M&A Fee Guide 2023-2024

For the third year running, Axial partnered with Firmex and Divestopedia on the annual M&A Fee Guide, the authoritative source…

Axial is excited to release our 2023 Lower Middle Market Investment Banking League Tables.

To assemble this list, we reviewed the 2023 deal-making activities of 807 investment banks and advisory firms that met the qualifications to be considered for league tables.

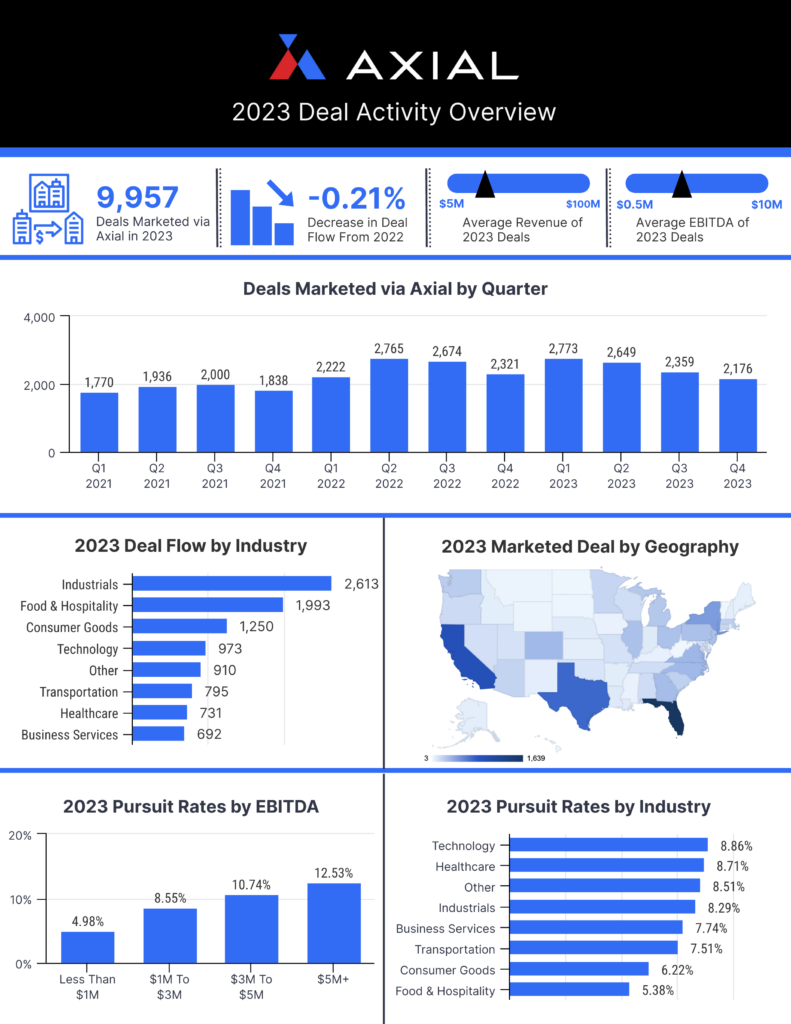

In 2023, the sell-side membership brought 9,957 deals to market via the Axial platform. The 2023 League Table recipients represented 360 (3.62%) of those deals.

See below for an overview of last year’s deal activity. If you’re interested in diving deeper, check out Axial’s SMB M&A Pipeline series, which surfaces a top-of-the-funnel breakdown of the deal activity, sorted by industry category.

Axial’s league table ranking methodology (detailed methodology available in the footnotes) is driven largely by four factors:

Congratulations to each of these investment banks and M&A advisory firms for their dealmaking achievements in 2023!

