Top 25 Lower Middle Market Investment Banks | Q1 2024

Axial is excited to release our Q1 2024 Lower Middle Market Investment Banking League Tables. To assemble this list, we…

Tags

Axial is excited to release its 2023 publication of the Top 50 Lower Middle Market Healthcare Investors & M&A Advisors. This list features the top 50 buy- and sell-side Axial members that specialize in healthcare deals and have remained resilient and productive in the industry over the past 12 months (see the methodology below for our criteria).

This publication wraps up the 2023 Industry Top 50 series. To see what firms were featured in each industry report, select the badges below.

Our Top 50 healthcare list was generated based on a weighted formula leveraging four key metrics:

Congratulations to these members for their achievements!

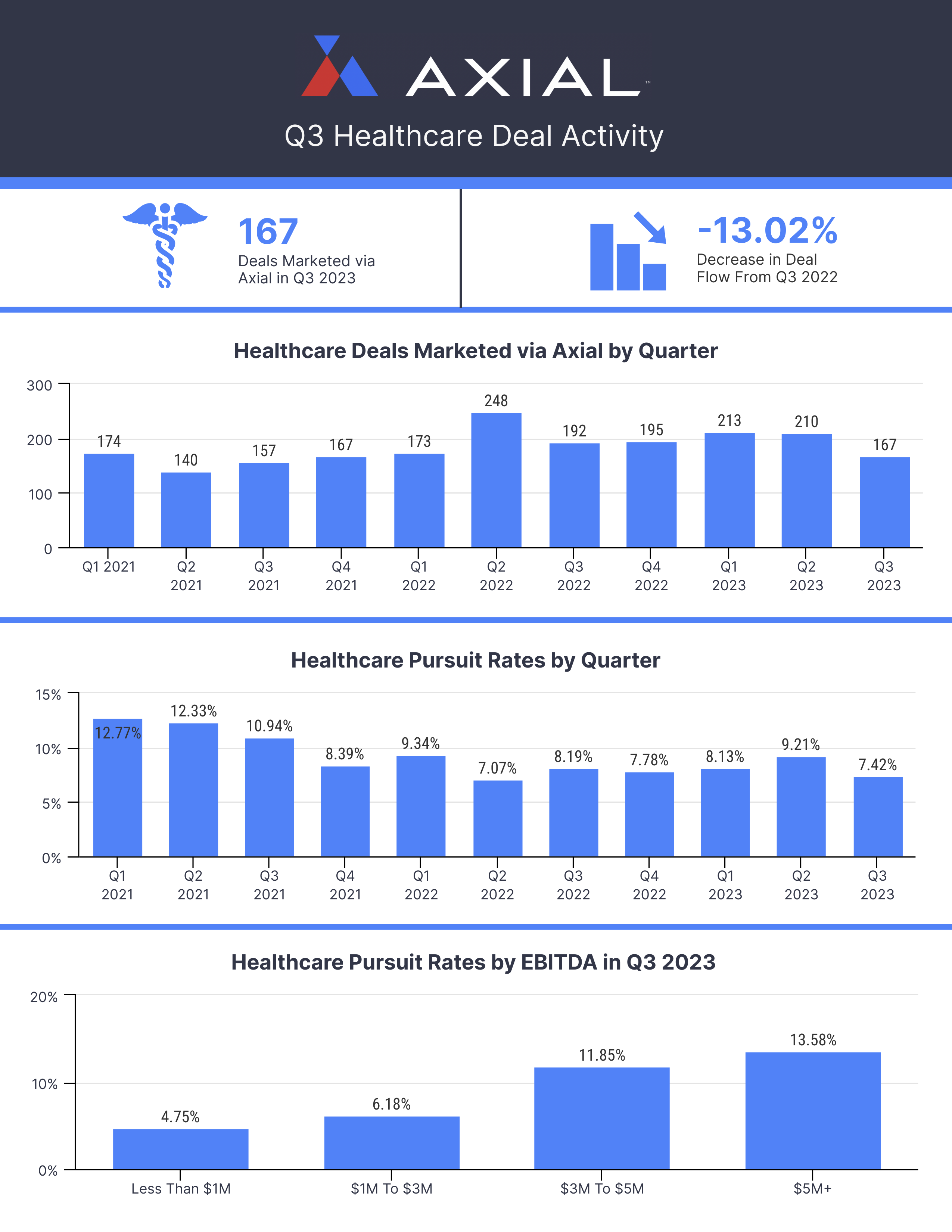

The below snapshot of healthcare deal activity was pulled from the latest issue of The SMB M&A Pipeline. This quarterly publication from Axial surfaces a top-of-the-funnel breakdown of the deal activity occurring on Axial’s platform. The aggregated metrics include quarterly deal volumes, financial and geographic characteristics, and pursuit rates, sorted by quarter and also by industry category.

