The Advisor Finder Report: Q4 2025

Welcome to the Q4 2025 issue of The Advisor Finder Report, a quarterly publication that surfaces the activity occurring on…

Tags

Investment banks serve as specialized financial intermediaries that help facilitate complex transactions like mergers, acquisitions, and business sales. In our experience, working with an investment bank can significantly increase the chances of getting your ideal exit. They use their industry expertise, extensive buyer networks, and transaction experience to maximize your exit outcomes — performing key tasks like valuing your business, creating marketing materials, attracting qualified buyers, negotiating favorable terms on your behalf, and more.

Plus, data shows that working with an investment bank can increase your final sale price between 6-25%, perfect for funding the next stage of your life — whether that’s retirement or a new project.

But finding the best investment bank can be difficult. You need both:

In our experience, business owners often can’t readily execute the hiring process on their own. They lack the time, resources, and evaluative framework to find and choose an investment bank.

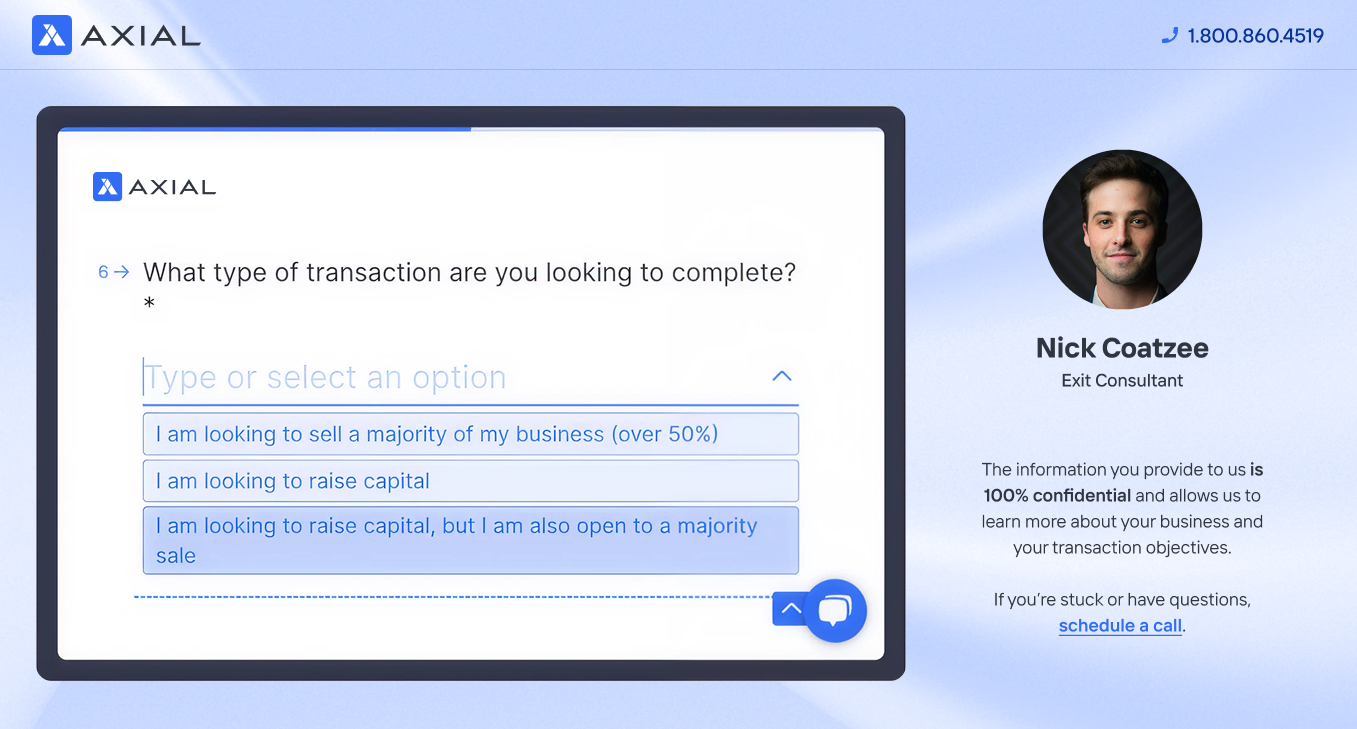

To solve this, you can schedule a free exit consultation with Axial. Axial will learn about your business needs and exit goals, then hand-curate for you a short-list of 3–5 investment banks from our network of over 2,000 investment banks and M&A advisors. We will then work with you to figure out which investment bank is the best fit, guiding you through interviews and answering questions you may have.

Below, we also provide an in-depth guide to hiring an investment bank, which can be used if you’re searching for a bank on your own, want to evaluate an investment bank that was recommended to you, or as a helpful resource if you’re using Axial’s advisor finder program.

