The Advisor Finder Report: Q4 2025

Welcome to the Q4 2025 issue of The Advisor Finder Report, a quarterly publication that surfaces the activity occurring on…

Tags

When you’re thinking about selling your HVAC business — whether in the immediate future or 5 years or more down the line — you want to get a valuation of your company.

An accurate valuation lets you know whether or not you can likely achieve the exit you need to finance the next stage of your life. If not, a valuation can show you where you can invest in your business to maximize its value further.

In this post, we look at two ways to value your HVAC business.

If you’re serious about selling your HVAC company, schedule a free Exit Consultation today. After we learn about your business and exit goals, we will hand-pick 3–5 of the best M&A advisors for you.

Our free business valuation calculator is designed specifically for small business owners who want a quick estimate of their company’s worth. Unlike generic online calculators, ours uses an industry-specific discounted cash flow methodology that M&A advisors trust when conducting preliminary valuations.

To use the calculator, you’ll input key metrics including:

For industry, you’re going to select Engineering/Construction to get the most accurate valuation.

Within minutes, you’ll receive a valuation range that provides a realistic starting point for understanding your business’s potential worth.

While our calculator provides a useful estimate, it’s important to recognize what it cannot capture.

Calculator-based valuations rely on standardized assumptions and industry averages, but they miss the nuance around key factors that significantly impact an HVAC business’s value. These factors include things such as:

Plus, just as critically, a valuation done by a calculator doesn’t have the experience of what businesses like yours have recently sold for. When you get a valuation, that’s your initial price point. Your actual final sale price can be different, depending on factors such as seasonal weather changes, expiring contracts, buyer demand, etc. When you work with an M&A advisor who has experience in closing HVAC deals, they’ll know first-hand what companies like yours have sold for. This lets them arrive at a more accurate valuation.

For example, Patrick Lange of BMG (who we spoke to in our post on selling HVAC companies to private equity firms) has closed 144 deals in the last 6 years. When he values an HVAC company, he relies on a comparable companies analysis, where he’s benchmarking your company’s value based on similar companies in the market. Plus, due to his experience, he has the data set necessary to make an informed valuation based on previously closed deals.

That’s the sort of nuance and industry insight that a calculator can’t tap into.

In short, think of the calculator as a helpful starting point — similar to using an online tool to estimate your home’s value before working with a real estate agent who understands your local market and property specifics.

To better understand how these preliminary estimates translate to actual market value, let’s explore the fundamentals of HVAC business valuation.

| Are you ready to sell your HVAC business? Schedule your free Exit Consultation today.

During your consultation, we’ll learn more about your business and exit goals. Then we will look over our network of over 3,000 M&A advisors and investment banks and hand-pick 3-5 of the best options for your business. These are advisors who have experience in conducting accurate valuations, creating competitive bidding processes, and closing deals in the HVAC industry. |

Generally speaking, your HVAC company’s value will be expressed as a multiple of your EBITDA.

EBITDA represents your earnings before interest, taxes, depreciation, and amortization. This metric offers potential buyers a clear snapshot of your HVAC company’s core profitability, free from the effects of taxes, financing, and accounting decisions like depreciation methods. EBITDA helps buyers gauge cash flow, assess whether your company is suitable for a debt-financed transaction, and compare it more easily to other businesses.

Your EBITDA multiple represents how many times your business’s earnings are multiplied to determine its total value. While EBITDA gives you an earnings figure in isolation, your business is also influenced by industry-specific factors like other companies’ valuations and buyer demand. That’s where your EBITDA multiple comes into play, helping put your earnings into context.

Within Axial’s platform, transaction multiples for HVAC companies have recently ranged from 2.08x to as high as 15.08x EBITDA. Here’s how median multiples break down by business size:

But figuring out the most accurate multiple for your business requires more than just plugging numbers into a formula — it’s about understanding what drives value in the HVAC industry and how buyers assess risk and opportunity when evaluating acquisition targets.

HVAC businesses have distinct characteristics that significantly impact their valuations, and understanding these factors is crucial for maximizing your company’s worth.

Below we put together a table of 15 key factors that can impact the value of your HVAC business, showing what drives a valuation higher and what drives a valuation lower.

