Subscribe to Exit-Ready

Choosing a qualified M&A advisor with relevant transaction experience to represent the company is arguably the most important decision a business owner will make to ensure a successful sale. Even well-meaning advisors and investment bankers can derail a deal with bad advice, poor judgment, or a misrepresentation of their skill sets.

The following article outlines key questions for a business owner to ask an M&A advisor before making any hiring decision. See the end of this feature for Axial member Permanent Equity’s Intermediary Hiring Checklist, along with access to their full 70+ page interactive diligence workbook.

Do they have the right experience?

- What comparable transactions have you completed in the past 4-5 years? The advisor should provide examples of companies in both similar industries and company size. With recent industry experience, the advisor will have insight into who is actively making acquisitions in that space and an existing foundation of knowledge for preparing marketing materials. The size of past transactions is also essential since the company’s size dictates which financial and strategic buyers will be the right fit.

- How many M&A assignments have you worked on in the last three years that didn’t close? Why didn’t they close? While many deals fall apart for reasons beyond either party’s control, it’s worthwhile to hear the reasons. Requesting to speak with several business owners the advisor has previously worked with is a great way to understand how hard the advisor worked, how long they stayed focused, and who were the individuals on the team that completed the work. Be wary of any advisor who will not provide such referrals.

What does the deal team look like?

- Walk me through the role of each deal professional at each stage of the transaction process. Junior bankers often handle the early stages of preparing materials for the company and, in some cases, will own the initial outreach to potential buyers. Senior bankers bring years of experience with the more serious conversations with potential investors or acquirers down the line, so it’s essential to understand what stage they step in.

- How many clients do you typically take on in a given year, and how many do you expect to take on this year? Understanding how the advisor plans to allocate their time and attention to their clients will provide additional clarity on their processes and help manage the business owner’s expectations along the way.

Want to dive deeper? Download The Guide to Building a Deal Team eBook.

What is the valuation and fee structure?

- What valuation range should I expect for my business and why? An experienced advisor should know enough about industry trends, current market activity, average multiples, and other valuation factors to provide a ballpark figure of the company’s worth.

- Tell me about your fee structure. The most common way an M&A advisory firm charges for its services is with a retainer and a success fee. The exact mix will vary from firm to firm, and it’s important to understand all potential costs upfront.

Earlier this year, Axial partnered with Firmex on the annual M&A Fee Guide: the authoritative source on M&A fees for sell-side engagements in the middle market. To download the guide – click here.

Can they add value beyond the transaction?

- What growth opportunities in my industry can I pursue leading up to a sale? With the fee ultimately being tied to the sale price of the business, the advisor should be able to offer advice and insights to maximize the company’s growth and value in the 1-3 years preceding a sale.

- What else can I do to prepare my company for a sale? Whether it’s ensuring that a strong management team is in place, the customer base is sufficiently diversified, or financial statements and accounting practices are in proper order, good advisors should be able to help with “diagnostics” to understand any issues prospective buyers may find.

- Can you connect me with other service providers I’ll need to speak with before executing the transaction? M&A advisors often have an extensive network of service providers that business owners can leverage. These providers help ensure that the transaction is successful by offering specialized expertise in areas such as wealth management, estate planning, tax and insurance advice, exit planning, and legal support.

Best Practices for Business Owners

- What are the indications that a business owner (and the business) are actually prepared to begin the transaction process? Having a well-drafted business plan, providing accurate, up-to-date financial statements, and understanding the market’s potential are three common indications that a business owner is ready to begin the process. However, it’s important to take advantage of any advice the advisor can provide in this area.

- What are the biggest mistakes that owners make in this process? Deals can fall apart for several reasons, and in some cases, those reasons can be avoided by learning from past mistakes. For example, not having the company’s financial and legal affairs in order can quickly derail the transaction. Understanding and correcting common, avoidable mistakes before engaging in the sale process is a major benefit to any business owner.

- Can you walk me through one of the best engagements that you’ve worked on? What did the business owner do to put themselves in the best position to succeed? Just as business owners can learn from the mistakes of their peers, knowing the steps and characteristics of a successful transaction is equally important. Sharing the commonalities of past successful engagements is one of the critical benefits M&A advisors can provide to business owners.

