Case Study: A Broken LOI, the Right Advisor, and a Successful Exit

When the owners of a concierge medical practice began thinking seriously about retirement, they knew the time was right to…

Selling your landscape business can be an overwhelming, complicated, and lengthy process.

First, exiting a business in general is difficult. For most owners, it’s the biggest financial transaction of their lives. The culmination of a life’s worth of work. It involves preparing financials, streamlining operations, securing legal documents, marketing your company to sell, finding buyers, and navigating negotiations. Data shows that the majority of business owners fail to bring out the exit outcomes they’re looking for, which means these owners are compromising on price, timeline, and stewardship.

Second, there are specific challenges that landscape owners will have to navigate, such as:

But the more you know about these challenges and potential roadblocks ahead, the better you can prepare for them.

To help simplify the process of selling your landscaping business and maximize your exit outcomes, we put together this guide, which covers:

How to Value a Landscaping Business

Preparing Your Business for Sale

Marketing Your Business and Evaluating Buyers

Negotiating and Structuring the Deal

If you’re ready to sell your landscaping business, the next step is working with an M&A advisor. M&A advisors can help you exit your business and get a higher final sale price. Axial can help you find the best M&A advisor by looking over its database of over 3,000 M&A advisors and hand-picking a curated list of 3-5 advisors with experience in selling businesses like yours. Schedule your free exit consultation.

When you want to sell your landscaping business, you need to have a clear understanding of its value. The value of your company is made up of several factors (we have a full list down below), including:

When you speak of your company’s value, you’ll generally word it in terms of a multiple of your earnings.

For most landscaping companies, this means talking about value as a multiple of your EBITDA. Smaller companies will sometimes use seller’s discretionary earnings (SDE) instead of EBITDA, but SDE is generally for smaller companies that bring in less than a million a year. However, 65% of landscaping businesses are bringing in more than a million a year, so we’re going to focus on EBITDA for this article.

EBITDA represents your earnings before interest, taxes, depreciation, and amortization. This metric offers potential buyers a clear snapshot of your business’s core profitability, free from the effects of taxes, financing, and non-operational factors. EBITDA helps buyers gauge cash flow, assess whether your company is suitable for a debt-financed transaction, and compare it more easily to other businesses.

So if your EBITDA is $4 million and you have a multiple of 2x, that means your business is valued at $8 million.

But how do you figure out the right multiple to apply to your EBITDA? That’s where it gets difficult. To arrive at the right multiple, you need to conduct several different valuation methods, understand which factors are driving your value, and have experience in selling landscaping companies. You want this experience because you want to know first-hand what buyers are willing to pay for a lawn care business. For these reasons, most business owners can’t accurately conduct their own valuation.

While you can find average EBITDA multiples online broken down by industry, being off even by a point or two can significantly alter your valuation and your chances of achieving a successful exit.

At Axial, we pair you with an M&A advisor with recent deal experience in selling companies like yours. This helps them accurately value your company, arriving at the most accurate multiple and valuation of your business.

When you work with an M&A advisor, they generally use two different valuation methods to arrive at your valuation range.

These methods focus on forecasting future cash flows and looking at the purchase prices of closed deals in your industry.

This method estimates the value of your landscaping business based on projected future cash flows, accounting for the unique seasonal patterns typical in landscape operations. Landscaping companies face distinct financial challenges, with weather dependency and seasonal demand fluctuations being primary concerns: peak activity during spring and summer growing seasons and reduced revenue in fall and winter.

An M&A advisor can determine appropriate growth and discount rates based on their experience with recent landscaping acquisitions. To provide a more accurate valuation that reflects your actual landscaping business value, your advisor will incorporate industry-specific factors, such as:

This method estimates the value of your business based on the purchase prices of similar, recently closed deals, which may include transactions your advisor has facilitated for other landscaping owners.

However, gathering this information for small businesses can be difficult, as transaction details are often private. Transaction dates are also important, as outdated deals may not reflect current market conditions. By working with an advisor with insider knowledge of past transactions, you can effectively use recent deal data to refine your valuation.

Using these methods, your advisor can arrive at an accurate valuation range for your landscaping business, providing a clearer understanding of what your business could realistically sell for.

