The Advisor Finder Report: Q3 2025

Welcome to the Q3 2025 issue of The Advisor Finder Report, a quarterly publication that surfaces the activity occurring on…

For most HVAC business owners, selling their company is the most significant financial transaction of their lives. If done correctly, it can set the stage for what’s next — whether retirement or a new venture — while protecting the legacy they’ve worked hard to build.

But selling a business is challenging. Owners often face long exit timelines, stalled negotiations, and valuation misalignments, causing deals to fall through or owners accepting terms that don’t meet expectations.

Recent research shows that about 52% of HVAC companies that go to market don’t sell. For those that do, working with an M&A advisory firm is linked to higher valuations and larger cash payouts.

At Axial, we have over 14 years of experience in mergers and acquisitions. Within our network, we have data from over 3,000 M&A advisors and investment banks, including deals they’ve closed for HVAC companies. For example, an advisor from our network helped Core Mechanical, an HVAC company in Chicago, get acquired by Amalgam Capital.

Using this experience, we put together this in-depth guide to help you achieve your ideal exit — that means getting the sale price you want, the exit timeline that works for you, and finding a good steward for your business.

Table of Contents

Throughout this section, we’ll break down a four-step process for selling your HVAC business:

Keep in mind that the specific things you do for each step will depend on your business and your exit goals.

For example, if you’re looking to maximize your sale price, you may spend more time optimizing customer contracts and ensuring that your infrastructure is built to scale. But if you’re on a fast exit timeline and want to sell your business as quickly as possible (even if it means getting a lower valuation), you can work with your M&A advisor to demonstrate how a buyer can increase value once they own the business — without implementing the changes yourself.

The first thing you need to know is your exit goals — that is, what do you want to achieve with this sale? While it may sound obvious, investment banks and M&A advisors cite not knowing exit goals as a main reason why deals fall through. Without them, it’s difficult to come up with an exit strategy and determine if you’re getting a good deal.

Your exit goals are made up of your ideal sale price, exit timeline, and what you want to happen to your business and its employees after your exit. Articulating these goals while looping in family and loved ones in the discussion can help solidify your commitment to sell.

Ask yourself questions such as:

You also want to know how to prioritize each of these. For example, if the main motivation for selling your HVAC business is to fund your retirement, then you may be willing to sacrifice on stewardship if it means getting a more competitive price. Or, if your main motivation is stewardship — keeping your brand and legacy intact — then you may be willing to accept a lower valuation in exchange for higher levels of stewardship. Knowing your goals and how to prioritize them will help you make more strategic moves up to and during negotiations.

The other key part of exit preparation is preparing your business for due diligence. Due diligence is when an interested buyer looks at your financials and operations to clearly understand your company’s value. The better prepared you are, the less likely there’ll be a valuation misalignment, stalled deal, or a deal that goes completely off the rails.

Verify That Your Financials Are Buyer-Ready

When evaluating your business, buyers will look closely at your financials to ascertain your HVAC company’s value. To help reduce the risks of misunderstanding or valuation misalignments, you should:

For most HVAC companies, conducting a third-party Quality of Earnings (QofE) assessment is a great way to validate your financials, identify issues to resolve, and expedite due diligence for a smoother sale.

Prepare All Relevant Legal Documents

You want comprehensive documentation of all legal documents, including:

Plus, you want to be transparent about any litigation, even if it happened in the past. This includes settlement agreements, court judgments, claims history, and documentation of compliance with any court orders. Also include records of any OSHA violations, warranty claims, or customer disputes that resulted in legal action.

Remove Operational Gaps and Key Person Dependencies

One of the most impactful things you can do as you’re preparing to sell is to make yourself redundant as the business owner.

You likely wear many hats at your HVAC company. But that creates a talent gap when you leave the business. You want to hand over any responsibilities you handle to other employees. Otherwise, potential buyers will lower their valuation to account for the fact that they’re going to have to hire/train employees to take over the roles you filled.