| Rank | Firm | HQ |

|---|---|---|

| 1 | FOCUS Investment Banking |

VA |

| 2 | Peakstone Group |

IL |

| 3 | Woodbridge International | CT |

| 4 | New Direction Partners |

PA |

| 5 | Cornerstone Business Services |

WI |

| 6 | VERTESS Healthcare Advisors |

AZ |

| 7 | Embarc Advisors | CA |

| 8 | Kratos Capital |

TX |

| 9 | Bridgepoint Investment Banking | NE |

| 10 | Vesticor Advisors | MI |

| 11 | Madison Street Capital |

TX |

| 12 | True North M&A | MN |

| 13 | Merit Investment Bank |

WA |

| 14 | Brentwood Growth Corp |

NJ |

| 15 | Vercor |

GA |

| 16 | Gleason Advisors |

PA |

| 17 | Plethora Businesses | CA |

| 18 | ASA Ventures Group |

CO |

| 19 | Murphy McCormack Capital Advisors |

PA |

| 20 | SDR Ventures |

CO |

| 21 | Auctus Capital Partners |

IL |

| 22 | Osage Advisors | CT |

| 23 | BMI Mergers & Acquisitions |

PA |

| 24 | ACT Capital Advisors | WA |

| 25 | Young America Capital, LLC | NY |

| Firm | HQ |

|---|---|

| Bentley Associates | NY |

| Cascade Partners |

MI |

| Meritage Partners |

CA |

| Sun Mergers & Acquisitions | NJ |

| The Hatteras Group |

NC |

| Firm | HQ |

|---|---|

| IEI Advisors | VA |

| CRI Capital Advisors |

AL |

| Kreshmore Group |

IL |

| Hext Capital Partners |

TX |

| Evangeline Securities |

LA |

| Firm | HQ |

|---|---|

| Capital Canada Limited | CAN |

| Vista Business Group |

KS |

| Sterling Point Advisors | VA |

| Kaulkin Ginsberg | MD |

| LB Transitions | MN |

| Firm | HQ |

|---|---|

| Mertz Taggart |

FL |

| RigSide Energy Partners | GA |

| IT ExchangeNet |

OH |

| M&A Healthcare Advisors | CA |

| SF&P Advisors | FL |

![]() – 1 closed deal on Axial |

– 1 closed deal on Axial | ![]() – 2 or more closed deals on Axial

– 2 or more closed deals on Axial

“With more than three decades of experience, FOCUS Investment Banking is a trusted name in M&A advisory services with a nationwide footprint and a global reach. Headquartered in the Washington, DC metro area, FOCUS also has corporate offices in Atlanta and the Los Angeles metro area. Its team of 35+ senior bankers is supported by more than a dozen analysts, senior advisors and support staff. Each FOCUS banker maintains a core practice in one of the 12 industry verticals comprising the firm’s current areas of specialization, keeping FOCUS abreast of developments in today’s rapidly changing market environments.”

Visit FOCUS Investment Banking’s Profile

![]()

“The Peakstone Group is an investment bank that specializes in mergers and acquisitions advisory and capital raising for middle market clients. Our team is comprised of senior investment banking professionals and operating executives, all of whom have decades of experience and have executed hundreds of transactions totaling billions of dollars.”

Visit Peakstone Group’s Profile

“Woodbridge International has been closing lower-middle-market M&A deals for 30 years. We closed 32 deals in 2022 in various industries, including manufacturing, distribution, e-commerce, logistics, consulting and healthcare; generating $619 million in liquidity for our clients.

We do ground-breaking, confidential global client marketing. We create powerful marketing videos showcasing our client’s companies. We have an innovative 150-day timeline-driven auction that establishes a closing date upfront, and all clients attend a 2-day virtual, Management Meeting Training Program. We are a technology-driven, fully virtual firm.

That’s why Woodbridge International is well-positioned to dominate the highly fragmented, underserved lower middle market.”

Visit Woodbridge International’s Profile

“New Direction Partners provides advisory services in investment banking, valuation, financial advisory and management consulting. Our partners have unparalleled experience, with involvement in over 200 sales and mergers since 1979. We specialize in providing services to the printing, packaging and allied graphic arts industries with an emphasis on mergers and acquisitions.”

Visit New Direction Partners’ Profile

“Cornerstone Business Services is a boutique investment bank serving the lower middle market of mergers & acquisitions. We’re based in the Midwest but work throughout North America, and are a founding member of the Cornerstone International Alliance. We create value through acquisition searches, company sales, and valuations, with a focus on businesses with annual revenue from $5 million to $150 million.

Cornerstone uses a team approach on each transaction along with our proprietary Assurance 360™ process which typically generates multiple offers, a high likelihood to close and maximizes value. We work really well with first time sellers that value an advisor’s role and want to ensure the largest financial transaction of their life is done right.”

