M&A Fee Guide 2023-2024

For the third year running, Axial partnered with Firmex and Divestopedia on the annual M&A Fee Guide, the authoritative source…

Tags

Competition is brewing in the middle market — and a lot of it has to do with the growing diversity of buyer types. “There is more capital, from a wider variety of sources, that is looking to be deployed than ever before,” says Nancy Hament of Scura Paley & Company.

In particular, there’s been a significant rise in fundless sponsors and family offices looking to do direct deals. For investment bankers and M&A advisors, this means sifting through a whole lot more suitors on behalf of their clients. It also means that deal processes will vary wildly, depending on the type of buyer and the complexity of the deal.

Axial data suggests that nontraditional buyers (e.g., independent sponsors, individual investors, etc.) are beginning to gain ground on traditional private equity firms. Of the deals marketed on Axial in the last twelve months, 91.9% were sent to buyers with dedicated funds. Seventy-seven percent of that same pool of deals, however, were also sent to buyers without dedicated funds.

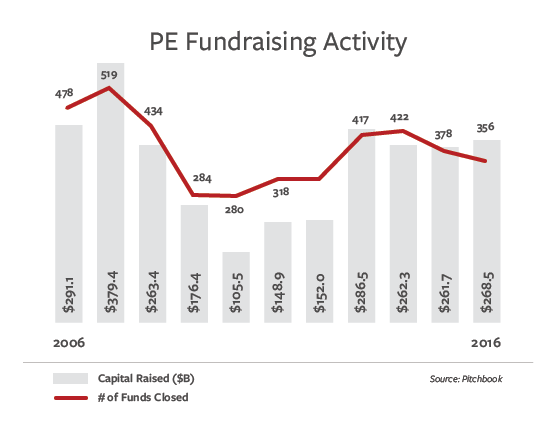

According to Pitchbook’s most recent PE & VC Fundraising Report, the amount of capital raised for funds has plateaued somewhat since 2013 compared to years prior.

In this article we explore the pros and cons of forgoing a traditional fund structure among two emerging buyer types, fundless sponsors and family offices, and the effect this emergence is having on sell-side activity.

“I think there are a lot of folks leaving traditional funds because it’s just the natural evolution of the industry,” says Brandon Labrum, Managing Director of Breakout Capital and Founder of Fund Lab. “The people who were part of the early stage of the private equity boom are retiring or stepping away from the business, and firms aren’t always great at planning ahead to pass the baton. More and more often the investment professionals who have come up behind them and have a demonstrated track record are finding it more enticing to venture out on their own.”

The increasing abundance of information about private companies has also lowered the barriers to entry into the marketplace, making it easier for these one-man-shops and breakaway firms to be successful.

Investors are increasingly committing to these less traditional funds with the hope of getting access to a more flexible investment vehicle, and of course, seeing higher returns. “What we’re seeing now is the emergence of large family offices that are putting lots of money to work,” says Labrum. These investors are a great a fit for the new non-traditional funds. “They often have more flexible investment horizons, they can make large capital commitments, and they prefer to see deals on a one-off basis.”

More firms are transitioning from the committed capital 2 and 20 model to a more flexible deal-by-deal model, allowing investors to look at a wider variety of deals and commit to only the companies they’re seriously interested in.

Having no dedicated fund also allows for a more flexible investment horizon and hold period. “In a traditional fund, you’re pigeon-holed into putting money to work over a specific period of time,” says Labrum. “In order to raise committed capital, you generally have to be pretty specific up front about what types of deals you’re chasing, what size, and what industries.”

This type of environment, one where LPs feel entitled to know every detail about the firm and its investments, is causing many fund managers to run for the hills.

“In a traditional investment fund, there’s this ever-present pressure of putting money to work at a certain pace. You have to constantly be thinking about the next fund, and so you can fall into the cycle of selling your winners before you should and holding losers longer than you should,” says Labrum. “In some ways, you live and die by the next fund.”

Fundless sponsors, on the other hand, can run an elastic investment process, either by themselves or with the help of a few like-minded friends or peers.

[pull_right]In essence, fundless sponsors are creating a new type of patient capital.[/pull_right] In this new model, says Labrum, “I can let the market and the opportunity drive capital commitments versus a fund construct. If I do one deal in a year, great. If I do six deals, that’s great too.” One major challenge for fundless sponsors is being able to stick to their intended strategy. Many feel pressure to move up market where management fees are higher, but as a result, can end up competing against the traditional firms they just left.

Another major shift in the “private equity industry is the rise of the family office as a significant player,” says Watermill Group’s Julia Karol, in an interview at ACG’s InterGrowth 2017. “More family offices are going direct to acquire deals rather than go through funds.” In doing so, family offices can avoid paying costly management fees.

“While family offices will want to avoid nonaligned or excessive fees, they may possibly be better off buying into private equity firms,” says Arthur Bavelas, Founder of BavelasGroup Family Office and Family Office Insights. Resource-light family offices often can’t afford to buy a business if the price has been driven sky-high by competition. They also can’t create a well-recognized brand and reputation in a plethora of industries overnight. “A lot of family offices don’t have the necessary skill or size to compete,” says Bavelas. While funds require fees, the traditional fund structure provides certain comforts as well as assumes the burden of sourcing, due diligence, and, perhaps most worrisome, costly mistakes.

One thing is for sure — this proliferation of buyer types ensures competition for deals will remain strong.

In this landscape, sellers and their advisors are at an advantage when it comes to price and terms. However, it can take significant amounts of time to sift through the options to find the right suitor.

“Investment bankers responsible for delivering great outcomes to their business owner clientele will need to develop new playbooks to stay on top of all the emerging capital sources,” says Axial founder and CEO Peter Lehrman. “Those that do will deliver exceptional service and outcomes to their clients by reaching beyond the predictable strategic buyer and PE buyers when they take companies to market.”

Bankers marketing deals in this fragmented and vast buyer landscape should take note of the following when representing a sellside clients: