The Winning M&A Advisor [Volume 1, Issue 9]

Welcome to the latest issue of The Winning M&A Advisor, the Axial publication that anonymously unpacks data, fees, and terms…

Selling your SaaS business is likely to be the biggest and most complex financial transaction of your life. If the sale isn’t navigated correctly, you can run into valuation misalignments, where you end up taking a lower offer or agreeing to a deal structure that isn’t optimal, such as lower cash up front and hard-to-achieve earnouts. Or the deal may simply fall through if the buyer doesn’t have the finances to make the acquisition, or you and the buyer can’t agree on terms.

You can increase the chances of achieving your ideal exit by working with an M&A advisor who has relevant experience in the SaaS industry.

M&A advisors help in key ways:

Because of the above, M&A advisors have been shown to bring in higher sale prices and better overall exit outcomes — such as finding a good steward for a business or negotiating a deal that gives you the exit timeline and equity that you’re looking for.

Below, we take a deep dive into:

How M&A Advisors Can Achieve Your Ideal Exit

How Axial Connects SaaS Owners with the Right Advisors

|

We wrote this piece with the help of Aaron Solganick, CEO of Solganick & Co., a data-driven investment bank focused exclusively on software and IT service companies. Solganick is one of the M&A advisors within our network that can help you sell your SaaS business.

At Axial, we have a network of over 3,000 M&A advisors, along with information on their recent deals. We’ve had several types of SaaS companies contact us to find an M&A advisor for them, including companies in HR tech, GovTech, enterprise software, data analytics, and contact management platforms. These businesses ranged from $3M to $16M in revenue, each with unique positioning challenges and buyer requirements. |

| If you’re ready to sell your SaaS business, schedule your free exit consultation today. | |

Getting an accurate valuation is crucial because it sets expectations for both you and potential buyers, helping you determine whether current market conditions align with your exit goals. It also prevents you from accepting offers that undervalue your business.

The simplest way to understand the value of your business is to think in terms of a multiple of your annual recurring revenue (ARR), but arriving at this multiple requires in-depth analysis.

As Aaron Solganick, CEO of Solganick & Co., a data-driven investment bank focused exclusively on software and IT service companies, told us in a recent interview, “If a company gives me their ARR, gross margin, and EBITDA, I can give them a rough estimate. But you want a specific and accurate multiple. The more KPIs and the more financial data I have to work with, the more accurate your valuation will be.”

For example, in 2025, Solganick has been seeing multiples ranging from “3x-5x ARR for smaller SaaS companies to 7x-12x for mid to large companies that are showing consistent growth.” That’s a wide multiple range, and whether your company is going for 3x or 5x its ARR will likely impact whether or not you want to sell your business.

To get your multiple, M&A advisors will analyze your KPIs and financial data within the context of bigger market conditions to arrive at an accurate multiple.

The most important KPIs include:

Here’s why you want to work with an M&A advisor with recent and relevant experience in selling SaaS companies:

At the end of the day, your SaaS company is worth what someone is willing to pay for it.

When arriving at your multiple, advisors will also consider the Rule of 40, which states that if a SaaS company’s revenue growth rate plus its EBITDA margin equals or exceeds 40%, it will typically demand a market or above-market valuation multiple.

Note: Things you cannot necessarily change, such as industry and market conditions, also play a key role in your valuation. Currently, companies in high-growth areas like AI, data analytics, advanced applications, edge computing, and cybersecurity are much more likely to receive higher multiples. A key role of an advisor is to help you understand your business value so you can decide if selling is the right decision.

A key way that an M&A advisor can increase the final sale price (or overall exit outcomes) of your business is by creating a competitive bidding environment. Often, SaaS business owners will reach out to firms like Solganick & Co. because they received an offer from a buyer. But they don’t know if it’s a good offer or what other kinds of offers they could potentially get.

At Solganick & Co., Aaron and his team tend to focus on creating a competitive bidding environment by targeting diverse buyers. This includes researching who is actively buying companies, who has recently received funding (including publicly traded companies), and private equity firms that specialize in software. “About 50% of the buyers we target are ones we have personal relationships with, and the rest are buyers that we’ve found through our research.”

They focus on strategy and fit, examining how your company could potentially serve as a product add-on for a buyer, help its geographic reach, or if your company’s customer base aligns with a prospective buyer.

