s hard to beat.

They’re headquartered in Dallas/Fort Worth, with offices in:

Interested in working with Vertess Healthcare Advisors? Request an introduction.

Meritage Partners is a multifaceted advisory firm specializing in mergers and acquisitions, capital advisory, and strategic exit planning, with a focus on companies with EBITDA greater than $2 million.

Their client base includes privately-held businesses spanning diverse industries across North America. Meritage provides an all-encompassing suite of services covering the entire transaction lifecycle. From initial assessments, valuations, and the identification of value drivers to the development of robust go-to-market strategies, precise deal origination, thorough due diligence, meticulous deal structuring, skilled negotiation facilitation, and seamless post-merger integration, they offer expert guidance and support at every phase.

They’ve represented 94 businesses via the Axial platform, including:

They’re headquartered in Newport Beach, California.

Interested in working with Meritage Partners? Request an introduction.

Solganick & Co. is a data-driven investment bank and M&A advisory firm focused exclusively on software, healthcare IT, and tech-enabled services companies. Their team of skilled professionals offers customized, in-depth industry knowledge to align clients’ financial objectives with the evolving technology marketplace.

They specialize in identifying potential buyers and acquisition targets, structuring deals to maximize client value, and managing negotiations to ensure a smooth transaction process. Leveraging extensive market insights, data-driven research including artificial intelligence, and a wide network of industry connections, the firm provides a comprehensive solution for technology businesses seeking an exit or growth through M&A.

They’ve represented 46 technology businesses via the Axial platform, including:

Their deal team has completed over $20 billion in M&A transactions to date.

They are headquartered in El Segundo, California, and they have offices in:

Interested in working with Solganick & Co.? Request an introduction.

TREP Advisors is a sell-side advisory firm focused on succession solutions for business owners worldwide.

TREP is a team of 20 professionals, many of whom have owned their businesses and walked in the owner’s shoes. They believe that the owner succession plan is the single most important business decision an owner will make to achieve the freedom they deserve. That’s why they helped owners liquidate more than $140 million in equity from their businesses in 2024.

They work across verticals and have developed a lucrative referral program, helping them bring in great buyers to help their clients achieve their dreams.

They have represented 46 businesses via the Axial platform, including:

They are headquartered in Sarasota, Florida.

Interested in working with TREP Advisors? Request an introduction.

Protegrity Advisors is a leading M&A advisory firm focused on lower middle market transactions for companies with revenue ranging from $10 million to $100 million. They provide full-service management of the M&A process with an unwavering commitment to maximizing value and maintaining strict confidentiality.

With a management team averaging over 25 years of transactional experience, Protegrity has a proven track record of successfully closing deals with public and private companies and private equity firms across the U.S. and internationally.

Their reputation for representing highly sought-after clients attracts a wide range of buyers, and their extensive network, proprietary database, and dedicated research team position them to deliver exceptional results with speed and precision.

They represented 25 businesses via the Axial platform, including:

They’re headquartered in Ronkonkoma, New York.

Interested in working with Protegrity Advisors? Request an introduction.

Cornhusker Capital is a leading middle market advisory firm that provides superior and imaginative financial services, including mergers & acquisitions, buy-side and sell-side advisory services, fee valuation analyses, and corporate financial re-engineering. They are seasoned corporate finance executives with significant Fortune 500 experience.

They have represented 99 businesses via the Axial platform, including:

They are headquartered in Omaha, Nebraska.

Interested in working with Cornhusker Capital? Request an introduction.

After founding, building, and exiting their own businesses, the partners at Vesticor Advisors came together under a shared vision: to build an M&A firm that helps other business owners achieve their dreams of growth, expansion, legacy, and financial independence.

Vesticor Advisors was founded on the principle that owner-operated companies in the lower middle market are unique and require specialized attention and advice when considering strategic investment and exit opportunities.

Vesticor Advisors provides M&A and capital raising advisory services exclusively to founder and owner-operated companies. They support clients with the expertise needed to build their business through growth acquisitions, optimize value in an exit or sale, transition ownership to family or management, divest non-core assets, or raise capital.

Vesticor has represented 59 businesses via the Axial platform, including:

They’re headquartered in Lansing, Michigan, with additional offices in Cincinnati, Ohio.

Interested in working with Vesticor Advisors? Request an introduction.

Madison Street Capital is an international investment banking firm dedicated to the highest standards of integrity and professionalism.

They provide corporate financial advisory services, mergers and acquisitions expertise, valuation services, and financial opinions to publicly and privately held businesses through their offices in North America, Asia, and Africa.

They draw on specialized expertise in partnering with middle-market firms in all industry verticals and niche markets to achieve an optimal outcome through a variety of transactions. Madison Street Capital’s professionals precisely analyze each client’s needs to determine the best match between buyers and sellers, arrange cost-effective financing, and produce capitalization structures that maximize each client’s potential. Madison Street Capital is a trusted partner and industry-leading provider of financial advisory services, M&A assistance, and business valuations.

