Small Business Exits: M&A closed deal data from June

Welcome to the June edition of Small Business Exits, the monthly publication featuring fully anonymized deal data from a selection…

Click here to subscribe to Exit-Ready – the Axial newsletter that distills the best content, tips, and guides designed to educate exit-minded business owners running $5-$100M businesses.

It comes as no surprise that nearly all buyers will complete a Quality of Earning (QofE) analysis prior to a purchase to ensure that the financial information provided is trustworthy and reflective of the company’s true financial performance. But should buyers be the only side of the transaction concerned with QofE?

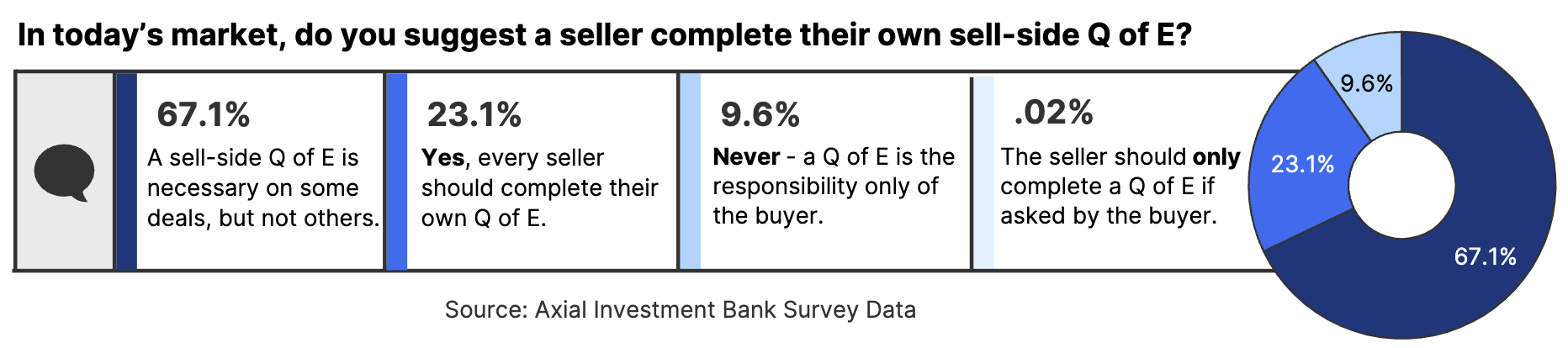

When we surveyed our Investment Banking members on the topic of Exit-Preparation, only 9.6% of respondents indicated that Quality of Earnings is strictly the responsibility of the buyer, while 23.1% had the opposite thought, recommending that sellers always complete QofE.

With the majority (67.1%) viewing the need for sell-side QoE on a deal-by-deal basis, we thought it would be valuable to dig deeper into the benefits.

We’re pleased to share more information on this topic from FOCUS Investment Banking, an Axial member since 2010 and an Axial sell-side partner since March of 2021.

Check Out FOCUS Investment Banking’s Axial Profile Here

by Mark McCraw

When a business owner is pursuing a sale, there are many elements out of his or her control. Going to market with credible and reliable financials doesn’t have to be one of them. Often a seller chooses to not have a sell-side quality of earnings report prepared to save money, only to have it backfire. The result? The buyer negotiates critical price reductions after finding issues in the internal financial statements.

At a base level, buyers want to get as much comfort from the financials before submitting an offer and closing the transaction. Usually, with larger companies, that comfort or assurance comes from audited financial statements. However, in the lower middle market (company value from $10mm-$250mm), most business owners do not get an audit prepared because of cost. That is where a Quality of Earnings report comes into play. When a seller conducts a Quality of Earnings analysis, the upfront investment, which is lower than the cost of an audit, can yield significant returns, including a higher valuation and a smoother transaction process.

A Quality of Earnings, or QofE, report is a key part of the M&A process with buyers. In a typical scenario, a third-party accounting firm conducts an analysis and review of a seller’s financials to validate the quality of earnings i.e., how sustainable are the company’s revenues and do underlying assumptions support projections. While buyers have used a Quality of Earnings process for decades, it is increasingly becoming a best practice for sellers before they go to market. During the sell-side QofE process, which typically takes a few weeks, the QofE team will review the selling company’s key metrics and processes including historical revenues, forward projections, accounting policies, supply chain management, financial reporting, and other important items. If an issue surfaces, the seller can take time to correct the problem before going to market, or at least disclose it during due diligence.

A seller that conducts a QofE can often experience a higher valuation. M&A valuations are based on a multiple of earnings, and the higher the earnings, the higher the value. When a QofE team reviews a company’s financials, part of the process includes uncovering expense adjustments. These adjustments are expenses that should not count against future earnings; examples could be one-time legal fees, costs associated with switching contract manufacturers, or personal expenses running through the business. A QofE team will work with the seller to identify and verify expense adjustments to EBITDA, which often can boost a company’s profitability and in turn, support a higher valuation. Another critical result of the QofE process includes identification of errors in the financials and management. With knowledge of such errors, a seller’s CPA and Investment Banker can be in front of potential issues that a buyer may raise.

A sell-side QofE can also help expedite due diligence. When a seller undergoes a QofE, many of the documents and supporting data required also apply to a buyer’s diligence process. Having materials that are readily available, and having a seller who understands what the materials say about the company, gives a buyer confidence in the numbers and reduces potential obstacles. More time in diligence runs the risk of a deal falling apart. When a seller can hand off a QofE at the beginning of diligence, it can help expedite a deal closing.

A sell-side QofE signals to a buyer that the seller has credible financials and is prepared for a sale — qualities that support a clean and easier transaction process. Working with an outside team to thoroughly review the numbers and incorporate adjustments paints a clear picture of a company’s financials, most importantly its profitability. A thorough sell-side Quality of Earnings can help support a higher valuation (which may amount to millions of additional dollars going to the seller), favorable terms, and a smoother transaction process.

Approaching a Live Transaction?