Top 25 Lower Middle Market Investment Banks | Q1 2024

Axial is excited to release our Q1 2024 Lower Middle Market Investment Banking League Tables. To assemble this list, we…

Tags

Axial is excited to release its 2023 publication of the Top 50 Lower Middle Market Consumer Investors & M&A Advisors.

In recent years, the consumer sector has faced several obstacles: a decline in discretionary spending; interest rate increases; challenges associated with forecasting forward demand and potential margin contraction.

In our upcoming research report, we shed light on these topics and share the 6-12 month M&A market outlook from the perspective of consumer focused dealmakers on Axial.

Today, we are featuring the 50 Axial members that have remained resilient through the recent industry setbacks and have continued to be productive. Congratulations to each of them for their achievements.

Our Top 50 consumer list was generated based on a weighted formula leveraging four key metrics:

~ Closed 1 or more deals on the Axial Platform

~ Closed 1 or more deals on the Axial Platform

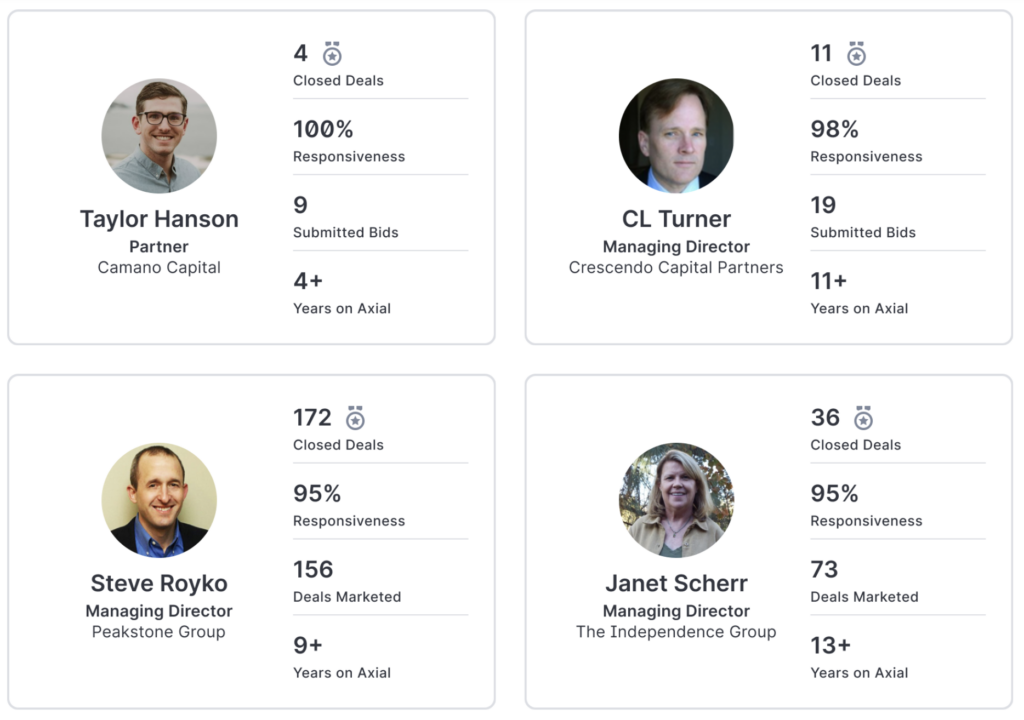

In the world of M&A, reputation and credibility are paramount…. which is why Axial recently released the Axial Passport.

The purpose of the Passport is to allow any member of the M&A ecosystem to efficiently gauge the experience and credibility of potential transaction counterparts.

Above, we’ve featured four passports for Consumer Top 50 members. As you can see, the Passport provides a snapshot of a member’s M&A credentials and key performance metrics. It attaches to every member profile and updates daily.

To learn more about the Axial Passport and the metrics featured, see here.