The Advisor Finder Report: Q3 2025

Welcome to the Q3 2025 issue of The Advisor Finder Report, a quarterly publication that surfaces the activity occurring on…

Tags

Selling your transportation business is a complex financial transaction, where errors can lead to valuation misalignments and deals that don’t close. The process involves exit preparation, transition planning, conducting nuanced valuations, evaluating and disqualifying buyers, keeping a clear head during negotiation, and structuring the deal.

But when done correctly, selling your business can help you finance the next stage of your life, give you the exit timeline you want, and put your business in good hands.

This guide is designed for owners of small to midsize transportation businesses (typically $1M+ EBITDA) who are serious about selling their companies and want to maximize their exit outcomes.

Whether you’re considering a sale due to retirement, new opportunities, health changes, or shifting priorities, the strategies in this guide can help you avoid common pitfalls and achieve better results in terms of sale price, timeline, and stewardship.

Our guide covers:

But first, let’s look at the M&A outlook for the transportation industry.

| Are you ready to sell your business? Schedule your free Exit Consultation today.

We’ll learn about your business and exit goals, then use our platform of over 3,000 M&A advisors and investment banks to hand-curate a short list of the best advisors to help you achieve your ideal exit. |

The 2025 Tenney Group M&A report found that transportation M&A activity surged 159% to $90.5 billion in 2024 compared to $35 billion in 2023, signaling strong buyer interest across all transportation sectors.

Dinan M&A Advisors reported that “global transaction volume in the Transportation and Logistics industry held firm in early 2025, despite macroeconomic pressures, shifting policy environments, and geopolitical uncertainty.”

Whether you operate a logistics company, aviation services, ground transportation, freight forwarding, or specialized transportation business, this increased activity can help lead to better exit outcomes in terms of final sale price, exit timeline, and stewardship.

The transportation industry is emerging from a prolonged freight recession that began in 2022, characterized by depressed freight rates, excess capacity, and elevated operating costs that stressed businesses for over three years. While market conditions varied across transportation sectors, the broader downturn created challenges for valuations and exit timing.

Several factors suggest improving conditions for transportation M&A. The freight recession is officially declared over by many analysts, capacity is reducing as weaker players exit the market, strategic buyers have cash reserves ready to deploy, and private equity firms are targeting transportation for consolidation opportunities.

These improving market conditions benefit transportation business owners considering exits, particularly those who successfully navigated the recent downturn and are positioned for growth as freight markets recover.

Technology integration commands premium valuations as buyers seek companies with digital capabilities, automated systems, and advanced tracking technology. Transportation businesses that have invested in operational technology are seeing higher multiples than traditional asset-heavy competitors.

Sustainability focus attracts buyer interest in green transportation solutions, electric fleets, and carbon-efficient operations.

If you’re interested in selling your transportation business, schedule your free exit consultation.

An unsolicited offer is unlikely to be the best offer you’ll get. Plenty of business owners start thinking about selling when they get such offers, but there are two things to consider here.

But it isn’t just a higher price that you may get through this process. By creating a competitive bidding process, you can maximize your exit outcomes, which means: a higher price and finding a better steward for your business.

Working with an M&A advisor can help you sell your business successfully. Advisors can:

But not all M&A advisors are created equal. You want an advisor with recent and relevant deal experience in your industry.

Transportation businesses require specialized knowledge that generic advisors often lack. The kind of advisor you want depends on your business type. For example, you may benefit the most with an advisor who understands freight cycles and market timing, maintains relationships with transportation-focused buyers (strategic acquirers, PE consolidators, logistics technology companies), and has experience with the asset valuation complexities central to transportation deals.

Specialized transportation advisors provide crucial advantages: broader buyer coverage creating competitive bidding environments, deep industry relationships with both strategic and financial buyers, and the ability to time exits around freight cycles to maximize valuations.

At Axial, we maintain a network of over 3,000 M&A advisors with detailed performance data on their deals, buyer coverage, and success rates. We hand-curate shortlists of 3-5 advisors specifically matched to your transportation business and exit goals.

Ready to sell? Start the process today.

We also have additional resources about M&A advisors, including:

There are two main types of buyers for your transportation business: strategic buyers and financial buyers.

Strategic buyers want to acquire your business to help grow their own company. These could be:

Financial buyers include:

But overall, buyers exist on a spectrum between offering premium prices (but less stewardship) versus better stewardship (but lower prices).