Additional Resources

Interactive Hiring Checklist

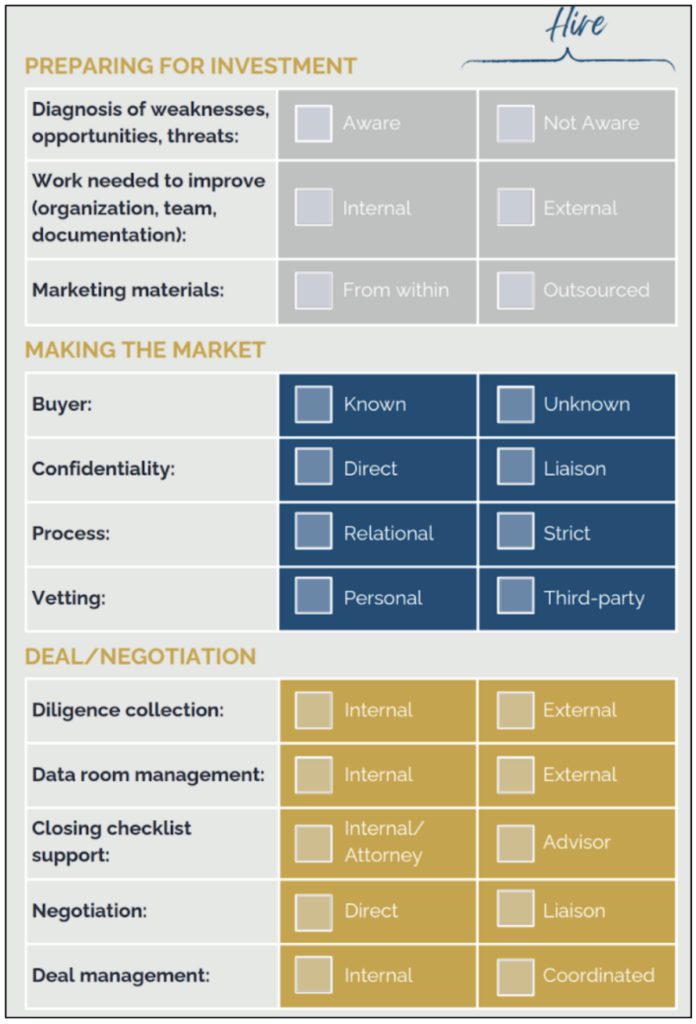

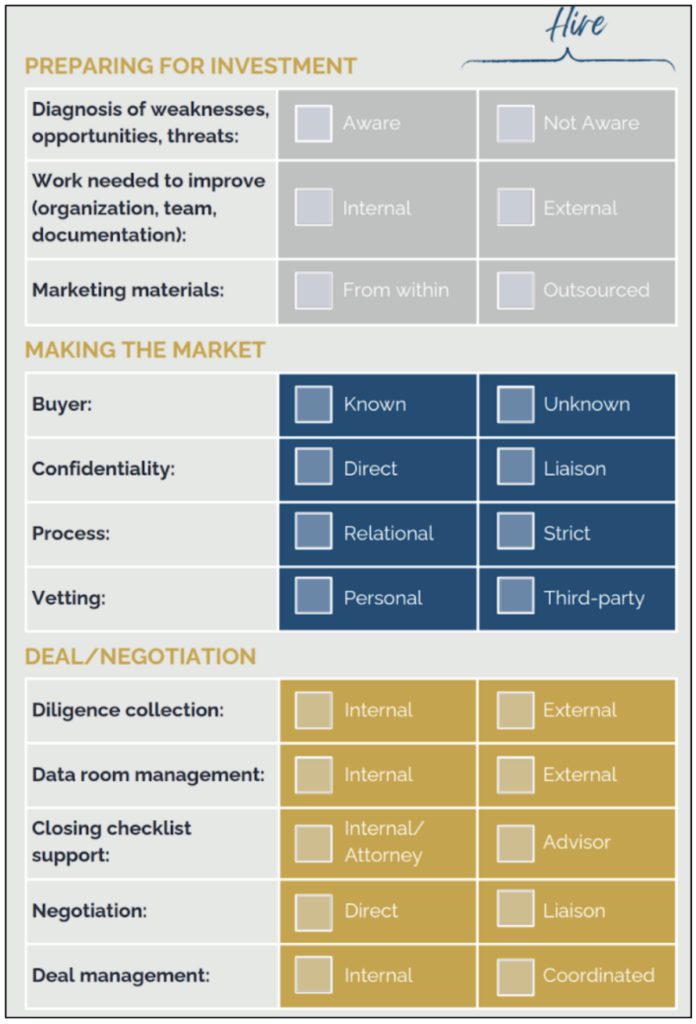

Permanent Equity recently released a comprehensive workbook that provides guidance for sellers navigating the due diligence process of a deal. Included is a checklist for hiring an M&A advisor. The first step in the checklist includes a rubric (snapshot below) that can be used to vet three specific advisory functions – Preparing for Investment, Making the Market, and Deal Progression & Diligence Support.

To download Permanent Equity’s full interactive workbook, which includes 70+ pages of due diligence checklists, worksheets, frameworks, and guidance – click here.

Can’t Get Enough Due Diligence?

On this episode of the Masters in Small Business M&A podcast, Axial CEO Peter Lehrman discusses acquisition due diligence and how to prevent broken LOIs with guest Emily Holdman.

Discussion points include:

- Strategies for creating a powerful diligence team

- Building trust in buyer-seller relationships

- Why you need an M&A attorney

- Rolls of an M&A Advisor

- Timing a deal

To listen to this episode – click here.