Table of Contents

Sometimes, business owners rely on one-off, word-of-mouth referrals from friends or acquaintances to choose an investment bank. This is inefficient for two reasons.

First, the chances of someone recommending an investment bank that’s a good fit for you are slim. Generally, when another business owner recommends an advisor they’ve worked with, they’re doing so because they had a good experience. But just because that advisor helped another owner achieve a great exit outcome doesn’t mean they have the industry experience or knowledge needed for your business.

For instance, if you’re selling an HVAC business, and the person recommending an investment bank to you sold their healthcare business, that isn’t a good indicator that the investment bank can deliver the same results to you.

Second, even if a peer is recommending an industry-fit investment bank, there’s still a chance that a better option is available for you. Let’s say the recommended investment bank comes from someone within the same industry. It’s still the right move to evaluate more than one bank before making a hiring decision.

Exiting your business is a significant project that will last 1–3 years. If navigated correctly, it can give you what you need to fund the next stage of your life while leaving the business you helped build in good hands. You want to make sure you’re picking the best firm to help you with this endeavour.

That’s why we recommend putting together a list of several different investment banks you can evaluate and choose from — even if you’ve received recommendations from other business owners. When you have a list, you can interview multiple investment banks, learn about their culture, their relevant deal experience, their fees, and make an informed decision.

You can search for investment banks in several places:

But often, business owners struggle to shore up enough of a qualified pool that allows them to finalize a good final list of 3–5 investment banks. They generally don’t have the time or resources to reach out to hundreds of investment banks and read through their case studies and services. They can’t easily tell if an investment bank has the right kind of experience or expertise, which means it’s harder to disqualify options without reaching out and interviewing them. This creates a time-consuming process, which delays how quickly you can start the process of selling your business.

At Axial, we can offer you a significant shortcut with much better results. We have over 2,000 investment banks within our network, who bring tens of thousands of deals each year. This gives us data on the kinds of deals they’ve represented and the outcomes they’ve delivered.

After learning about your business, we can hand-curate for you a short-list of 3–5 investment banks. If you’re actively looking to hire an investment bank, you can schedule a free exit consultation to start the process.

When selecting an investment bank to help sell your business, you’ll typically choose between specialist and generalist firms.

Specialist investment banks offer deep industry knowledge, strong relationships with sector-specific buyers, and a nuanced understanding of value drivers particular to your market.

Generalist banks, on the other hand, bring broader resources, often handle more complex transactions across multiple industries, and may have larger teams to manage concurrent deals with multiple potential buyers. This choice represents one of the most significant decisions in your selection process, as it will influence both the positioning of your business and the pool of potential acquirers.

Figuring this out is important and is often a decision that business owners get stuck on. At Axial, our Exit Consultants work with business owners to help them make this decision..

For instance, one of the owners we recently worked with was initially leaning towards an advisor with direct experience selling businesses within the same franchise system that his business operated in. However, Axial’s Exit Consultant strongly encouraged them to speak to a specialist we had shortlisted with deep vertical expertise. Even though this specialist hadn’t sold a business within the same franchise system, they knew the industry and the vertical.

After interviewing both firms, the owner ultimately decided to work with the recommended specialist because their network would attract a wider pool of qualified buyers.

When hiring an investment bank to sell your business, understanding their fee structure is essential for making an informed decision. Investment banks use different pricing methods to determine their final fees, often working on a case-by-case basis. This means it’s impossible to provide an exact cost without understanding your business and the specific investment bank you’re considering.

However, we can bring transparency to the process by explaining the different types of fees you might encounter when working with an investment bank, using real data from industry surveys to examine potential cost ranges.

A retainer fee is the amount you pay to have an investment bank work on your business sale. It can also be referred to as a “work fee” or “engagement fee.”

Investment banks may charge their retainer fee:

According to industry data, the fixed model is the most widely used, with 32% of investment banks asking for a one-time retainer fee.

In most cases, they’ll subtract the retainer from the success fee when the deal closes. For example, if your success fee would have been $200,000, but you paid a $20,000 retainer at the start of the engagement, your final success fee would be $180,000.

Understanding the potential range of these fixed retainer fees is important:

A smaller percentage (10%) use milestone-based structures, where payment is linked to completing specific steps in the process. For example, an investment bank might bill $10,000 at the beginning of the engagement, another $10,000 after creating the Confidential Information Memorandum (CIM), and a final $10,000 after a Letter of Intent (LOI) is executed with a potential buyer. If you’re interested in a bank that uses a milestone approach, you can ask them about how often they reach certain milestones with clients.

Notably, 19% of investment banks don’t use retainer fees at all. For these firms, their entire income comes from the success fee when they close the deal. If you’re considering hiring an investment bank that doesn’t use retainer fees, you can ask questions about their success rate, how many deals they take on at once, and what criteria they have for working with a business.

The success fee is the commission investment banks earn when they close a business sale. Most investment banks will use a success fee structure alongside their retainer fee.

Success fees percentages are generally higher for smaller deals. This is because smaller deals require the same amount of work as larger ones when it comes to preparation, marketing, due diligence, negotiations, and closing. Achieving profitability while charging a smaller success fee percentage on such deals can be challenging, which is why investment banks charge a higher fee percentage when working with smaller businesses.

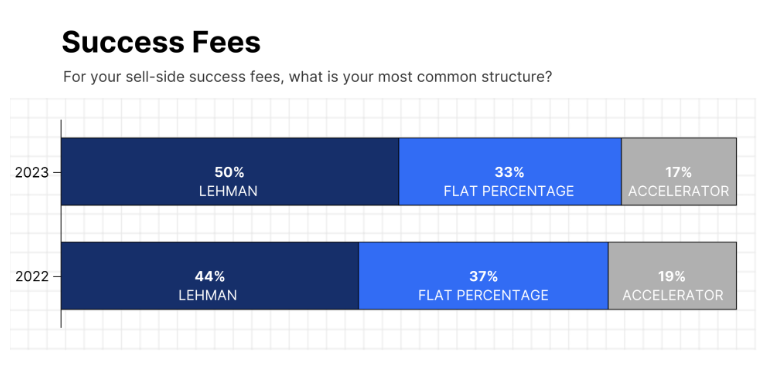

There are three main structures for success fees:

Success fee percentages typically decrease with deal size:

Based on this data, if a company sells for $10 million, the average success fee would be just over 4% of the purchase price, or around $400,000. But if the company sold for $20 million, the average success fee would drop to 3%, and the investment bank would take home $600,000. The purchase price would double, but the success fee would not.

When evaluating an investment bank, you want a clear understanding of:

Before signing any agreement, all of this should be clear and in writing.

For a complete breakdown on pricing and fees, you can view our posts on:

Plus, when you work with Axial, your Exit Consultant can give you specific industry-backed insight on whether or not an investment bank’s fees are within the normal range for your specific business.

Selling your company likely represents the single largest financial transaction of your life. Choosing to work with an investment bank that has a good reputation and comes highly recommended, but doesn’t fit your needs, can cost you millions in valuation. It can also lead to stalled deals that don’t close.

No matter how you find potential investment banks to hire, the interview is a key part that will give you the confidence to choose the right bank — if done right.

When you interview an investment bank, you can more easily assess their expertise, evaluate cultural fit and communication style, verify their market knowledge, and test their honesty and transparency.

You also want to ask pointed and specific questions about:

Further reading: 12 Questions to Ask an Investment Banker Before Hiring Them

There are also significant red flags to watch out for:

The investment banking relationship is ultimately built on trust. But trust should be validated through a rigorous vetting process before you commit to what will likely be a lengthy engagement for your company’s most consequential transaction.

After you’ve put together a list of potential investment banks and conducted your interviews, it’s time to make a decision.

This final decision can be challenging. It’s likely you may come across more than one investment bank that’s a good fit, especially if you did a thorough job in searching out options. It’s also likely that every firm will not check every box. Some will be a better fit culturally, while others have the experience you want. Some will have the experience you want, but will charge a success fee that can feel quite steep. Knowing how to weigh the pros and cons of different banks is not easy.

When you work with Axial, your Exit Consultant helps you make a final decision. They do this by following the “CREATE” framework. These are specific questions that help you better assess which investment bank is right for you. Even if you’re trying to evaluate investment banks on your own, these are good questions to ask yourself as you make your decision.

Additionally, your Exit Consultant reviews various fee structures and engagement letter terms with you.

Above, we looked at a practical guide on hiring the best investment bank for your business, from getting a good number of potential options and evaluating those options through a specific framework.

In our experience, business owners who want to sell their business, especially those who are running a business of a $1 million+ EBITDA, can better serve their exit goals by preparing thoroughly for sale in order to maximize exit value. This means the less time you have to spend on looking for and hiring an investment bank, the better.

When you use Axial to help you find and hire an investment bank, you:

Plus, you are assigned a hands-on Exit Consultant who guides you through the entire process, including making the final hiring decision. This includes deciding between two or three investment banks that come with specific pros and cons.

For example, we worked with a business owner who was undecided between two firms.

The first firm had a strong record of relevant deal flow, but the owner wasn’t sold on the team. They were professional and had a strong reputation, but their chemistry wasn’t the strongest.

The second firm had less directly aligned transactional experience, but the owner and the team connected really well.

This is a challenging call to make. On one hand, relevant deal experience is critical to getting an accurate valuation, finding the right buyers, and negotiating favorable terms. On the other hand, you’re working with this investment bank for 1–3 years, and you want a good cultural fit.

Our Exit Consultant worked with the owner to assess whether, in this specific case, the pros of the team chemistry outweighed the cons of their lack of relevant deal experience. In the end, the gap in experience between the two firms was too significant to overlook, so the business owner went with the first firm.

These are not hard-and-fast rules. It depends on the options you have, your business, and your exit goals — including exit timeline, ideal sale price, and what kind of steward you’re looking for. The right investment bank for you will reveal itself as you follow a process, talk to the right banks, and ask the right questions.

At Axial, your Exit Consultant will be available to help guide you through these decisions.

Schedule your free exit consultation today.

The owner of an HVAC and Plumbing company in New England came to Axial because they wanted help selling their business. Specifically, they wanted to exit their HVAC company so they could focus on another business in their holdings. With that kind of workload, partnering with an investment bank is a no-brainer.

After learning about their business and exit goals, we recommended Apogee as one of the investment banks that could be a great fit. Apogee specializes in M&A services for lower-middle market businesses, specifically HVAC and plumbing companies. They have a robust database of buyers specifically looking for companies in the HVAC space. Apogee has partnered with a national industry consolidator, acquiring service companies in HVAC and plumbing. They’ve represented at least twelve businesses since 2023 via Axial.

To receive a personalized recommendation like this, schedule your free exit consultation.

After building up a food service company on the West Coast, the owner was ready to move on. The business thrived on delivering high-protein, ready-to-eat, and nutritionally rich meals to its customers on a weekly basis.

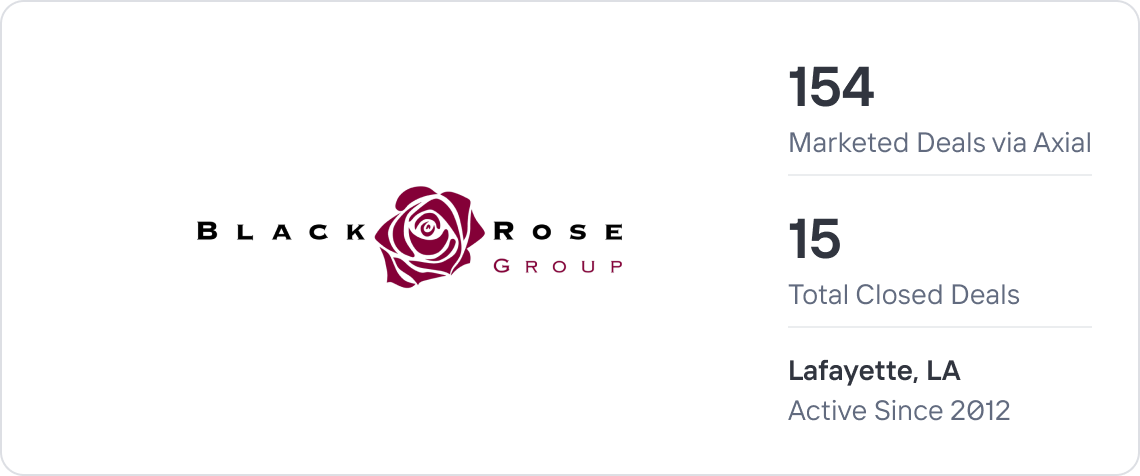

Based on their specific business and their desire to work with a firm that had D2C experience, we recommended BlackRose Group. The firm specializes in private corporate transactions, using a strong network to connect sellers with well-qualified buyers and maximize company value.

Plus, BlackRose had represented at least three meal prep businesses through Axial in the past, including a D2C business that delivered nutritionally balanced meals and snacks to the baby, toddler, and kid food sector.

To receive a personalized recommendation like this, schedule your free Exit consultation.

When the owner of a global transportation and logistics company wanted to retire, they came to Axial so we could help them identify the best investment banks for their exit.

The business offered supply chain solutions to clients in over 185 countries, including air transportation, ocean transportation, ground transportation, freight forwarding, and warehousing.

Based on their industry, their company size, and their clients, we recommended Clarke Advisors, LLC. The firm specializes in investment banking within the supply chain sector, including transportation, logistics, warehousing, and related technologies.

They focus on lower middle market transactions ranging from $10 to $250 million and have a strong network of private equity firms and large strategic buyers.

Since 2021, they have represented over 66 companies in the sector via Axial and have closed at least 12 deals. This includes deals for warehousing and logistics companies and heavy hauling trucking companies.

To receive a personalized recommendation like this, schedule your free Exit consultation.