The Winning M&A Advisor [Volume 1, Issue 9]

Welcome to the latest issue of The Winning M&A Advisor, the Axial publication that anonymously unpacks data, fees, and terms…

According to the International Business Brokers Association (IBBA), 75–90% of businesses that go to market don’t sell. Even when a business does sell, the owner doesn’t always necessarily get the best deal in terms of final sale price, deal structure, exit timeline, and finding a good steward for their company.

Dental practice owners face unique challenges, such as:

1. A limited pool of buyers.

Often, there are very few individual dentists with the required capital who are looking to acquire a practice in your specific area. While doctor-to-doctor transactions still occur, they’re increasingly rare due to high practice values and younger dentists’ preference to avoid business ownership responsibilities.

To increase your chances of getting a competitive offer, you’ll likely be selling to a Dental Support Organization (DSO). But DSOs have very specific criteria — minimum revenue thresholds, required operatory counts, and geographic preferences — that eliminate many practices from consideration.

2. Value that is difficult to transfer to new buyers.

Your practice value is tied directly to your clinical reputation and patient relationships. When you leave, there’s real concern about patient retention, staff transitions, and whether referral networks will transfer successfully. This dependency on your presence often reduces valuations as buyers price in the risk of losing patients and revenue after closing.

Even when dentists want to stay on as a provider while relinquishing the majority of their ownership, there can be concern about how this new dynamic will unfold. Will the dentist be open to changes from management? Will they be less motivated now that their stake in the business is smaller?

In this post, we look at how you can better prepare for your exit and increase the chances of achieving your exit goals. But first, let’s look at the most impactful thing you can do as an owner of a dental practice — working with an M&A advisor who has recent and relevant experience in the dental industry.

Table of Contents

H/T: Throughout this article, we quote Ryan Mingus, the Managing Director of Mergers and Acquisitions at TUSK Practice Sales. The team at TUSK has over 100 years of combined experience in dental practice sales.

An M&A advisor facilitates the sale process and provides strategic guidance, ensuring that business owners maximize value and navigate the transaction’s complexities successfully.

By working with the right M&A advisor, you can maximize your exit outcomes, which can mean:

M&A advisors can deliver these results due to four key reasons:

For dentists like you, working with an M&A advisor is the obvious move if you’re serious about selling your practice. The challenging part is finding an M&A with the right experience necessary to help you maximize your exit outcomes.

That’s where we can help at Axial. We have a network of over 3,000 M&A advisors and investment banks, along with data on the deals they’ve marketed, their outcomes, and their professionalism. We can help you find the right M&A advisor to help value your business accurately, target enough buyers to get your ideal exit, and negotiate and structure the deal. To get started, schedule your free exit consultation.

To learn more about the M&A process for dental practices, keep reading.

Getting an accurate valuation first helps you determine if you’re ready to sell or if you need another 1–2 years to optimize your practice to achieve the exit you want.

Dental practice valuations involve analyzing multiple key factors specific to your practice but within the context of the broader dental industry, such as patient retention rates, location advantages, revenue growth trends, recall system effectiveness, and the percentage of fee-for-service versus insurance patients. An accurate valuation requires comparing these metrics against industry benchmarks and recent sales of comparable practices to understand where you stand competitively.

Plus, to get an accurate idea of your value, you also need to compare your business against others in the market. You need to know what other dental practices like yours have sold for, what multiple buyers are paying in your geographic area, and how current market conditions affect pricing.

The easiest way to get the most accurate valuation is to have your M&A advisor conduct the analysis for you. Sometimes, sell-side advisory firms will do an initial valuation for free to help you see if you’re in the ballpark of the kind of exit you want.

When you work with an M&A advisor recommended to you through Axial, you’re working with an advisor who has experience in selling practices like yours. They know what buyers are willing to pay and can spot value drivers that general business brokers miss.

