The Advisor Finder Report: Q4 2025

Welcome to the Q4 2025 issue of The Advisor Finder Report, a quarterly publication that surfaces the activity occurring on…

Tags

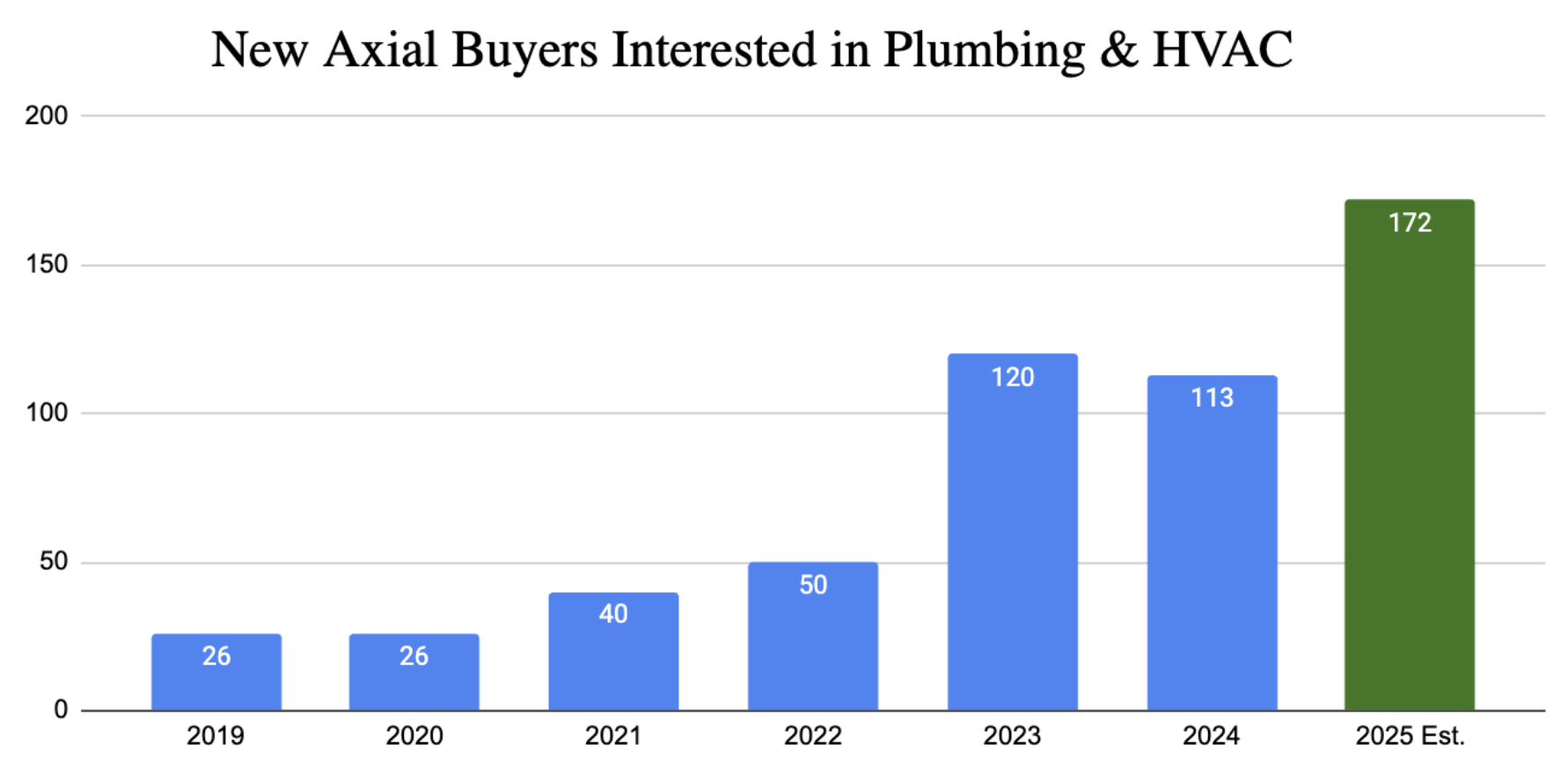

Buyer demand for HVAC companies has been increasing over the years. Within Axial’s buyer network alone, buyer demand increased by 550% between 2020 and 2023.

This increase is partially due to the fact that more private equity firms are buying HVAC companies.