Visit Cornerstone Business Services’ Profile

“VERTESS is a healthcare-focused Mergers + Acquisitions (M+A) advisory firm that helps owners increase their company’s financial value and negotiate the best price when they decide to sell their own company or grow through acquisition. Our expertise spans diverse healthcare and human service verticals, ranging from behavioral health and intellectual/developmental disabilities to DME, pharmacies, home care/hospice, urgent care, dental practices, life sciences, and other specialized services and products. Each VERTESS Managing Director has had executive experience in either launching or managing and ultimately successfully exiting a healthcare company.

VERTESS is headquartered in Dallas/Fort Worth, with additional offices in Phoenix, Tucson, Los Angeles, Denver, Boston, and Orlando. For more information visit www.vertess.com.”

Visit Vertess Healthcare Advisors’ Profile

“We are a disruptive M&A Advisory firm founded by ex-Goldman Sachs, and ex-McKinsey M&A professionals with a goal of bringing Goldman & McKinsey level services to the middle market. We doubled in size in 2023, one of the worst M&A markets in the recent decade.

Leveraging our M&A expertise, we have been successful in a broad range of sectors including business services, IT services, healthcare, industrial, software / hardware, consumer retail etc. We have even been successful in situations where traditional investment banks were not able to successfully close a transaction.

In addition to sellside transactions, we have advised on buyside acquisitions and debt / equity financing for acquisitions or recapitalizations.

Given our hourly billing model, we are able to work on transactions that are as small as $500k in EBITDA, all the way up to +$10M in EBITDA. ”

Visit Embarc Advisors’ Profile

“Kratos Capital (KC) is an M&A firm dedicated to ensuring our client’s goals and expectations are met and oftentimes exceeded. With over 100 years of combined experience in the M&A industry, we take pride in being experts at planning, facilitating, and executing exit strategies with extremely favorable results. Because we only answer to our clients, we’re free to focus on building long-term relationships and long-term value. Our investment bankers draw on the Kratos Capital way of nurturing enduring relationships, providing unvarnished advice and leveraging our principal mentality.

We work with clients of all sizes in many industries in all parts of the country including South America and Canada. For middle market companies who wish to start the sale or divestiture process, KC’s Value Enhancement model is an M&A capability that maximizes shareholder value. Unlike business brokers and other M&A firms, KC utilizes proprietary analytical technology which can help institutionalize your company during the process, to help ensure rapid exit with maximum returns to the stakeholders. Advance planning of the exit process is a key factor in determining the ease and overall outcome of the transition. Planning ahead allows sufficient time to enhance profits, improve your marketability, and time the execution of the sale based on external economic and market factors.

Hiring an expert to help you plan in advance and evaluate your goals and expectations can mean the difference between you walking away from the closing table extremely satisfied, or you walking away very disappointed.”

Visit Kratos Capital’s Profile

“Bridgepoint Investment Banking is a market-leading boutique investment bank that serves clients over their corporate lifecycles by providing capital raising and M&A advisory solutions. Bridgepoint is a tenacious, creative and results-oriented boutique investment bank focused on impact and value creation for the companies we serve. We provide confidential, independent and unconflicted solutions and strategic advice. We have an unequivocal focus on our clients and their prosperity. We measure our performance by the long-term success of our clients.

Together, Bridgepoint principals have more than 360 years of investment banking experience, allowing us to provide our clients with Wall Street-quality experience and deep national and international funding and buyer connectivity. We have successfully moved more than $382 billion of capital across 475+ completed debt, equity and merger and acquisition transactions.

Securities-related services offered through M&A Securities Group, Inc. Any third-party posts linked to this profile should not be considered to represent my view, the views of Bridgepoint Investment Banking or the views of M&A Securities Group, Inc. Bridgepoint Investment Banking is a division of Bridgepoint Holdings NE, LLC.”

Visit Bridgepoint Investment Banking’s Profile

“Vesticor Advisors was founded on the principle that owner-operated companies in the lower middle market are unique and require specialized attention and advice when considering strategic investment and exit opportunities.

Vesticor Advisors provides M&A and capital raising advisory services exclusively to founder and owner-operated companies. We support clients with the expertise needed to build their business through growth acquisitions, optimize value in an exit or sale, transition ownership to family or management, divest non-core assets, or raise capital. After founding, building and exiting our own businesses, the partners at Vesticor came together under a shared vision: to build an M&A firm that helps other business owners achieve their dreams of growth, expansion, legacy and financial independence.”

Visit Vesticor Advisors’ Profile

“Madison Street Capital is an international investment banking firm dedicated to the highest standards of integrity and professionalism – provides corporate financial advisory services, mergers and acquisitions expertise, valuation services, and financial opinions to publicly and privately held businesses through our offices in North America, Asia, and Africa. Our professionals draw on specialized expertise in partnering with middle-market firms in all industry verticals and niche markets to achieve an optimal outcome through a variety of transactions. Madison Street Capital’s professionals precisely analyze each client’s needs to determine the best match between buyers and sellers, arrange cost-effective financing, and produce capitalization structures that maximize each clients’ potential. Madison Street Capital is a trusted partner and industry-leading provider of financial advisory services, M&A assistance and business valuations.”

Visit Madison Street Capital’s Profile

“True North Mergers & Acquisitions advisors serve business owners from across the country who want to sell companies that generate annual revenue between $5 million and $150 million.”

Visit True North M&A’s Profile

“JD Merit is a leading boutique investment bank focused on middle market companies. We are experts in M&A transaction execution and closing. We combine decades of experience with technical expertise, tenacity, creativity, and dedication to ensure not only that a transaction is closed, but that it is closed in our client’s best interest. We deliver market-leading outcomes by applying the integrity, intelligence, insight, instinct, and intensity of a trusted advisor, with no conflicts.

We provide end-to-end M&A advisory services, utilizing our specialized M&A 2.0® process to deliver the most qualified and capable buyers at above-market prices with better terms and certainty of close. We don’t just take on clients – We close deals.

As a full-service Broker / Dealer, licensed in all 50 states, JD Merit executes sell-side M&A, buy-side M&A, and capital advisory services. In addition, JD Merit offers other Investment banking services such as debt and equity capital raises, corporate finance and valuation, and real estate & project finance.”

Visit Merit Investment Bank’s Profile

“Brentwood Growth assists home service and facility management business owners wanting to sell all or part of their business. We assist in valuation, transaction structure, marketing the business, leveraging our network of institutional buyers and managing due diligence / legal process to close. Our fees are 100% performance based paid at close of transaction.”

Visit Brentwood Growth Corp’s Profile

“VERCOR, a leading middle market mergers and acquisitions firm, serves business owners who are interested in selling all or part of their company or who are seeking a private equity recapitalization. Our team manages the entire process – business valuation, assessing the market value of a company, pre-sale planning, marketing, negotiations, and closing the best possible deal. VERCOR brings national and international resources to the job of selling a business in the mid-size market. VERCOR merger and acquisitions consultants provide worldwide resources usually available only to companies with revenues in excess of $100,000,000. VERCOR Investment Banking Serves Business Owners Who Are Interested In: Selling all or part of their business Private equity recapitalization Management Buyouts.”

“When closely held, private companies have a need for financial advice – in seeking a liquidity event or when capital needs to be raised, for example – Gleason Advisors acts as a trusted partner to business owners and management. We provide valuable financial and strategic advice throughout the business life cycle.

Our service offering at Gleason Advisors allows us to work with businesses facing a wide range of issues and financial challenges. These situations often call on us to leverage our symbiotic relationship with the services of Gleason Experts, where we have deep expertise in forensic accounting, litigation support, and bankruptcy proceedings. Combined, these groups allow us to serve our clients as a more complete financial advisor. Providing value beyond dispute.”

Visit Gleason Advisors’ Profile

“Plethora Businesses is a leading M&A firm specializing in business sales, mergers, acquisitions and valuations for privately owned businesses.”

Visit Plethora Businesses’ Profile

“ASA Ventures Group supports business owners by reducing their ongoing equity risk and their burden of business ownership. We will take the burden off your shoulders by providing you with a dedicated and knowledgeable growth investment partner so that you may not have to worry about your business growth. Whether you wish to further grow your business or exit your existing business, you can count on our team.”

Visit ASA Ventures Group’s Profile

“Murphy McCormack Capital Advisors is a regional investment banking firm offering unparalleled expertise, advice and experience in the transfer of ownership within middle market privately-held companies. With offices and a team of professionals in Lewisburg, Harrisburg and Sayre, we are widely regarded as central and southeastern Pennsylvania’s leading investment banking and strategic consulting firm for mid-size companies.”

