M&A Fee Guide 2023-2024

For the third year running, Axial partnered with Firmex and Divestopedia on the annual M&A Fee Guide, the authoritative source…

Tags

As 2017 draws near, we talked to Nancy Hament, Partner at Scura Paley, and Jim McCabe, Senior Vice President at Outcome Capital, to get their thoughts on the state of the middle market investment banking industry.

Here are three once-trends and now realities that face every middle market investment banker.

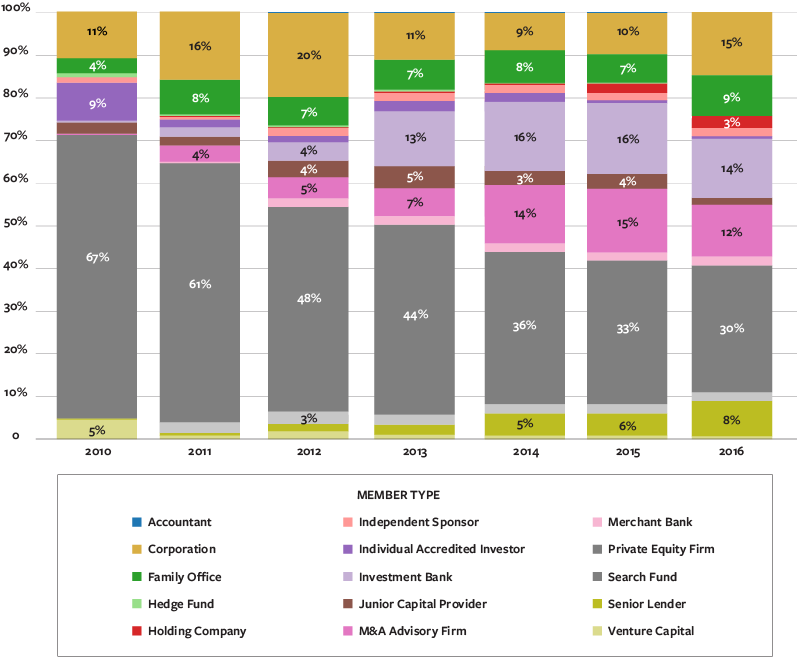

“The number and diversity of participants in both M&A and capital raising transactions has grown tremendously over the past few years,” says Hament. “I don’t think anyone would argue with the statement that there is more capital, from a wider variety of sources, that is looking to be deployed than ever before. Rising transaction multiples are a manifestation of that.”

Hament notes that available capital for M&A and private debt/equity capital raises from “the usual suspects” (PE firms, strategic acquirers), “…has been augmented by non-bank sources that have taken up where the banks have left off, due in large part to an environment with increased regulatory requirements.” Moreover, she notes, independent sponsors and, increasingly, family offices have accelerated their participation in middle market deals.

“This has impacted the investment banker’s role from an investor coverage standpoint,” says Hament. “Finding the best price/structure/cultural and personality fit is still the name of the game but there are more places to look for it.”

Hament, Keith Dee of Osage Advisors, George Shea of Focus Investment Bank, and Noah Anderson of Tangent Capital Partners discuss how Axial can help facilitate connections and boost visibility in an increasingly fragmented market:

“I think the business is really evolving and it’s changing every day, primarily because there’s new participants in the market. There’s no way that you can stay on top of every single buyer. So you have to use tools like Axial to network,” says Noah Anderson, Managing Director at Tangent Capital Partners.

“The notion of a Rolodex, while it still hangs on in some minds, has become almost irrelevant, as finding contact information and getting through to buyers and investors is easier than it has ever been,” says Outcome Capital’s McCabe. Thanks to technology, “fewer resources are needed to source deals, run comps, manage deal rooms, etc.”

Adds Hament, “more transparency will be available for all parties. Sellers or those looking for capital can have unprecedented access to the information they require to achieve their goals.”

Still, the need for an intermediary isn’t going anywhere, argues Hament. “The one thing technology cannot do is replace the human interaction required to gauge whether one party is suitable for the other and to smooth the process when it encounters bumps in the road.”

Noah Anderson of Tangent Capital Partners discusses the changing private capital markets and the new way of investment banking:

“Finding the right buyer or investor for a client involves more than just money,” says McCabe. “Bankers need to have a deep understanding of their clients’ business models and industry landscape to find the right partners. Correctly and creatively positioning a firm within its competitive landscape for maximum strategic value is vastly more important than having a handful of multiples for valuation purposes.”

Hament agrees that “expertise in a particular field is extremely helpful in winning a beauty contest,” but adds that it’s not the only important variable. “Experience in execution will always be crucial and while specialization in an area is a plus, knowing how to get a deal across the finish line is also key, particularly given the twists and turns most deals take.”