If you’re not yet ready to work with an M&A advisor, you can use Axial’s free valuation calculator. This calculator uses an industry-specific DCF methodology to give you a ballpark estimate of your practice value. It’s a good starting point if you’re curious about your value.

Here are other resources Axial has written about business valuation:

Your initial valuation helps determine your next steps.

If your practice value supports your goals: You can move forward with exit preparation and marketing.

If there’s a valuation gap: Your advisor can recommend specific improvements to maximize value before going to market. Common recommendations include:

If timing isn’t right: You might delay your exit by 1–2 years to implement value-driving improvements.

Remember, this initial valuation serves as a starting point. The final sale price will depend on market conditions, buyer competition, and deal structure. But knowing your practice’s current value helps you make informed decisions about timing and preparation.

Understanding what drives your practice value helps you identify areas for improvement and set realistic expectations. Here are the most important factors buyers consider:

| Revenue Growth | Consistent annual growth | Declining or flat revenue |

| Profit Margins | Strong EBITDA margins | Low margins, high overhead |

| Patient Base | High number of active patients, low concentration | High patient concentration, declining patients |

| Recall System | High hygiene recall rate | Poor recall system, missed appointments |

| Treatment Acceptance | High case acceptance rates | Patients frequently decline treatment |

| Payer Mix | High fee-for-service percentage | Heavy insurance dependence |

| Location | Growing area, good visibility | Declining area, hard to access |

| Facility | Modern, well-maintained | Outdated, needs major updates |

| Equipment | Current technology, well-maintained | Outdated, equipment needing replacement |

| Staff Retention | Long-term, skilled team | High turnover, training issues |

| Owner Dependence | Practice runs without owner | Heavily dependent on owner presence |

| Collections | High collection rate | Low collection rate |

| New Patients | Steady flow of new patients | Declining new patient numbers |

| Compliance | Current licenses, no issues | Regulatory problems or violations |

While different factors will impact your valuation, keep in mind that different types of buyers often have a limit on what they’ll spend.

DSO Buyers typically offer higher multiples (100–200% of collections, per Dental Practice Connect) but structure deals differently. They may pay less cash upfront and require you to work back for 3-5 years. DSOs look for practices with:

Private Buyers (individual dentists) usually offer 75–90% of collections but provide more cash at closing. They often value:

Associate Buy-Ins might offer lower initial valuations but provide mentorship opportunities and gradual transitions. These work well when:

Keep in mind that there’s generally a spectrum of stewardship and price. While not always the case, it’s often the case that the more you get in stewardship, the less premium price you can get, and vice versa. Most dentists want both: a good and fair price for their practice, but also a good steward to take over their business. By preparing for your exit (which we will cover next) and working with an M&A advisor, you can increase your chances of finding the right buyer.

Once you understand your practice value, you can prepare for your exit. The goal is to address any valuation gaps identified in Step 1 while ensuring your practice is ready for buyer due diligence. In short, you want to have your ducks in a row so you can demonstrate value to buyers and show them how your business operates. You can start doing this early on, 5-7 years before you intend to sell.

Clean, accurate financials are essential for a smooth sale process. Buyers will scrutinize your numbers, so you want everything organized and professional.

But as Ryan Mingus from TUSK Practice Sales shared, it’s rare that a dental practice will have sophisticated accounting procedures. They also don’t know how to present their financials in a way that’s tailored towards the buyer.

“Dental practice owners often use their business as a personal checking account, intermingling personal and business expenses like automotive payments, country club dues, etc.” But that can give a wrong snapshot of your finances.

The advisors at TUSK will extract any personal and one-time expenses that the new owners won’t have to pay. Advisors like those at TUSK understand exactly what buyers will and won’t give you credit for when analyzing your EBITDA.

What you can do to make the process smoother before you even consult with an advisor is:

Switch to accrual-based accounting if you’re not already using it. This method records revenue when services are performed and expenses when they’re incurred — regardless of when payments are received or made — giving buyers a clearer view of performance over time and revealing true revenue trends without the distortion of delayed payments or irregular billing cycles.

These metrics help buyers understand the health and sustainability of your practice beyond just the financial numbers.

Perhaps the most impactful thing you can do as an owner of a practice is to set up your business to ensure its value doesn’t diminish after your exit.

This means setting up a team that can handle the transition but also becoming (if you’re not already) a multi-provider practice.

Multi-provider and multi-location dental practices are becoming the norm in M&A. For example, most of TUSK’s clients have at least 3 doctors in a practice. If you’re thinking about selling down the line, and you’re still a single doctor business, then a great next step for you would be growing into a multi-provider practice.

Recurring, reliable revenue is a great way to demonstrate value to buyers and get higher multiples. Strong recall systems and patient retention demonstrate recurring revenue potential to buyers.

Improve Your Recall Rate

Document Patient Relationships

Review Service Agreements

If you offer treatment plans or payment plans, ensure they’re properly documented and transferable. Clear agreements protect both you and the buyer.

Diversify Your Patient Base

If you have high patient concentration (a few patients representing large revenue percentages), here’s what you can do to diversify:

For more information on exit preparation, you can read our posts on:

If you don’t already have an M&A advisor you want to work with, and you’re serious about selling your business in the near future, then it’s time to find one.

The best M&A advisor for your dental practice will have recent and relevant experience in selling businesses like yours.

Such M&A advisors can:

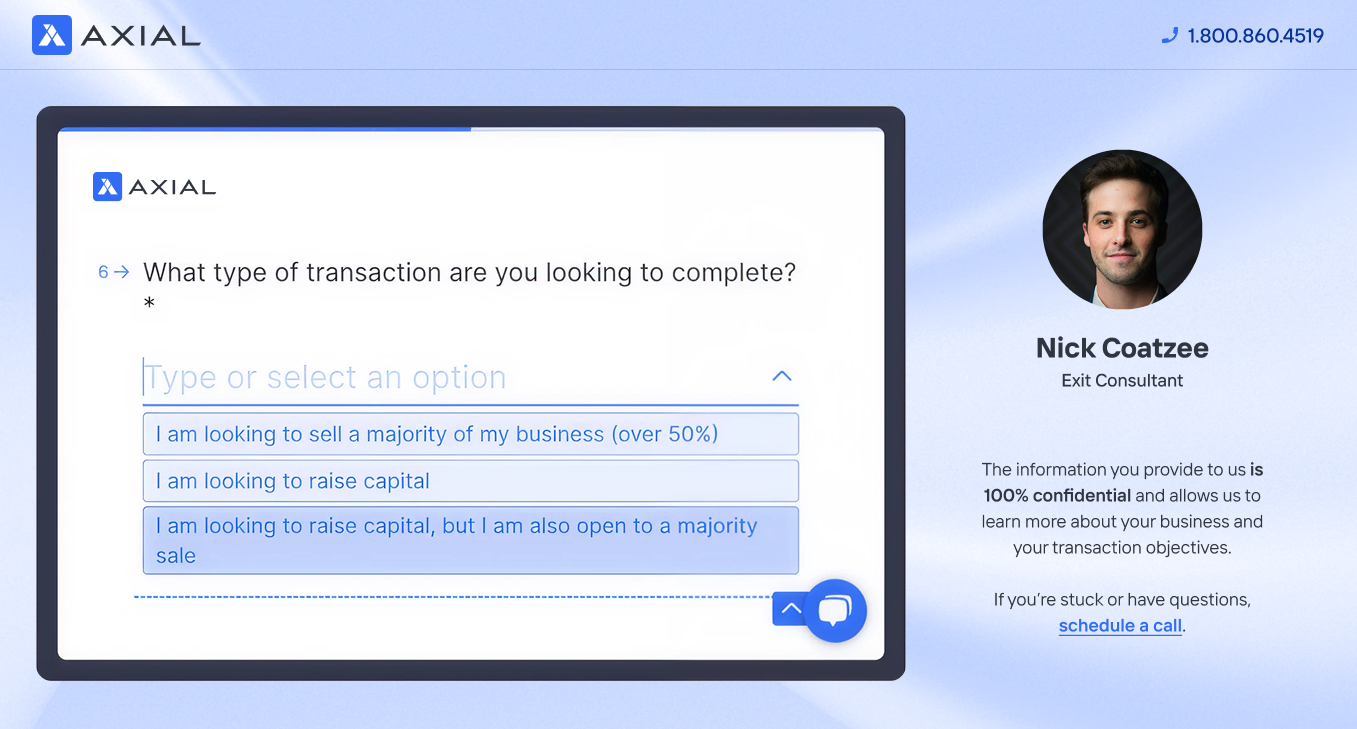

At Axial, we specialize in helping small-to-midsize business owners find the advisors who can bring them these results.

We start by pairing you with an Exit Consultant who gets to know your business and your exit goals.

Your Exit Consultant will leverage Axial’s network of 3,000+ M&A advisors to create a shortlist of candidates with:

We’ll send you a curated list of 3–5 qualified advisors, complete with detailed insights to help you evaluate your options and resources to prepare for meetings with your candidates.

Schedule your free exit consultation today.

At Axial, we offer several resources for small business owners looking to sell their company, learn more about the M&A process, and better understand the value of their business.

Here are just some of the resources that can be helpful to you:

These are just a few of the resources we’ve created for business owners. You can find more here.

EBITDA multiples for dental practices are usually a range, and can vary based on several factors like practice size, location, growth rate, and operational efficiency.

Ryan Mingus from TUSK Practice Sales provided these ballpark estimations:

But these are general estimates based on his experience. Mingus explains, “Where exactly your EBITDA multiple falls within those ranges depends on your revenue growth, patient base, pay mix, location, the facility, revenue trends, churn range, and much more.”

To get an accurate EBITDA multiple for your dental practice, you want to work with an M&A advisor.

You want to use multiple valuation methods to arrive at an accurate valuation range.

These can include:

Generally speaking, you don’t want to rely on just one valuation method. Instead, advisors will use multiple methods to triangulate your practice’s value range.

For example, you might see:

This gives you a valuation range of $1.1M–$1.4M, which becomes your starting point for pricing negotiations.

Confidentiality is critical for dental practice sales. If you let news of a possible sale spread, you can lose patients and staff, leading to a lower valuation, which can derail a deal.

You can’t self-represent and maintain confidentiality, as you’ll be speaking on your own behalf to see if businesses are interested in buying your dental practice.

So a key part of maintaining confidentiality during the sale process is working with an M&A advisor who can speak on your behalf.

Professional M&A advisors use structured processes including non-disclosure agreements, confidential marketing materials, and careful timing of staff and patient notifications.

DSOs typically offer higher valuations (100–200% of collections) but require work-back periods of 3–5 years and may change practice culture. Private buyers usually pay 75–90% of collections with more cash upfront and shorter transitions, but offer less overall value. The right choice depends on your goals regarding price, timeline, and post-sale involvement.

If your practice doesn’t meet typical DSO criteria (revenue minimums, operatory counts, location requirements), you would then focus on private buyers, smaller dental groups, or associate buy-ins instead. These alternatives can provide good outcomes for practices that don’t fit DSO models, though it’s a much smaller market.

The timeline varies significantly based on practice characteristics, market conditions, and your preparation level. Well-prepared practices in active markets may sell within 4–6 months from listing to closing. Practices requiring significant preparation or operating in challenging markets may take 12–18 months. Working with an experienced advisor and preparing thoroughly can significantly reduce your timeline.

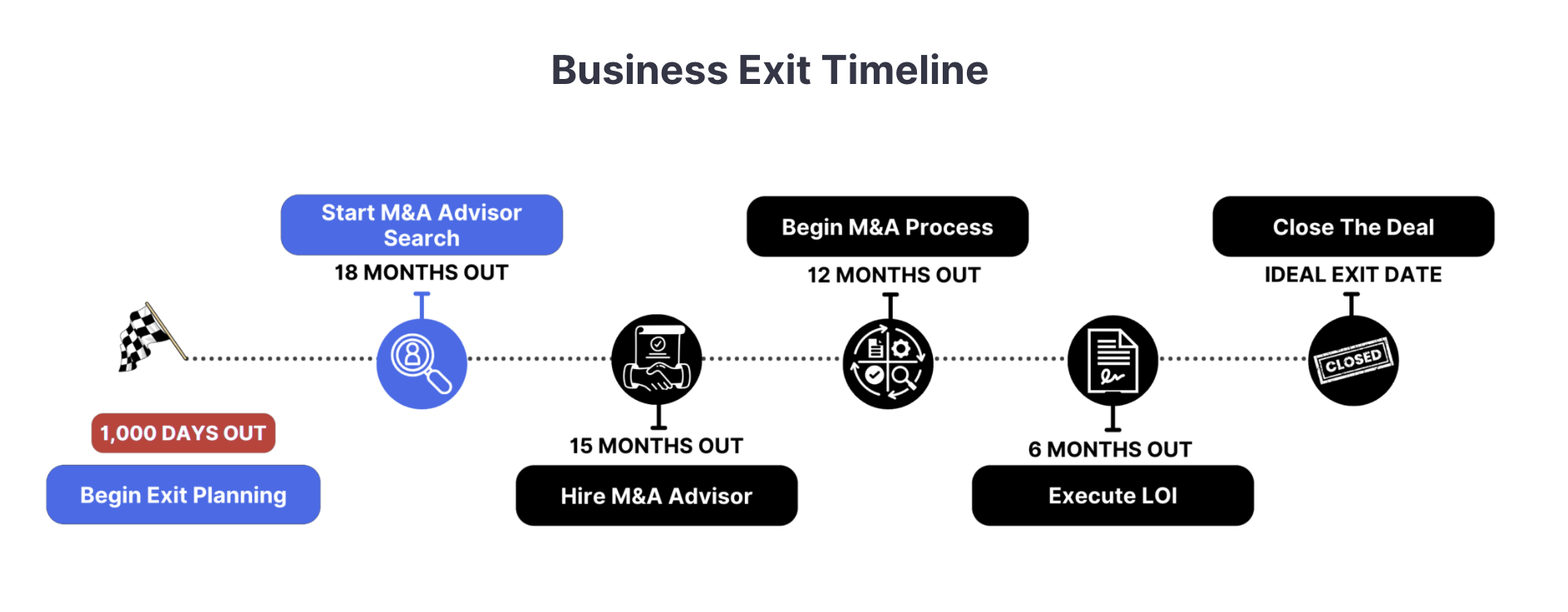

But in general, Axial’s business exit timeline maps the entire process from beginning your exit planning to closing the deal, which can take over ~3 years.

But that’s just an average estimate; you can expedite your timeline by:

M&A advisor fees typically consist of two components:

Retainer fees vary significantly, with some advisors charging fixed upfront fees while others use monthly retainers or milestone-based structures. About 24% of advisors work without any retainer, earning compensation only when the deal closes.

Success fees are commonly structured using the Lehman Formula, which 50% of brokers use (5% on the first $1M, 4% on the second $1M, 3% on the third, 2% on the fourth, and 1% above $4M), while 33% use flat percentage structures and 17% use accelerator formulas where fees increase with deal size. While these fees may seem substantial, data shows that businesses represented by advisors sell for 6–25% more than those sold by owners directly, and owners save 30+ hours per week during the process.

Additionally, businesses represented by advisors have a significantly higher success rate of actually completing a sale compared to owner-operated sales.

For more information, read Axial’s comprehensive guide on how much brokers charge to sell a business.