In 2023, private equity firms (PE firms) accounted for just 8% of HVAC deals within Axial; by 2024, that number rose to 23%. The HVAC industry is a fragmented market ripe for consolidation. Plus, demand for HVAC services is expected to grow. Both of which are great for PE firms whose main goal is to realize a profit on their acquisition.

As a business owner, this increase in demand can potentially lead to better offers, both in terms of sale price and stewardship.

But there are several questions around the increased demand from PE firms, including:

In this post, we’ll answer key questions like:

| Pros | Cons |

|

Certainty + Speed

PE firms use committed capital and have deal experience, leading to faster, more predictable closings. This is ideal if you’re working toward a defined exit timeline. |

Complex Deal Structure + Potentially Lower Offers

PE deals often include earnouts or layered terms. They can be complex and may deliver less upfront than offers from strategic buyers. |

|

Potential for Strong Stewardship Post-Exit

Many PE firms aim to grow — not absorb — the business. They often retain your team, brand, and operations while investing in systems and infrastructure to support future growth. |

Cultural Shift

While your business remains intact, expect a cultural shift as the new owners work to scale the company. PE firms prioritize growth, which can involve cost-cutting measures and operational overhauls. |

|

Experienced Partners for Growth

PE firms bring proven playbooks and industry expertise. Retaining equity allows you to benefit from their support in scaling the business and a potential second exit. |

Short-Term Ownership

PE firms typically exit within 3–7 years. If long-term continuity is your priority, consider a family office or holding company. |

If you’re at retirement age — or need to exit relatively quickly for any other reason — then you’ll be motivated to find a buyer who can close the deal quickly.

In this scenario, selling to a PE can be a good strategy because:

You’ve likely built your HVAC company up over the years and have developed good relationships with your employees, your customers, and the community. That’s why you want a good steward for your business — someone who doesn’t just manage existing operations, but also helps grow them.

Here, PE firms can be a good fit, though there is some nuance to keep in mind when evaluating potential firms.

While PE firms usually will not absorb your business the same way a competitor might, they’re motivated by overall growth potential. So a PE firm’s focus on growth can lead to a change in company culture and operations.

Your M&A advisor is a great resource in evaluating whether or not a specific PE firm matches your company culture. Advisors can help you identify buyers who align with your values and vision for the company’s future. Plus, an advisor will significantly increase your buyer pool, which increases the chances of finding that good fit.

Private equity firms are experienced buyers that are beholden to investors to return a profit on their acquisition.

Because of this, a PE firm will factor in what it will take to get a return on their investment and consider the debt they’re taking on to finance the acquisition when making you an offer.

In short, they’re savvy buyers looking to maximize profits. Deals can get complicated and multi-faceted.

A deal may sound more attractive than it actually is once you fully understand the implications of the agreement. For example, a PE firm may propose using earnouts. An earnout means you get less cash up front in exchange for potentially earning more in the future after your exit, if specific performance benchmarks are met.

Here’s an example: Let’s say your HVAC company has several long-term contracts that are coming up for renewal right after the sale. A PE firm is going to calculate the risk of those contracts not renewing. To safeguard their investment, they’re going to give less cash up front (based on the idea that those contracts won’t renew) and then offer an earnout, where you’ll receive more cash down the line if the contracts are, in fact, renewed.

But is that earnout in your best interest? Is it fair? Are there things you can do to avoid a buyer insisting on an earnout?

Your M&A advisor can help here in several ways, including:

Private equity firms are focused on your business because of its growth potential. This means they’re likely to make operational changes aimed at improving efficiency, reducing costs, and accelerating growth. While these shifts can benefit the business financially, they may also introduce a different pace, structure, or leadership style — resulting in a noticeable change in company culture.

If you’ve run your HVAC company like a family, the transition to PE ownership can sometimes feel more corporate, metrics-driven, or financially rigid. You can also expect a strong focus on KPIs, EBITDA growth, and margin expansion, which can create a more intense and performance-driven environment. In some cases, PE firms may also bring in outside executives or restructure teams, which can affect internal dynamics and employee morale.

As M&A advisors evaluate interested buyers, they can weed out buyers that aren’t a good cultural fit based on what you want for your business.

Unlike long-term buyers like family offices or holding companies, PE firms operate with a defined investment timeline. As mentioned above, their goal is to enhance value and eventually sell the company, either to another buyer or through a public offering.