You might see a breakdown like this:

This represents the EBITDA multiple range for your business, indicating you can expect a sale price between 3.5x and 5x your EBITDA.

Keep in mind that this initial valuation range serves as a starting point for eventual pricing negotiations with interested buyers. The final price paid for your business will often differ from this initial valuation. Factors like market conditions, the deal structure (e.g., less cash upfront in exchange for a higher offer), and whether you’re retaining any ownership stake in the business (either yourself or your employees) will all play a role in determining the final price.

You can learn more in Axial’s post on How to Value Your Company for Sale.

While you may not be conducting the analyses that lead to your valuation, you want to understand the factors driving your company’s value. This helps you decide whether or not it’s the right time to sell or how you can best maximize value before you sell.

An M&A advisor is invaluable here, as they can provide pointed insights on what buyers value. For example, here are some critical factors for most landscaping companies:

Here’s a more comprehensive table showing all the factors that can affect your valuation:

From here, you have several options:

In this section, we look at how to prepare your business for sale. Specifically, we cover knowing your exit goals and preparing for due diligence, which includes verifying your financials, preparing all relevant documents, removing operational and key person dependencies, and optimizing customer contracts.

One of the main reasons why deals can fall through is the business owner having unrealistic or unclear expectations. You don’t want to go to market unsure of what your value is or what you want from your exit in terms of sale price, exit timeline, and stewardship.

You want to articulate these things before you start the M&A process. This way, if there’s any valuation misalignment — such as wanting more money from your exit than what you’re likely to get — you can work to either increase value or decide it isn’t the time to sell.

Here are some questions business owners should know the answer to:

At Axial, we recommend that you prioritize your motivations for selling. For example, if your main motivation is financial, such as funding your retirement and making sure your children are financially independent, you may be willing to sacrifice on things like exit timeline and stewardship if it brings you a more premium sale price.

A key part of exit preparation is preparing your business for due diligence. Due diligence is when an interested buyer looks at your financials and operations to understand your company’s value clearly. The better prepared you are, the less likely there’ll be a valuation misalignment, stalled deal, or a deal that goes completely off the rails.

Most landscaping companies aren’t going to have perfect books ready to go. They tend to use simple accounting practices, running their finances out of QuickBooks and homegrown operational processes.

While you don’t necessarily need a major overhaul of your financials and operations, there are simple things you can do to help create a smooth process for your potential buyers.

Here are the most helpful and relevant documents to gather and prepare:

You also want to gather all legal documents, from your business formation documents to labor documentation and landscaping-specific licensing.

Here’s a checklist of legal documents to make sure you have ready:

Plus, you want to be transparent about any litigation, even if it happened in the past. This includes settlement agreements, court judgments, claims history, and documentation of compliance with any court orders. Also include records of any OSHA violations, environmental violations, customer disputes, or property damage claims that resulted in legal action.

One of the most impactful things you can do as you prepare to sell is to make yourself redundant as the business owner.

You likely wear many hats at your landscaping company, but that creates a talent gap when you leave the business. You want to hand over any responsibilities you handle to other employees and your management team. Otherwise, potential buyers will lower their valuation to account for the fact that they’re going to have to hire/train employees to take over the roles you filled.

Best practice is to have standard operating procedures (SOPs) in place. SOPs ought to address granular processes like seasonal service transitions, equipment maintenance schedules, customer communication protocols, and crew management during peak and off-seasons — breaking each process into individual steps with consideration for seasonal variations.

SOPs help ensure a smooth transition after your exit and reduce the chance that a buyer will lower their valuation.

Customer contracts are a great way to show value to potential buyers, but landscaping businesses face unique challenges that buyers scrutinize carefully. Buyers may offer a lower valuation if you have high customer concentration, significant seasonal revenue fluctuations, or contracts heavily weighted toward residential versus commercial clients.

As you prepare for your exit, you want to:

However, there will be times when you can’t reduce customer concentration or address seasonality concerns before your exit. If that’s the case, here’s how you can demonstrate long-term value:

An M&A advisor will help you determine which strategies work best for your ideal exit and the specific dynamics of your local landscaping market.

So far, you’ve established objectives, verified and cleaned up financial records, gathered all legal documents, and optimized business processes. Working with an M&A advisor, you’ve arrived at an accurate multiple range for your company.

Now you want to market your business towards the right buyers and evaluate any interested parties.

There are several challenges here, including landscaping-specific challenges:

An M&A advisor will help you with all of the above.

Most businesses don’t have a network of buyers they can target. But the more interested buyers you have, the higher the chance you’ll get the exit you want. That’s why you want to work with an M&A advisor with relevant deal experience, because they have access to a network of buyers interested in companies like yours. This includes buyers who already have licenses in your state or operate in adjacent states where they can easily obtain licensing.

Your advisor can also tailor the story around your business based on the type of buyer they’re targeting. For example, if you’re marketing your business to a private equity firm, the advisor will highlight things PE firms want to see, like recurring revenue, growth potential, and likely return on investment.

Although you and your M&A advisor worked to get an accurate valuation of your business, that number is really for getting your company to market. The real final value of your landscaping company is what someone is willing to pay for it.

Different buyers have different motivations when acquiring a company. For example, an M&A advisor can recommend targeting specific buyers, like strategic buyers, who may be more likely to offer a higher valuation.

Strategic buyers will be existing landscaping companies, related service businesses, or any company seeking vertical integrations. They tend to pay more for your business as they see synergistic value. In short, they believe that absorbing businesses can help grow their own.

A trade-off here is that a strategic buyer won’t offer much in terms of stewardship. This can mean your brand, legacy, and current workforce will end after you sell your company.

You can learn more in the Axial guide on Strategic Buyers vs Financial Buyers.

Finally, M&A advisors are skilled at managing a buyer funnel, saving you time. While you want more buyers interested in your business, that also means a lot more legwork and negotiations. For example, one recently closed deal started with 290 interested buyers. That’s how many buyers signed an NDA to learn more about the business. From there, 60 of those buyers issued an Indication of Interest. From that 60, the business ended up with 12 serious buyers.

That means the advisor had to target a) more than 290 buyers and b) manage the buyers going in and out of the funnel. Your M&A advisor will manage this process for you.

When you identify a purchaser who aligns well with your exit objectives, you’ll finalize a Letter of Intent (LOI). This represents your buyer’s commitment to purchase, and it means your company is effectively removed from the market for a specified period (typically 90 days). This allows the purchaser to conduct due diligence and present a formal offer, assuming everything meets their evaluation criteria.

As you navigate through negotiations, it’s crucial to recall the selling motivations that you established in step one of your business exit planning. The ultimate transaction price isn’t merely a figure; it also represents what you hope to preserve and what’s required to support the upcoming phase of your personal journey — whether that’s a fresh investment opportunity, retirement planning, or funding your family’s educational needs.

Your advisor will assist you through the final decision process and help you organize the transaction to achieve your post-sale objectives.

For instance, a purchaser might propose a reduced initial cash payment or a higher payout distributed across multiple years, dependent on achieving operational benchmarks. This is called an earnout. Earnouts enable the purchaser to minimize their exposure by paying less at closing while compensating you if business performance continues as projected. In the landscaping sector, earnouts are frequently linked to client retention percentages, maintenance contract renewals, or seasonal revenue targets.

A seasoned advisor can help you impartially assess these proposals, utilizing their understanding of your landscaping operation and the prevailing market conditions to identify the optimal deal framework for your situation.

Throughout this post, we covered how you can value and sell your landscaping business. A key part to navigating this process successfully is to partner with an M&A advisor.

M&A advisors can:

However, these benefits depend on working with the right M&A advisor. At Axial, we specialize in helping small-to-midsize business owners find the best advisor who can bring them these results.

