M&A Fee Guide 2023-2024

For the third year running, Axial partnered with Firmex and Divestopedia on the annual M&A Fee Guide, the authoritative source…

Tags

For M&A professionals, it can be challenging to balance a productive social media strategy with stiff regulations and compliance risks. The rewards, however, can be plentiful. When implemented thoughtfully, social media acts as both a powerful brand-building tool and an alternative source of dealflow.

At ACG’s recent Dealmaking at the Beach Conference, we heard from professionals with experience implementing successful social media strategies. Here are a few quick tips to get you started.

Professionals are now much more fluid in the way they consume and share information, and best-in-class firms are adopting basic social media practices to supplement their deal flow. “I suggest being both a curator that re-shares quality information and a content creator,” says Janine Truitt of Talent Think Innovations. Firms can productively use social media if they think of it as a vehicle for building the brand and authenticity.

Lewis Goldberg of KCSA says that “FAVOR is the most important thing to remember when using social media as a microphone, and it can help you be respected and eminent online.” It’s important to think critically about the information you’re sharing, who the intended audience is, and what value the information will bring to those who consume it. “Decide who you want to be as a firm online and execute a plan at a daily, monthly, and quarterly cadence,” says Allison Tepley of Axial.

Scott Gluck of Duane Morris says that “the SEC will and does monitor social media, so it’s very important to establish procedures and think through what you’d like to accomplish.” He also recommended getting social content approved by the CCO or equivalent manager in your organization. Firms should use social media to discuss things like firm culture, headcount, and events and stay away from discussing revenue numbers and deal details. While some firms associate social media with nothing but risk, many are seeing new deal flow and deepening relationships as a result of being active online.

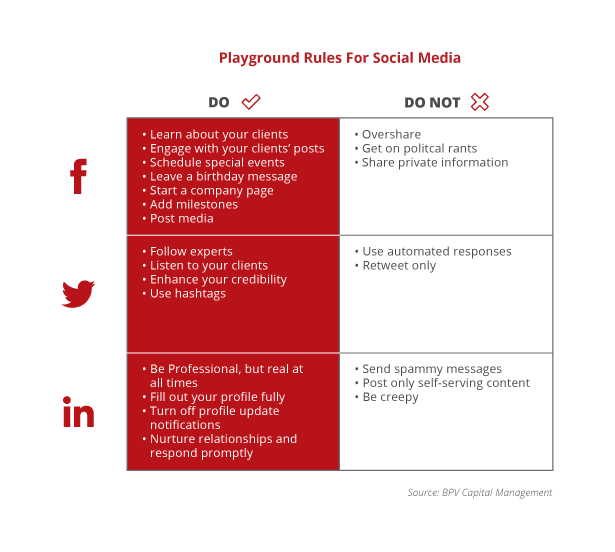

While the tips above are helpful in executing an overall strategy, each social media platform should have its own set of rules and procedures. During a recent webinar, BPV Capital Management shared the following do’s and don’ts for each social media platform. Use these tips to guide the social content program at your firm: