The Winning M&A Advisor [Volume 1, Issue 9]

Welcome to the latest issue of The Winning M&A Advisor, the Axial publication that anonymously unpacks data, fees, and terms…

Tags

When you’re considering selling your SaaS business, one of the first things you must do is to get a valuation. Once you know what your business is worth, you can decide if it’s the right time to sell.

Your valuation range defines the type of exit you can achieve, including sale price, exit timeline, equity, and stewardship. If this doesn’t align with your goals, you can work on maximizing value by focusing on key SaaS metrics.

In this post, we look at:

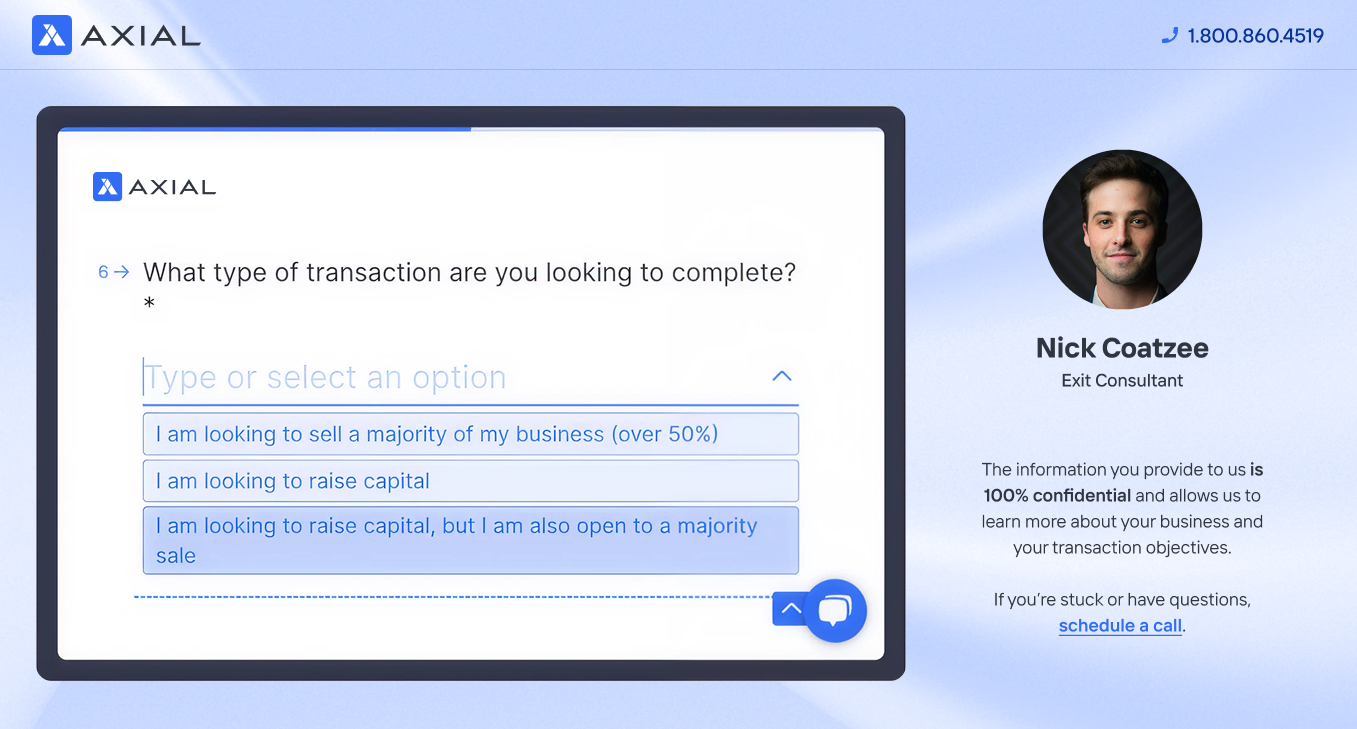

| Are you ready to sell your SaaS business? The next step is finding an M&A advisor who can help take your business to market and secure a premium offer. At Axial, we’ll connect you with the right M&A advisor — one experienced in selling businesses like yours. Schedule your free exit consultation today. |

When discussing the valuation range of your SaaS business, you’re essentially speaking to how buyers will perceive your KPIs and financial information under current market conditions. There are several variables to consider, including company size, business type, and buyer demand.

As Aaron Solganick, CEO of Solganick & Co., a data-driven investment bank focused exclusively on software and IT service companies, explains: “If a company gives me their ARR, gross margin, and EBITDA, I can give them a rough estimate. But you want a specific and accurate multiple. The more KPIs and the more financial data I have to work with, the more accurate your valuation will be.”