While many PE firms take great care in growing and supporting the business during their ownership, their short-term hold period may not align if your priority is long-term continuity for your team, culture, or customer relationships.

If you want to sell to a long-term owner, then you may want to consider search funds/investors. These are individuals who are basically buying a job for themselves, though this may give you a smaller buyer pool (limited to those individuals who have the capital necessary to acquire your business).

This brings us to our next section, which is about how you can increase the chances of getting your ideal exit, in terms of:

According to the International Business Brokers Association (IBBA), 75-90% of businesses that go to market don’t sell. There are several reasons for this, including:

When you’re ready to sell your business, you can significantly increase the chances of achieving a successful exit by working with an M&A advisor who has relevant experience in closing deals within the HVAC industry.

An experienced advisor knows first-hand:

Plus, an M&A advisor for an HVAC company will have a network of buyers to whom they can market your business. This creates a competitive bidding process, where multiple buyers are interested in acquiring your company.

Below, we look at how Patrick Lange, of Business Modification Group, helps HVAC owners successfully exit their business. Lange has closed deals on 144 different HVAC companies in the last 6 years, one of which was closed within the Axial network.

| Looking for the best M&A advisor for your business? Schedule a free exit consultation with Axial.

First, we’ll learn about your business and exit goals. Next, we’ll review our network of over 3,000 M&A advisors, investment banks, and business brokers to hand-pick a shortlist of 3–5 options. Finally, we’ll help you interview and choose the right advisor. |

Before you reach out to advisors like Patrick Lange, it’s best to know your exit goals. It’s good to know the answers to questions such as:

You want to be committed before starting the M&A process. Plenty of deals fall through because a seller is not committed. You generally don’t get very far into the process if that’s the case. But if you do happen to attract buyers, they’ll quickly figure out if you’re not genuinely interested in selling, and this will cause them to walk away from the deal.

A good way to show commitment is to prepare for due diligence. This means:

Patrick Lange gives all of his new clients a seven-page questionnaire to fill out (where he’s looking for HVAC-specific details like your maintenance agreements, employee roster, and compensation, the owner’s role), and then requests three years of tax returns and P&Ls. This helps him get all of the info he needs for the next step, which is accurately valuing your HVAC business.

If you want to learn more about exit preparation, you can read our posts on:

Valuing your HVAC company helps you see if it’s the right time to sell. Lange stresses that owners get a valuation done early and often. Even if you’re not thinking of selling for another 5-7 years, getting an accurate valuation will help create a roadmap to selling your business and achieving your ideal exit.

There are several different valuation methods M&A advisors will use to value your HVAC business. Lange likes to use a comparable company analysis, which makes sense given the breadth of deals he’s closed. He can better evaluate the value of your business by looking at what other similar companies have sold for.

Sometimes a valuation misalignment will occur — when a seller has valued their business at one EBITDA multiple, and then the buyer arrives at a different multiple.

Often this is an effect of timing: the HVAC industry is a weather-driven business. As Lange explained, “When you have a mild winter or mild spring, numbers can be down. This can lead to a discrepancy between initial valuations and actual performance.” As a result, buyers may offer less money up front, resulting in earnouts after meeting specific metrics.

After your business has been accurately valued, Lange and his team will take your company to market. One of the key benefits of working with M&A advisors like Lange is that they can significantly increase your buyer coverage. That is, they can get more qualified buyers looking at your business.

Each M&A advisor will have a different network and process for creating a competitive bidding environment. As an example, let’s look at how Lange’s team at BMG targets buyers for their HVAC clients:

When a buyer is interested, Lange and his team vet them to make sure they’re not local competitors or someone who is just going to waste time. If they’re qualified buyers, Lange and his team issue an NDA and verify the buyer’s finances (to show they’re able to buy).

Based on a survey we did with M&A advisors and investment banks in our network, we’ve found that business owners can save up to 30+ hrs a week by working with an advisor. One of the reasons is because an advisor will help manage this buyer distribution process.

For example, Lange once listed an HVAC business for sale in Houston and got 90 signed NDAs within the first day. Even if only 20 of those NDAs ended up requesting a call with an owner, that’s still 20 hours of calls to handle within a relatively short period.

M&A advisors like Lange and his team can:

The goal of increased buyer coverage and managing that distribution channel of buyers is to find a buyer that’s a good fit for your exit. When a buyer is a good fit and is interested in your business, they’ll execute a Letter of Intent (LOI).

