M&A Fee Guide 2023-2024

For the third year running, Axial partnered with Firmex and Divestopedia on the annual M&A Fee Guide, the authoritative source…

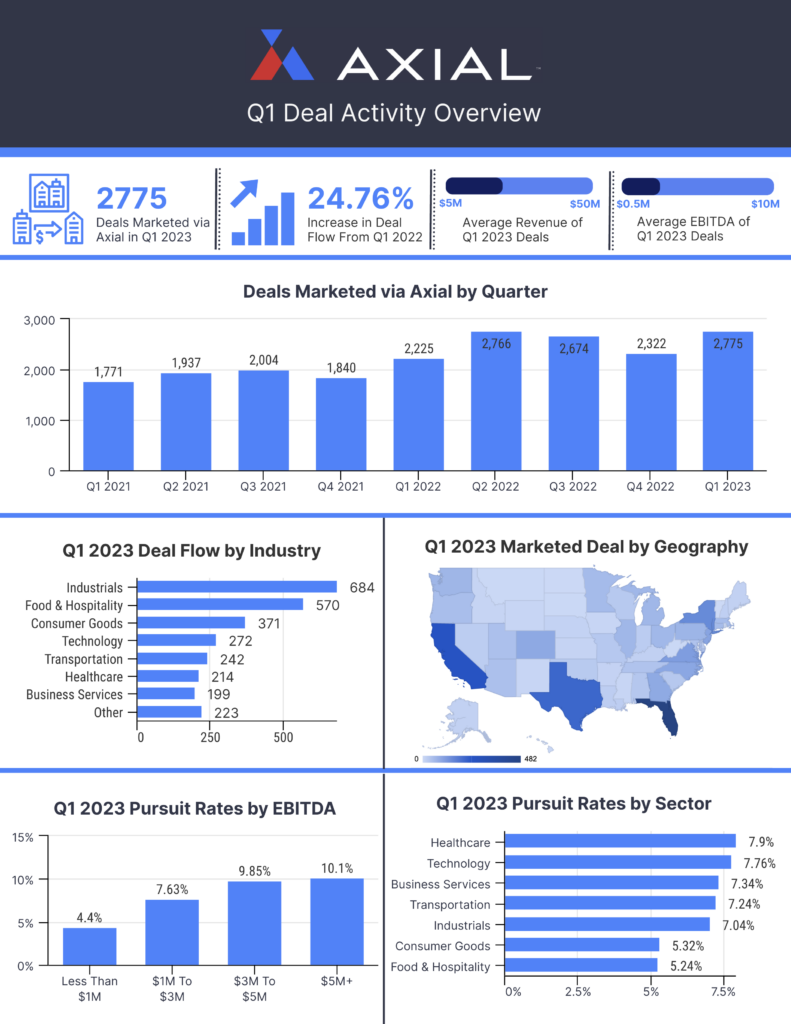

Axial is excited to release its Q1 2023 Lower Middle Market Investment Banking League Tables.

These league tables reveal the top 25 investment banks that were active on the Axial platform in Q1. In Q1, 740 sell-side investment banks and M&A advisors brought a total of 2,775 deals to market. League Table recipients quarterbacked 111 of the total 2,775 deals in the quarter.

Axial’s league table ranking methodology is driven largely by four factors:

For a detailed methodology, please see the end of this feature.

In Q1, the top 25 investment banks had an average pursuit rate of 9.85%, higher than the platform wide average of 7.08%. The deals they marketed had an average revenue and EBITDA of $21.4 million and $3.2 million, respectively. The most active sector of deal activity was Industrials, followed by Consumer Goods, Healthcare, & Technology.

These league tables can serve as an information resource for business owners and investment firms who are actively seeking to hire a vetted M&A advisor to assist them in navigating exit strategy.

Find An Investment Banker to Help Sell Your Business

Congratulations to the top 25 investment banks!

