Small Business Exits: M&A closed deal data from October

Welcome to the October edition of Small Business Exits, the monthly publication featuring fully anonymized deal data from a selection…

Tags

Selling your software company will potentially be the largest financial transaction of your life. If done correctly, you can maximize exit outcomes, such as your sale price, exit date, and finding a good steward for your business.

To increase the chances of a successful exit, you want to:

But most business owners struggle with the above. They lack experience in selling companies, and they don’t have the time to navigate the M&A process on their own. This can lead to unrealistic expectations, incomplete exit preparation, lower valuations, and deals that don’t close.

At Axial, we have over 14 years of experience in mergers and acquisitions. Within our network, we have over 3,000 M&A advisors, investment banks, and business brokers who have worked on selling software companies.

Using this experience, we put together an in-depth guide to help you sell your software business and achieve your ideal exit — that means getting the sale price you want, the exit timeline that works for you, and finding a good steward for your business. We break the guide down into 5 steps:

| Why You Need an M&A Advisor

Working with an M&A advisor can save you time, help you target more buyers, and result in a higher final sale price. To find the best M&A advisor for your business, schedule your free Exit Consultation with Axial. After the call, we’ll send you a curated list of 3-5 M&A advisors who can help you achieve your exit goals. |

Valuing your software business helps you see whether or not you’re likely to get the exit you want, which helps you determine if it’s the right time to sell. Software companies require specialized valuation approaches that account for recurring revenue models, customer lifetime value, churn rates, and technology scalability — metrics that, if overlooked, will lead to unrealistic expectations and valuation misalignment between you and your buyer.

There are three ways to value your business.

This expertise is crucial because software valuations depend heavily on SaaS metrics like ARR multiples, net revenue retention rates, and the split between recurring subscription revenue versus one-time licensing fees. They understand what buyers are willing to pay for companies like yours and recognize how factors such as technical debt, customer concentration, and competitive moats impact software company valuations differently than traditional businesses.

Keep in mind that your initial valuation range serves as a starting point for eventual pricing negotiations with interested buyers. The final price paid for your business will often differ from this initial valuation. Factors like market conditions, the deal structure, and whether you’re retaining any ownership stake in the business will all play a role in determining the final price.

Your software company’s value will be expressed in multiples of your EBITDA, which represents your earnings before interest, taxes, depreciation, and amortization. This metric offers potential buyers a clear snapshot of your business’s core profitability, free from the effects of taxes, financing, and non-operational factors. EBITDA also helps buyers gauge cash flow, assess whether your company is suitable for a debt-financed transaction, and compare it more easily to other businesses.

In Axial’s breakdown of EBITDA multiples by industry, you can see average multiples across several industries.

But how do you calculate the right EBITDA multiple for your software business?

You need to conduct in-depth analyses informed by actual experience in selling software companies. That’s where an M&A advisor becomes invaluable. They’ll use proven valuation methods and analyze key business factors to arrive at the most accurate valuation for your company.

Your advisor will use two methods to value your software company for sale.

1. Discounted Cash Flow (DCF) Analysis

This method estimates the value of your software business based on projected future cash flows, accounting for the unique characteristics of software businesses such as high gross margins and scalable revenue models. Software companies often face distinct financial patterns, with many prioritizing growth over profitability in early stages.

Your M&A advisor can determine appropriate growth and discount rates based on their experience with recent software acquisitions. To provide a more accurate valuation that reflects your true software business value, your advisor will incorporate industry-specific factors, such as:

2. Precedent Transaction Analysis

This method estimates the value of your business based on the purchase prices of similar, recently closed deals, which may include transactions your advisor has facilitated for other software owners.

Gathering this information for smaller software businesses can be difficult, as transaction details are often private. Transaction dates are also important, as outdated deals may not reflect current market conditions. By working with an advisor who has insider knowledge of past transactions, you can effectively use recent deal data to refine your valuation.

Using these methods, your advisor can arrive at an accurate valuation range for your software business, providing a clearer understanding of what your business could realistically sell for.

There are several valuation factors that influence your multiple — these are the inputs that your advisor has incorporated into the valuation methods discussed above.