Let’s look at the numbers associated with creating a competitive bidding environment. In a recent deal that Solganick & Co. closed, they had marketed the business to around 300 companies. Out of those 300 companies, 80 signed NDAs, indicating their interest in learning more about the business. Out of those 80 NDAs, 16 buyers submitted an Indication of Interest (IOI), which meant they were interested in potentially making an offer. From that list of 16, Solganick and his team narrowed it down to 8 viable buyers — ones who were a good fit. Now, their client has 8 buyers to work with and negotiate with before executing a Letter of Intent and working towards closing the deal. Before working with an M&A advisor, they only had one offer.

Rather than negotiating with a single interested buyer, advisors can simultaneously engage multiple qualified buyers, driving up your final sale price through competition.

We discussed the importance of accurately valuing your company and marketing your business to a large number of qualified buyers to create a competitive advantage. But it isn’t enough to simply reach out to a long list of buyers. Advisors can help your business stand out by marketing your business in a way that helps buyers truly understand its value.

As we discussed above, SaaS businesses have unique characteristics that require specialized knowledge to market effectively. Unlike traditional businesses that might be evaluated primarily on revenue and profit, SaaS companies are valued based on complex metrics, such as:

An experienced SaaS advisor understands how to present these metrics in the most favorable light while maintaining credibility with sophisticated buyers. The value of these metrics does not exist in a vacuum — they exist within the context of what type of buyer you’re targeting and what they’re looking for in an acquisition.

For example:

The key takeaway here is that different buyers value and offer different things. Here are two examples from SaaS companies that have reached out to us at Axial:

You can learn more about the differences between a strategic and financial buyer here.

SaaS transactions can involve complex deal structures, including earnouts based on customer retention, revenue milestones, or product development goals. These structures can significantly impact your actual payout, but evaluating their fairness requires understanding both market norms and the specific risks involved.

An experienced advisor can negotiate protective provisions around earnouts, ensure reasonable achievement benchmarks, and structure deals to minimize your downside risk while preserving upside potential.

When you work with an M&A advisor like Aaron Solganick, they’ll understand what is driving you to sell, including whether you want to make a complete exit or maintain some equity. They’ll understand what sale price you need, what your exit timeline looks like, and what you want for your company after your exit.

All of those goals go into navigating negotiations and deal structures.

At Axial, we’ve developed a data-driven approach to matching SaaS business owners with M&A advisors who have relevant experience and proven track records in the software industry.

Rather than providing generic referrals, we analyze each advisor’s transaction history within our network to understand their specific expertise. For SaaS businesses, this means identifying advisors who understand software industry valuations, have experience with SaaS-specific due diligence requirements, and maintain relationships with buyers who actively acquire software companies.

We examine factors like the advisor’s experience with businesses of your size, their familiarity with your technology stack or market vertical, and their success rate in closing SaaS transactions at competitive valuations.

Our evaluation process considers three critical factors:

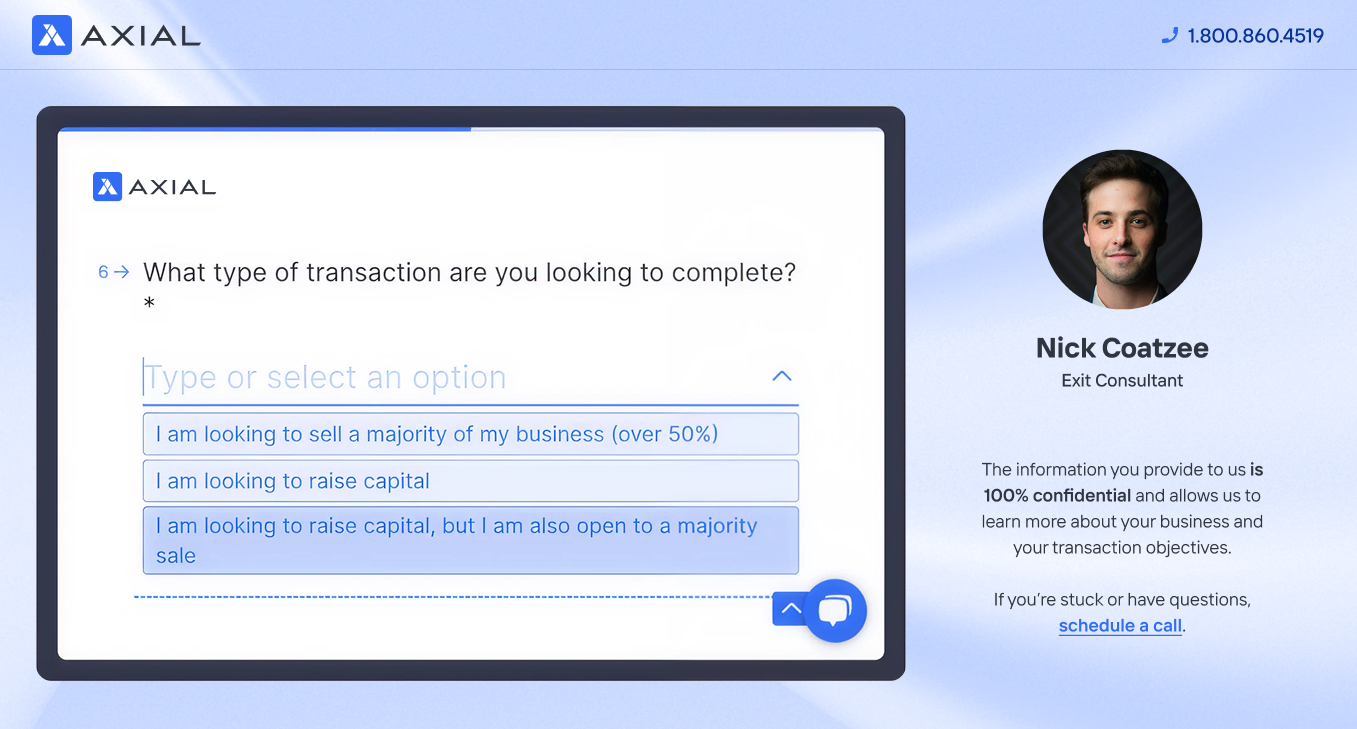

We start by pairing you with an Exit Consultant who understands your business and exit goals. Your consultant will leverage Axial’s network of over 2,000 M&A advisors to create a shortlist of 3-5 candidates who are specifically qualified to handle your SaaS business sale.

Each advisor on your shortlist will have demonstrated expertise in SaaS transactions, proven ability to generate competitive interest, and strong professional reputation within our network. We provide detailed insights about each candidate to help you evaluate your options and prepare for advisor interviews.

Our Exit Consultants have successfully connected SaaS owners with advisors who specialize in understanding software industry dynamics, including the shift toward private equity interest in the sector and the growing demand from strategic buyers seeking to expand their technology capabilities.

Schedule your free Exit Consultation today.

As a business owner, one of the most impactful things you can do to ensure a smooth exit is to prepare your business. At Axial, we surveyed M&A advisors and investment banks and asked them what could derail a deal; some of the most frequently cited reasons were unrealistic expectations from the owner and a lack of exit preparation.

Most SaaS companies benefit from 6–12 months of preparation before going to market. During that exit preparation, you can:

If you’re ready to get your company accurately valued and work towards going to market, we can help you by pairing you with the right M&A advisor. Schedule your free Exit Consultation today.

SaaS businesses are typically valued using different methods than traditional companies, with a heavy emphasis on recurring revenue metrics and growth potential.

The most common valuation method for SaaS businesses uses multiples of Annual Recurring Revenue (ARR). Current market multiples typically range from 3-8x ARR, although exceptional businesses with strong growth and profitability can command higher multiples.

The specific multiple your business achieves depends on several factors:

M&A advisors will use comparable company analysis and precedent transaction analysis to better understand the value of your company within the context of the current market.

You can learn more about valuation in our posts on:

The more KPIs and financial data you have at your disposal, the more accurate your valuation will reflect your SaaS company’s value.

Before engaging buyers, focus on optimizing the metrics that drive valuation:

Plus, having a thorough exit preparation and clean financials go a long way in helping maximize the value of your company. Aaron Solganick of Solganick & Co. says:

“If your company is still using simple accounting systems like QuickBooks, I’d generally recommend that you implement a more robust system that can correctly report KPIs and operating metrics. That data is key in helping a buyer see your value.”

According to Bain & Company, the Rule of 40 is a significant metric that originated in Silicon Valley. It suggests that if a SaaS company’s revenue growth rate plus its EBITDA margin equals or exceeds 40%, it will typically receive a market or above-market valuation multiple.

For example, a company might be “growing 40% year-over-year or greater” with break-even profitability, or it might have “20% growth revenues and 20% EBITDA margins.” This rule applies to ARR and earnings, helping buyers quickly assess whether a SaaS business represents good value.

Companies that exceed the Rule of 40 threshold demonstrate they can balance growth and profitability effectively, making them attractive acquisition targets.

When you want to sell your SaaS business, you’ll want to work with an M&A advisor — like Aaron Solganick of Solganick & Co. — who can better help you understand if now is the right time to sell.

If it’s the right time, you can start the M&A process, which includes:

At Axial, we can connect you with M&A advisors who specialize in SaaS transactions and have proven track records of successfully closing software business sales. Our Exit Consultants will help you find the right advisor match for your specific business and exit goals.