Visit Murphy McCormack Capital Advisors’ Profile

“SDR Ventures is a Denver-based investment banking firm serving private business owners in the lower middle market, including companies with values up to $300 million. The SDR Ventures approach of THINKING LIKE OWNERS helps businesses maximize their value. Whether owners are looking to sell a business, buy a business or raise debt or equity, SDR is committed to helping them succeed.

Our core services include M&A Transaction Advisory – Buy Side and Sell Side, Private Capital Formation – Debt and Equity, and Strategic Advisory/Consulting.

Investment banking and securities are offered through SDR Capital Markets, LLC, member FINRA and SIPC. SDR Capital Markets, LLC is a wholly owned subsidiary of SDR Ventures, LLC.”

“Auctus Capital Partners is a leading financial services and investment banking firm focused exclusively on creating value for the lower middle market. We specialize in merger & acquisition advisory, institutional private placements of debt and equity, financial restructuring, valuation, and strategic consulting. Our senior bankers have deep domain expertise across a range of industries, with the necessary foresight to navigate highly-complex transactions to maximize value and achieve optimal outcomes for clients.”

Visit Auctus Capital Partners’ Profile

“Founded in 2001, Osage Advisors is a boutique Investment Banking firm dedicated to helping business owners receive the maximum value from the sale of their companies. We use traditional investment banking techniques, typically not available to owners of closely-held businesses to create a competitive environment that delivers multiple options and the best prices for our clients.

Our teams of Advisors are former business owners who understand that selling a business is personal and, therefore, we are committed to our clients – not just the deal. We tailor our process to meet the needs of each individual business owner, never losing sight of their personal goals and objectives.

Osage has closed numerous transactions for clients across a broad range of industries and has strong relationships with both Strategic and Financial Buyers increasing our ability to deliver superior results for our clients.”

“For over thirty years, our professionals have successfully engaged in the practice of buying, selling, and managing the business acquisition process. We have completed multi-million-dollar deals in many industries and successfully integrated businesses post-merger. Whether your business is worth $3 million or $100 million, this experience is put to work to achieve your desired result. Mr. Kerchner, Mr. Clark, Mr. Fay, Ms. Marlowe, and Mr. Tortora hold securities licenses Series 79 and 63.”

Visit BMI Mergers & Acquisitions’ Profile

“ACT Capital Advisors has been helping owners sell their businesses since 1986. Through hundreds of transactions, we’ve developed a strategic process that’s highly effective in closing deals. Unlike other M&A companies that hand you off to various specialists throughout the stages of a sale, you’ll work with one team at ACT, a group of hand-selected individuals familiar with your industry. They’ll be with you from start to finish, working toward your goals and looking out for your best interests.”

Visit ACT Capital Advisors’ Profile

“Young America Capital leverages strong relationships with banks, venture-capital and private-equity funds, family offices, fund-of-funds, foundations, hedge funds, Fortune 500 M&A executives and large employers’ retirement systems to facilitate clients’ goals. Advisor to: Investment managers in the alternative-asset classes, including venture capital, private equity, and hedge funds. YAC provides advisory services in the areas of fund structuring, fund-raising/marketing, LP relations, and back-office operations. Advisor to: Businesses seeking seed stage, early stage, and mezzanine debt and/or equity working capital.”

Visit Young America Capital’s Profile

Unlike traditional league table structures that have remained the same for years, where firms are assessed against deal activity and deal dollar volume, Axial league tables surface data on investment banks that reveal their client quality, ability to manage a sell-side process, and down funnel effectiveness for their client.

The investment banks at the top of the Axial League Table are leaders across the following categories:

Together, the top 25 investment banks are those who work with the most in-demand clients; balance breadth, selectivity, and accuracy in the buyers they engage; and generate the largest number of positive outcomes for their clients.

Axial is the trusted deal platform serving the lower middle market ($2.5-$250M TEV).

Over 3,500 advisory firms and 3,000 corporate and financial buyers have joined Axial to efficiently connect with relevant capital partners, source actionable deals, and build new relationships.

Visit the Member Closed Deals page to see selected transactions that have been sourced and closed via Axial.