M&A Fee Guide 2023-2024

For the third year running, Axial partnered with Firmex and Divestopedia on the annual M&A Fee Guide, the authoritative source…

The CIM, also referred to as the Offering Memorandum (OM), Information Memorandum (IM), or pitch book, explains in more detail the intricacies of the company being sold and the long-term value of the business.

Although most business owners realize the importance of investing hundreds of thousands of dollars annually in high-quality marketing materials to sell their products and services, many fail to appreciate the importance of having professionally prepared materials when it comes time to explore an M&A transaction.

After a potential buyer signs your NDA, what do you do next? This is where the CIM comes in. The purpose of the CIM is to help a buyer understand your business and the unique strategic investment opportunity it presents The components of a CIM vary depending on the company’s industry and unique characteristics.

Imagine you approach 20 carefully targeted potential buyers. Ten of the buyers express a preliminary level of interest, sign an NDA, and ask for more information. Without a CIM, the next step would be participating in 10 separate conference calls with each buyer, in which you would answer some of the exact same questions over and over again. The conference call would lead to more one-off phone calls and emails.

With a CIM, you can accomplish the equivalent of these conference calls, phone calls, and emails with one document. Once a buyer has reviewed the CIM, they can quickly determine if they want to pass or move to the next stage in the deal process, typically a conference call with the business owner. This call with be a more in-depth conversation covering topics like the owner’s personal goals, valuation, and desired deal structure.

Buyers will always want to speak with business owners and management over the phone, visit the company in person, meet the team, and tour the facilities to get a clear picture of your business. But a CIM can and should set the tone for all discussions and set expectations in a transaction. Sharing a CIM is the most productive and efficient way to determine a qualified buyer’s level of interest.

Even if you are not actively selling your business, there are several reasons to have a prepared CIM on hand. Creating a CIM often helps business owners uncover issues in the company (e.g., large customer concentration, unscalable processes, or a lack of suitable management expertise in place) that can be corrected before selling the company. The CIM can help owners visualize their business from the perspective of a buyer and identify potential sticking points (e.g., large customer concentration or lack of management expertise) and opportunities for improvement. The CIM can also serve as a useful tool when approaching commercial banks for a loan. Lastly, a good CIM can be used in emergency situations (e.g., your plant burns down, you lose a key manager or owner to illness, major personal financial change of status, etc.).

Just as you would not put together professional marketing materials for your business without the help of a marketing professional, you should also enlist the help of a qualified professional to help prepare the CIM for your company.

Your options include:

Committing the necessary resources is key to producing a successful and professional CIM. Buyers will be turned off by incomplete or amateur documentation, and in turn, think poorly of your business, lowball the valuation, or simply ignore you. If you’re serious about selling (either now or in the future), your investment in the CIM will pay off.

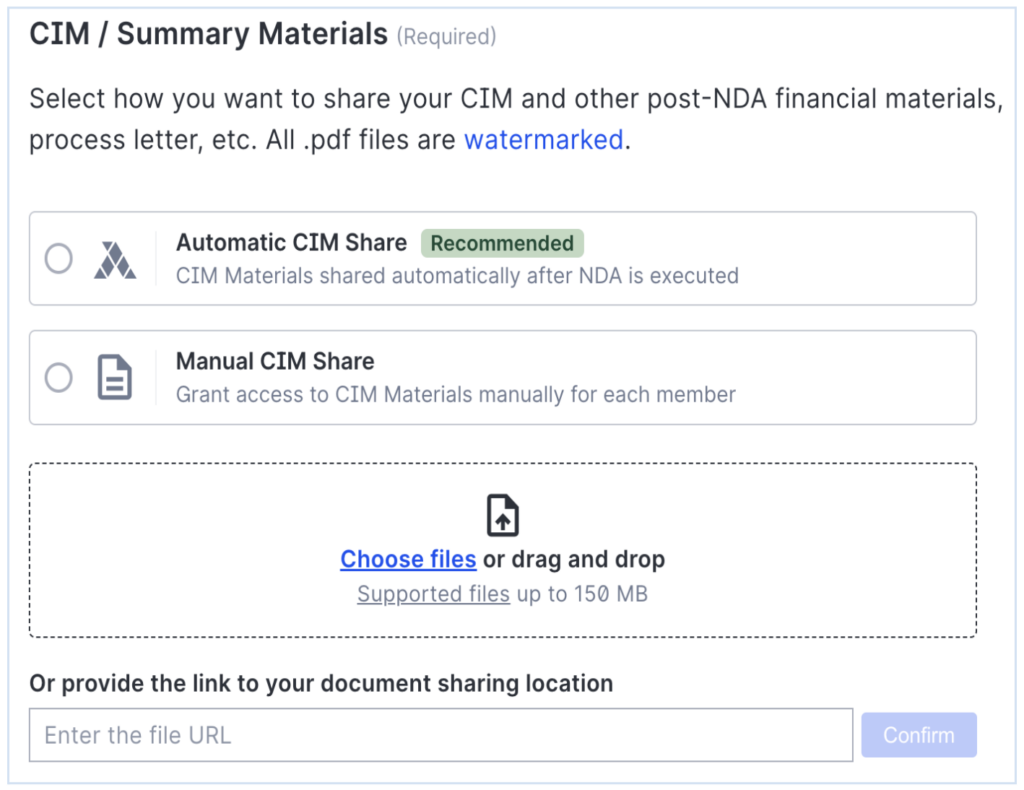

Creating a professional CIM is crucial for a successful M&A deal, but the process of sharing it with potential buyers can be a hassle. That’s where Axial comes in – simplifying the process of uploading and distributing CIMs, allowing businesses to focus on what matters most: attracting serious buyers and closing deals.

With the autoCIM feature, Axial automates the CIM sharing process entirely, making it easy to send CIMs to interested buyers. When a buyer e-signs your NDA, they instantly receive the CIM documents, eliminating the need for you to manually send documents to every member who signs the NDA. This also relieves you of the need to constantly check on the status of your deals, which can be both time-consuming and tedious. If that doesn’t fit your business needs, you can also choose to share your CIM with members on the platform manually.

When it comes to sharing your CIM, security is key and Axial’s got you covered there too. By implementing watermarking on all CIM documents, we ensure that your documents are protected and cannot be shared without permission. This means you can easily distribute your CIM to interested buyers without worrying about the security of your sensitive information. And if that’s not enough, you can also keep track of who’s viewed your CIM and when. Your deal activity on the platform will log any views of your CIM documents so that you’re never left in the dark. So whether you’re a seasoned M&A professional or just starting out, Axial’s suite of features offers a streamlined solution to make your CIM sharing process faster, easier, and more efficient.

To learn more, download the Axial eBook on the 7 M&A Documents Demystified or check out the Deal Advice section on Middle Market Review.

Want to get these articles directly to your inbox? Subscribe to Exit-Ready, the Axial newsletter that distills the best content, tips, and guides designed to inform, educate (and entertain) exit-minded business owners running $5-$100M businesses.

Disclaimer: The information provided on this page does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this page are for general informational purposes only. No reader, user, or browser should act or refrain from acting on the basis of information on this page without first seeking legal advice from relevant counsel.