2018 was full of exciting developments on the Axial platform. We shipped over 450 updates to the site, evolving the product multiple times each business day.

Our work was informed by customer feedback at every step, and was centered around two main themes:

- Intelligence of Matching: What can be done to ensure each deal shared is a great fit?

- Efficiency and Sophistication of Process Tools: How can Axial provide its members with an advantage in the market?

Read (or skim) on for an overview of the most significant changes.

Intelligence of Matching

The advances in our matching engine in 2018 alone have enabled up to 10x increases in relevancy rate.

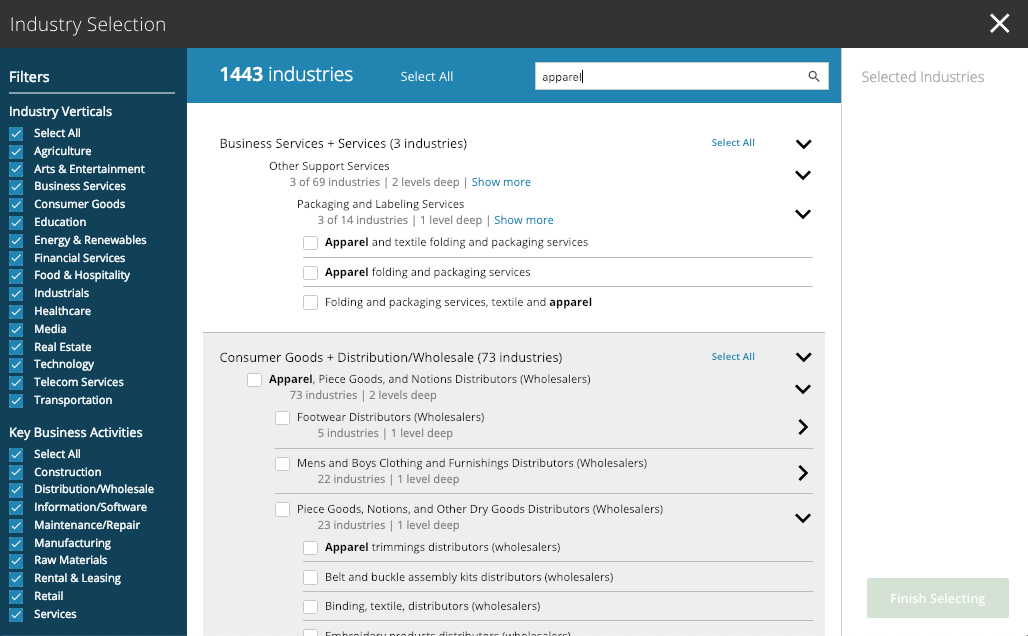

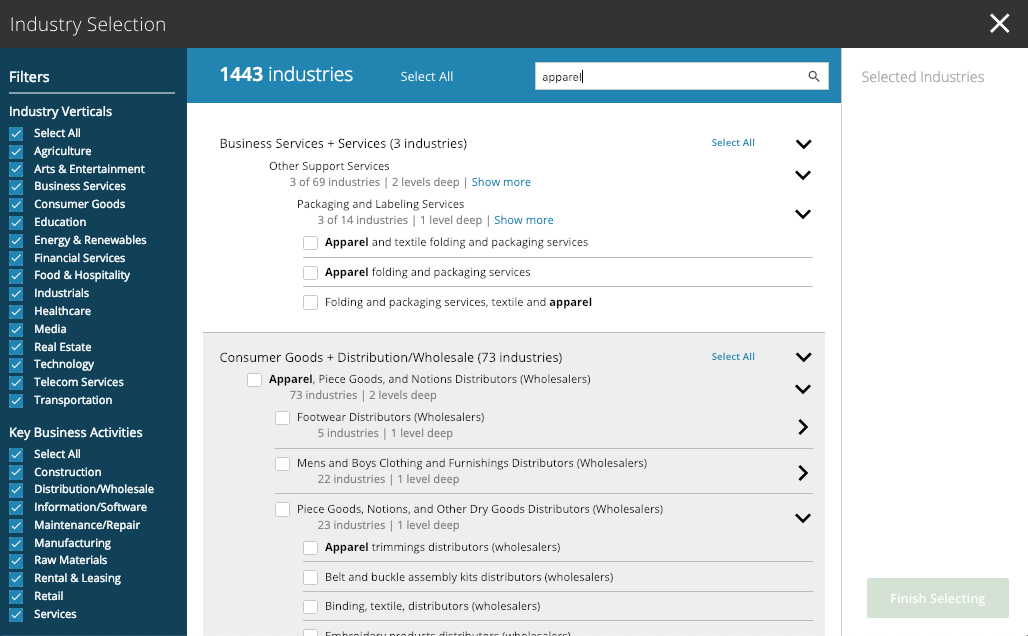

- Industries: We rolled out our new industry taxonomy in February. Built on the shoulders of the NAICS taxonomy, it’s now gone through several iterations, and features over 19,000 industries – with more on the way.

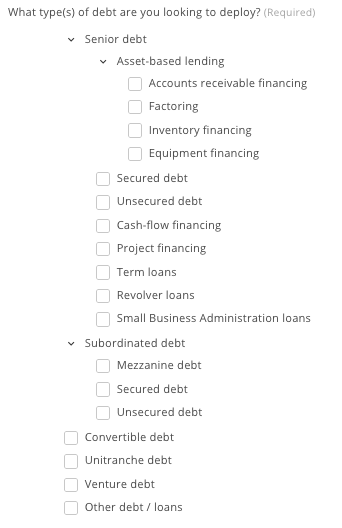

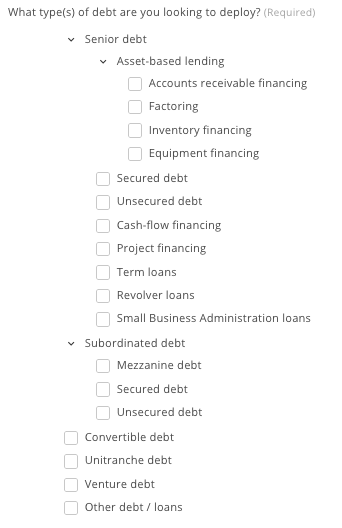

- Debt types: At the top of the year,we supported just six debt types.We now support seventeen. We’ve also limited capital raisers to selecting a maximum of 5 debt types, which has led to unprecedented levels of relevant deal flow for lenders.

- New buyside filters:

- State-based geographic matching: Previously, when sourcing deals on Axial, you had to select geographic areas of interest from a set of broad regions within the US or Canada. With this summer’s update, you’re able to filter for businesses in specific states and / or provinces.

- Disqualifying Industries: As a buyer or capital partner, if there are industries you know you’re not interested in, you can now filter out deals where the business operates in those areas.

- Disqualifying End Markets / Customer Types: Similarly, if you’d like to avoid seeing deals which sell into certain end markets (e.g., government), you can control for that.

- Deal Review Program: To help create a standard of consistency across the platform, we’ve instituted a white glove feedback process where we work with members on the sellside to make sure each deal is represented as cleanly and accurately as possible.

Efficiency and Sophistication of Process Tools

App Performance and Ease of Use

- Time is money, and no one likes a slow app. We’ve invested in speed across the board, significantly improving load times, often by 10x or more. Here’s what sped up:

- Recommendation engine

- Sellside outreach process

- Buyside deal inbox

- Industry taxonomy browser

- Project lists

- Homepage

- Our industry taxonomy interface has greatly improved to make it much easier to find what you’re looking for.

- We added a chat support interface to the app, so you can easily reach our team whenever you need us (you can still always email us at [email protected] with any questions!)

- We fixed a total of 150 bugs to keep your experience as smooth as possible. 🐜

Buyside-Specific Updates

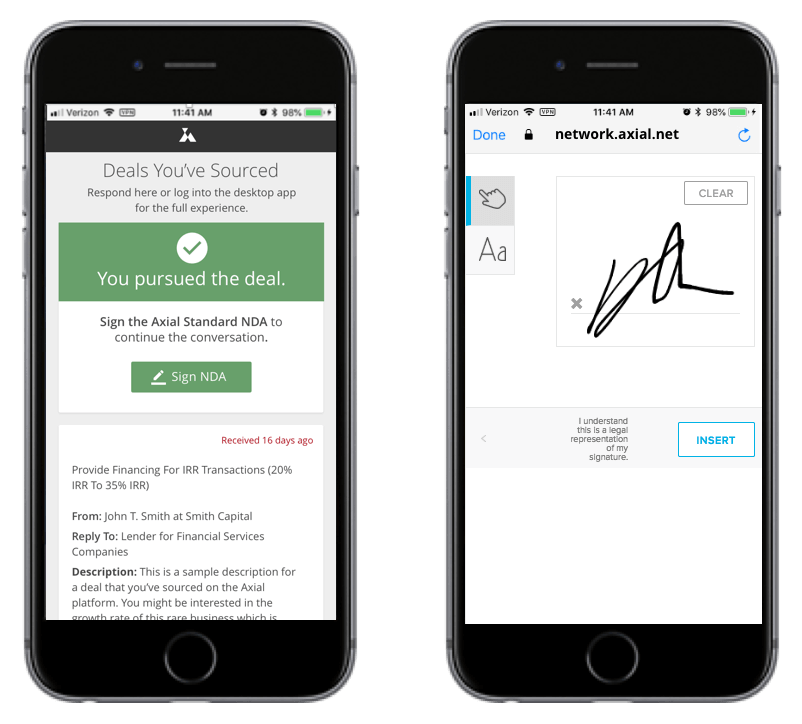

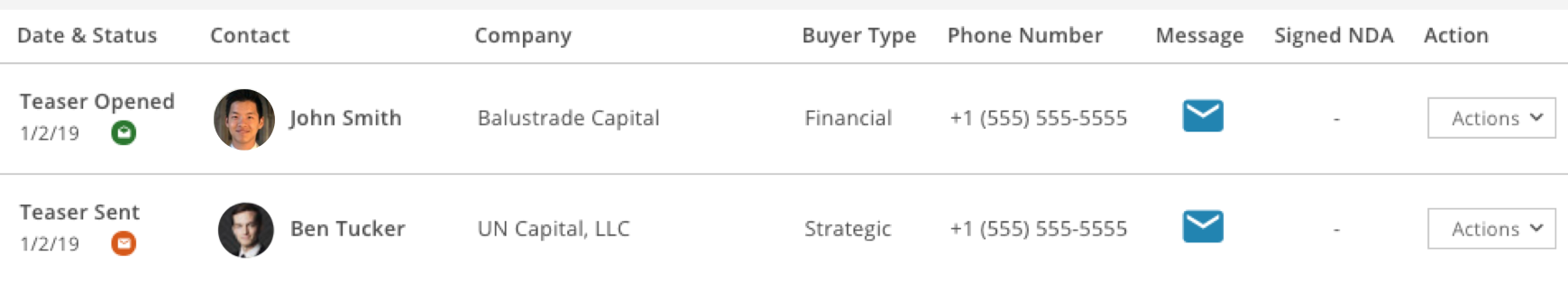

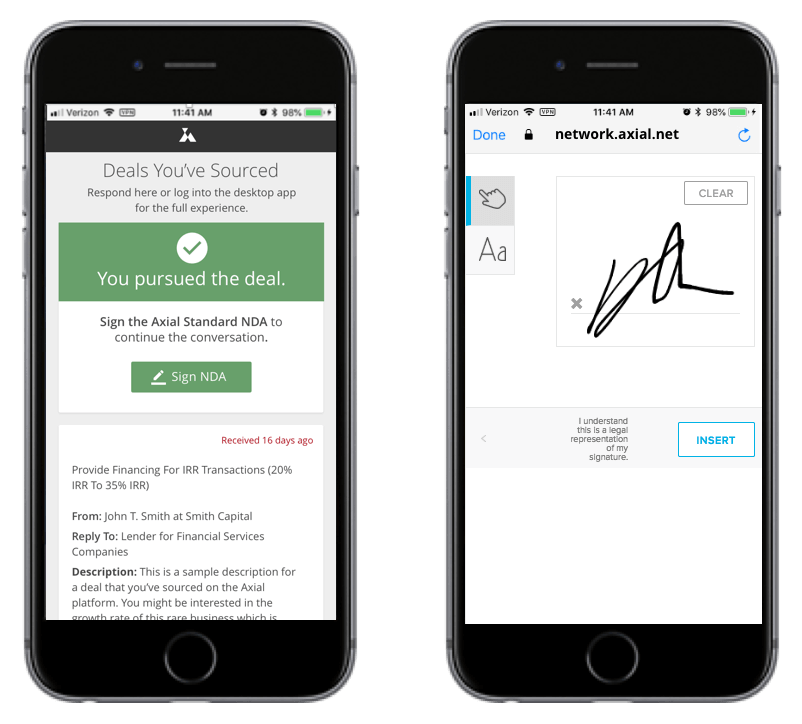

- NDA efficiencies

- After pursuing a deal via email, you can now immediately electronically sign the Axial Standard NDA, even on a mobile phone.

- After pursuing a deal via your “New Deals” list, the interface now makes it easier to see & sign the NDA.

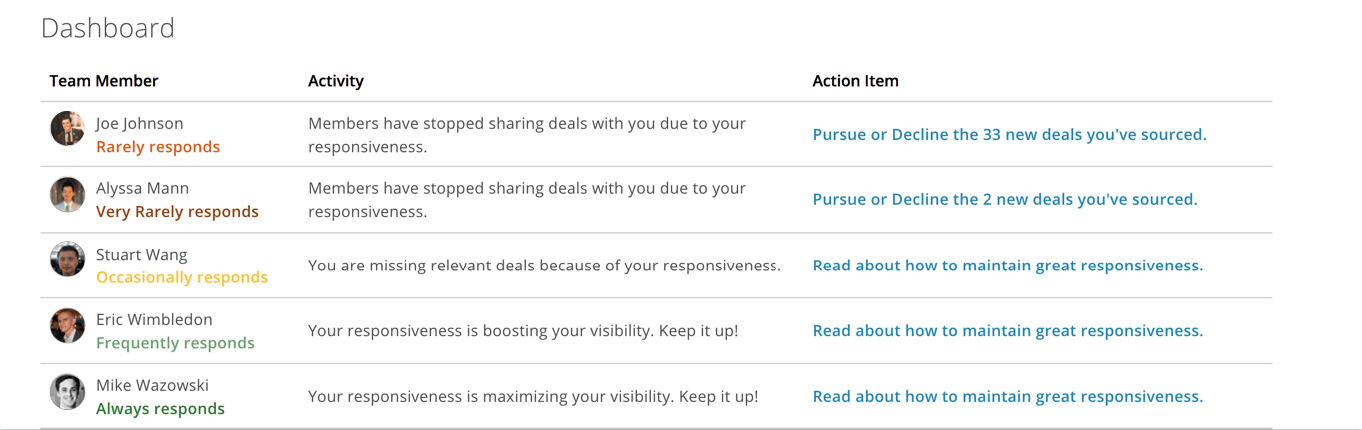

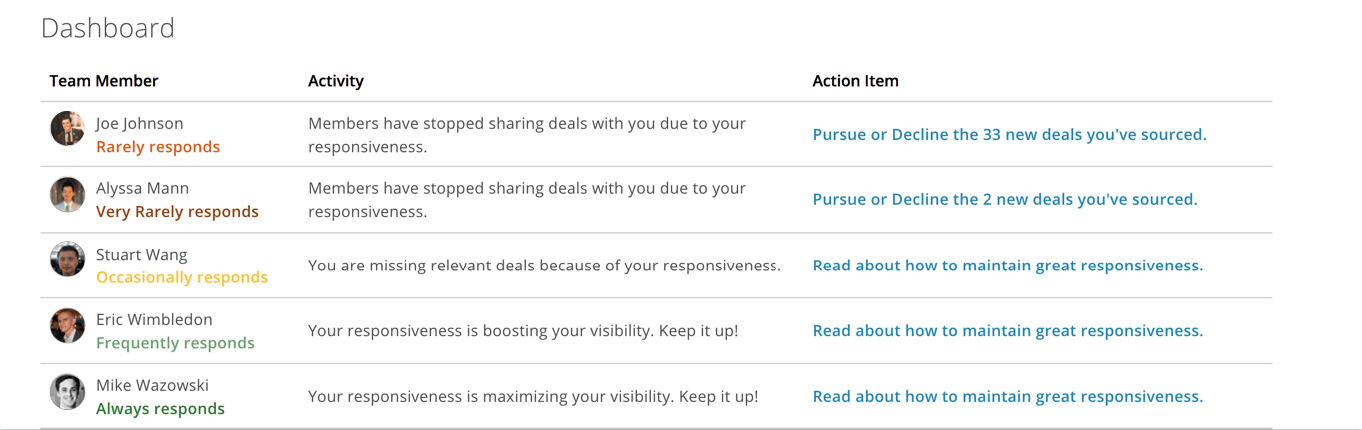

- A New Responsiveness Dashboard

- Stay on top of your firm’s reputation and engage with action items that improve your responsiveness score so that you can maximize your deal flow.

Sellside-Specific Updates

- If the geographic location of a business you’re representing is especially sensitive, you now have the option to disclose only the country to recipients, as opposed to the specific region.

- You can now run a much more efficient and customizable outreach process.

- Save time with the ability to message multiple recipients at once when following up.

- When you’re reaching out to multiple members at once, our “mail merge” functionality ensures each note starts with a personalized greeting.

- Project-specific message templates allow you to draft an outreach note early on, and save your work so it’s there whenever you come back to the project.