| Rank | Firm | HQ |

|---|---|---|

| 1 | Woodbridge International | CT |

| 2 | Peakstone Group | IL |

| 3 | Vertess Healthcare Advisors, LLC | TX |

| 4 | SDR Ventures | CO |

| 5 | eMerge M&A | NY |

| 6 | New Direction Partners | PA |

| 7 | Ardent Advisory Group | AZ |

| 8 | Plethora Businesses | CA |

| 9 | ACT Capital Advisors | WA |

| 10 | Cross Keys Capital | FL |

| 11 | Meritage Partners, Inc | CA |

| 12 | Vesticor Advisors | MI |

| 13 | Berkery Noyes Investment Bankers | NY |

| 14 | Cornerstone Business Services, Inc. | WI |

| 15 | Murphy McCormack Capital Advisors | PA |

| 16 | Liberty Ridge Advisors | WA |

| 17 | Gleason Advisors | PA |

| 18 | Impact Acquisition | KY |

| 19 | BlackRose Group | LA |

| 20 | Hext Capital Partners | TX |

| 21 | Peakview Partners | CO |

| 22 | Vercor | GA |

| 23 | JD Merit & Company | WA |

| 24 | Business Acquisition and Merger Associates | NC |

| 25 | Brentwood Growth Corp | NJ |

| Firm | HQ |

|---|---|

| Groce, Rose & Moore, LLC | SC |

| TREP Advisors | FL |

| The DAK Group | NJ |

| Bentley Associates | NY |

| Osage Advisors | CT |

| Firm | HQ |

|---|---|

| Kratos Capital | TX |

| Kaulkin Ginsberg | MD |

| Westbury Group | CT |

| McDonald Dalton Capital Partners | TX |

| Flatirons Capital Advisors | CO |

| Firm | HQ |

|---|---|

| Hill View Partners | RI |

| Confederation M&A | PE |

| FOCUS Investment Banking | VA |

| Northern Edge Advisors | NY |

| Ridgefield Partners | CO |

| Firm | HQ |

|---|---|

| Fortunet | ISR |

| Access Global Partners | NY |

| Mertz Taggart | FL |

| STS Worldwide | GA |

| Corum Group | WA |

“Woodbridge International has been closing lower-middle-market M&A deals for 30 years. We closed 32 deals in 2022 in various industries, including manufacturing, distribution, e-commerce, logistics, consulting and healthcare; generating $619 million in liquidity for our clients.

We do ground-breaking, confidential global client marketing. We create powerful marketing videos showcasing our client’s companies. We have an innovative 150-day timeline-driven auction that establishes a closing date upfront, and all clients attend a 2-day virtual, Management Meeting Training Program. We are a technology-driven, fully virtual firm. That’s why Woodbridge International is well-positioned to dominate the highly fragmented, underserved lower middle market.”

Industries: Manufacturing, Financial Services, Consumer Goods, Industrials, Materials, Technology, Energy & Utilities, Retail, Business Services, Distribution, Health Care, Consumer Services, Media, Life Sciences, Telecommunications, Real Estate, Financial Services

“The Peakstone Group is an investment bank that specializes in mergers and acquisitions advisory and capital raising for middle market clients. Our team is comprised of senior investment banking professionals and operating executives, all of whom have decades of experience and have executed hundreds of transactions totaling billions of dollars.”

Industries: Business Services, Consumer Goods, Financial Services, Food & Beverage, Health & Wellness, Healthcare, Industrials Manufacturing, Real- Estate, Retail, Tech Software/SaaS

“VERTESS is a healthcare-focused Mergers + Acquisitions (M+A) advisory firm that helps owners increase their company’s financial value and negotiate the best price when they decide to sell their own company or grow through acquisition. Our expertise spans diverse healthcare and human service verticals, ranging from behavioral health and intellectual/developmental disabilities to DME, pharmacies, home care/hospice, urgent care, dental practices, life sciences, and other specialized services and products. Each VERTESS Managing Director has had executive experience in either launching or managing and ultimately successfully exiting a healthcare company.”

Industries: Heath Care, Life Sciences

“SDR Ventures is a Denver-based investment banking firm serving private business owners in the lower middle market, including companies with values up to $300 million. The SDR Ventures approach of thinking like owners helps businesses maximize their value. Whether owners are looking to sell a business, buy a business or raise debt or equity, SDR is committed to helping them succeed.”

Industries: Manufacturing, Consumer Goods, Industrials, Business Services, Technology, Distribution, Health Care, Energy & Utilities, Financial Services, Materials, Consumer Services, Life Sciences, Media, Real Estate

“Originally founded in 1989, our mission is to provide a level of expertise, knowledge, and execution not typically available to owners of privately-held middle market companies. We get to know the owners’ personal goals and we get them there. We dig in and get to know the owner’s company almost as well as they do in order to provide the highest level of detail and execution. We work for owners selling their companies – and them alone.

With offices in New York, Florida, Texas, North Carolina and California, eMerge M&A is perhaps the most experienced and data rich M&A firm serving this market segment. No one has more experience with privately-held companies. No one.”

