M&A Fee Guide 2023-2024

For the third year running, Axial partnered with Firmex and Divestopedia on the annual M&A Fee Guide, the authoritative source…

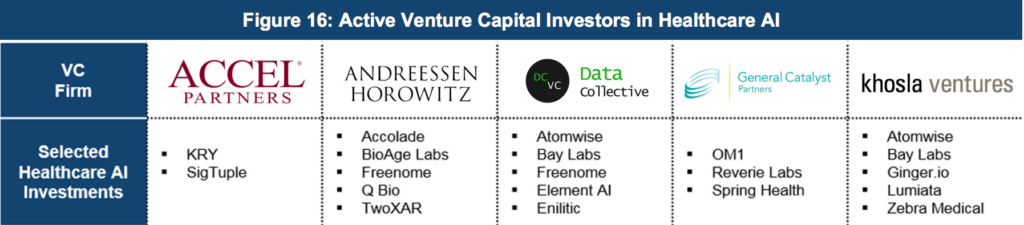

Artificial intelligence (AI) and machine learning (ML) are playing a very important role in today’s healthcare industry. AI is predominantly used in clinical research, robotic personal assistants and big data analytics. Classic venture capitalists and corporate strategic investors are both investing generously in this space.

A October report published by TM Capital shows that healthcare AI VC deal volume and funding hit a 5 year high in 2016, with $794 million in investments across 90 deals in the healthcare AI space. It’s projected that AI-focused healthcare and wellness startups are to raise over $690 million from venture capital firms in 2017.

“I don’t really view that as a step back,” said Michael Goldman, a managing director with TM Capital’s Healthcare Leadership Team. “In 2016, there were a couple of really large financings that spiked the market. In 2017, there was more overall financing, in terms of the number of financings, but smaller in average size.”

The TM Capital report shows that despite a decline in venture capital funding across industries overall in 2016, AI startups raised a record $5 bn, a 71% CAGR since 2012. Startups are leveraging ML algorithms to help solve key problems such as reducing time and error costs in the drug discovery process, providing virtual assistance to patients and improving accuracy of diagnosis with medical imaging and diagnostic procedures.

The use of AI and ML in healthcare is a fairly recent phenomenon. Michael said companies that are most aggressively pursuing AI are healthcare startups – younger companies that are prepared to take risks and invest time and effort but don’t have the entrenched interest that the larger companies do.

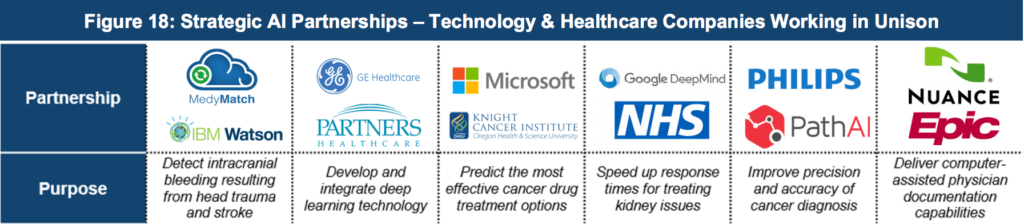

Over time, the startup companies that succeed will end up being acquired by larger companies, such as IBM’s Watson platform, or healthcare companies like the J&J. “In general, if larger companies are participating in this space, it’s more by providing technology and capital. Often times, the most innovative work comes from smaller startup companies that take risks,” he added.

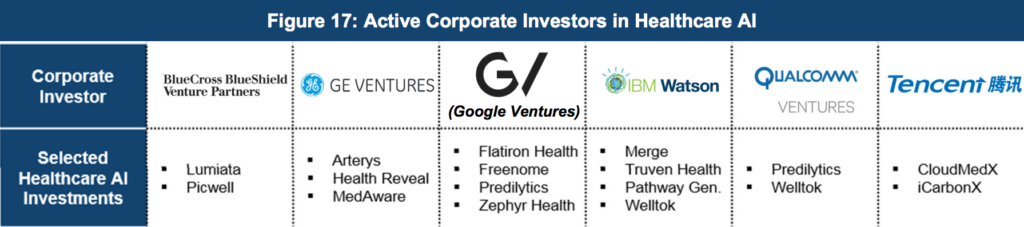

Large technology and healthcare corporations are increasingly turning to targeted investments in AI startups to augment and propel internal corporate investment and development initiatives.

“Corporate investors are investing for reasons of both defense and offense,” Michael said.

“Offense as in they want to be in the game. They want to have the knowledge and they want to hopefully incorporate the technology into their own businesses.”

“They’re investing for defense because artificial intelligence and machine learning could really disrupt some of their lines of business. If they don’t get ahead of the curve on this, they could wake up years from now and find that new AI driven technologies are making some of what they do obsolete.”

large traditional healthcare players are joining forces with some of the largest technology companies through nontraditional partnerships and strategic alliances. Such relationships are mutually beneficial – providing technology companies with the data points and research they need to drive continued innovation within AI applications for healthcare, while concurrently improving efficiency and patient outcomes for healthcare companies and institutions.

For a company to succeed in the healthcare AI space, it needs to have staying power. It needs the ability to develop the technology and bring it through the regulatory process, which requires sufficient capital. In general, the mistake we have seen entrepreneurs make at this stage is to not raise enough capital; they don’t have the war chest it takes to succeed.

There are companies that tend to focus their presentation to investors just on the technology itself. They sometimes fail to effectively address the ultimate commercial applications of the technology. Ultimately, a company has to have a product or service that will meet a genuine need in the healthcare marketplace. You need an analysis of reimbursement and payment and you need an analysis of demand.

The analysis of the market should include basics like the overall market size, how it’s growing, what’s the proportion of that market the technology is going to capture.

Click here to see the full report: The Next Generation of Medicine: Artificial Intelligence and Machine Learning