Case Study: A Broken LOI, the Right Advisor, and a Successful Exit

When the owners of a concierge medical practice began thinking seriously about retirement, they knew the time was right to…

Tags

When you’re thinking about selling your construction company — whether in the immediate future or 5+ years from now — you want to get your business valued.

An accurate valuation lets you know whether or not you can achieve your ideal exit. Your ideal exit is made up of more than just the sale price. It also consists of:

The more valuable your business is to buyers, the more likely you can maximize those exit outcomes in your favor: a competitive price, a good deal structure, an exit timeline that works for you, and a good steward for your business.

If your business isn’t where you need it to be to get your desired exit, you can work on maximizing your company’s value by focusing on key metrics (such as customer concentration and customer contracts) and working with surety partners to increase your bonding capacity.

In this post, we look at two ways to value your construction business:

| If you’re serious about selling your construction company, schedule a free Exit Consultation today. We’ll hand-pick 3–5 of the best M&A advisors from our network of over 3,000 advisors and investment banks. We’ve found advisors for construction companies ranging from $1.6M to $70M in revenue — including custom home builders with $21M annually, roofing contractors with $20M, and specialty contractors serving the commercial market. |

Our free business valuation calculator is designed specifically for small business owners who want a quick estimate of their company’s worth. Unlike generic online calculators, our calculator uses an industry-specific discounted cash flow methodology that M&A advisors trust when conducting preliminary valuations.

To use the calculator, you’ll input key metrics including:

For industry, you’re going to select Engineering/Construction to get the most accurate valuation. Within minutes, you’ll receive a valuation range that provides a realistic starting point for understanding your business’s potential worth. You can also choose other industries such as building materials, construction supplies, homebuilding, and more.

While our construction company valuation calculator provides a useful estimate, it’s important to recognize what it cannot capture.

Calculator-based valuations rely on standardized assumptions and industry averages. They miss the nuances around key factors that significantly impact a construction business’s value.

These factors include:

Plus, a valuation done by a calculator doesn’t know what businesses like yours have recently sold for. When you get a valuation, that’s your initial price point. Your actual final sale price can be different, depending on factors such as project pipeline changes, market conditions, equipment needs, and buyer demand.

Finally, a calculator won’t tell you how your deal will likely be structured. For example, how much of your deal price will you get as cash at close vs. how much will be tied to earnouts?

When you work with an M&A advisor who has experience in closing construction deals, they’ll know first-hand what companies like yours have sold for. This lets them arrive at a more accurate valuation.

In short, think of the calculator as a helpful starting point — similar to using an online tool to estimate your home’s value before working with a real estate agent who understands your local market and property specifics.

To better understand how these preliminary estimates translate to actual market value, let’s explore the fundamentals of construction business valuation.

Generally speaking, your construction company’s value will be expressed as a multiple of your EBITDA.

EBITDA represents your earnings before interest, taxes, depreciation, and amortization. This metric provides potential buyers a clear snapshot of your construction company’s core profitability — free from the effects of taxes, financing, and accounting decisions like depreciation methods.

For construction companies, EBITDA is particularly important because it shows operational performance separate from equipment financing decisions and depreciation schedules.

EBITDA helps buyers gauge cash flow, assess whether your company is suitable for a debt-financed transaction, and compare it more easily to other construction businesses.

Your EBITDA multiple represents how many times your business’s earnings are multiplied to determine its total value. While EBITDA gives you an earnings figure in isolation, your business is also influenced by industry-specific factors like other companies’ valuations and buyer demand. That’s where your EBITDA multiple comes into play, helping put your earnings into context.

But figuring out the most accurate multiple for your business requires more than just plugging numbers into a formula. It’s about understanding what drives value in the construction industry and how buyers assess risk and opportunity when evaluating acquisition targets.

When valuing your construction company, M&A advisors will use different valuation methods, like discounted cash flow and a comparable company analysis. They adjust their assumptions and multiples based on construction-specific factors, such as:

Below, we put together a table of 15 key factors that can impact the value of your construction business, showing what drives a valuation higher and what drives a valuation lower.

| Factor | ↑ Drives Valuation Higher | ↓ Drives Valuation Lower |

|---|---|---|

| Revenue growth | Steady, predictable revenue growth | Declining or highly volatile revenue |

| Profit Margins (EBITDA) | Strong profit margins, efficient operations | Low margins, high overhead costs |

| Contract backlog & pipeline | Strong backlog, recurring clients | Weak pipeline, project-by-project business |

| Bonding capacity | High bonding capacity, strong surety relationships | Limited bonding, surety issues |

| Client concentration | Diversified client base, repeat customers | Heavy reliance on a few clients |

| Geographic market | Strong local market, growing region | Declining market, oversaturated competition |

| Equipment fleet | Well-maintained, modern equipment | Aging equipment in need of replacement |

| Key personnel dependencies | Strong management team, documented processes | Heavy owner dependence, weak bench |

| Safety record & EMR | Excellent safety record, low EMR rating | Poor safety history, high EMR rating |

| Licensing & certifications | Current licenses, specialized certifications | License issues, limited capabilities |

| Technology & systems | Modern project management, estimating software | Outdated systems, manual processes |

| Cash flow management | Strong working capital, efficient collections | Poor cash flow, collection issues |

| Project types | High-margin speciality work | Low-margin commodity projects |

| Economic conditions | Booming construction market | Recession, declining construction activity |

| Regulatory compliance | Full compliance, no legal issues | Regulatory problems, pending litigation |

Market demand for construction companies varies significantly based on economic conditions, infrastructure spending, and regional development patterns. Unlike some industries, construction valuations are heavily influenced by local and regional economic factors:

As a business owner of a construction company, strong market demand benefits you in two ways:

If you’re considering a future sale, several strategic improvements can significantly increase your business’s value:

These factors focus on building recurring relationships, reducing risk, and positioning your business for sustained growth.

But a good exit is about more than just price. While your final sale price is important, you also want to factor in:

Below, we look at how you can increase your chances of getting an ideal exit by working with an M&A advisor with relevant and recent experience in the construction industry.

Above, we talked about how and why an M&A advisor can more accurately value your company. But they do more than just perform valuations. They also help manage the entire M&A process, from going to market to closing the deal, and work to help you maximize your exit outcomes.

Your exit outcomes are made up of:

Working with an M&A advisor can help you achieve your ideal exit outcomes. One key way they do this is by creating a competitive bidding process for your business.

For example, among construction companies that have reached out to Axial, we’ve seen successful exits across various specializations — from custom home builders generating $21M annually to commercial roofing contractors with $60M in revenue. These companies worked with M&A advisors to identify the right buyers who understood their market position and growth potential.