To review the full report – click here.

![]() – 1 closed deal on Axial |

– 1 closed deal on Axial | ![]() – 2 or more closed deals on Axial

– 2 or more closed deals on Axial

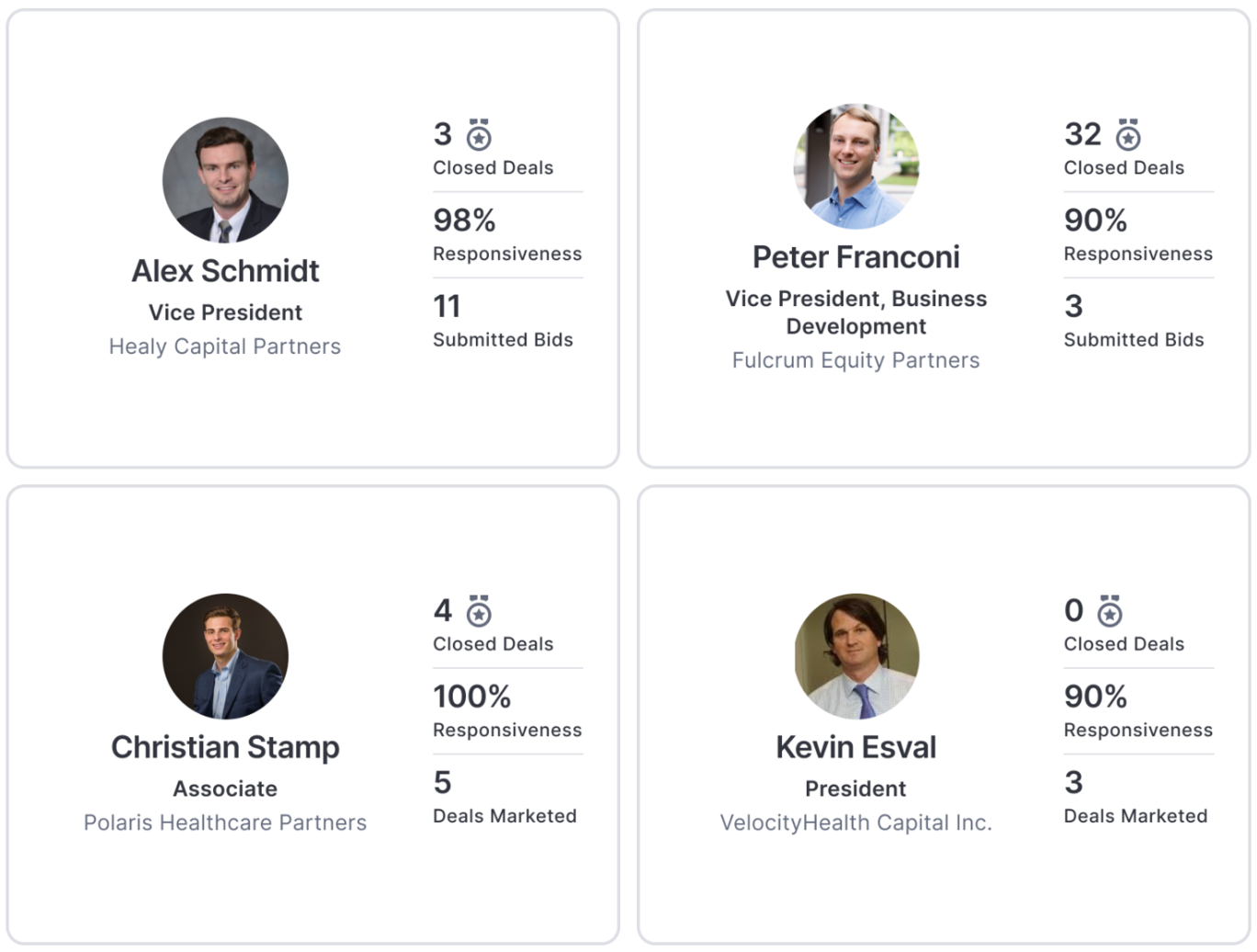

In the world of M&A, reputation and credibility are paramount, which is why Axial released the Axial Passport this year.

The purpose of the Passport is to allow any member of the M&A ecosystem to efficiently gauge the experience and credibility of potential transaction counterparts.

Above, we’ve featured four passports for Healthcare Top 50 members. As you can see, the Passport provides a snapshot of a member’s M&A credentials and key performance metrics. It attaches to every member profile and updates daily.

To learn more about the Axial Passport and the metrics featured, see here.