The Advisor Finder Report: Q2 2024

Welcome to the second issue of The Advisor Finder Report, a quarterly publication that surfaces the activity occurring on Axial…

The first document produced and executed for an M&A transaction is typically a non-disclosure agreement (NDA), sometimes known as a confidentiality agreement (CA). The NDA is designed to enforce confidentiality among buyers, define terms of engagement, limit what can be disclosed to third parties, and dictate other terms to which counterparties must agree.

NDAs are legal documents designed to protect confidential information from being disclosed to a third party or being negatively used against the party disclosing the information — often a private business. Even if a business is not currently for sale, it is still important for any business owner or CEO considering the sale of their business to have a basic understanding of NDAs, their key elements, and how and when to use them to protect themselves and their business.

Pro Tip: When it comes to structuring and writing an NDA, you should always seek the advice of professional counsel.

NDAs can typically be structured in two formats: a one-way NDA or a mutual NDA. In a one-way NDA, also known as a unilateral NDA, the receiving party of the confidential information is bound to protect such information. For example, if you have been approached by a private equity group, you could require them to sign a one-way NDA; doing so would protect any confidential information you disclose to the private equity group, but you would not be bound if the private equity group disclosed confidential information to you. A one-way NDA protects your information, but not the information of the other party.

By contrast, if a competitor approaches you at a trade show, they may require that you sign a mutual NDA. In this case, any confidential information that you disclose, and any confidential information that the competitor discloses, is protected by the NDA.

What constitutes confidential information? The answer is different in many cases. A proper NDA should clearly define what is considered confidential information and what is not. Usually, an NDA stipulates that any information relating to products, services, markets, customers, research, software, developments, inventions, designs, drawings, financials, and other items is to be kept confidential. Exclusions to confidential information may include information already in possession of the receiving party or information that is in the public domain and can be proven to be public.

Pro Tip: Never sign an NDA that does not specifically indicate confidential information — you don’t want the courts to interpret the definition for you.

The term of the NDA specifies how long the confidential information will be protected. Usually, this ranges from one to three years, depending on the nature of the transaction and market conditions.

The term is often where a disconnect occurs between buyers and business owners. While business owners want to protect their information as long as possible, buyers don’t want to be bound by an NDA for an indefinite amount of time.

Axial understands the value of NDAs and their impact on deal-making. For this reason, Axial offers a range of different NDA experiences that are designed to be flexible and customizable, to fit the needs of businesses of all sizes and types. This approach ensures that users have the right level of protection for their confidential information, which can vary depending on the industry, the type of information being shared, and the relationship between the parties.

The existing process of reviewing, marking up, signing, scanning, and returning an NDA can be time-consuming and expensive. Despite the significant expenses involved in preparing and negotiating NDAs, they remain an essential tool for protecting business owners and establishing the terms of a transaction.

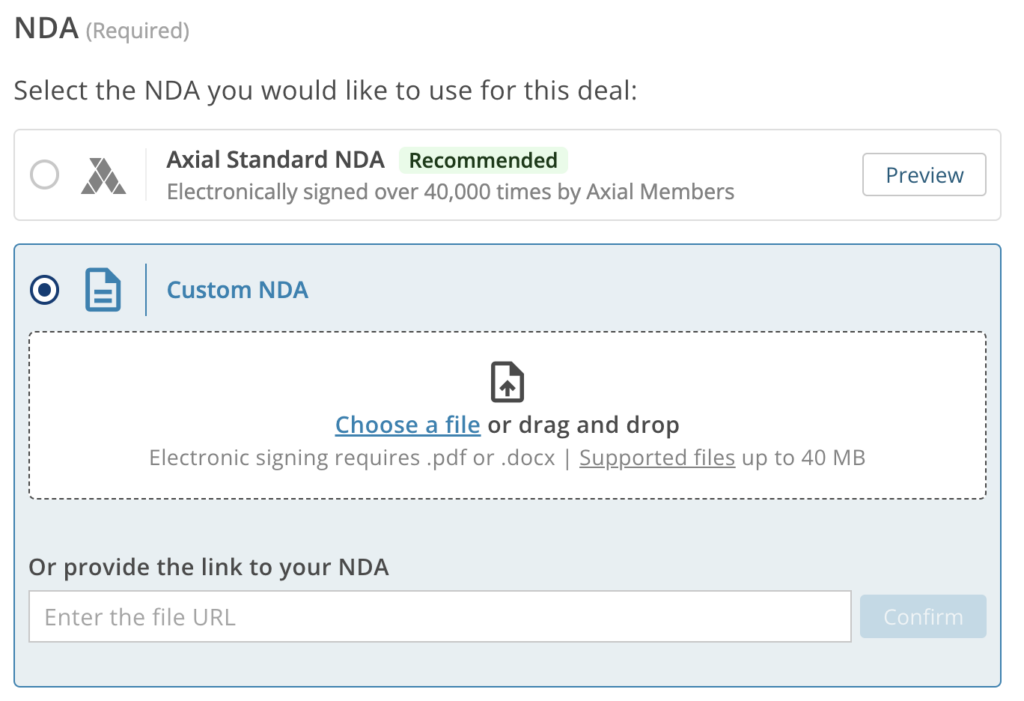

To combat this expense, Axial created a standardized NDA. The Standard NDA is a single standardized agreement that replaces the need for each party to draft and negotiate their own NDA. The goal is to ensure that all parties feel protected, save time, and are empowered to move forward with the right safeguards in place. Additionally, it’s designed to be straightforward and easy to understand, reducing the need for extensive legal review and negotiation. The ease of use of the Axial Standard NDA has resulted in it being the most popular NDA option on the Axial platform. 75% of members choose to use this standardized agreement, as it provides a cost-effective and time-efficient alternative to the traditional NDA process.

