The Winning M&A Advisor [Vol. 1, Issue 3]

Welcome to the 3rd issue of the Winning M&A Advisor, the Axial publication that anonymously unpacks data, fees, and terms…

Tags

We recently released the Top 50 Lower Middle Market Technology Investors & M&A Advisors. This list showcases Axial’s 50 most active and sought-after members who specialized in transactions across various tech sectors over the past 12 months.

In order to better understand the current technology trends and challenges, we asked select featured members to share insights on the general landscape as well as on the five technology sub-sectors below.

Today, we’re sharing these dealmaker insights along with the M&A deal activity data from the Axial platform for these specific sub-sectors.

Congratulations again to the members on the Top 50 list, and thank you to the below members who are quoted in today’s article.

| Member Insights |

|---|

| As we head into the second quarter of 2024, many investors are focused on when the Fed will begin cutting interest rates and that decrease in rates will flow through to lower cost of capital, especially for acquisition debt financing. Until then, most investors need to be creative with deal structure to find win-win deals that help both buyer and seller meet their goals. Ali Evans Metamora Growth Partners |

| Significant accumulated investment capital ("Dry Powder") looking for opportunities and certain sectors continue to be in high demand for good assets. Debt continues to be expensive so Buyers that have alternatives paths are well positioned. Stan Gowisnock FOCUS Investment Banking |

| As strategics get accustomed to a more stable interest rate environment, and bolstered by improving earnings resulting from greater efficiencies, we expect a discernible pick up in M&A activity. Based on our discussions with VCs, all of the companies in their portfolio are for sale, if not formally. Martin Magida Berkery Noyes |

| Columbia River Partners continues to see a lot of deal flow, but earnings of the companies is very volatile. We are focused on the portfolio for the next 3-6 months, making sure that our existing investments have a strong foundation to weather the next 12-18 months of volatility (elections, interest rates, etc.) Nathan Chandrasekaran Columbia River Partners |

| We are seeing a disciplined approach to transactions, especially with continued high cost of borrowing both at the operating level, and the sponsor level. Dustin Muscato Auctus Capital Partners |

