The Top 50 Lower Middle Market Industrials Investors & M&A Advisors [2025]

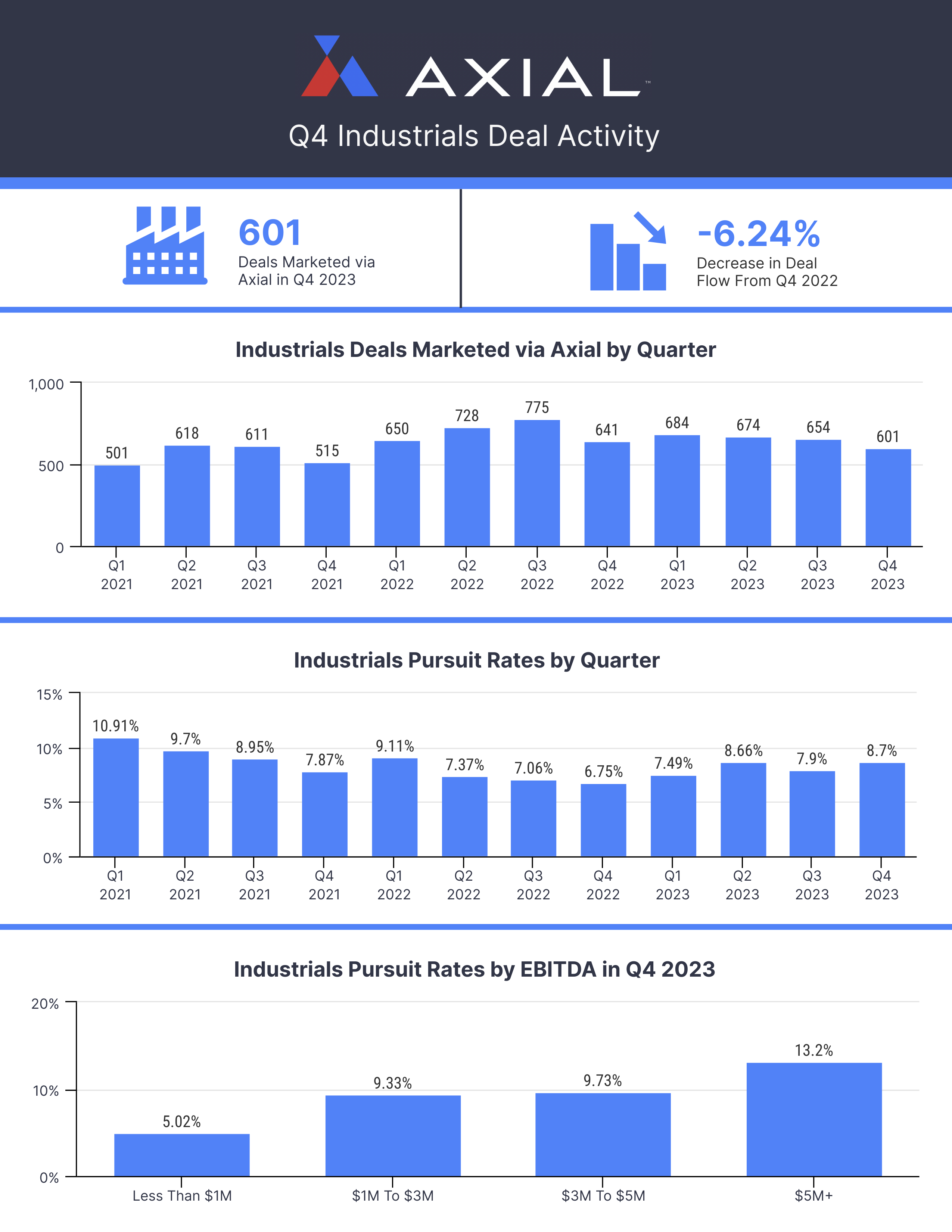

Industrials remains the most dominant sector in Axial deal flow, representing more