- Additional outreach note enhancements include custom subject lines and the support for rich text (bold, italics, underline, bullets). Members who customize their subject lines and messages during initial outreach enjoy a 10% boost in open rates compared to the network average.

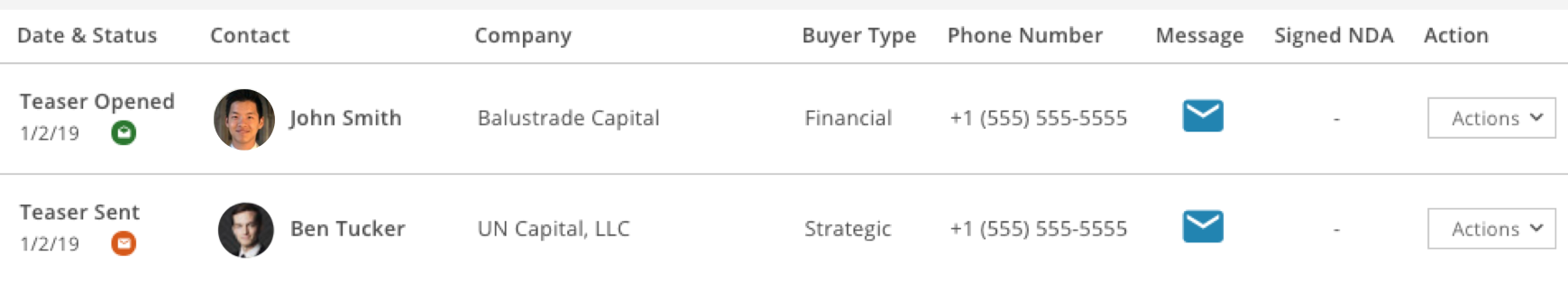

- Read receipts after initial outreach let you track which recipients have seen your message, so you can tailor your follow-ups accordingly.

- Enhancements to the buyside interface mean that signage rates of the Axial Standard NDA post-pursuit are up by 20%.

- After you upload documents to your project, you can now download and delete them, too.

Looking Ahead to 2019:

We will continue to strengthen our matching and process tools until we become the best place for you to send and receive deals. With 2018 behind us, we would like to thank you for helping us continue to grow Axial into a vital marketplace and the future of the lower middle market. None of what we’ve been able to build would be possible without your support!

Happy New Year!