Often, business processes grow organically within an HVAC company. Your technicians learn what to do during installation and service calls, and your office staff knows how to handle scheduling and invoicing. And you, as the owner, hold a lot of the missing pieces together to make the operation run smoothly.

A good way to mitigate key person dependencies is to have standard operating procedures (SOP) in place. When done right, SOPs will address granular processes like installing systems, performing maintenance checks, and handling service emergencies — breaking each process into individual steps with consideration for variations. This helps ensure business continuity after your exit and maximizes your company’s value during sale negotiations.

Optimize Your Customer Contracts to Show Reliable, Recurring Revenue

Customer contracts are a great way to show value to potential buyers. But often, business owners don’t see their contracts through the eyes of a buyer. Buyers may offer a lower valuation if you have high customer concentration or if your contracts are set to expire in the near future. Buyers want to see predictable, recurring revenue.

To put your best foot forward in a sale, demonstrate a diverse portfolio of agreements, including residential tune-up plans, commercial preventative maintenance contracts, and multi-year service agreements with varied expiration dates to minimize renewal risk.

HVAC service maintenance agreements are the lifeblood of an HVAC business, as they bring in predictable cash flow and generate additional “pull-through” service work through established customer relationships.Unlike one-off service calls and equipment replacements, maintenance agreements create recurring revenue, exactly what sophisticated buyers with investment capital are seeking when acquiring HVAC companies.

Current valuation research shows HVAC companies with stable revenue streams through long-term or recurring contracts can achieve significantly higher multiples, often 20% above pre-pandemic numbers.

However, there will be times when you can’t reduce customer concentration or renew contracts before your exit. If that’s the case, here’s how you can demonstrate long-term value:

An M&A advisor will help you determine which strategies work best for your ideal exit.

If you want to learn more about exit preparation, you can read our posts on:

After you’ve prepared for your exit, you want to value your business. It’s here that you’ll engage an M&A advisor. They will have the experience needed to help you accurately value your business, and navigate the rest of the exit process — from buyer targeting to negotiations and closing the deal.

Plus, M&A advisors will help you understand the factors driving your valuation and how different buyers will value your HVAC company.

Keep in mind that this initial valuation range serves as a starting point for eventual pricing negotiations with interested buyers. The final price paid for your business will often differ from this initial valuation. Factors like market conditions, the deal structure (e.g., less cash upfront in exchange for a higher offer), and whether you’re retaining any ownership stake in the business (either yourself or your employees) will all play a role in determining the final price.

As we cover below, buyer demand is currently trending higher year over year in the HVAC industry, which means you could potentially expect a higher valuation.

Generally speaking, an M&A advisor will use several valuation methods to arrive at the most accurate valuation range for your HVAC business. These include:

1. Discounted Cash Flow (DCF) Analysis

This method estimates the value of your HVAC business based on projected future cash flows, accounting for the unique seasonal patterns typical in heating and cooling operations. HVAC companies face distinct financial challenges, with 40% citing cash flow management as their top concern due to the seasonal nature of demand: heavy in summer and winter, light in spring and fall.

Your M&A advisor can determine appropriate growth and discount rates based on their experience with recent HVAC acquisitions. To provide a more accurate valuation that reflects your true HVAC business value, your advisor will incorporate industry-specific factors, such as:

2. Comparable Company Analysis

This analysis benchmarks your company’s valuation against similar businesses in the HVAC industry, considering factors like size, growth, geography, capital structure (including debt levels), and lifecycle stage.

For small businesses, this can be challenging, as valuation data is more readily available for larger, publicly traded companies. To ensure a meaningful comparison, your advisor will carefully select the right set of comparables and adjust for size differences.

3. Precedent Transaction Analysis

This method estimates the value of your business based on the purchase prices of similar, recently closed deals, which may include transactions your advisor has facilitated for other HVAC owners.

However, gathering this information for small businesses can be difficult, as transaction details are often private. Transaction dates are also important, as outdated deals may not reflect current market conditions. By working with an advisor who has insider knowledge of past transactions, you can effectively use recent deal data to refine your valuation.