Your M&A advisor, with their experience in selling software companies like yours, can tell you which factors are the most important to buyers. They can also help you create a narrative around these factors.

But keep in mind, these valuation factors may not be relevant to your specific exit. It will depend on:

Plus, which valuation factors you focus on and whether or not you work to maximize value before you sell will depend on your exit goals. Establishing your exit goals is a key part of buyer targeting and exiting your business. It’s what we’ll go over next.

Your exit goals include:

These goals help shape your exit strategy.

Let’s say you want to sell your software company to finance your retirement and set up a trust for your family. Getting the maximum price is your biggest motivator. You may be willing to sacrifice on stewardship — such as selling to a competitor who will absorb your company into their own — because strategic buyers typically pay higher multiples than financial buyers. In this case, your M&A advisor would likely recommend that you focus on optimizing growth metrics, customer concentration, and market position to attract premium offers.

But if you need to exit quickly due to health reasons or other time constraints, you might accept a lower valuation in exchange for a faster, more certain close. To help sell your business quickly, your advisor will ensure you’re set up for a streamlined due diligence process — with clean financials, documented processes, and minimal key person dependencies.

At Axial, we often see deals fall through because owners aren’t fully committed to their exit. Knowing your exit goals and discussing them with your close circle helps confirm your readiness to sell. You should know your target sale price, what you want to happen to your company after you leave, and your ideal exit date. Keep in mind that the exit process typically takes about a year.

Before you go to market, you want to prepare for due diligence. Due diligence is when an interested buyer examines your financials and operations to understand your company’s value clearly.

The better prepared you are, the less likely there’ll be a valuation misalignment, stalled deal, or a deal that goes completely off the rails.

When evaluating your business, buyers will closely examine your financials to determine the value of your software company. You want to make it easy for them to understand your company’s value.

To help reduce the risks of misunderstanding or valuation misalignments, you can:

It’s a good idea to make it easy for prospective buyers to review all relevant legal and technical documents.

For software companies, it’s recommended that you make a data room. A data room is a secure digital repository where you can organize all of your critical business information. Buyers can then access this information easily.

Using a data room can lead to faster due diligence (as you’re not dealing with sending documents back and forth and email threads) and higher buyer confidence. For software companies, it’s a more professional and technologically advanced way to share documents, signaling to buyers that you understand modern business practices and have your operations well-organized.

Below is a high-level overview of documents to gather. Plan to start this process 3-6 months before going to market, as intellectual property and security compliance documentation often take the longest to compile.

One of the most impactful things you can do as you’re preparing to sell is to make yourself redundant as the business owner.

You likely wear many hats at your software company — from product development to customer support to technical architecture. But that creates a talent gap when you leave the business. You want to hand over any responsibilities you handle to other employees. Otherwise, potential buyers will lower their valuation to account for the fact that they’re going to have to hire/train employees to take over the roles you filled.

Often, business processes grow organically within a software company. Your developers learn the codebase through tribal knowledge, your support team handles customer issues through experience, and you, as the owner, hold many critical pieces together to make the operation run smoothly.

For software companies, this is particularly critical because buyers worry about:

A good way to mitigate key person dependencies is to have comprehensive documentation and standard operating procedures (SOPs) in place. When done right, this documentation will address:

This helps ensure business continuity after your exit and maximizes your company’s value during sale negotiations.

Another key area you can potentially optimize before going to market is your revenue model. Generally, you want to show high customer retention, subscription-based revenue, and a diversified customer base. But how much you focus on this depends on your exit timeline, target buyers, and goals.

When revenue optimization is most critical:

When it may not be worth the time investment:

However, if you can’t improve your customer contracts before your exit, you can work with your M&A advisor. They can help you craft a narrative around future potential, use earnout structures to bridge valuation gaps, or target buyers who are less sensitive to these specific metrics.

So far, what we’ve examined is mostly preparatory work before going to market. You’ve set goals, verified financials, streamlined operations, and prepared for due diligence. Alongside your M&A advisor, you’ve accurately valued your business based on market trends and industry comparables.

Now you want to target enough qualified buyers to help increase the chances of achieving your ideal exit.