Industries: Industrials, Business Services, Consumer Services, Consumer Goods, Distribution, Energy & Utilities, Health Care, Manufacturing, Life Sciences, Materials, Media

“New Direction Partners provides advisory services in investment banking, valuation, financial advisory and management consulting. Our partners have unparalleled experience, with involvement in over 200 sales and mergers since 1979. We specialize in providing services to the printing, packaging and allied graphic arts industries with an emphasis on mergers and acquisitions.”

Industries: Manufacturing, Business Services, Industrials, Media

“At Ardent Advisory Group, we look first to understand our clients’ strategic objectives, and then execute a plan to serve those individual objectives. Alongside transaction consideration, we understand that timing, tax issues, future involvement, legacy of the business, and other factors vary according to each client’s particular situation. By identifying our clients’ objectives we are able to maximize value in a transaction, whether a business sale, acquisition, merger, or other corporate finance transaction.”

Industries: Consumer Goods, Manufacturing, Materials, Financial Services, Distribution, Industrials, Real Estate, Business Services, Consumer Services

“Plethora Businesses is a leading M&A Advisor for the lower middle market. We were formed in 1999 with the objective of creating a market place for buyers and sellers of privately held businesses. Throughout the years we have pursued this objective with constant vigor and dedication. We’re proud of our history, the relationships we’ve built and the hundreds of completed transactions and projects.

Whether an acquisition or merger, we believe these transactions are a significant milestone for every client. Each transaction helps to transform an individual’s life, create opportunities, transfer wealth and build upon prior success. We have fun doing what we do, enjoy the challenges, and find satisfaction navigating and completing complex transactions.”

Industries: Consumer Goods, Industrials, Materials, Retail, Business Services, Consumer Services, Media

“ACT Capital Advisors has facilitated the mergers, acquisitions, and divestitures of hundreds of companies. Our principals have closed mergers and acquisitions totaling over $2 billion in total corporate transactional value.

We work closely with our client’s financial and legal advisors. With multiple decades of experience, ACT’s principals have represented a diverse range of industries, including manufacturing, contracting, wholesale, distribution and service industries. Our track record of success has provided us with an understanding and appreciation of the unique challenges presented by each industry, and allows us to continue to best realize the goals of our clients.”

Industries: Consumer Goods, Industrials, Materials, Energy & Utilities, Financial Services, Retail, Technology, Business Services, Health Care, Consumer Services, Media, Real Estate, Life Sciences, Telecommunications

“Cross Keys Capital has offices in Fort Lauderdale, Florida, and Chicago, Illinois. With a team of more than 20 professionals, we provide our clients with a full suite of investment banking advisory services including sell-side and buy-side M&A, recapitalizations, restructurings, and capital raising. At the onset, we perform comprehensive diligence and analyses on our clients to identify key deal factors, including the quality of the management team, the stability and track record of the business, the strength and testing of the company’s financial profile, and its competitive positioning.”

Industries: Manufacturing, Business Services, Industrials, Materials, Consumer Goods, Distribution, Energy & Utilities, Health Care, Technology

“Meritage Partners is a multi-disciplined mergers and acquisitions advisory firm serving the lower middle market. Our advisors are made up of accomplished and experienced entrepreneurs with over 130 years of collective experience. Our team has advised on over $2 billion of successful transactions with private equity firms, high net-worth individuals, and public companies. Our clients are privately-held businesses in a variety of industries throughout North America.”

Industries: Manufacturing, Consumer Goods, Industrials, Technology, Retail, Business Services, Distribution, Energy & Utilities, Materials, Health Care, Financial Services, Life Sciences, Telecommunications

Visit Meritage Partners’ Profile

“Vesticor Advisors was founded on the principle that owner-operated companies in the lower middle market are unique and require specialized attention and advice when considering strategic investment and exit opportunities.

“Vesticor Advisors provides M&A and capital raising advisory services exclusively to founder and owner-operated companies. We support clients with the expertise needed to build their business through growth acquisitions, optimize value in an exit or sale, transition ownership to family or management, divest non-core assets, or raise capital. After founding, building and exiting our own businesses, the partners at Vesticor came together under a shared vision: to build an M&A firm that helps other business owners achieve their dreams of growth, expansion, legacy and financial independence.”

Industries: Financial Services, Industrials, Energy & Utilities, Health Care, Retail, Technology, Consumer Goods, Life Sciences, Consumer Services, Distribution, Media, Real Estate

“Berkery Noyes is an independent investment bank providing mergers and acquisitions (M&A) advisory and financial consulting services to middle-market leaders in the global information, software, and technology industries.

Since its founding by Joseph W. Berkery in 1983, Berkery Noyes has assisted corporate clients in their desire to grow through acquisition, divest non-core assets, and maximize shareholder returns through strategic transactions and restructurings. For private owners, we help create liquidity and execute timely exit strategies that achieve the personal and professional objectives of each client.”