Using these methods, your advisor can arrive at an accurate valuation range for your HVAC business, providing a clearer understanding of what your business could realistically sell for.

Typically, your company’s value is shared with buyers as a multiple of earnings. This will be either an EBITDA multiple or, for smaller HVAC companies, a multiple of their SDE (seller’s discretionary earnings).

EBITDA represents your earnings before interest, taxes, depreciation, and amortization. This metric offers potential buyers a clear snapshot of your business’s core profitability, free from the effects of taxes, financing, and non-operational factors. EBITDA helps buyers gauge cash flow, assess whether your company is suitable for a debt-financed transaction, and compare it more easily to other businesses.

Your EBITDA multiple represents how many times your business earnings are multiplied to determine its total value. While EBITDA gives you an earnings figure in isolation, your business is also influenced by industry-specific factors like other companies’ valuations and buyer demand. That’s where your EBITDA multiple comes into play, helping put your earnings into context.

For example, when valuing your business using the three methods discussed above, you might see a breakdown like this:

This represents the EBITDA multiple range for your business, indicating you can expect a sale price between 3.5x and 5x your EBITDA.

For HVAC companies, transaction multiples in recent years have ranged from 2.08x to as high as 15.08x.

Below is a breakdown of median multiples and ranges by business size:

Your M&A advisor is going to conduct your valuation, but they’re also going to contextualize what is going into your valuation.

Below we have a list of common factors relevant to HVAC businesses. You can see how the factor can drive a valuation higher or lower.

When working towards a sale, keep your exit goals in mind and consider making operational changes to help achieve those goals.

This is when an M&A advisor is invaluable. They have a much clearer understanding of what buyers will pay for a business like yours and how to potentially increase your value without significantly altering your business. For example, you may have a high valuation in mind due to what you view as reliable recurring revenue from three high-paying accounts. But to a buyer, that high customer concentration signals concern — if they lose one of those three accounts, they’re losing a bulk of their value.

If you can’t easily lower customer concentration, an M&A advisor can look at your business and identify other factors of high value, like strong profit margins, how many years those three accounts have been with your HVAC company, your growing geographic market, and your streamlined operations that make it easy to take on new customers. They’ll craft a narrative around these factors to better explain to buyers how the risk of losing a customer is minimal and the opportunity for growth is high.

Ultimately, what your business is worth is what someone is willing to pay for it. To better gauge this, you can look at buyer demand. And with an increase in buyer demand, you can potentially see higher valuations.

This is great news for HVAC companies. Based on our internal data, buyer demand for HVAC companies has surged, with a 550% increase in our network of buyers between 2020 and 2023. Until 2023, boutique investment firms, including independent sponsors and search funds, dominated the buyer landscape. Starting in 2024, private equity firms began to target HVAC deals, further driving up buyer demand. Private equity firms accounted for just 8% of HVAC deals within Axial in 2023, but that number rose to 23% by 2024.

So far, what we’ve looked at is mostly preparation work before going to market. You’ve set goals, verified financials, streamlined operations, and prepared for due diligence. Alongside your M&A advisor, you’ve accurately valued your business based on market trends and industry comparables.

Now you want to target enough qualified buyers to help increase the chances of achieving your ideal exit.

When you work with an M&A advisor we’ve recommended from our network, you’re partnering with someone who has a relevant, ready-to-go network of interested buyers. That helps increase buyer coverage for your business.

Your advisor will target two main types of buyers:

Strategic Buyers

Strategic buyers acquire and absorb HVAC companies to grow their businesses. They might be your firm’s competitor, supplier, or customer; they might be looking to expand in your service area or diversify their revenue streams. For example:

Strategic buyers often pay more for an HVAC business, making this type of buyer a strong option if your goal is to maximize the sale price.

Although strategic buyers may offer more cash upfront, they cut parts of the business they can’t use. This means premium sale prices can come at the cost of losing all your equity in the business you’ve built.

Here’s the most critical part: most of the time, your business is fully absorbed when you sell to a strategic buyer. Your HVAC brand and company will likely cease to exist.