Madison Street Capital has represented 380 businesses via the Axial platform, including:

They’re headquartered in Austin, Texas, and have additional offices in:

Interested in working with Madison Street Capital? Request an introduction.

Through hundreds of transactions, ACT Capital Advisors has developed a strategic process that’s highly effective in closing deals.

When you work with ACT, you’re assigned to one team of hand-selected individuals (with experience in your industry) who will be your partners through the entire M&A process. They’ll be with you from start to finish, working toward your goals and looking out for your best interests.

ACT Capital Advisors has represented 162 businesses via the Axial platform, including:

They’re headquartered in Mercer Island, Washington.

Interested in working with ACT Capital Advisors? Request an introduction.

Venture North is a firm based in Anchorage, Alaska, providing a full suite of services to buy-side, sell-side, and capital finding clients. They have successfully managed and handled engagements in a wide variety of industries and are recognized as a leader in assisting in the sale or purchase of businesses.

They do business throughout the US, but they have unmatched expertise in the Alaska market. Due to Alaska’s very low level of VC and PE activity, the returns tend to be higher and deal quality better compared to other, more competitive markets.

Their team has more than 30 years of experience working in diverse industries, enabling them to build their services and solutions in strategy, consulting, mergers, acquisitions, and capital finding that assist our clients in maximizing their potential.

Venture North Group has represented 23 businesses via the Axial platform, including:

They’re headquartered in Anchorage, Alaska.

Interested in working with Venture North Group? Request an introduction.

SDR Ventures is a Denver-based investment banking firm serving private business owners in the lower middle market, including companies valued up to $300 million. They credit their collaborative approach and perseverance for their 22 years of successful outcomes and 88% closure rate for owners throughout the country.

SDR Ventures works across a wide range of traditional and niche industries, including pet products & services, business services, consumer, industrial, technology, health & wellness.

Their core services include:

SDR Ventures has represented 102 businesses via the Axial platform, including:

They’re headquartered in Greenwood Village, Colorado.

Interested in working with SDR Ventures? Request an introduction.

Premara Group focuses on helping business owners maximize their outcome during a liquidity event. As operators with a combined 25+ years of experience running all sizes of businesses, they are uniquely positioned to help business owners with sales and financial operations early in the process, all the way through to the closing of a transaction. They utilize technology and specialized services to implement the best solutions for their clients.

Their primary focus is on lower middle market transactions in the high-tech and eCommerce space. Their team of advisors has experience running the types of companies they represent, which means they understand the nuances associated with trying to sell a business. They have experience running large teams in Fortune 100 organizations and early-stage startups with less than 10 employees.

Premara Group has represented 25 businesses via the Axial platform, including:

They’re headquartered in Lehi, Utah.

Interested in working with Premara Group? Request an introduction.

American Healthcare Capital is a full-service, nationwide mergers & acquisitions advisory firm. With over $1 billion in active Sell-Side and Buy-Side engagements, they cover the entire spectrum of the healthcare industry, including home health, hospice, private duty, behavioral health, IDD, DME, medical staffing, long-term care, and all types of pharmacy.

With an emphasis on healthcare transactions, they understand the need for a unique approach to the healthcare services sector. They pride themselves on their intimate, real-time knowledge of the marketplace. They know who’s buying for a premium, who’s selling for a discount, and what deals can get financing, thanks to their network of buyers being larger than many other middle-market advisory firms. They also own healthcare receivable lenders, providing competitive, non-recourse accounts receivable financing in conjunction with Union Bank, as well as real estate loans for healthcare facilities.

Their full scope of services includes:

American Healthcare Capital has represented 433 businesses via the Axial platform. They’re headquartered in Marina Del Rey, California.

Interested in working with American Healthcare Capital? Request an introduction.

New Direction Partners provides investment banking and financial advisory services to family-owned and closely-held firms, though they also serve the middle-market needs of publicly traded companies.

They’re one of the only investment banking firms dedicated to the print and packaging industry. They have expertise in the media and marketing sectors, recently representing a business focused on graphic media, POP displays, and wide and grand format signage.

Together, New Direction Partners’ founders have more than 100 years of investment banking experience in the sale or purchase of more than 300 companies.

Since 2017, New Direction Partners has represented 103 businesses via the Axial platform. They’re headquartered in Valley Forge, Pennsylvania, with additional offices in:

Interested in working with New Direction Partners? Request an introduction.

Sun Mergers & Acquisitions is a full-service professional business intermediary firm specializing in all aspects of the confidential sale, merger, acquisition, and valuation of privately held mid-market companies, with a primary focus on handling the sale of entrepreneurial and family-held companies.

Their executive team has more than 30 years of experience and has closed more than 300 transactions for our clients since our inception.

Sun M&A brings extensive, broad-based expertise, yielding the greatest probability of a successful sale with a maximum net after-tax yield. Plus, using their extensive network of business and financial professionals, they can identify highly targeted potential buyers, including strategic acquirers, financial buyers, and private equity firms.

Since 2017, Sun M&A has represented 88 businesses via the Axial platform, including:

They’re headquartered in Hasbrouck Heights, New Jersey.

Interested in working with Sun Mergers & Acquisitions? Request an introduction.