Axial provides an alternative to the Standard NDA to accommodate members that have specific legal or business requirements. For example, parties may need to include additional clauses to address unique circumstances, such as specific intellectual property protections, non-solicitation provisions, or data privacy requirements. By offering the option to upload custom NDA documents or provide a link to NDA documents off the platform, parties can tailor the agreement to their specific needs and ensure that all parties feel adequately protected.

In the event you upload your own custom NDA to the Axial platform, you will be presented with two possible signature settings. The first option, ‘Set up my NDA for eSignature’, will allow you to drag and drop custom fields onto your document, such as names, dates, titles and signatures, completed through Axial’s Dropbox integration. When your NDA is sent out, recipients will be required to fill out or sign any fields you customized your NDA with. The second option, ‘Add a signature page to the end of my document’, will automatically add a new page with a signature field that recipients will be required to sign once they receive your NDA.

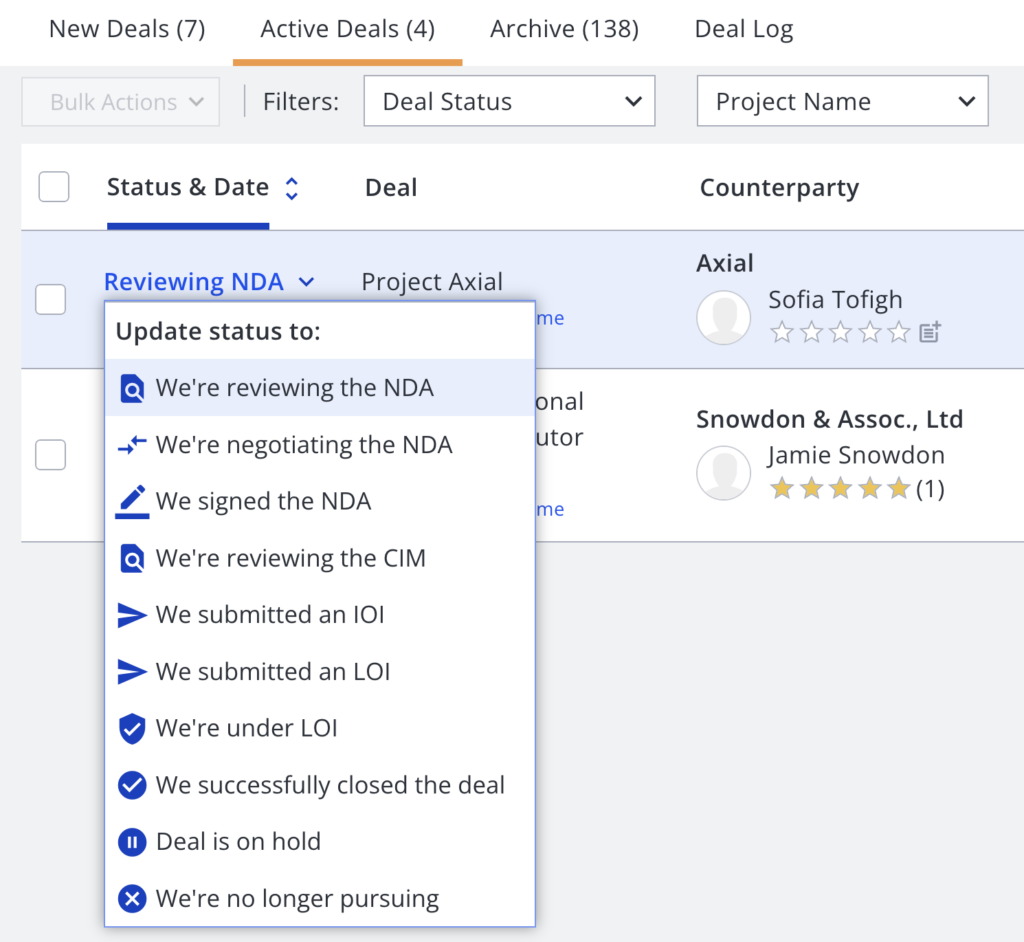

Axial’s platform reflects when NDAs have been sent, received, and signed, with email notifications sent when an NDA is signed. In addition, members have the ability to manually update their status to reflect changes occurring outside the platform, such as “Reviewing NDA”, enabling them to stay up-to-date with the progress of their deals.

Keeping track of the NDA status can provide several benefits to the overall NDA process. First, it can help ensure that all parties involved are aware of the current status of the NDA, from when it was sent to when it has been signed. This transparency can help reduce confusion and misunderstandings, as well as prevent delays in the process. Additionally, tracking NDA statuses can help identify potential bottlenecks in the process and allow members to take proactive steps to resolve them. For example, if an NDA has been sent but not yet signed, the sender may need to follow up with the recipient to discuss potential changes needed to be made to the NDA. Overall, by providing real-time updates on the status of the NDA, Axial streamlines the NDA process and improves communication and collaboration among all parties involved.

To learn more, download the Axial eBook on the 7 M&A Documents Demystified or check out the Deal Advice section on Middle Market Review.

Want to get these articles directly to your inbox? Subscribe to Exit-Ready, the Axial newsletter that distills the best content, tips, and guides designed to inform, educate (and entertain) exit-minded business owners running $5-$100M businesses.

Disclaimer: The information provided on this page does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this page are for general informational purposes only. No reader, user, or browser should act or refrain from acting on the basis of information on this page without first seeking legal advice from relevant counsel.