For example, in 2025, Solganick has been seeing multiples ranging from “3x-5x ARR for smaller SaaS companies to 10–15x for large companies that are showing consistent growth.” That’s a wide multiple range, and whether your company is going for 3x or 5x its ARR will likely determine whether or not you want to sell your business now.

The more KPIs and financial data you have at your disposal, the more accurate the valuation will reflect your SaaS company’s value.

Here are the key SaaS metrics that will determine your company’s valuation range:

Buyers scrutinize this ratio because it tells them whether pumping more money into your customer acquisition will generate profits or losses. If your acquisition costs are too high relative to what customers actually pay you, it means growth will burn cash rather than create value. According to Phoenix Strategy Group, achieving a ratio between 3:1 and 4:1 is often seen as the ideal balance for achieving growth while staying profitable.

According to Software Equity Group, as of Q4 2023, businesses with gross margins in the 70–80% range had a median EV/TTM Revenue multiple of 5.9x, while those with gross margins above 80% achieved a median multiple of 6.9x.

The Rule of 40 helps investors distinguish between SaaS companies that are growing sustainably versus those burning cash recklessly in pursuit of growth.

To apply the rule of 40, you combine your revenue growth rate plus your EBITDA margin. If the sum equals or exceeds 40%, it typically commands a market or above-market valuation multiple. For example, a company growing 30% annually with 15% EBITDA margins would score 45% on the Rule of 40.

McKinsey research shows that investors reward companies at or above the Rule of 40 with consistently higher enterprise value to revenue multiples, with top-quartile SaaS companies generating nearly three times the multiples of bottom-quartile performers.

The beauty of this metric is that it recognizes the fundamental trade-off in SaaS: you can either grow fast or be profitable, but doing both simultaneously is difficult. As long as your combined score hits 40%, buyers and investors view your business as healthy and scalable.

We recommend getting valuations done early and often — before you have a concrete plan for selling your business. By knowing your valuation, you can make strategic decisions about your company.

For example, what do you do if your valuation range isn’t what you wanted?

If your valuation range is too low, there are ways to maximize the value of your SaaS company. The specific ways will vary based on your business and the kind of buyer you’re targeting, but focusing on these 6 key metrics will help you maximize the value of your business.

The issue: When SaaS businesses struggle with churn, it can show buyers unpredictable revenue and growth. This will lead to lower valuations and less attractive deal structures, where a good chunk of your sale price is tied to earnouts.

Target benchmark: Aim for monthly churn rates below 2% for B2B SaaS or annual churn below 10%. These levels demonstrate strong product-market fit and predictable revenue to buyers.

The impact of this metric: A study on SaaS valuations published by OPEXEngine showed that “a 1 percent difference in churn can have a 12 percent impact on company valuation in 5 years.” Even a reduction of 3% to 2% monthly churn can translate into 9% less ARR churn in 12 months.

Tips to reduce churn:

The issue: If your SaaS company is spending too much to acquire customers who don’t generate sufficient lifetime value, then buyers are unlikely to want to invest money in your business, as they’ll see little to no ROI.

Target benchmark: Achieve an LTV:CAC ratio of at least 3:1, with best-in-class companies reaching 4:1 or higher. As mentioned above, the Phoenix Strategy Group reports that “a ratio between 3:1 and 4:1 is often seen as the ideal balance for achieving growth while staying profitable.”

The impact of this metric: This ratio tells buyers whether investing more money into your customer acquisition will generate profits or losses. A strong ratio demonstrates scalable, efficient growth that investors want to fund.

Tips to optimize your LTV:CAC ratio:

The issue: Many SaaS companies, especially smaller ones, operate with gross margins in the 60–70% range due to inefficient operations and technology costs.

Target benchmark: According to multiple industry sources, SaaS businesses should typically maintain gross margins above 75%, with best-in-class companies exceeding 85%.

The impact of this metric: Improved gross margins can lead to higher multiples. According to Software Equity Group, as of Q4 2023, businesses with gross margins in the 70–80% range had a median EV/TTM Revenue multiple of 5.9x, while those with gross margins above 80% achieved a median multiple of 6.9x.

Tips to improve gross margins:

The issue: Some enterprise SaaS companies, particularly in early stages, rely too heavily on a small number of large customers for revenue. But this shows risk for buyers. Let’s say your biggest customer represents 15–20% of your ARR. The risk of losing that customer can create significant valuation concerns for buyers who worry about the sustainability of your business model.

Target benchmark: While your target benchmark will depend on your business, your industry, and your exit goals, a good rule of thumb is that no single customer should represent more than 10% of your revenue. Further, according to MetricHQ, your top 5 customers should account for no more than 25% of total revenue. Forbes and other industry sources consistently recommend the “10% rule” as the standard benchmark.

