M&A Fee Guide 2023-2024

For the third year running, Axial partnered with Firmex and Divestopedia on the annual M&A Fee Guide, the authoritative source…

Tags

With oil prices beginning to stabilize near $60 per barrel, the probability of a V-shaped recovery is unlikely. To prepare for a prolonged environment of depressed oil prices, the energy sector has shifted its focus to cash management and liquidity.

For large upstream energy companies, the renewed focus on cash management will come in the form of operational improvements and increased capital discipline for new investments. For select issuers with strong balance sheets, new debt and equity capital may even be available. However, for smaller companies with less operational flexibility and limited access to liquidity via the public or private capital markets, alternative solutions may be required to stay afloat and preserve equity value. Strategic solutions such as mergers/acquisitions, divestiture of non-core assets, or a balance sheet restructuring should be explored to survive a prolonged downturn.

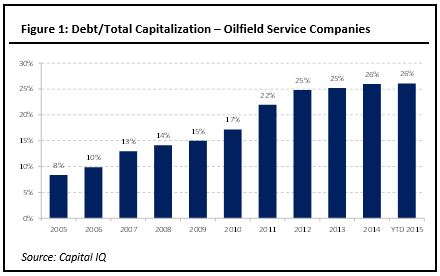

Fueled by high oil prices and large profit margins, the oil and gas industry experienced record levels of expansion in 2012 and 2013 as new capital flooded the market to capitalize on the U.S. Shale Boom. Investors eagerly deployed new capital into the energy sector seeking to develop the new unconventional resources made available by technological improvements in fracking and horizontal drilling. U.S. resource expansion in tandem with a low interest rate environment allowed energy companies relatively easy access to cheap debt financing. Figure 1 illustrates how the debt/total capitalization ratio for a subset of major oilfield services firms has increased over the last 10 years.

The oil and gas sector is a capital intensive business, and a substantial amount of new debt capital was brought into the industry in recent years to fund new project development that could not be financed purely through internal cash flow.

However, for the oilfield companies who assumed risky levels of debt during the recent expansion, the dip in oil prices left them in a precarious position.

Liquidity crunch hampers overleveraged businesses. Companies in danger of missing interest payments or tripping financial covenants are facing considerable financial headwinds that threaten future operations.

Burdened with high fixed costs and pricing pressures upstream, many smaller oilfield service companies are facing major difficulty in meeting their debt service. In addition, for companies with maturing debt, refinancing has also proved an arduous task as lenders look to reduce exposure to the industry.

The reduction in credit availability is most visible for E&P companies at the top of the supply chain. The drop in oil prices has resulted in redeterminations of borrowing bases of reserve backed loans (RBL), the primary method by which established E&P companies obtain financing. RBLs are bank credit facilities that use oil reserves as collateral for the loan. RBLs are generally structured as revolving credit facilities based on the net present value of producing reserves where oil price represents a direct input to the NPV calculation.

Borrowing base redeterminations for RBLs are an easy way for banks to reduce their exposure to the sector without having to alter existing credit agreements materially. RBLs play an important role in the working capital financing for well operators, for example. With the reduction in credit availability, operators have retrenched on investment in new projects and are focusing attention on the management of existing projects.

Oilfield service companies hurt by upstream capex cutbacks. Next in the supply chain, oilfield service companies have been directly impacted by the decrease in upstream capital expenditures. Overall, the reduction in upstream investment has decreased revenues and squeezed margins.

Major oilfield service company Halliburton recently announced 9,000 job cuts, or approximately 10% of the company workforce, to reduce overhead costs. The company reported a Q1 2015 loss of $641 million, a year-over-year drop of greater than 200%.

For smaller oilfield service companies, there is less leeway in making such major operational changes. Oilfield service companies unable to generate revenues that fully absorb overhead costs have experienced deteriorating EBITDA margins. Coupled with consistently high maintenance capital expenditure requirements, negative free cash flows have eroded cash balances significantly in recent months. Negative free cash flows, upcoming debt maturities, and the extension of trade supply are all telltale signs of a company in financial distress.

Financial restructuring as a possible solution. For companies experiencing financial distress, a full assessment of the strategic options is required. Possible solutions include seeking deferral of interest payments, extending the maturity of the debt, exchanging existing debt for equity, or potentially raising new debt or equity capital.

Many commercial banks view the current $50-$60 per barrel oil price environment as a transition period. Although lenders are looking to cut overall exposure to the industry, forcing a distressed company into default is often not in a lender’s best interest. In the current environment, lenders will be focused on optimizing the recovery of assets and improving their standing for a potential future default. This may manifest itself in the perfection of additional liens or more stringent covenants.

Conversely, equity holders seek to avoid dilution of their existing equity and to extend the maturity of existing liabilities. If properly negotiated, a restructured credit agreement can achieve the goals of both the owners and lenders and right-size the company balance sheet for prosperity even through a prolonged period of low commodity prices.

Veteran PEGs raise funds to capitalize on distressed prices. With assets available at distressed prices and strategic buyers focusing on internal cash management, the plight of the energy industry has surfaced a major opportunity for savvy private equity groups (PEGs). Veteran PEGs such as GSO Capital Partners, Oaktree Capital Management, and The Carlyle Group have all raised new funds targeting distressed energy assets. While the first quarter of 2015 experienced only light deal flow, we expect energy focused private equity to become more active in acquisitions as more distressed situations arise.

Energy deal volume hits trough. Despite lower valuation multiples, smaller PEGs without major experience in the energy sector are taking a step back from oil and gas opportunities until oil prices stabilize. For generalist firms, the lack of clarity in the sector poses too much risk for limited partners. Further, oil and gas focused funds are devoting their attention to managing existing portfolio companies and potential bolt-on acquisitions. New platform acquisitions, especially opportunities with material exposure to the drilling market, have been put on hold and for good reason.