Financial Buyers

Financial buyers identify and acquire HVAC companies with attractive growth opportunities to realize a return on their investment. Private equity firms have been particularly active in the HVAC sector, with add-on acquisitions accounting for the second largest share (21.9%) of deal activity in the industry. These buyers can include private equity firms, family offices, independent sponsors, holding companies, search funds, or individual investors.

Financial buyers are predominantly focused on cash flow and are often a good fit for HVAC sellers who want a strong sale price while also finding a trusted steward for their business. They’re attracted to the HVAC services sector because of its recession-resistant nature, as demand for heating and cooling services remains steady even during economic downturns. They focus on understanding how quickly and how much they can increase the long-term value of an HVAC business, but they generally do not aim to integrate it into a larger company.

Given this distinction between strategic and financial buyers, it’s crucial for HVAC business owners to have a clear answer to the question of “money vs. legacy” for their sale. There are also countless other factors to consider when thinking about who your ideal buyer is.

If you want to learn more about buyer targeting, we recommend our posts on:

As buyers express interest, your advisor will continually assess them against your criteria. This means figuring out if:

Your advisor is skilled at disqualifying “tire kickers” who aren’t genuinely interested (or capable) of acquiring your business.

When you find a buyer who’s a good fit for your exit, then you’ll execute a Letter of Intent (LOI). This is your buyer’s intent to buy, and it means your business is technically off market for a set time (usually 90 days). This gives the buyer time to perform due diligence and make an official offer, if everything passes their review.

As you go through negotiations, it’s important to remember the motivations for selling that you outlined in step one of your small business exit strategy. The final sale price is not just a number; it also reflects what you want to leave behind and what’s needed to fund the next stage of your personal life — whether it’s a new investment, retirement, or securing your children’s education.

Your advisor will guide you through the final decision-making process and help you structure the deal to meet your post-exit goals.

For example, a buyer might offer a smaller upfront cash payout or a larger payout spread over several years, contingent on meeting performance milestones. Earnouts are common in middle-market HVAC transactions, although they generally represent a small percentage of the purchase price — usually 10% to 15%. This allows the buyer to hedge their risk by paying less at closing while rewarding you if operations continue as planned. In the HVAC industry, earnouts are often tied to customer retention rates, service contract renewals, or seasonal performance metrics.

An experienced advisor can help you objectively evaluate these offers, leveraging their knowledge of your HVAC business and the current market to determine the best deal structure for you.

Throughout this post, we broke down the 4 steps of selling your HVAC business, from exit preparation to structuring and closing the deal. We looked at how an M&A advisor plays a critical role in helping you achieve your ideal exit.

M&A advisors can:

But these benefits depend on working with the right M&A advisor. At Axial, we specialize in helping small-to-midsize business owners find the best advisor who can bring them these results.