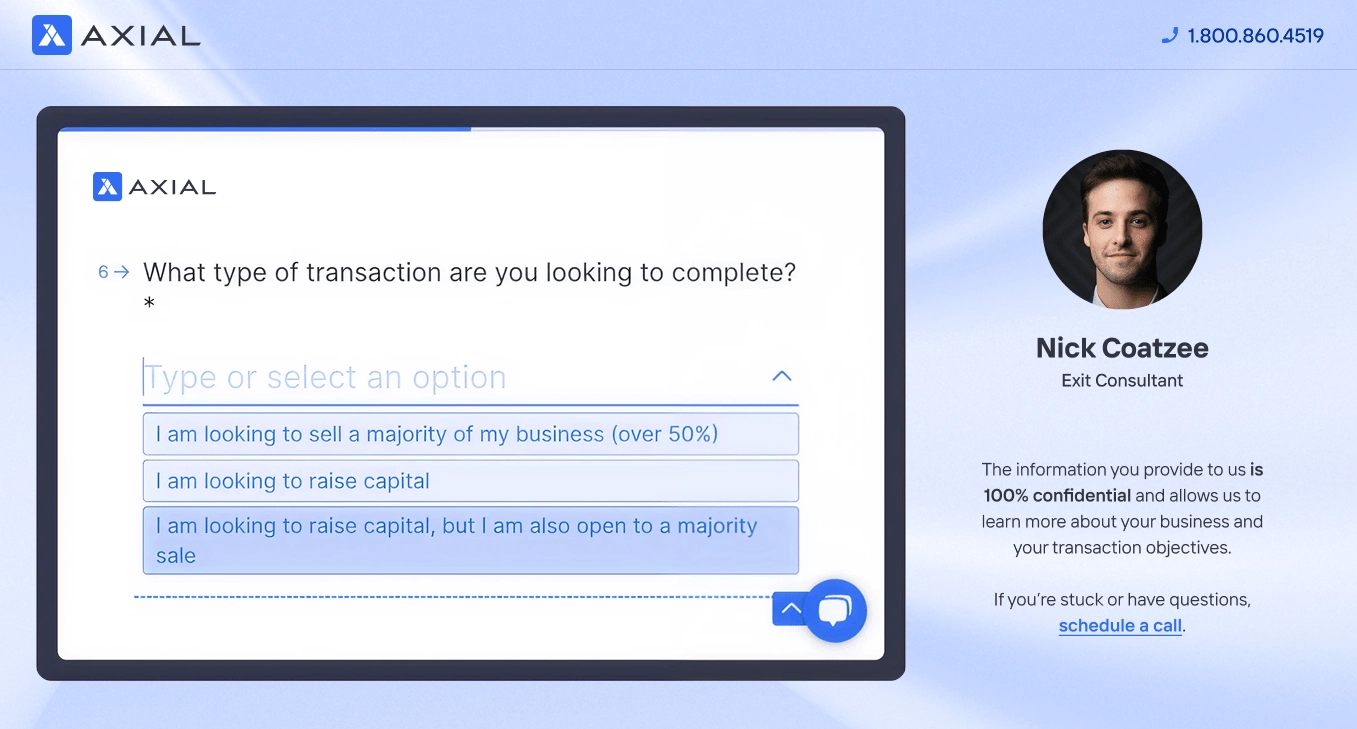

At Axial, we can pair you with M&A advisors who have recent and relevant deal experience in the construction industry.

First, we pair you with an Exit Consultant who gets to know your business and your exit goals.

Your Exit Consultant will leverage Axial’s network of 3,000+ M&A advisors to create a shortlist of candidates with:

We’ll send you a curated list of 3–5 qualified construction industry advisors, complete with detailed insights to help you evaluate your options and resources to prepare for meetings with your candidates.

Schedule your free exit consultation today.

At Axial, we’ve helped all types of construction companies find the right M&A advisor, specifically construction companies ranging from $1.6M to $70M in revenue. This includes custom home builders generating $21M annually, roofing contractors with $20M in revenue, and specialty contractors serving the commercial market.

But we also have plenty of free online resources that you can use to help you better understand the process of selling your business, including:

These are just a few of the resources we’ve created for business owners. You can find more here.

Buyers are attracted to construction companies for several reasons. The industry offers essential services that remain in demand regardless of economic conditions, particularly maintenance, repair, and infrastructure work. Well-run construction companies can provide stable cash flows, especially those with recurring clients or maintenance contracts.

Plus, the construction industry is fragmented, which means there are opportunities for consolidation. Buyers can achieve economies of scale by combining multiple companies, sharing resources like bonding capacity, equipment, and management expertise. Private equity firms and strategic buyers also value construction companies with specialized expertise, strong client relationships, and established market positions.

To learn more about buyers, check our posts on:

Construction equipment represents a significant portion of many companies’ value, and buyers evaluate it carefully. Key factors include the age, condition, and maintenance history of equipment, as well as its current market value and replacement cost.

Modern, well-maintained equipment adds significant value, while aging equipment that requires major repairs or replacement can reduce overall business value. Buyers also consider whether equipment is owned or leased, as this affects financing and operational flexibility.

M&A advisors often recommend getting professional appraisals for significant equipment to ensure accurate valuation during the sale process.

Construction company deals often involve more complex structures than other industries due to equipment considerations, bonding requirements, and project transition needs.

Common elements include:

The optimal structure depends on factors like business size, buyer type, and specific operational considerations.

M&A advisors typically use three primary methods to value construction businesses, each providing a different perspective on your company’s worth:

M&A advisors will often use all three methods to triangulate an accurate valuation range, ensuring you don’t undersell or overprice your business when going to market.

You can learn more about business valuation in our posts on:

If you’ve already researched ways to value your construction business online, you may have come across SDE (seller’s discretionary earnings).

SDE takes a business’s EBITDA and adds the owner’s salary, perks, and discretionary expenses. But this is only useful for small, owner-operated businesses because your discretionary earnings can affect profitability to a much greater extent than in a larger business.

Generally, valuations are presented as a multiple of EBITDA once a business has grown beyond $1 million in annual profits. At this stage, the owner’s salary, perks, and discretionary expenses are not as relatively significant compared to the business’s overall earnings, and buyers expect the business to operate with professional management structures rather than owner-dependent operations.