However, most software business owners face a fundamental problem: they lack a network of qualified buyers. The only interested parties they typically encounter are:

This limited buyer pool often leads to lower valuations and fewer negotiating options.

When you work with an M&A advisor from our network, you’re partnering with someone who has a ready-to-go network of interested buyers specifically looking for software companies. This dramatically increases buyer coverage for your business, increasing the chance of you getting the best deal.

For example, one deal that was closed within the Axial network received 290 signed NDAs from buyers. That means 290 initial buyers signed an NDA so they could learn more about the business being sold. From that 290, 60 buyers issued an Indicator of Interest (IOI), a good indicator that they’re serious about buying the business. From that 60, the owner and M&A advisor narrowed the list down to 12 potential buyers. In the end, that owner got the exit they wanted, but it took starting with 290 interested buyers to find the one who was the right fit.

Furthermore, your advisor knows how to target buyers based on your specific exit goals:

Of course, most likely you want a bit of all the above — a good price, a smooth exit, and a good steward for your company. By knowing which one you prioritize the most, your advisor can strategically target the kind of buyer who is most likely to get you the deal you want.

As buyers express interest in your software company, your advisor will guide them through a structured process while continuously evaluating whether they’re the right fit.

First, your advisor assesses buyers against software-specific criteria to ensure they’re genuinely qualified and aligned with your goals. This includes evaluating their technical capabilities and software industry experience, understanding their integration approach and development philosophy, and assessing cultural fit with your team. Your advisor focuses on buyers who have successfully acquired software companies before, understand SaaS metrics and business models, and can maintain your product’s growth trajectory post-acquisition.

Second, your advisor also saves you plenty of time as they manage the entire buyer distribution process, which we outline below:

When you’re fielding multiple offers (which is ideal for getting the best deal), this stage of the sale can involve a lot of spinning plates. In the course of a few weeks, your advisor might:

Your advisor manages this delicate process, ensuring you find a buyer with the right experience, sufficient funds, and a strategic fit for your company.

When you find a buyer who aligns with your exit goals, you’ll execute a Letter of Intent (LOI). This represents your buyer’s commitment to purchase, and it means your business is effectively off market for a specified period (typically 90 days). This allows the buyer to conduct due diligence and present a formal offer, assuming everything meets their evaluation criteria.

As you navigate negotiations, it’s crucial to remember the exit goals you established in step one. The final sale price isn’t just a number; it reflects what you want to preserve and what’s needed to fund the next stage of your life, whether that’s retirement, a new venture, or securing your family’s future.

Your advisor will guide you through deal structuring to meet your post-exit objectives. Software transactions often include unique considerations such as:

But knowing if an earnout is standard or fair can be tricky for business owners. Your M&A advisor can help verify if the performance targets tied to the earnout are achievable. Plus, they can compare the earnout terms of your deal with other similar deals they’ve represented.

Throughout this post, we broke down the 5 steps of selling your software business, from exit preparation to structuring and closing the deal. We looked at how an M&A advisor plays a critical role in helping you achieve your ideal exit.

M&A advisors can:

But these benefits depend on working with the right M&A advisor. At Axial, we specialize in helping small to mid-sized business owners find the best advisor who can deliver these results.

We begin by pairing you with an Exit Consultant who will get to know your business and your exit goals.

Your Exit Consultant will leverage Axial’s network of 3,000+ M&A advisors to create a shortlist of candidates with:

We’ll send you a curated list of 3–5 qualified software industry advisors, complete with detailed insights to help you evaluate your options and resources to prepare for meetings with your candidates.

Schedule your free exit consultation today.

At Axial, we offer several resources for small business owners looking to sell their company, learn more about the M&A process, and better understand the value of their business.

Here are just some of the resources that can be helpful to you:

These are just a few of the resources we’ve created for business owners. You can find more here.

The amount you can sell your software business for will depend significantly on several factors, including your financial records, customer concentration, recurring revenue percentage, technology stack, and much more.

To figure out a rough estimate of how much your software business is worth, you can use Axial’s free business valuation calculator. This calculator uses an industry-specific DCF methodology to give you a valuation range.

