M&A Fee Guide 2023-2024

For the third year running, Axial partnered with Firmex and Divestopedia on the annual M&A Fee Guide, the authoritative source…

“I looked at the law last year and I thought it couldn’t be true. It’s only a 15 page law, and I must have read it ten times,” says Al Puchala, CEO of investment management company CapZone Impact Investments.

Puchala is referring to the Investing in Opportunity Act, which was introduced in the Tax Cuts and Jobs Act of December 2017. The act provides a huge tax-avoidance option for today’s investors, reducing capital gains taxes for equity investors putting capital to work in certain economically distressed areas around the country — known as “opportunity zones.”

Puchala notes that one way that opportunity zones are unique is that investors don’t have to receive any sort of credit or benefits or subsidies from the government ahead of time. “It’s like a tax break. I donate money to a museum and take it off my taxable income this year. If you’re wrong, you’ll pay a tax and a penalty. For the first time in history, this program allows equity investors something similar at scale. Normally an equity investor has to buy a solar credit or get approved for a housing credit, and the government manages the whole process. But this lets anyone open their own fund, without onerous approvals or disclosure, and invest in their own deal in an opportunity zone.”

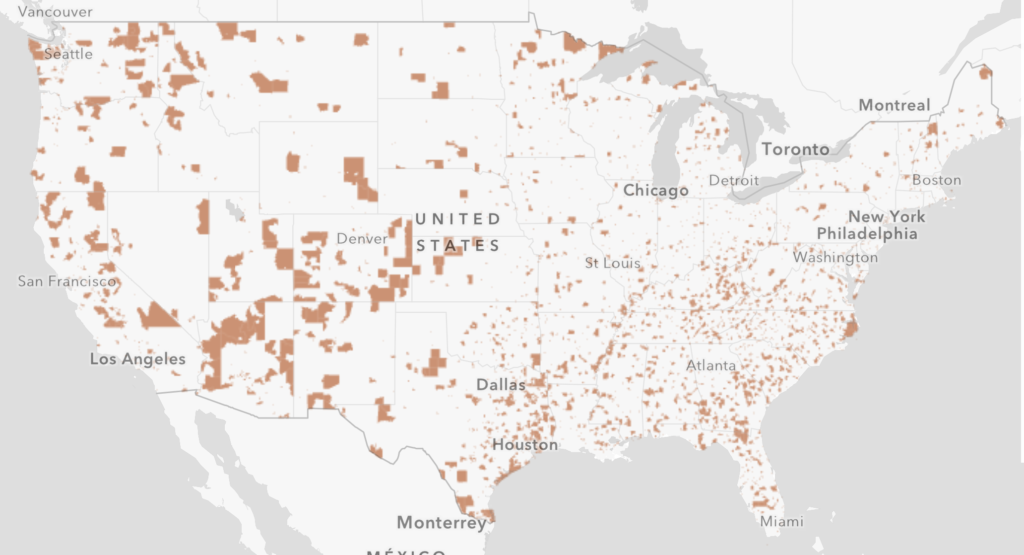

Under the new law, investors can put recently realized capital gains into a Qualified Opportunity Fund (QOF), which must hold at least 90% of assets in opportunity zone projects or businesses. Investors must do this within 180 days of realizing their capital gains. Each state governor has designated opportunity zones in their state; there are nearly 8,700 in total.

Opportunity zones in general are “more demographically diverse than the nation as a whole, with a 56 percent share of minority residents compared to 38 percent nationwide,” according to the Economic Innovation Group, a bipartisan policy group led by ex-Facebook executive and philanthropist Sean Parker, which worked with Senator Tim Scott (R-SC) as well as Senator Cory Booker (D-NJ) and Representatives Pat Tiberi (R-OH) and Ron Kind (D-WI) to champion the legislation. The image below shows where the opportunity zones are currently located.

Nearly any investment is eligible as long as it is inside a zone and isn’t in a “sin business,” which include casinos, private golf courses, tanning or massage parlors, and liquor stores.

There are three main benefits of the law, as laid out by the Economic Innovation Group:

“There a number of potential wrinkles in the law,” says CapZone Impact’s Puchala. “So I would say don’t try this at home — definitely get your lawyer, accountant, and wealth manager on board.”

The IRS is expected to release a number of additional guidelines this spring to clarify and operationalize the law following its hasty passage. According to the New York Times, 80 qualified opportunity funds have already been formed, despite the lack of final regulations.

Alex Livingston, Managing Partner of Atlanta-based real estate investment firm Longline Holdings, is among those waiting on these guidelines before deciding whether to take advantage of the tax break. Opportunity zones “are obviously an incredibly good tax benefit, but you’re investing in areas that probably didn’t warrant investment prior to the tax break, so you’re inherently a little nervous to be at the end of a cycle investing in something that’s driven by a tax benefit,” says Livingston.

Recognizing both the complexity and the huge financial and economic potential of the new law, Puchala created CapZone Impact in May 2018 as what he calls the first national opportunity zone investment platform. “Here you have one of the biggest social programs since the New Deal and yet the federal government has not established a large office to manage the program.” CapZone Impact’s purpose is to help facilitate the law, bringing interested investors with capital gains together with a) advisors (e.g., wealth managers, accountants, lawyers) and b) users of capital — “the thousands and thousands of real estate projects and data centers and water facilities and other investments that can really help the communities in these opportunity zones grow.” CapZone Impact is based in an opportunity zone itself, in Norwalk, CT.

Puchala believes the legislation around opportunity zones has the potential to be transformational for the communities in opportunity zones. However, he and others acknowledge that gentrification is a real risk of the program. “There’s definitely a fear that it’ll be used just to bring five-star hotels or other projects that don’t do anything for the community, and the existing residents get pushed out. Of course our goal is to use the zones to create positive social impact through private capital. But this is so dramatically different from how the government normally acts. This is the free market. So it will take a while before we find out whether it just helps a few people make more money or actually helps those communities,” says Puchala.