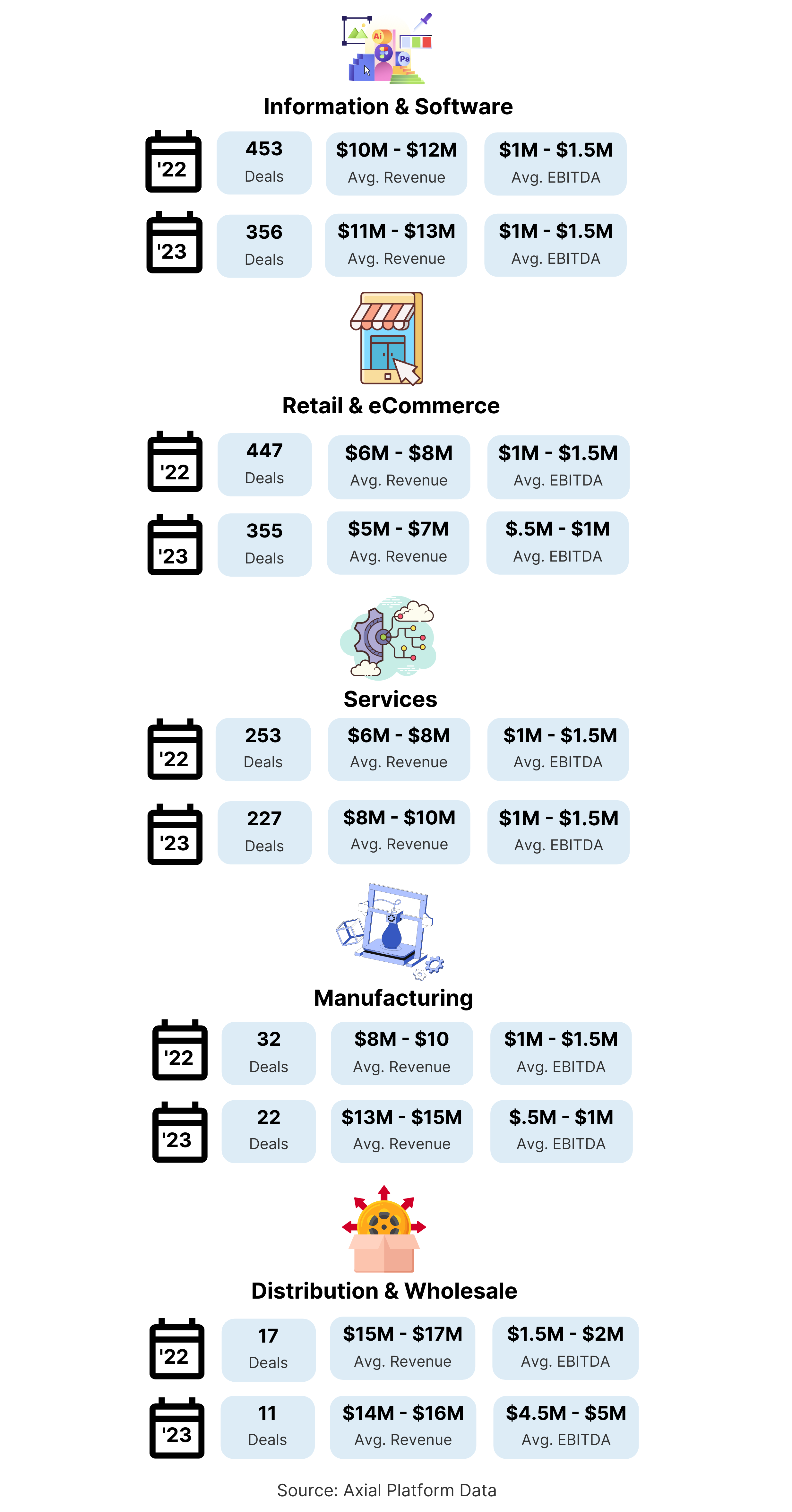

The five sub-sectors featured today represent 99% of all Technology deals brought to market via Axial in 2022 (1,208) and 2023 (974).

While the sector experienced an overall decrease in deal flow YoY, Technology had the highest 2023 pursuit rate.

Below are the deal counts, average revenue, and average EBITDA for each sub-sector broken down by calendar year.

The Software, Retail & eCommerce, and Services sub-sectors accounted for 96.3% of deal flow in 2023. Below are a few of the insights our members have observed in these industries.

| Member Insights |

|---|

| Software Development & Digital Transformation remain a very desirable area for investors. The demand is extremely large right now and there is a technical shortage of labor in the U.S. to support the amount of work needed. From conversations we continue to have with CFOs, CTOs and CIOs -- IT budgets continue to keep software strategy & digital transformation as a top 2-3 priority right behind Cyber and Cloud Infrastructure costs. David Eshaghian Panther Equity Group |

| For software deals, if the business does not have a path to profitability, it may be harder for firms to get excited about the opportunity compared to a few years ago. Stan Gowisnock FOCUS Investment Banking |

| M&A within the software sector is setting up for a solid 2024, partly as a function of a challenging financing environment. Companies that last raised in 2022 or earlier with the hope of a follow on round in 2024 are watching their investors shift their sights to early stage AI companies. Martin Magida Berkery Noyes |

| Young America Capital is seeing a lot of energy in the tech sector as Artificial Intelligence moves from concept to application. One area where we are seeing a high level of activity is in the AdTech/MarTech space. Companies are trying to get more impact from their advertising dollars at the same time that they are adjusting to new privacy laws that limit consumer tracking. AI applications are helping them address both of these issues with more efficiency and deeper insights. Greg Crowell Young America Capital |

| IT infrastructure is becoming more important (not just the software, but the infrastructure that supports the software); great example is Nvidia; we see more opportunities in the “unsexy” part of the technology sector (distributors, hardware, etc). Nathan Chandrasekaran Columbia River Partners |

| Over the past six months, we have been introduce to several start ups that we believe are Global Unicorns in the AI- 3D SaaS space. The technology that is being created, specifically, in Infrastructure that we believe will change the world views Construction Management, and City Planning. Ken Miller BlackRose Group |

| Even though things have settled down from COVID-19 disruptions, supply chain is still top of mind for manufacturing and consumer businesses. Although the slowing economy has impacted some of our project-based IT services companies, we have seen no delays to supply chain projects. Charles Scripps Black Lake Capital |

| Retail software and tech has been a harder segment for the middle market as very large players continue to expand into the back office after strong growth at the point-of-sale to push out SMBs with presence in retail tech. Chris Reedy Big Band Software |

![]() – 1 closed deal on Axial |

– 1 closed deal on Axial | ![]() – 2 or more closed deals on Axial

– 2 or more closed deals on Axial