The impact of this metric: High customer concentration creates significant risk that buyers factor into valuations through lower multiples or earnout structures. In the SaaS metric school podcast, Ben Murray discusses how “high concentration can lower a company’s valuation” and “scare off private equity buyers.”

Tips to reduce customer concentration:

The issue: If you’re still using basic accounting systems like QuickBooks, you can’t provide the detailed metrics and reporting that sophisticated buyers need to value your business accurately.

Target benchmark: Have clean, auditable financials with accurate SaaS metrics reporting that can withstand due diligence from sophisticated buyers.

The impact of this metric: Aaron Solganick told us, “If your company is still using simple accounting systems like QuickBooks, I’d generally recommend that you implement a more robust system that can correctly report KPIs and operating metrics. That data is key in helping a buyer see your value.”

Tips for improving your financials and reporting:

The issue: You may get lower valuations if you’re experiencing erratic growth patterns that make it difficult for buyers to predict future performance

Target benchmark: Show consistent month-over-month MRR growth with predictable seasonality patterns. According to SaaS Capital’s 2025 survey, “The median growth rate for all companies in the survey registered 25%.” But keep in mind that predictability and consistency matter as much as the number itself.

The impact of this metric: Buyers value predictable revenue streams significantly higher than volatile ones. McKinsey research shows that “consistent, predictable growth patterns are more valuable than erratic high-growth periods followed by slowdowns.” This can mean higher multiples for your SaaS valuation.

Tips to demonstrate predictable revenue growth:

The six ways to maximize your business work together to create compound improvements in valuation.

As a hypothetical, we had a form-building SaaS tool business that reached out to Axial for help in finding the right M&A advisor.

If that client had been focused on improving key SaaS metrics before going to market, they may have implemented strategies that helped them:

Changes as impactful as those could increase their valuation multiple from 4.2x ARR to 6.1x ARR — a 45% increase in enterprise value.

The key is to start measuring these metrics now, establish improvement targets, and systematically work on the areas that will have the biggest impact on your specific business. Remember, buyers evaluate these metrics as a package — strong performance across multiple areas signals a well-managed, scalable business that commands premium valuations.

SaaS businesses are typically valued using different methods than traditional companies, with a heavy emphasis on recurring revenue metrics and growth potential.

The most common valuation method for SaaS businesses uses multiples of Annual Recurring Revenue (ARR). Per a report published by SaaS Capital, current market conditions show the median multiple is down roughly 60% from its peak achieved in 2021. It has recently stabilized in the 6-7x range, with high-demand sectors, like AI and cybersecurity, often seeing premium valuations.

The specific multiple your business achieves depends on several factors:

Current market conditions significantly impact valuations. Companies in high-growth areas like AI, data analytics, cybersecurity, and advanced applications are more likely to receive higher multiples due to increased buyer demand and strategic value.

M&A advisors will typically use three complementary valuation methods to triangulate an accurate and market-ready valuation range, though the emphasis varies significantly based on your SaaS company’s maturity and profitability:

While Discounted Cash Flow analysis is a fundamental valuation method, it’s typically reserved for more mature, profitable SaaS companies that generate meaningful cash flows. For high-growth SaaS businesses that reinvest heavily in growth (often resulting in minimal current cash flows), revenue multiples provide a more practical valuation framework that better reflects the subscription-based business model’s future cash generation potential.

So far, we’ve discussed how you can improve your SaaS valuation by focusing on key metrics.

But keep in mind that your valuation range is just your initial number. The offer you get will vary based on how many buyers you target, what type of buyers you offer, how performance is maintained as you try to exit your business, and how you handle negotiations.

In our experience, working with an M&A advisor with experience in selling SaaS companies like yours significantly increases the chances of getting your ideal exit. Plus, the data shows that working with an M&A advisor can lead to higher sale prices.

An advisor can help you get the exit you want by:

One of the most effective ways to maximize your sale price is through competitive bidding. Often, what happens is that you’ll receive an unsolicited offer from a buyer. But even if the offer seems fair, the truth is you don’t know if it’s a good offer or not until you’ve properly marketed your business towards a high number of qualified buyers — creating a competing bidding environment.

The problem is that as a business owner, you can’t really do this on your own. You don’t have the time or the network of buyers. That’s why at Axial, we strongly recommend that you work with advisors who have experience in selling SaaS companies like yours — because that means they have a network of buyers who are likely to be interested.

By targeting a higher number of buyers, you can create a competitive bidding process and make sure you’re taking the best deal.

For example, let’s look at a recent deal handled by Aaron Solganick’s team:

This process transformed the seller’s position from negotiating with one buyer to choosing among eight qualified options, significantly increasing leverage and final sale price.

The value of your metrics doesn’t exist in isolation — it depends on the type of buyer you’re targeting. An experienced SaaS advisor knows how to present your metrics towards what a buyer is looking for.

For example, if your business has slightly higher churn in certain customer segments, an experienced advisor might reframe this by showing how your overall LTV:CAC ratio remains strong due to higher-value customer segments. Or they might highlight how recent product improvements are already reducing churn in newer cohorts.

SaaS transactions often involve complex structures, including earnouts based on customer retention, revenue milestones, or product development goals. An experienced advisor can:

While maximizing sale price is important, experienced SaaS advisors help you evaluate the full picture of what makes an ideal exit:

The difference between a good exit and a great exit often comes down to having an experienced guide who understands both the SaaS market dynamics and your specific goals. As the data consistently shows, businesses represented by experienced M&A advisors not only sell for higher prices but are significantly more likely to complete a successful transaction.

At Axial, we’ve developed a data-driven approach to matching SaaS business owners with M&A advisors who have relevant experience and proven track records in the software industry.

At Axial, we have over 3,000 M&A advisors and investment banks within our network. Rather than providing generic referrals, we analyze each advisor’s transaction history within our network to understand their specific expertise. For SaaS businesses, this means identifying advisors who understand software industry valuations, have experience with SaaS-specific due diligence requirements, and maintain relationships with buyers who actively acquire software companies.

We examine factors like the advisor’s experience with businesses of your size, their familiarity with your technology stack or market vertical, and their success rate in closing SaaS transactions at competitive valuations.

Our evaluation process considers three critical factors:

We start by pairing you with an Exit Consultant who understands your business and exit goals. Your consultant will leverage Axial’s network of over 3,000 M&A advisors and investment banks to create a shortlist of 3-5 candidates who are specifically qualified to handle your SaaS business sale.

Each advisor on your shortlist will have demonstrated expertise in SaaS transactions, proven ability to generate competitive interest, and strong professional reputation within our network. We provide detailed insights about each candidate to help you evaluate your options and prepare for advisor interviews.

Our Exit Consultants have successfully connected SaaS owners with advisors who specialize in understanding software industry dynamics, including the shift toward private equity interest in the sector and the growing demand from strategic buyers seeking to expand their technology capabilities.

Schedule your free Exit Consultation today.

Key SaaS metrics are performance indicators that measure the health, growth, and profitability of subscription-based software businesses.

The most critical metrics include:

These metrics are essential because they help determine your company’s valuation range and attract potential buyers. As Aaron Solganick of Solganick & Co. explains, “If a company gives me their ARR, gross margin, and EBITDA, I can give them a rough estimate. But you want a specific and accurate multiple.”

The more comprehensive your KPI data, the more accurate your valuation will be, with multiples ranging from 3x-5x ARR for smaller SaaS companies to 10–15x for large companies showing consistent growth.

The 5 Pillar SaaS Metrics Framework focuses on the core areas that drive sustainable business growth and valuation. These are:

This framework helps SaaS businesses systematically improve their performance by addressing each pillar. For example, optimizing your LTV:CAC ratio addresses the acquisition pillar, while reducing churn below 2% monthly strengthens the retention pillar.

If you can present strong numbers across all five pillars, you’re putting yourself in a good position to achieve higher valuations because you’re demonstrating sustainable, efficient growth that buyers value.

The Rule of 40 is a benchmark that combines your revenue growth rate plus your EBITDA margin, with the sum ideally equaling or exceeding 40%. For example, a company growing 30% annually with 15% EBITDA margins would score 45% on the Rule of 40.

This metric helps investors distinguish between SaaS companies that are growing sustainably versus those burning cash recklessly in pursuit of growth. McKinsey research shows that investors reward companies at or above the Rule of 40 with consistently higher enterprise value to revenue multiples.

This metric acknowledges the fundamental trade-off in SaaS: you can either prioritize growth or be profitable, but doing both simultaneously is challenging. As long as your combined score hits 40%, buyers and investors view your business as healthy and scalable.

SaaS businesses are typically valued using multiples of Annual Recurring Revenue (ARR), with current market conditions showing multiples stabilized in the 6-7x range. The specific multiple depends on factors like company size, growth rate, profitability, and market position.

M&A advisors typically use three complementary methods:

For the most accurate valuation, work with an M&A advisor who has recent experience selling SaaS businesses like yours. They understand software industry dynamics and can properly position your metrics to maximize your valuation range.

For more information about valuing your company, read our guide on how to value a business for sale.