than 25% of all deals brought to market…

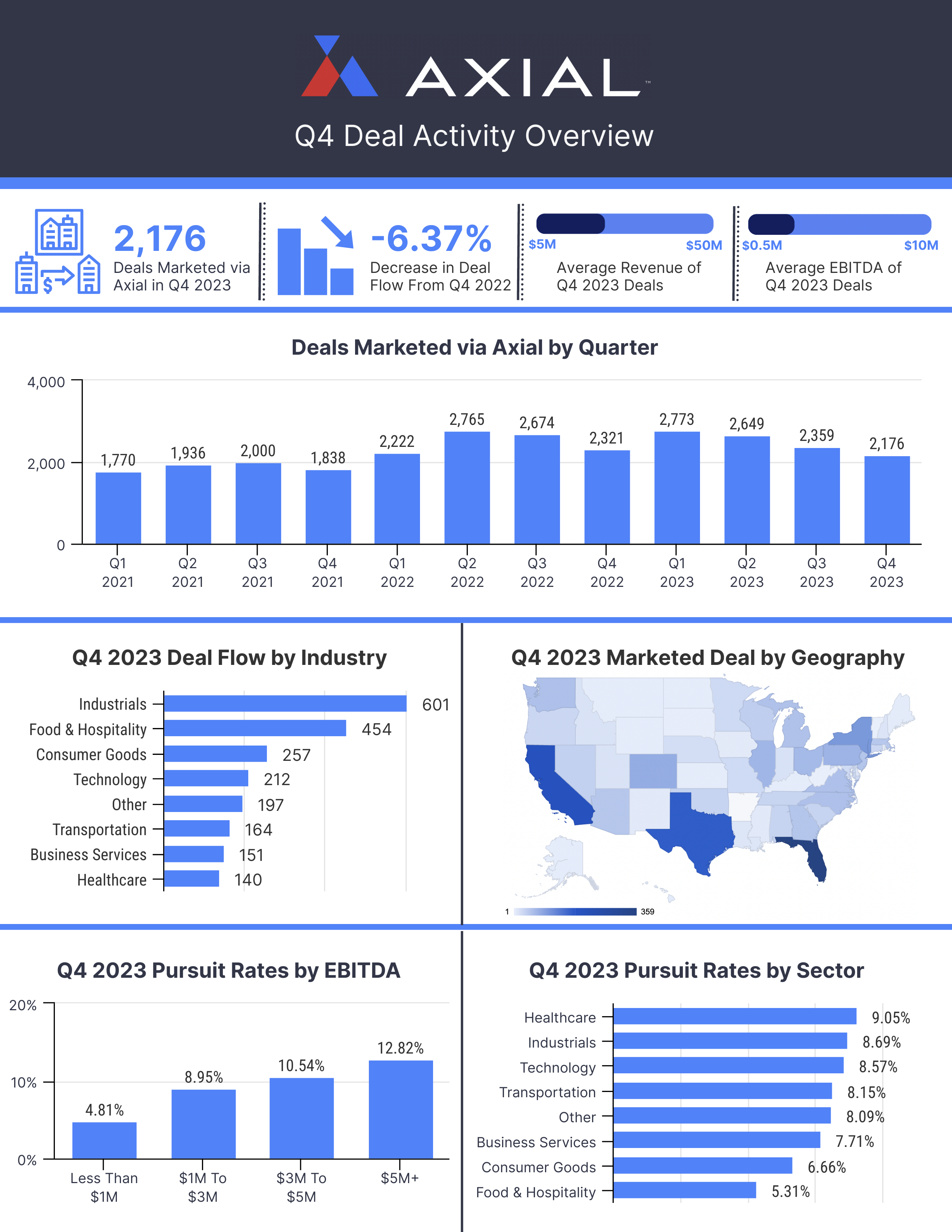

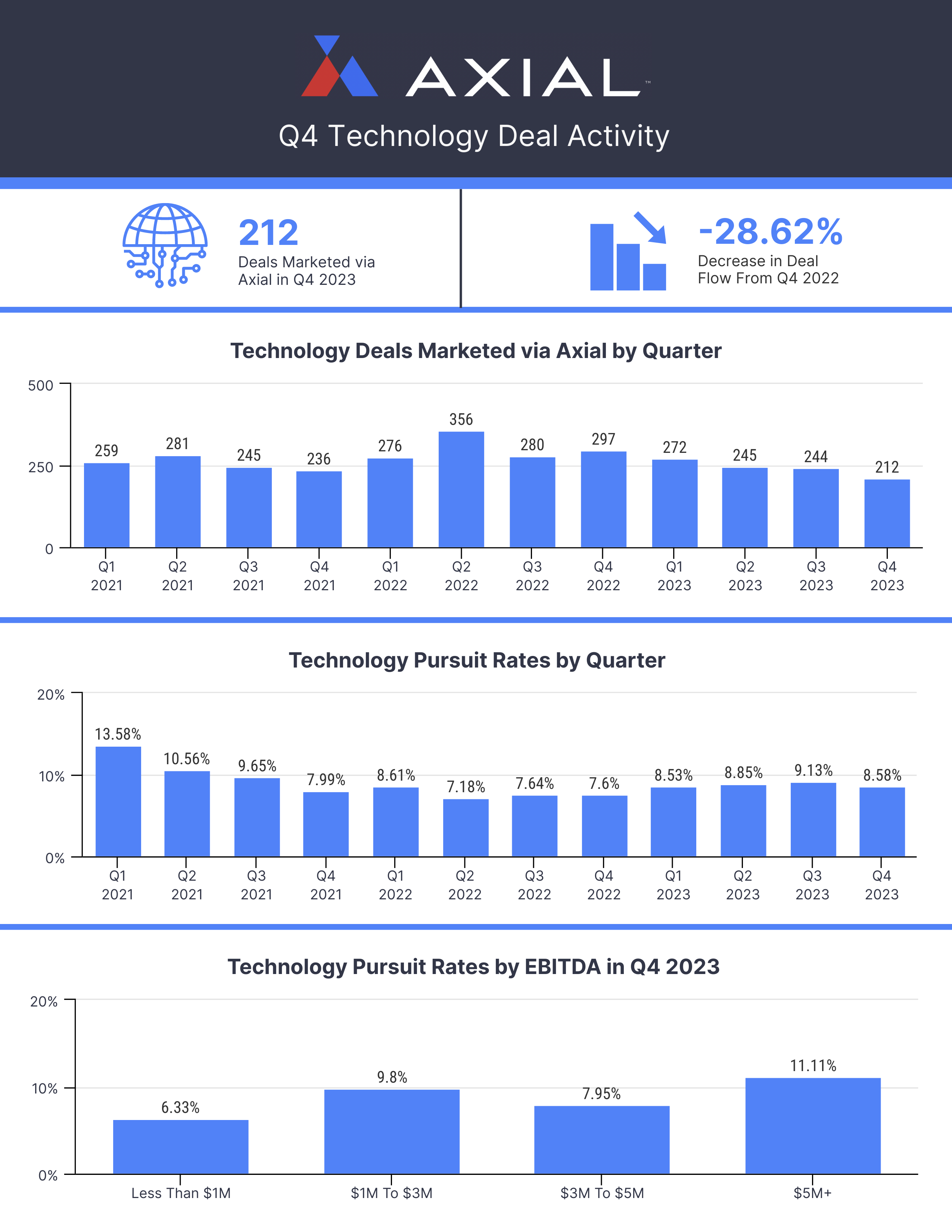

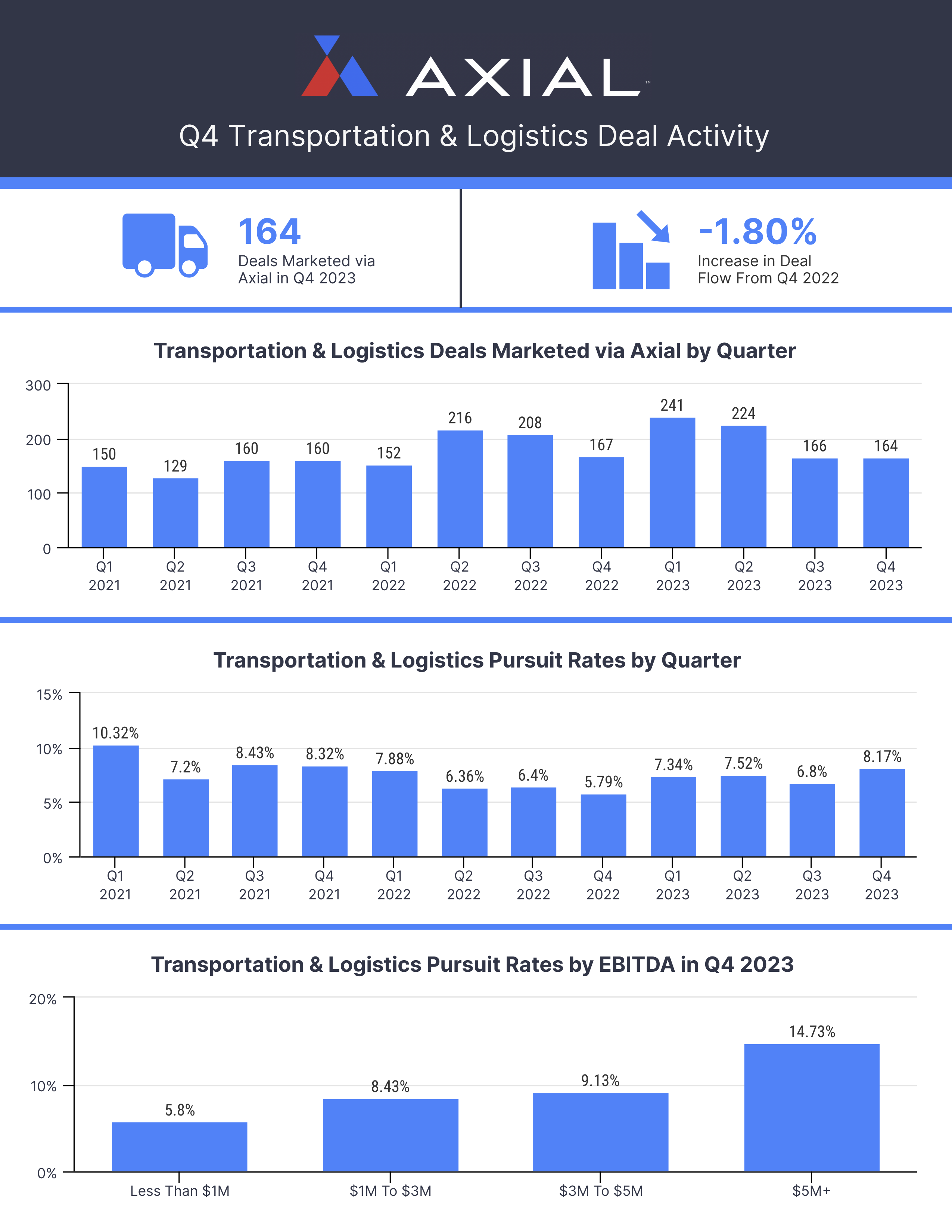

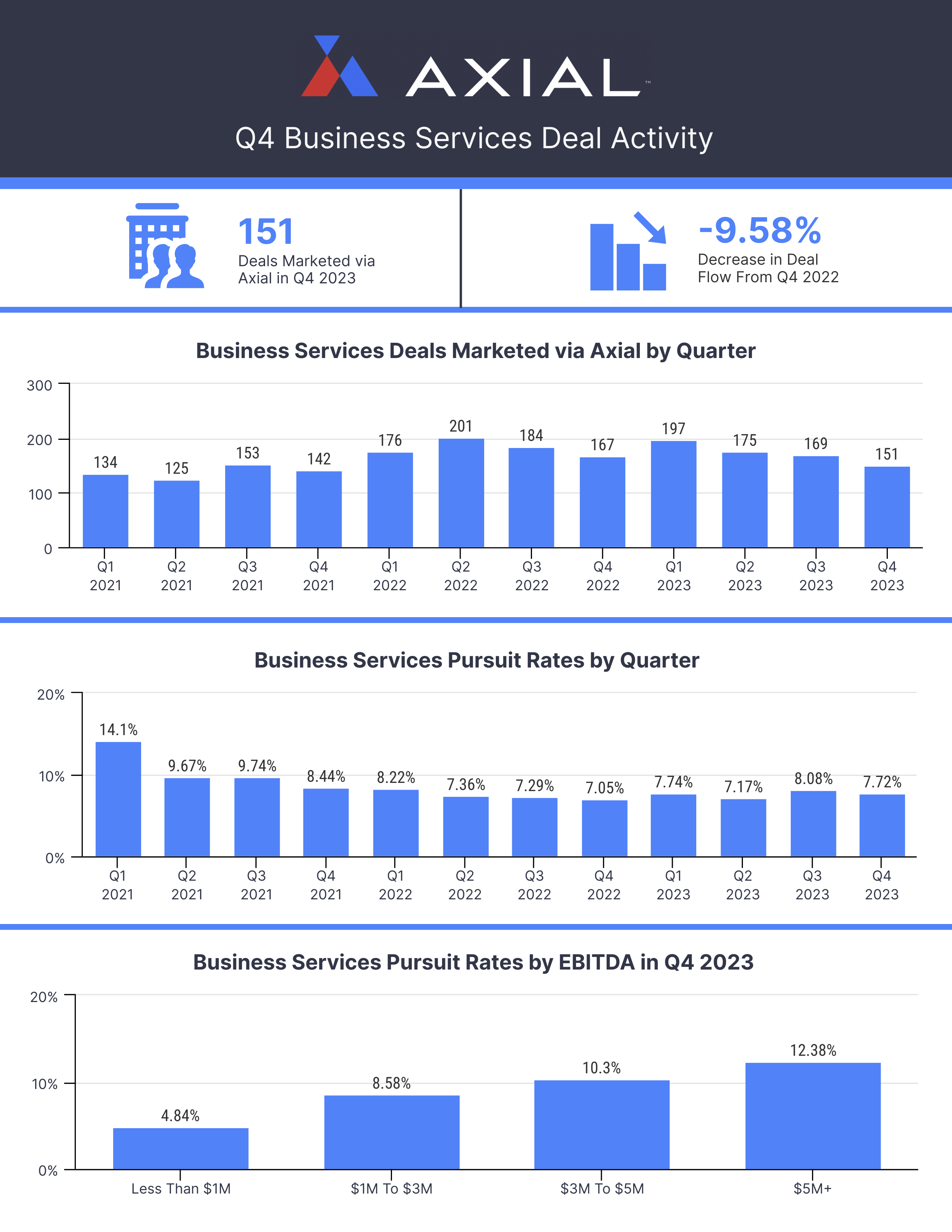

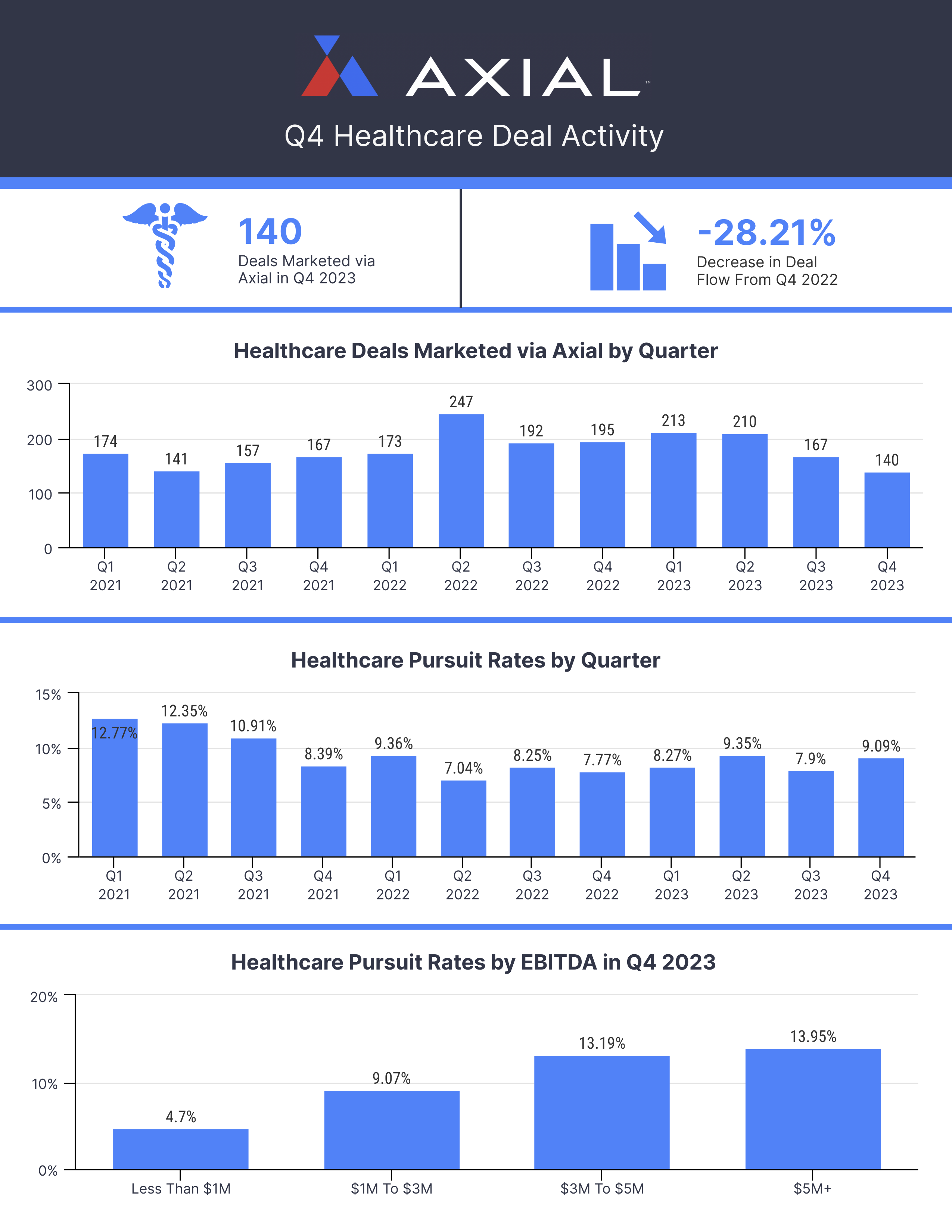

Welcome to the Q4 2023 edition of The SMB M&A Pipeline. This quarterly series surfaces a top-of-the-funnel breakdown of the deal activity occurring on Axial’s platform. The aggregated metrics include quarterly deal volumes, financial and geographic characteristics, and pursuit rates, sorted by industry category.

“Pursuit rate” measures the rate at which Axial’s buyside members register interest in a deal that an Axial sell-side member has invited them to consider. If NDAs, IOIs, and LOIs reflect the deepening progression of interest among acquirers on a given deal, the pursuit rate is one step higher in the funnel than the signed NDA. It offers insight into the forward deal pipeline and the initial interest level of prospective Axial buyside members.

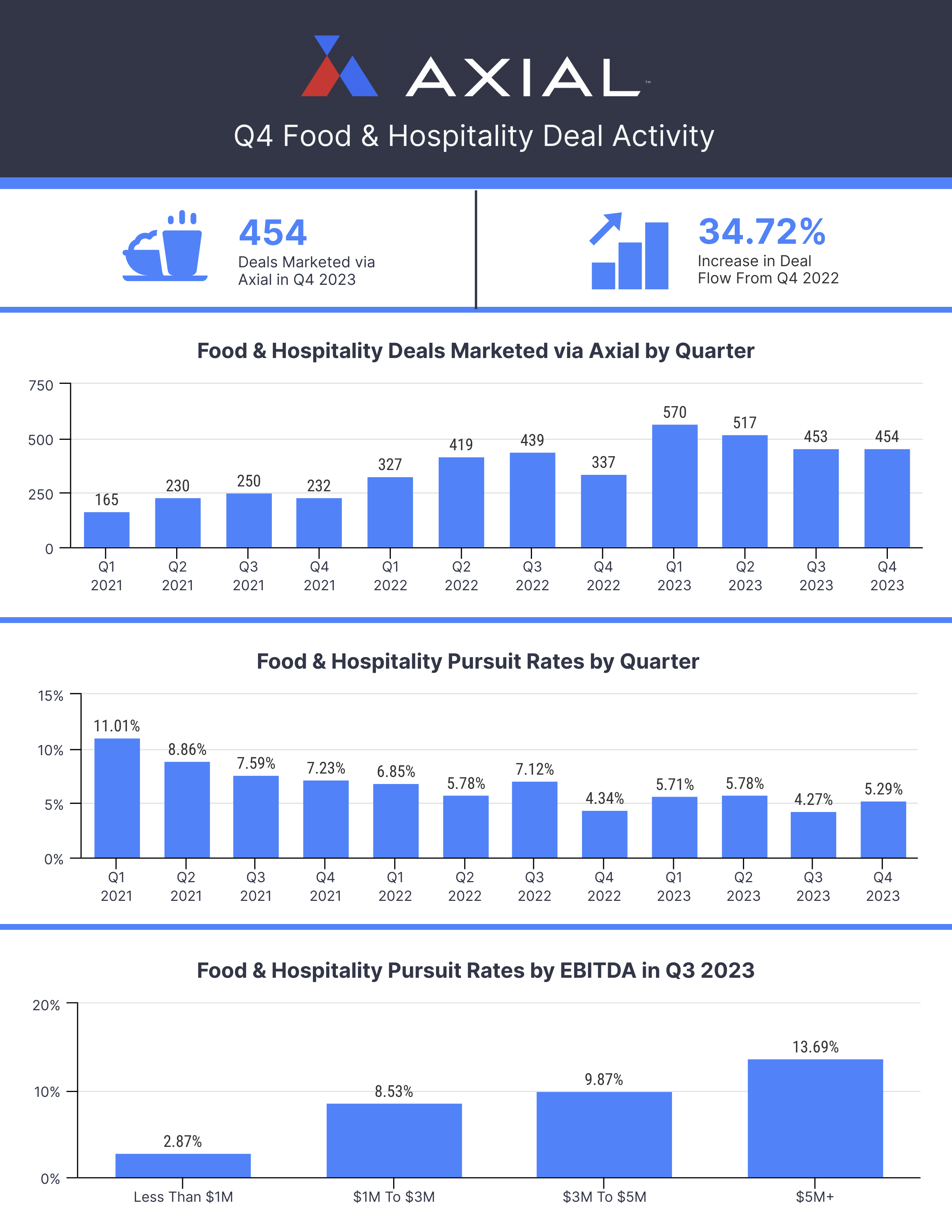

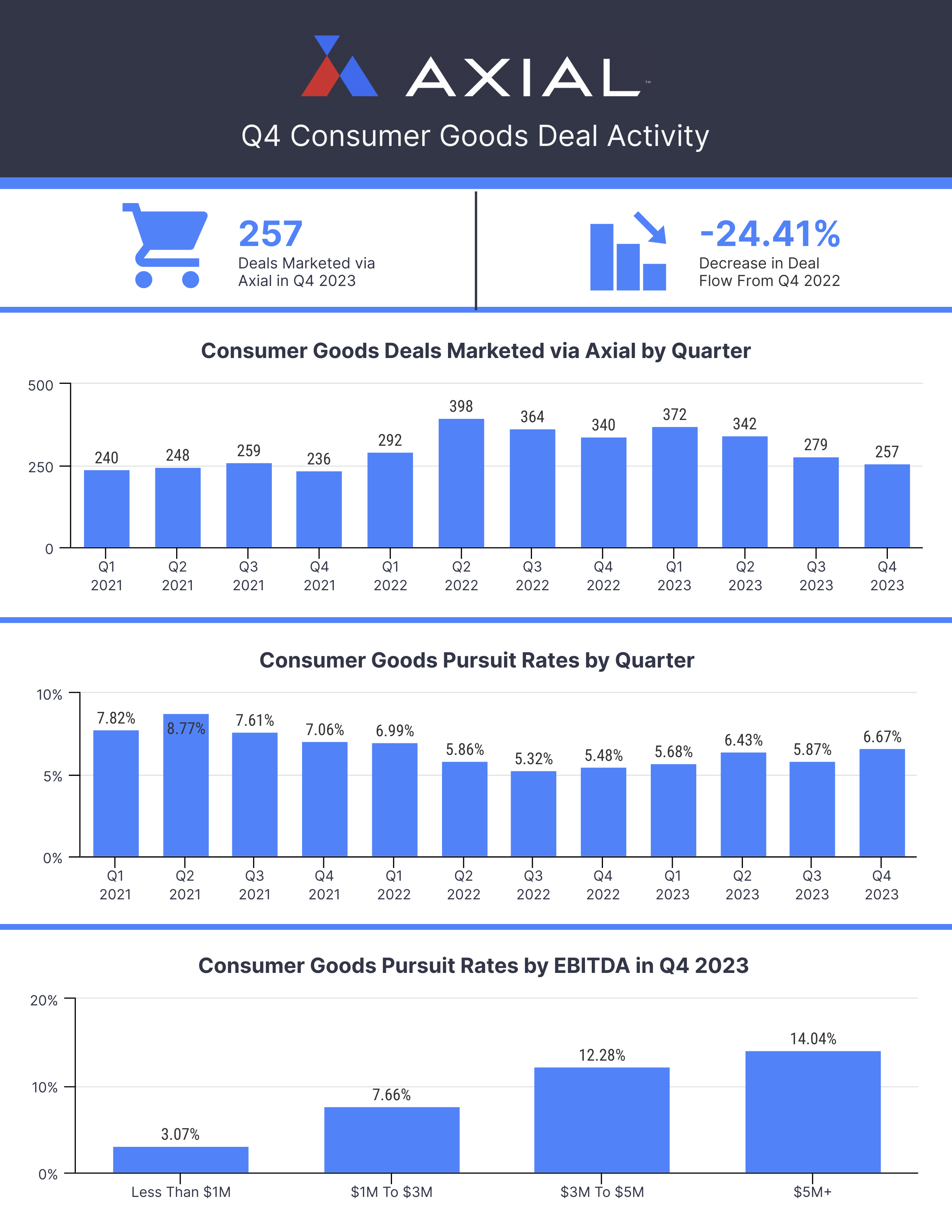

We saw 2,176 deals come to market in Q4, 6.37% lower compared to the same time period last year. For the second consecutive quarter, Food & Hospitality was the only sector to see positive YoY deal flow (see table below), with a 34.72% increase. Technology, Healthcare, and Consumer Goods all had 20%+ YoY deal flow decreases.

Even with consistent quarterly deal volume increases, Food & Hospitality ranked in the bottom (7th) for pursuit rate. Healthcare had the most significant discrepancy, ranking 7th in deal volume, but 1st in pursuit rate.

Below are a set of industry-specific and overall deal activity tearsheets that lay out a complete breakdown of deal activity in Q4 on Axial. Feel free to share and incorporate the data into your materials as you see fit.