This is your buyer’s intent to buy, and it means your business is technically off market for a set time (usually 90 days). This gives the buyer time to perform due diligence and make an official offer, if everything passes their review.

As you go through negotiations, it’s important to remember your motivations for selling. The final sale price is not just a number; it also reflects what you want to leave behind and what’s needed to fund the next stage of your personal life — whether it’s a new investment, retirement, or securing your children’s education.

Your advisor will guide you through the final decision-making process and help you structure the deal to meet your post-exit goals.

For example, a buyer might offer a smaller upfront cash payout or a larger payout spread over several years, contingent on meeting performance milestones. Earnouts are common in middle-market HVAC transactions, although they generally represent a small percentage of the purchase price — usually 10% to 15%. This allows the buyer to hedge their risk by paying less at closing while rewarding you if operations continue as planned. In the HVAC industry, earnouts are often tied to customer retention rates, service contract renewals, or seasonal performance metrics.

An experienced advisor can help you objectively evaluate these offers, leveraging their knowledge of your HVAC business and the current market to determine the best deal structure for you.

When you’re working towards exiting your business, it’s not necessarily advantageous to think in terms of selling to a private equity firm or selling to a competitor. Instead, you want to think of achieving your ideal exit.

One of the most impactful things you can do is find an M&A advisor with relevant deal experience in your industry.

These M&A advisors can:

But these benefits depend on working with the right M&A advisor. At Axial, we specialize in helping small-to-midsize business owners find the best advisor who can bring them these results.