When selling a small software business, you want to:

No matter the size of your business, it makes sense to partner with a business broker or M&A advisor to sell your company.

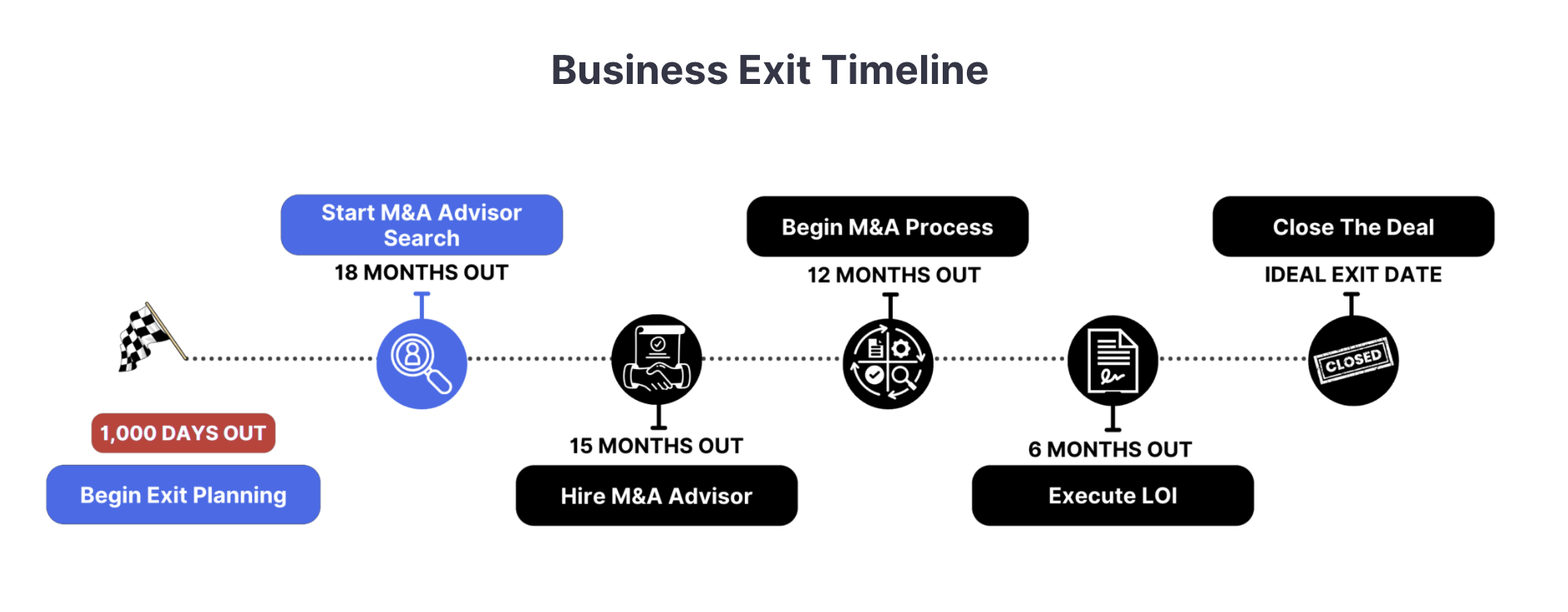

Axial’s business exit timeline maps the entire process, from beginning your exit planning to closing the deal, over ~3 years.

But that’s just an average estimate; you can expedite your timeline by:

Based on Axial’s data from over 2,000 M&A advisors and brokers, fees typically consist of two components: a retainer fee and a success fee.

Retainer fees can be done as a lump sum or in monthly payments. The retainer is usually credited toward the final success fee when the deal closes.

Success fees are the primary form of compensation and are typically higher for smaller deals, as they require similar work regardless of size.

About 50% of advisors use the Lehman Formula:

5% on the first $1M, 4% on the second, 3% on the third, 2% on the fourth, and 1% above $4M. Another 33% charge a flat percentage.

For context:

Despite the cost, the investment is generally worthwhile since businesses represented by advisors sell for 6–25% more than self-represented companies and have a 60–70% higher success rate.