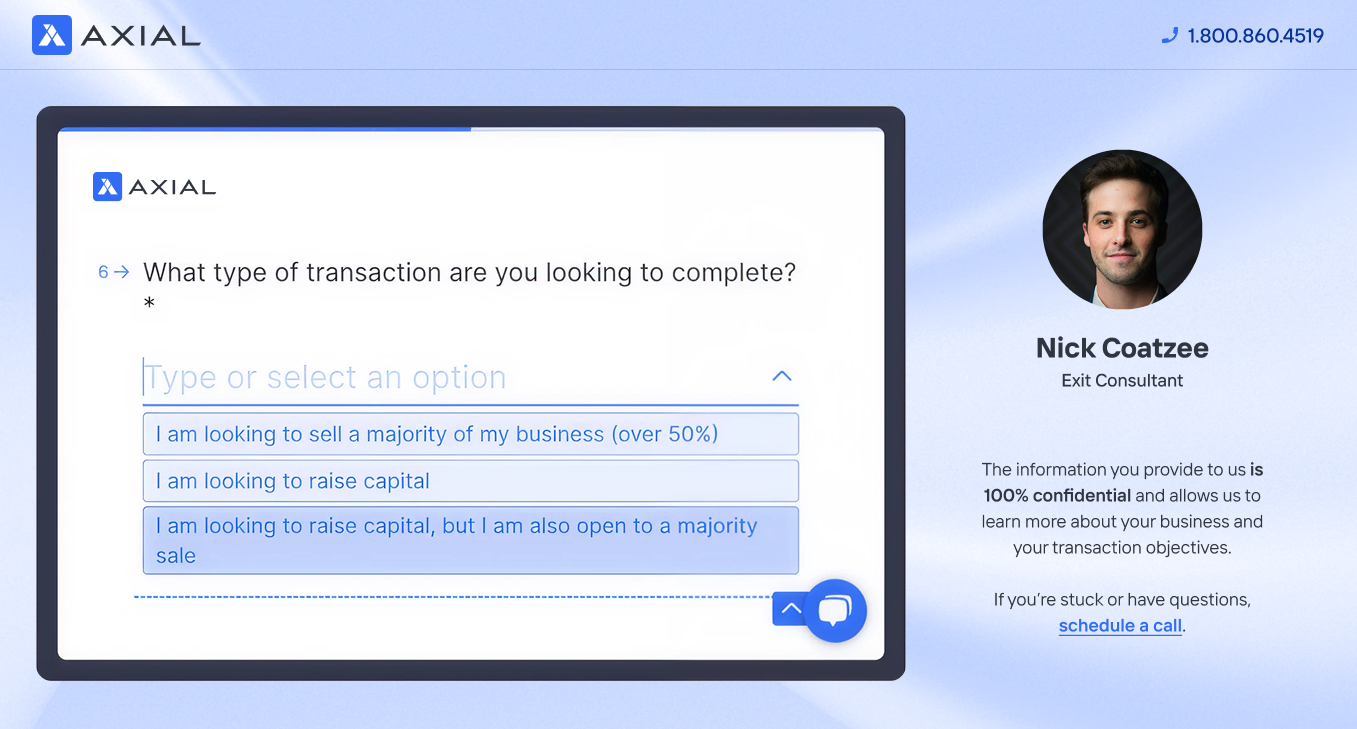

We start by pairing you with an Exit Consultant who gets to know your business and your exit goals.

Your Exit Consultant will leverage Axial’s network of 3,000+ M&A advisors to create a shortlist of candidates with:

We’ll send you a curated list of 3–5 qualified HVAC industry advisors, complete with detailed insights to help you evaluate your options and resources to prepare for meetings with your candidates.

Schedule your free exit consultation today.

At Axial, we offer several resources for small business owners looking to sell their company, learn more about the M&A process, and better understand the value of their business.

Here are just some of the resources that can be helpful to you:

These are just a few of the resources we’ve created for business owners. You can find more here.

The amount you can sell your heating and air conditioning business for will depend significantly on several factors, including your financial records, customer concentration, geographic location, and much more.

To figure out a rough estimate of how much your HVAC business is worth, you can use Axial’s free business valuation calculator. This calculator uses an industry-specific DCF methodology to give you a valuation range.

When selling a small HVAC business, you want to:

No matter the size of your business, it makes sense to partner with a business broker or M&A advisor to sell your company. Learn more here about why we recommend you partner with an M&A advisor, especially for companies with $1 million or more in EBITDA.

We can look at transaction multiples in recent years to gauge the estimated value of HVAC companies.

This data is pulled directly from Axial’s network of buyers and business owners. Transaction multiples have ranged from 2.08x to as high as 15.08x. Below is a breakdown of median multiples and ranges by business size:

It’s very difficult to sell an HVAC business, especially if you’re managing the sale yourself as a business owner.

Data shows that about 52% of HVAC companies that go to market do not sell. This is due to several reasons, including a lack of exit planning and unrealistic expectations.

To increase your chances of selling your HVAC business and getting a premium price for your company, you can partner with an M&A advisor. At Axial, we can help you find an M&A advisor with experience in closing HVAC deals.