As a business owner, you probably want the best possible price while ensuring your company goes to someone who will:

You’ll have your own priorities here. If you need to maximize sale price above all else — maybe to fund retirement — you might accept a buyer who absorbs your business into theirs, even if that means your company ceases to exist independently.

That’s why the best approach isn’t targeting just one type of buyer. Instead, you want to reach as many qualified buyers as possible to create competition for your business.

Here are some additional resources on understanding buyer profiles:

You want to get your transportation business valued early and often, as it can help you see if you’re on the roadmap to hitting your exit goals.

But transportation valuations present unique challenges that require industry-specific expertise. Key valuation drivers that transportation advisors understand include the contract versus spot market revenue mix (contract revenue provides more stable valuations), customer diversification and retention rates, asset utilization rates and equipment condition, geographic coverage and market positioning, technology adoption and operational efficiency, and regulatory compliance history. Additionally, these valuation factors need to be understood within the context of what a buyer is willing to pay.

For example:

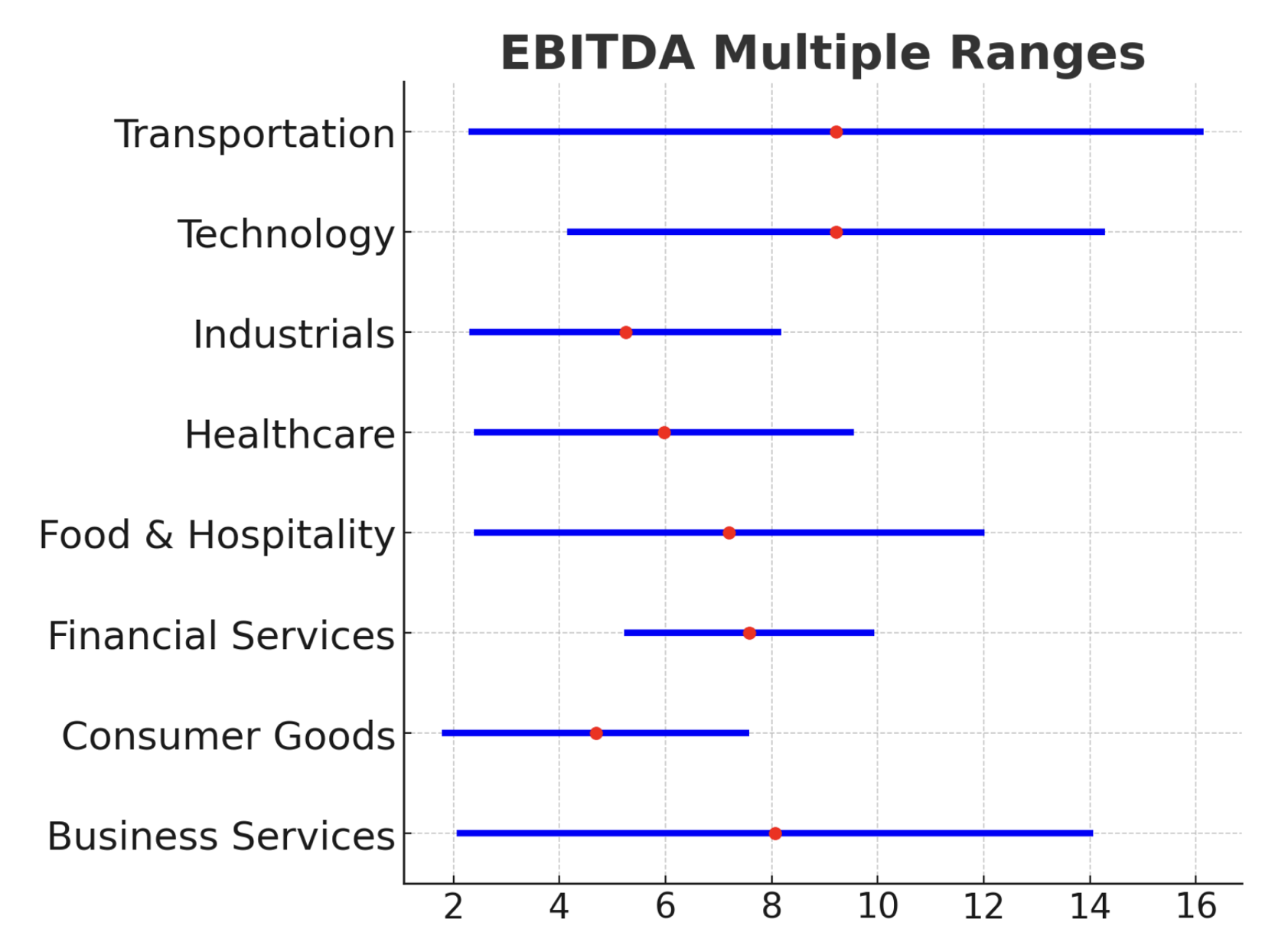

Because of such factors, EBITDA multiples for transportation businesses can vary significantly.