Industries: Financial Services, Technology, Business Services, Health Care

“Cornerstone Business Services is a boutique investment bank serving the lower middle market, domestically and internationally for more than 20 years. We create value through acquisition, valuation and exit strategies, with a focus on businesses typically with annual revenue from $5 million to $150 million. Being one of the largest M&A firms in the Midwest focused exclusively on the lower middle market, we bring a team of specialist, our proprietary Assurance 360 process and the full benefits of being a founding member of the Cornerstone International Alliance to clients to achieve extraordinary results.”

Industries: Industrials, Manufacturing, Technology, Distribution, Financial Services, Health Care, Business Services, Consumer Goods, Life Sciences, Materials, Telecommunications, Energy & Utilities, Consumer Services, Media, Retail

“Murphy McCormack Capital Advisors is a regional investment banking firm offering unparalleled expertise, advice and experience in the transfer of ownership within middle market privately-held companies. With offices and a team of professionals in Lewisburg, Harrisburg and Sayre, we are widely regarded as central and southeastern Pennsylvania’s leading investment banking and strategic consulting firm for mid-size companies.”

Industries: Distribution, Financial Services, Media

Visit Murphy McCormack’s Profile

“Liberty Ridge is the most difficult and treacherous trek on the Pacific Northwest’s iconic Mt. Rainier. As founders, with deep roots in the Pacific Northwest, we consider Liberty Ridge the perfect metaphor to represent the challenging yet rewarding endeavors that a merger or acquisition can be for business owners.

The final summit, for any private business owner, is to achieve hard earned liquidity and successfully exit the business on one’s own terms. Even the most experienced climbers understand that it’s a team effort and would never dare to summit Liberty Ridge without the aid of an experienced, results-focused guide. Likewise, we believe that when the stakes are high and the potential rewards are grand, no business owner, regardless of how experienced or savvy, should attempt the difficult and challenging journey of exiting their business without partnering with experienced advisors.”

Industries: Manufacturing, Financial Services, Consumer Goods, Industrials, Materials, Business Services, Distribution, Health Care

“When closely held, private companies have a need for financial advice – in seeking a liquidity event or when capital needs to be raised, for example – Gleason Advisors acts as a trusted partner to business owners and management. We provide valuable financial and strategic advice throughout the business life cycle.

Our service offering at Gleason Advisors allows us to work with businesses facing a wide range of issues and financial challenges. These situations often call on us to leverage our symbiotic relationship with the services of Gleason Experts, where we have deep expertise in forensic accounting, litigation support, and bankruptcy proceedings. Combined, these groups allow us to serve our clients as a more complete financial advisor. Providing value beyond dispute.”

Industries: Manufacturing, Consumer Goods, Industrials, Materials, Technology, Retail, Business Services, Distribution, Health Care

“Impact Acquisition is a professional, and experienced mergers and acquisitions team. With over 25 years of experience, and more than 600 closed transactions, we can bring that expertise to you. Bringing together entrepreneurs looking to buy established profitable businesses; and owners seeking to sell to qualified companies and/or individuals at a fair market value. We work one-on-one with clients to provide a level of service unsurpassed in our industry.

“Impact Acquisition is a professional, and experienced mergers and acquisitions team. With over 25 years of experience, and more than 600 closed transactions, we can bring that expertise to you. Bringing together entrepreneurs looking to buy established profitable businesses; and owners seeking to sell to qualified companies and/or individuals at a fair market value. We work one-on-one with clients to provide a level of service unsurpassed in our industry.

Our partners have worked in the M&A industry for more than two decades, gaining specialized experience and knowledge, as well as, cultivating strong relationships and partnerships. During the partners’ twenty plus years of operation alone, Impact Acquisition has closed hundreds of transactions. We are seasoned professionals, intermediaries, and business owners.”

Industries: Manufacturing, Retail, Consumer Goods, Consumer Services, Business Services, Distribution, Industrials

“We are an M&A firm focusing on sell-side and buy-side transactions. Our areas of specialty include Energy, Manufacturing, Healthcare, Business Services and TMT. Primarily our market is 5-50 million in transaction value, although we are a bit flexible outside of that range. We welcome all opportunities and are open to discuss at any time.”

Industries: Industrials, Health Care, Distribution, Technology, Energy & Utilities, Life Sciences, Telecommunications, Business Services, Materials, Media

“Hext Capital Partners focuses on building long term value for our clients through unbiased advice, access to the capital markets, and expert assistance in mergers and acquisitions. Through our extensive network of capital providers, and financial and strategic buyers, we help our clients solve capital problems and pursue opportunities.