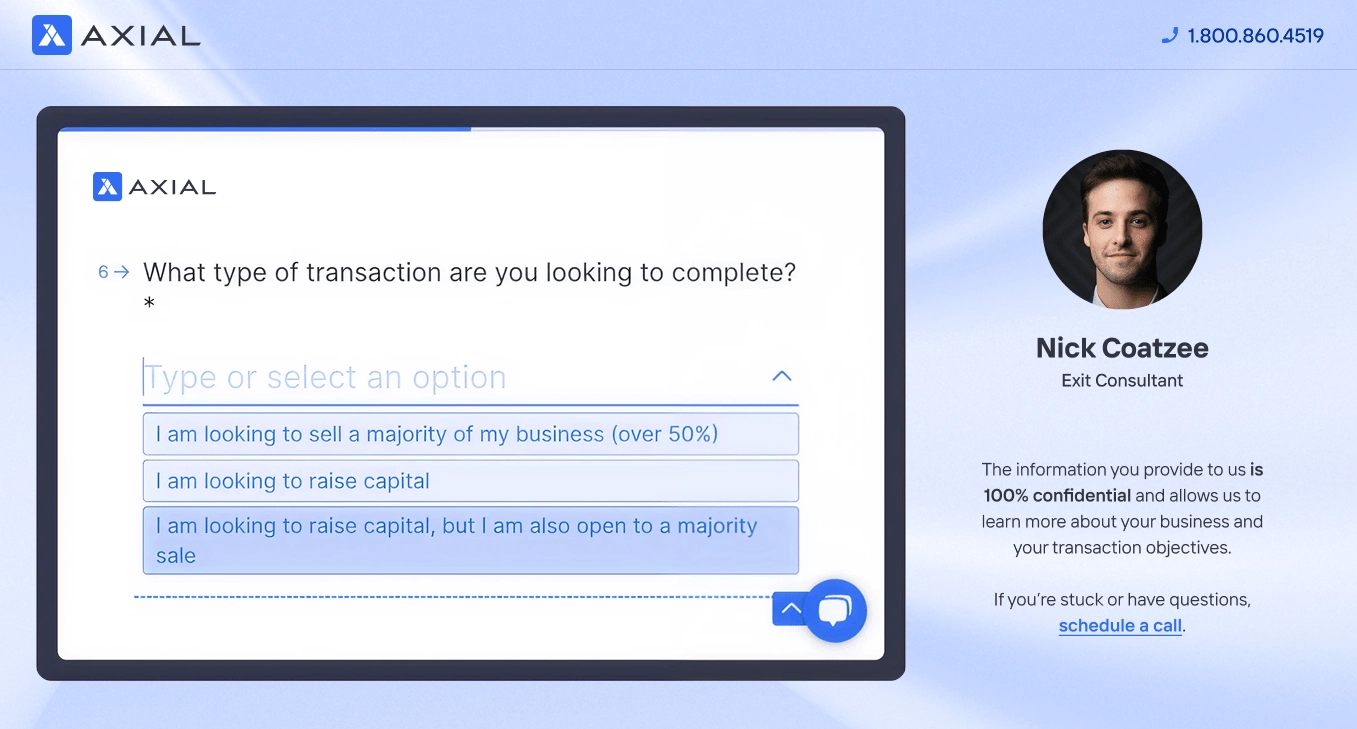

We start by pairing you with an Exit Consultant who gets to know your business and your exit goals.

Your Exit Consultant will leverage Axial’s network of 3,000+ M&A advisors to create a shortlist of candidates with:

We’ll send you a curated list of 3–5 qualified landscaping industry advisors, complete with detailed insights to help you evaluate your options and resources to prepare for meetings with your candidates.

Schedule your free exit consultation today.

At Axial, we offer several resources for small business owners looking to sell their company, learn more about the M&A process, and better understand the value of their business.

Here are just some of the resources that can be helpful to you:

These are just a few of the resources we’ve created for business owners. You can find more here.

There are several ways to calculate the value of your landscaping business. One of which is figuring out your EBITDA.

EBITDA is your net profit + interest + income taxes + depreciation and amortization.

But then you want to determine which multiple to apply to your EBITDA. This is because your company’s value exists within the context of the market. That is, what other companies like yours have been valued at and what buyers are willing to pay.

Smaller companies will sometimes use the Seller’s Discretionary Earnings (SDE) to value their business.

SDE is your net profit + owner compensation + income taxes + nonoperating and nonrecurring expenses and income + depreciation and amortization.

This works for smaller companies because owner compensation is a big chunk of expenses. This method still requires a multiple to give you an accurate picture of your company’s value.

Current estimates place the landscaping industry’s worth at $182.48 billion (in 2024).

The industry demonstrates robust growth trajectories across multiple segments, driven by increasing environmental consciousness, technological innovations, and rising disposable incomes that fuel demand for both residential and commercial landscaping services.