For example, the Winning LOI hub shows:

Another way to understand this drastic spread in multiples is that EBITDA transportation businesses can be divided into distinct camps in terms of the risk an investment poses to a new owner.

On the one hand, some businesses have strong recurring revenue, low capital expenditure, and high operational efficiency. These businesses are attractive because they promise stable cash flow and low reinvestment for the buyer. Some businesses may achieve an extremely high EBITDA multiple if their service is also strongly differentiated or the company has strategic dominance.

On the other hand, transportation can also be a very volatile sector. Take the trucking industry, which is heavily impacted by fuel prices and regulatory pressures. Some businesses are also dependent on cyclical demand, or they have heavy asset requirements that need a high level of ongoing investment. The EBITDA multiple for these businesses tends to be much lower.

To get an accurate valuation range of your business, schedule your free Exit Consultation with Axial. We will learn about your business and then pair you with an M&A advisor who can most accurately value your transportation business.

Here are some additional resources on business valuation:

One of the main reasons why deals can fall through is the business owner having unrealistic or unclear expectations. You don’t want to go to market unsure of what your value is or what you want from your exit in terms of sale price, exit timeline, and stewardship.

Here are some questions business owners should know the answer to:

At Axial, we recommend that you prioritize your motivations for selling. For example, if your main motivation is financial, such as funding your retirement and making sure your children are financially independent, you may be willing to sacrifice on things like exit timeline and stewardship if it brings you a more premium sale price.

As buyers become interested in your business, they’ll start to ask to see more information regarding your management structure, operations, financials, etc. And when a Letter of Intent (LOI) is executed, your potential buyer will perform due diligence.

So while you don’t necessarily need to have all your documents ready to go at the beginning of the process, being prepared to exit does help make the exit smoother.

Here’s a list of “nice to have” documents that you can store in a data room. Data rooms are virtual and secure ways to share important documents. We recommend using a data room, as it’s more efficient, especially if you need to update your documents throughout the process.

Key documents to include in your data room:

Before going to market, there are things you can do to increase your company’s value further.

Many transportation businesses operate on basic “cash in, cash out” accounting that buyers find insufficient for due diligence. To present your financials professionally, you can:

Transportation businesses are often heavily dependent on their owners. You’ll want to show buyers that your business can operate without you by:

You can make your business more appealing by improving its competitive positioning:

These improvements not only make your business more attractive to buyers but can also increase your valuation and make the due diligence process smoother.

For more information, you can read our guide on maximizing business value.

Throughout this post, we covered the do’s and don’ts of selling your transportation business, the importance of exit planning, and how an M&A advisor can help you achieve your ideal exit. A key part of navigating this process successfully is to partner with an M&A advisor.

At Axial, we specialize in helping small-to-midsize business owners find the best advisor who can bring them these results.

Here are two examples of transportation companies that have reached out to find the best advisor for their exit:

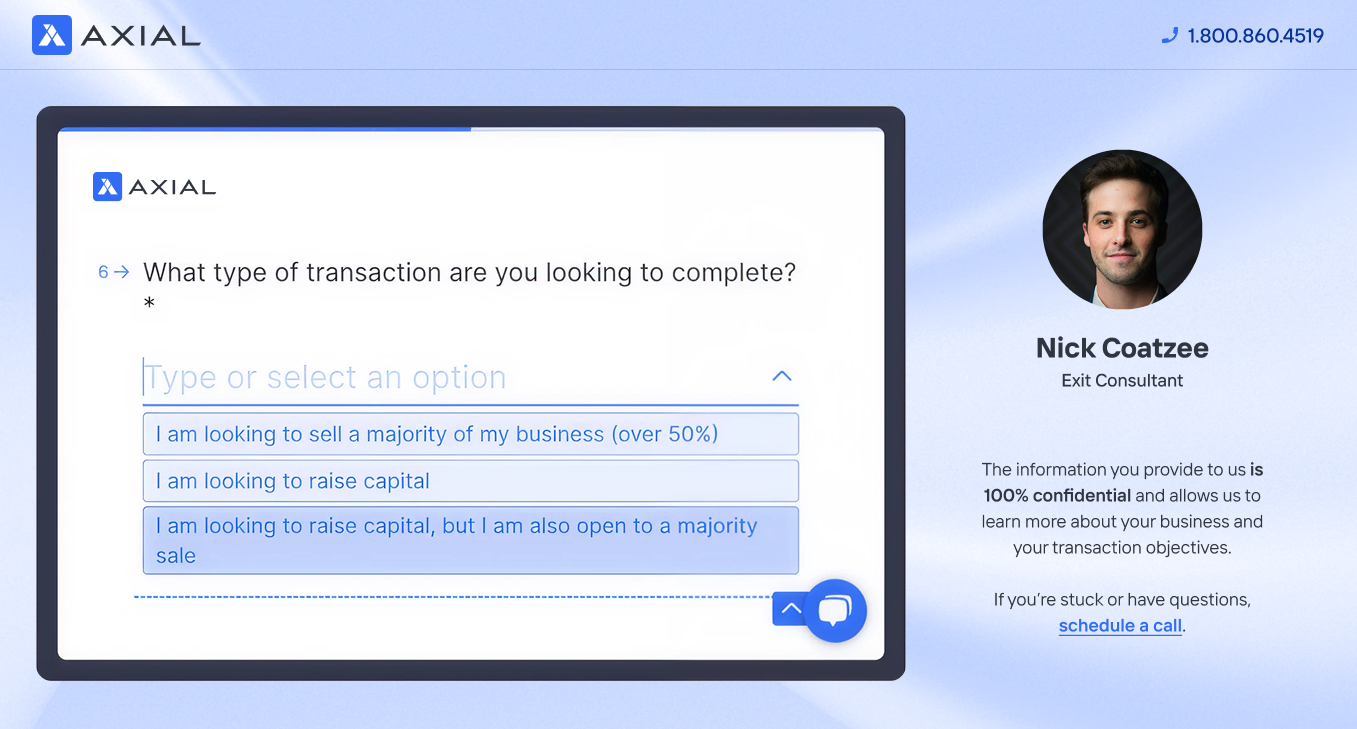

We start by pairing you with an Exit Consultant who gets to know your business and your exit goals.

Your Exit Consultant will leverage Axial’s network of 3,000+ M&A advisors to create a shortlist of candidates with:

We’ll send you a curated list of 3–5 qualified transportation industry advisors, complete with detailed insights to help you evaluate your options and resources to prepare for meetings with your candidates.

Schedule your free exit consultation today.

EBITDA multiples vary significantly by transportation subsector and business characteristics. Based on our internal data of transportation listed within Axial’s platforms, transportation companies have a range of EBITDA multiples between 2.2 and 16.2, with a median of approximately 9x.

These multiples are influenced by recurring revenue, capital expenditures, operational efficiency, and the industry your company operates in.

You will use several different valuation methods to value your business, including:

Using these methods together, you can triangulate an accurate valuation range that reflects both your operational performance and underlying asset values.

Several factors influence optimal timing for transportation business sales. The current post-recession recovery environment may be the best time to sell your business as freight markets stabilize and improve.

Selling from a position of financial strength rather than distress always produces better outcomes. The current market consolidation trend means buyers are actively seeking transportation acquisitions. Personal readiness for transition is equally important; owners should ensure they’re prepared for the emotional and practical aspects of selling their business.

Actual exit timelines will vary from business to business, but transportation business sales typically require 12–24 months from initial decision to closing. At Axial, our data shows that it takes an average of 415 days for transportation companies to close, from market date to final settlement, though this will also change based on your company’s EBITDA.

The preparation phase takes 6–12 months to optimize the business for sale, including financial system improvements, operational documentation, and addressing key person dependencies.

The marketing and sales process typically takes 6–9 months with an experienced advisor. Freight cycle timing may extend this timeline if market conditions aren’t favorable for the business’s specific situation.

You can learn more in our post on:

M&A advisor fees vary by advisor and deal size. Some advisors charge retainer fees while others work on success-fee only arrangements.

Success fees typically follow the Lehman Formula (5% on the first $1 million, with declining percentages on higher amounts). The ROI typically justifies these fees, as the 6–25% higher sale prices that experienced advisors achieve usually far exceed their costs. Transportation-specialized advisors may command slightly higher fees than generalists but typically deliver better outcomes due to their industry expertise and buyer networks.

The key is finding an advisor with demonstrated experience in transportation M&A who can navigate the industry’s unique challenges and access the right buyers for your specific transportation business.