Top 25 Lower Middle Market Investment Banks | Q2 2024

Axial is excited to release our Q2 2024 Lower Middle Market Investment Banking League Tables. To assemble this list, we…

Tags

Axial is happy to release its 2024 publication of the Top 50 Lower Middle Market Technology Investors and M&A Advisors: a list that features Axial’s 50 most active and sought-after members who specialized in transactions across various tech sectors over the past 12 months (full methodology below).

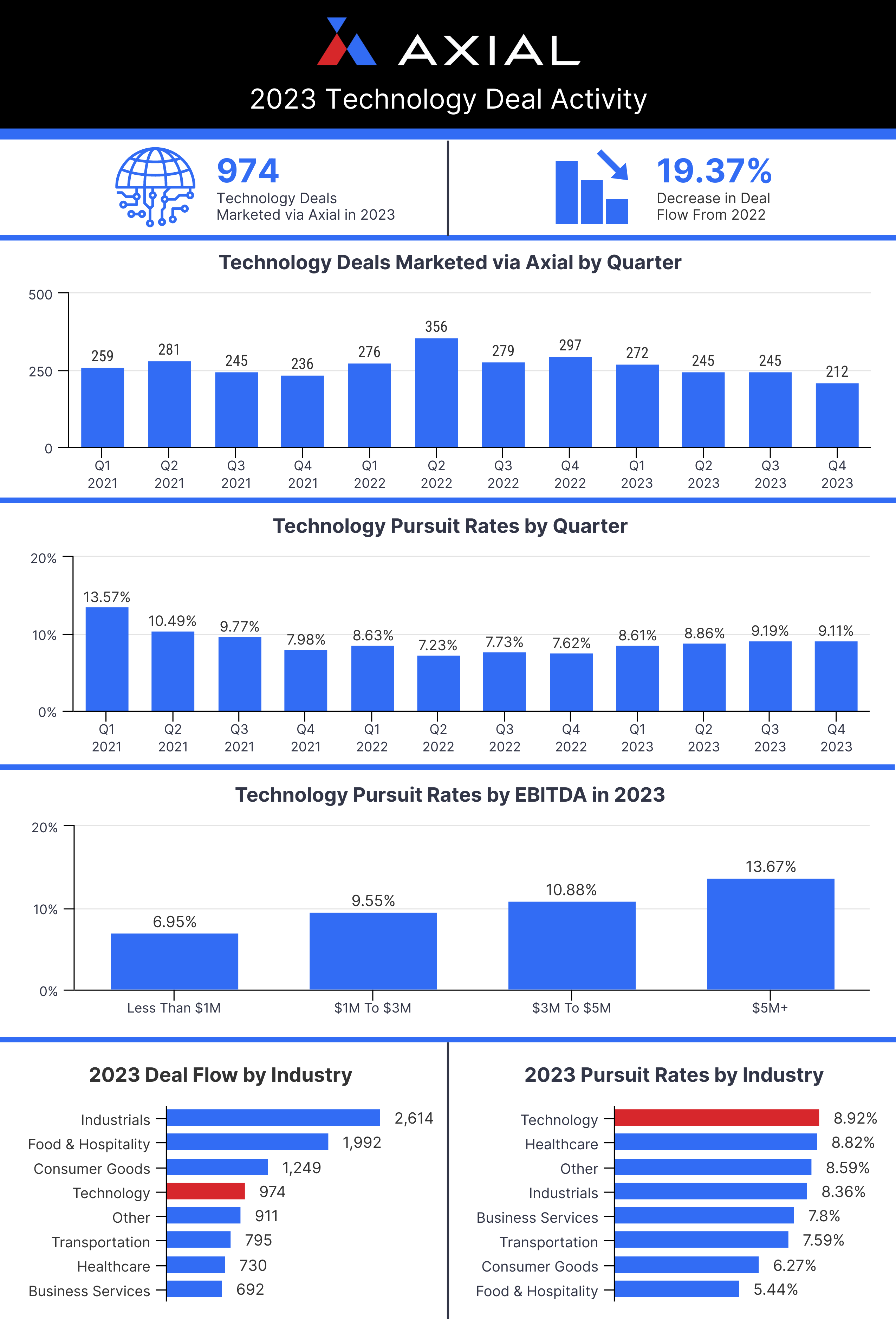

In addition to celebrating these featured members, we’d also like to share insight into the overall platform activity that informed the list.

One item of note is that while technology was ranked only the fourth highest industry as it relates to total deal flow in Axial in 2023, deals in the tech sector had the leading pursuit rate at 8.92%. This was a tenth of a percentage point higher than the runner-up – healthcare – and was based off of a total of 974 technology-focused deals.

Our Top 50 technology list was generated based on a weighted formula leveraging four key metrics:

Congratulations to these members for their achievements!

![]() – 1 closed deal on Axial |

– 1 closed deal on Axial | ![]() – 2 or more closed deals on Axial

– 2 or more closed deals on Axial

Axial is the trusted deal platform serving the lower middle market.

Over 3,500 advisory firms and 3,000 corporate and financial buyers have joined Axial to efficiently connect with relevant capital partners, source actionable deals, and build new relationships.

Visit the Member Closed Deals page to see selected transactions that have been sourced and closed via Axial.