As our client, you have a significant pool of talent to draw from to evaluate and execute on your short-and long-term goals. Our directors and associates work closely with the other Hext Financial Group divisions to pull together a custom team that fits your needs. The group has diverse backgrounds in accounting, finance, and banking, and offer their unique perspectives to each client.”

Industries: Health Care, Industrials

“Founded in 2015, Peakview Partners was established to provide focused and dedicated Partner-level advisory services for M&A and Financing transactions. Tim Dailey and Warren Henson, both with 30+ years of investment banking experience, came together with the vision of creating a boutique firm large enough to leverage a breadth of diverse experience while small enough for the Partners to deliver expertise and tailored support across the entire process directly to each client.

Culture is a key factor in Peakview Partners’ success and the team works hard to identify, understand and partner with organizations for whom they can provide the most value. Peakview strives to highlight what is working well while helping to uncover and improve areas needing attention for an optimal transaction. Peakview runs an organized, timely process allowing our clients to keep their focus where it is meant to be – on their businesses, families and plans for the future.”

Industrials: Manufacturing, Consumer Goods, Technology, Energy & Utilities, Business Services, Distribution

“VERCOR, a leading middle market mergers and acquisitions firm, serves business owners who are interested in selling all or part of their company or who are seeking a private equity recapitalization. Our team manages the entire process – business valuation, assessing the market value of a company, pre-sale planning, marketing, negotiations, and closing the best possible deal. VERCOR brings national and international resources to the job of selling a business in the mid-size market. VERCOR merger and acquisitions consultants provide worldwide resources usually available only to companies with revenues in excess of $100,000,000.”

Industrials: Manufacturing, Energy & Utilities, Technology, Consumer Goods, Distribution, Business Services, Industrials, Retail

“JD Merit is a leading boutique investment bank focused on middle market companies. We are experts in M&A transaction execution and closing. We combine decades of experience with technical expertise, tenacity, creativity, and dedication to ensure not only that a transaction is closed, but that it is closed in our client’s best interest. We deliver market-leading outcomes by applying the integrity, intelligence, insight, instinct, and intensity of a trusted advisor, with no conflicts.

We provide end-to-end M&A advisory services, utilizing our specialized M&A 2.0® process to deliver the most qualified and capable buyers at above-market prices with better terms and certainty of close. We don’t just take on clients – We close deals.“

Industries: Industrials, Manufacturing, Business Services, Financial Services, Technology, Consumer Goods, Distribution, Materials, Energy & Utilities, Media, Real Estate, Consumer Services, Telecommunications

“Founded on the principle of adding value and professional skill to business transfers, BAMA helps clients acquire or sell companies. Our “buyer” clients are both financial and strategic buyers, management teams, private equity groups, and mezz lenders who are looking to invest in good companies. “Seller” clients include business owners who desire recapitalizations for founder-family business transfer, growth capital, corporate divestitures and those seeking business transfer due to retirement, health, family or personal reasons.

Three key principles drive BAMA’s work. They can be summed up in one sentence. Execute a confidential process with people we enjoy who value and desire the unique skill set and services offered by BAMA.”

Industries: Distribution, Industrials, Health Care, Business Services, Consumer Goods, Consumer Services, Life Sciences, Manufacturing, Technology

“Brentwood Growth assists home service and facility management business owners wanting to sell all or part of their business. We assist in valuation, transaction structure, marketing the business, leveraging our network of institutional buyers and managing due diligence / legal process to close. Our fees are 100% performance based paid at close of transaction.”

Industries: Business Services, Industrials, Consumer Goods, Consumer Services

Unlike traditional league table structures that have remained the same for years, where firms are assessed against deal activity and deal dollar volume, Axial league tables surface data on investment banks that reveal their client quality, ability to manage a sell-side process, and down funnel effectiveness for their client.

The investment banks at the top of the Axial League Table are leaders across the following categories:

Together, the top 25 investment banks are those who work with the most in-demand clients; balance breadth, selectivity, and accuracy in the buyers they engage; and generate the largest number of positive outcomes for their clients.

Axial is the trusted deal platform serving the lower middle market ($5-$250M TEV).

Over 3,500 advisory firms and 2,000 corporate and financial buyers have joined Axial to efficiently connect with relevant capital partners, source actionable deals, and build new relationships.

Visit the Member Closed Deals page to see selected transactions that have been sourced and closed via Axial.

Email [email protected] to learn more.