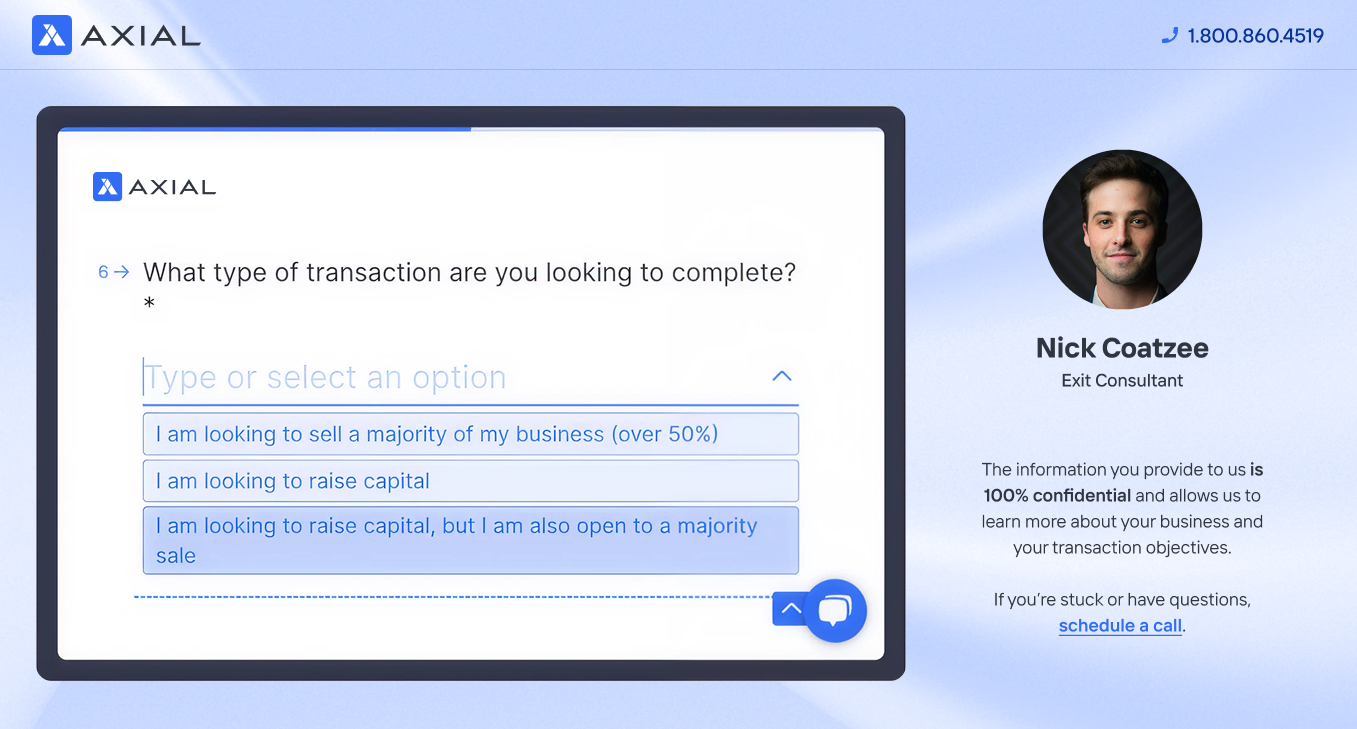

We start by pairing you with an Exit Consultant who gets to know your business and your exit goals.

Your Exit Consultant will leverage Axial’s network of 3,000+ M&A advisors to create a shortlist of candidates with:

We’ll send you a curated list of 3–5 qualified HVAC industry advisors, complete with detailed insights to help you evaluate your options and resources to prepare for meetings with your candidates.

Schedule your free exit consultation today.

At Axial, we offer several resources for small business owners looking to sell their company, learn more about the M&A process, and better understand the value of their business.

Here are just some of the resources that can be helpful to you:

These are just a few of the resources we’ve created for business owners. You can find more here.

Private equity firms are increasingly targeting HVAC companies because the industry represents an ideal consolidation opportunity. The HVAC sector is highly fragmented, with thousands of small-to-medium-sized local businesses that can benefit from operational improvements, technology integration, and geographic expansion. PE firms see strong potential for value creation through roll-up strategies, where they acquire multiple HVAC companies and combine them to achieve economies of scale.

Additionally, HVAC businesses offer recession-resistant revenue streams, since heating and cooling systems are essential services that can’t be delayed when they break down. The industry also benefits from predictable recurring revenue through maintenance contracts, which appeals to PE firms seeking stable cash flows. Private equity firm participation in HVAC deals increased from just 8% in 2023 to 23% in 2024, reflecting growing institutional interest in the sector’s consolidation potential and defensive characteristics.

HVAC businesses are typically valued using three complementary methods to triangulate an accurate valuation range:

M&A advisors with HVAC experience are essential for accurate valuations because they have access to proprietary transaction data. They also understand industry-specific factors like service contract valuations, seasonal cash flow patterns, and the impact of customer concentration. These three methods together provide a comprehensive view of your business’s worth that reflects both its intrinsic value and current market conditions.

You can find more information on valuation with these posts from Axial:

Plus, we have a free business valuation calculator you can use to get an initial range of your company’s value.

HVAC company valuations typically range from 2.08x to 15.08x EBITDA, with multiples increasing significantly as business size grows.

Based on recent transaction data, companies with under $1M EBITDA have a median multiple of 3.12x (range: 2.08x – 6.11x), while businesses generating $1M–$3M EBITDA achieve a median of 4.48x (range: 2.58x – 7.69x). Larger HVAC companies see even higher valuations, with $3M–$5M EBITDA businesses averaging 5.88x and companies with $5M+ EBITDA commanding a median multiple of 7.02x.

Several factors drive these valuations higher or lower, including recurring revenue from service contracts, customer concentration risk, profit margins, and operational scalability. Companies with strong maintenance contract portfolios, diversified customer bases, and systems that can operate without heavy owner involvement typically achieve multiples at the higher end of their size range. The increasing buyer demand, particularly from private equity firms, has also contributed to upward pressure on valuations in recent years.

Selling an HVAC company successfully requires a structured four-step process.

For more information, you can read Axial’s posts on:

M&A advisor fees typically consist of two components:

Retainer fees vary significantly, with some advisors charging fixed upfront fees while others use monthly retainers or milestone-based structures. About 24% of advisors work without any retainer, earning compensation only when the deal closes.

Success fees are commonly structured using the Lehman Formula, which 50% of brokers use (5% on the first $1M, 4% on the second $1M, 3% on the third, 2% on the fourth, and 1% above $4M), while 33% use flat percentage structures and 17% use accelerator formulas where fees increase with deal size. While these fees may seem substantial, data shows that businesses represented by advisors sell for 6-25% more than those sold by owners directly, and owners save 30+ hours per week during the process.

Additionally, businesses represented by advisors have a significantly higher success rate of actually completing a sale compared to owner-operated sales.

For more information, read Axial’s comprehensive guide on how much brokers charge to sell a business.