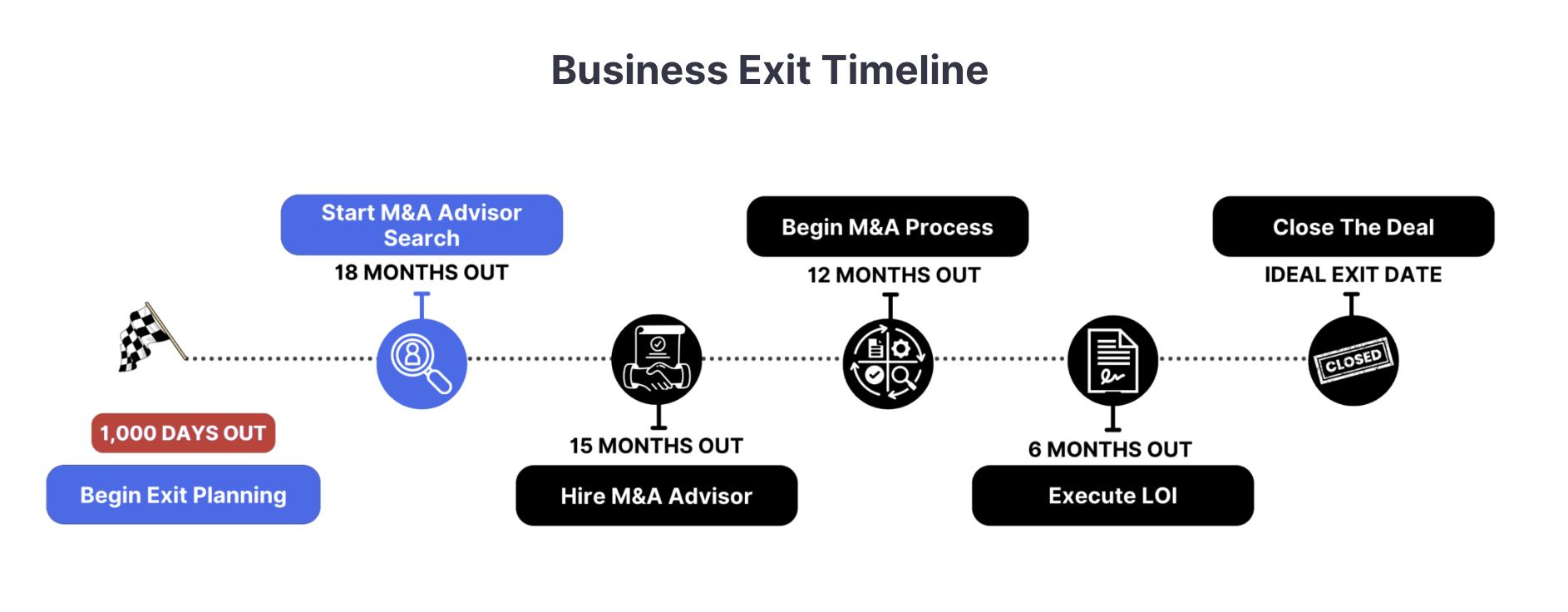

The timeline for selling a construction business varies significantly based on company size, market conditions, and preparation level. Well-prepared companies in active markets may complete a sale within 6–9 months from listing to closing. Companies requiring significant preparation or operating in challenging markets may take 12–18 months.

Construction companies often face unique timing considerations around project cycles, seasonal work patterns, and bonding transitions. Working with an experienced advisor and preparing thoroughly can significantly reduce your timeline.

In general, Axial’s business exit timeline maps the entire process, from beginning your exit planning to closing the deal, over approximately 3 years.

However, you can expedite your timeline by thoroughly preparing your business for exit and working with qualified advisors who understand the construction industry.

M&A advisor fees typically consist of two components:

Retainer fees vary significantly, with some advisors charging fixed upfront fees while others use monthly retainers or milestone-based structures. About 24% of advisors work without any retainer, earning compensation only when the deal closes.

Success fees are commonly structured using the Lehman Formula, which 50% of brokers use (5% on the first $1M, 4% on the second $1M, 3% on the third, 2% on the fourth, and 1% above $4M), while 33% use flat percentage structures and 17% use accelerator formulas where fees increase with deal size.

While these fees may seem substantial, data shows that businesses represented by advisors sell for 6-25% more than those sold by owners directly, and owners save 30+ hours per week during the process. Additionally, businesses represented by advisors have a significantly higher success rate of actually completing a sale compared to owner-operated sales.

For more information, read Axial’s comprehensive guide on how much brokers charge to sell a business.