VERCOR, a leading middle market mergers and acquisitions firm, serves business owners who are interested in selling all or part of their company or who are seeking a private equity recapitalization. Their team manages the entire process — business valuation, assessing the market value of a company, pre-sale planning, marketing, negotiations, and closing the best possible deal.

VERCOR brings national and international resources when selling a business in the mid-size market. Their merger and acquisitions consultants provide worldwide resources that are usually only available to companies with revenues in excess of $100 million.

VERCOR has represented 121 businesses via the Axial platform, including:

They’re headquartered in Atlanta, Georgia, with additional offices in:

Interested in working with Vercor? Request an introduction.

Confederation M&A is a trusted full-service M&A firm made up of highly experienced Advisors situated in Eastern Canada. Their service offerings include sell-side advisory services, buy-side advisory services, management buy-outs and buy-ins, and part or whole divestitures.

Being a proud member of the Cornerstone International Alliance, Confederation M&A is a globally connected firm. The trusted team has facilitated successful transactions both nationally and internationally.

Confederation M&A specializes in the low-middle market M&A space, representing businesses with revenue between $2 million and $100 million and EBITDA of $500,000 and $10 million.

Since 2022, Confederation M&A has represented 21 businesses via the Axial platform, including:

They’re headquartered in Charlottetown, Prince Edward Island, with additional offices in:

Interested in working with Confederation M&A? Request an introduction.

The Bloom Organization is a leading investment bank specializing in healthcare mergers and acquisitions. With closed transactions representing more than $10 billion in market capitalization, their leadership team of professionals has developed unmatched relationships with healthcare providers and industry professionals.

They understand that healthcare, more than any other industry, requires a deep understanding of the strategic value of both buyer and seller.

Since 2023, The Bloom Organization has represented 23 healthcare businesses via the Axial platform, including:

They are headquartered in Miami, Florida.

Interested in working with The Bloom Organization? Request an introduction.

True North Mergers & Acquisitions (TNMA), headquartered in Minneapolis, is a national sell-side and buy-side advisory firm.

TNMA’s senior professionals have built, operated, and sold successful companies, allowing the firm to perform transactions across all industry sectors. When you choose TNMA, you’re not just hiring another investment banker; you’re gaining passionate advocates for your business who have been in your shoes before.

TNMA’s dedication goes beyond the transaction to help founders and family business owners leave a legacy they can be proud of and free to start the next chapter of their lives.

Since 2022, TNMA has represented 35 businesses via the Axial platform, including:

They’re headquartered in Minneapolis, Minnesota.

Interested in working with True North M&A? Request an introduction.

Corum Group Ltd. is the global leader in merger and acquisition services, specializing in serving software and information technology companies worldwide.

For 37 years, Corum has created the standard for success. With offices across the globe, Corum has completed over 500 transactions with over $20 billion in wealth created. Corum is also the leading industry educator with its popular conferences and publishes the most widely distributed software M&A research.

Corum’s principals are highly experienced former tech CEOs supported by the industry’s leading researchers, writers, and valuators. The company has spent more than $50 million to build the world’s largest and most comprehensive buyer database. This knowledge base, combined with Corum’s experience and industry expertise, consistently ensures unequaled success in client engagements.

Corum has represented more than 73 technology businesses via the Axial platform, including:

They’re headquartered in Bothell, Washington, with an office in Zug, Switzerland.

Interested in working with Corum Group? Request an introduction.

In Axial’s Exit Planning Center, you’ll find several resources to help you navigate exiting your business, including:

Posts on understanding the basics of M&A:

Posts on preparing for your transaction:

Posts on Hiring an Investment Bank / M&A Advisory Firm:

Within the global investment banking landscape, several names consistently appear on lists of top investment banks, such as:

These are larger firms that service multinational corporations. So while Goldman Sachs is a reputable player in investment banking, there are better options for small-to-midsize companies trying to sell their business or raise capital.

Plus, keep in mind that investment banks are sophisticated financial institutions that provide a diverse range of services to corporations, governments, and high-net-worth individuals. These services include advising mergers and acquisitions, underwriting for debt and equity offerings, and asset management. Sometimes people think in terms of “finding the biggest investment bank,” but it’s often better to look for investment banks that have experience specific to your needs.

For example, some banks are known for their strength in certain industries or geographies, while others pride themselves on their global reach. The largest investment banks on Wall Street offer comprehensive services, while boutique firms may specialize in particular sectors or transaction types.

Investment banks provide a wide range of financial services, such as:

An investment banking firm usually has several groups dedicated to delivering the service(s) it offers. Here’s what M&A investment bankers do, based on their experience level:

A boutique investment bank is a specialized financial advisory firm that focuses on specific industries, transaction types, or geographic regions, rather than offering the comprehensive services provided by bulge bracket banks.

Boutique banks generally excel in their niche areas, offering deep expertise and specialized knowledge that can be particularly valuable for complex or unique transactions.

Many successful boutiques have built strong reputations for their advisory work in mergers and acquisitions, restructuring, and other specialized financial services.