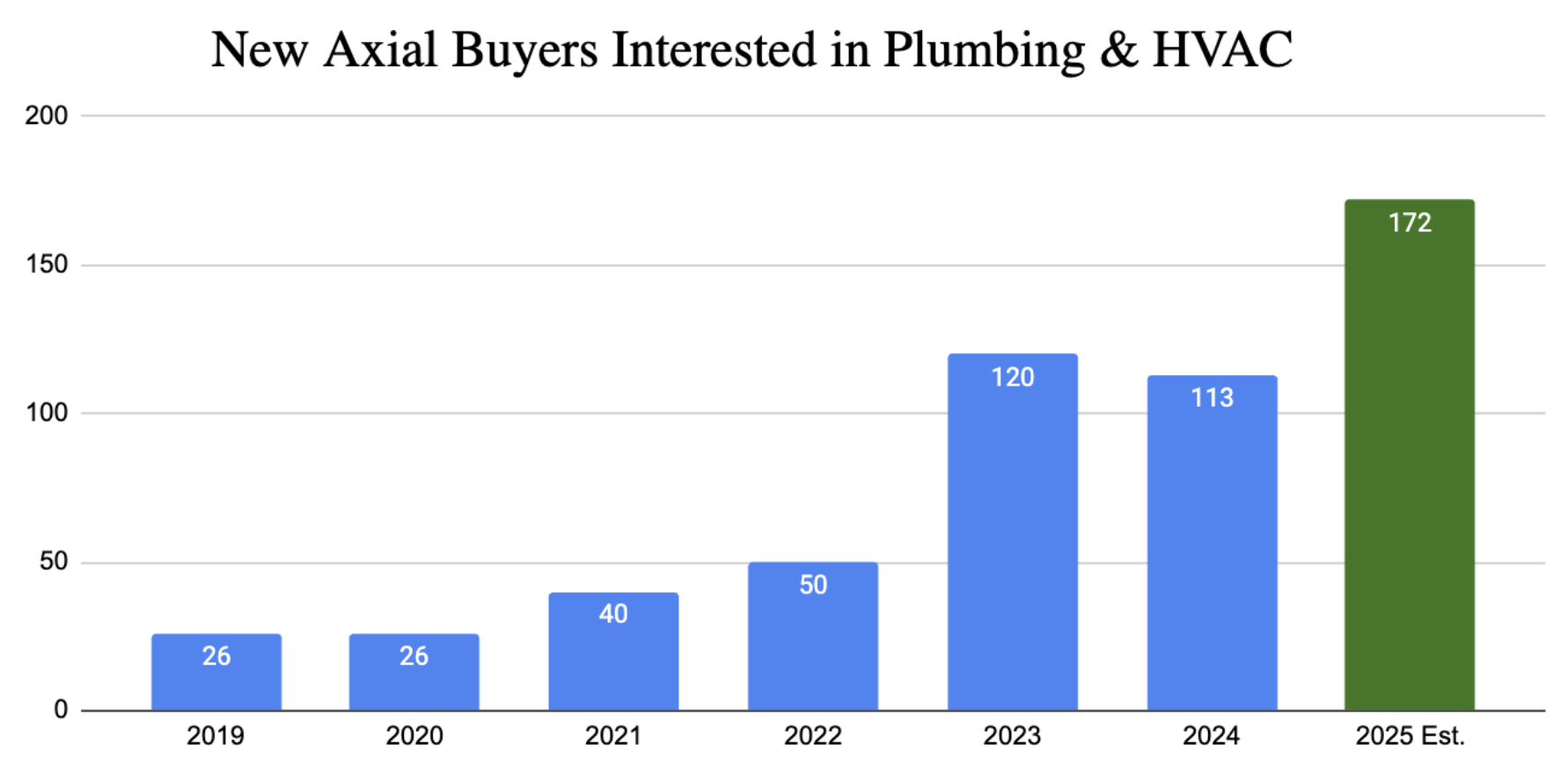

Buyer demand for HVAC companies has been increasing over the years. Within Axial’s buyer network alone, buyer demand increased by 550% between 2020 and 2023.

Part of this surge in demand was due to more private equity firms buying up HVAC companies. Until 2023, boutique investment firms, including independent sponsors and search funds, dominated the buyer landscape. However, starting in 2024, private equity firms began to target HVAC deals, because HVAC companies can provide predictable cash flows through recurring service contracts, essential services that are recession-resistant, and strong consolidation opportunities in a fragmented market.

In 2023, private equity firms accounted for just 8% of HVAC deals within Axial, but by 2024, that number rose to 23%, increasing buyer demand.

As a business owner of an HVAC company, this increase in buyer demand benefits you in two ways:

M&A advisors typically use three primary methods to value HVAC businesses, each providing a different perspective on your company’s worth:

M&A advisors will often use all three methods to triangulate an accurate valuation range, ensuring you don’t undersell or overprice your business when going to market.

If you’ve already researched ways to value your HVAC business online, you may have come across SDE (seller’s discretionary earnings).

SDE takes a business’s EBITDA and adds the owner’s salary, perks, and discretionary expenses. But this is only useful for small, owner-operated businesses because your discretionary earnings can affect profitability to a much greater extent than in a larger business.

Generally, valuations are presented as a multiple of EBITDA once a business has grown beyond $1 million in annual profits. Because at this stage, the owner’s salary, perks, and discretionary expenses are not as relatively significant compared to the business’s overall earnings, and buyers expect the business to operate with professional management structures rather than owner-dependent operations.

You can learn more about business valuation in our posts on:

If you’re considering a future sale, several strategic improvements can significantly increase your business’s value:

These four factors focus on scaling revenue, cutting costs, and positioning your business for long-term growth.

But a good exit is more than just about price. While your final sale price is important, you also want to factor in:

Below, we look at how you can increase your chances of getting an ideal exit by working with an M&A advisor with relevant and recent experience in the HVAC industry.

Above, we talked about how and why an M&A advisor can more accurately value your company. But they do more than just perform valuations. They also help manage the entire M&A process, from going to market to closing the deal, and work to help you maximize your exit outcomes.

Your exit outcomes are made up of:

Working with an M&A advisor can help you achieve your ideal exit outcomes. One key way they do this is by creating a competitive bidding process for your business.

One recent example of a successfully closed deal, represented by an M&A advisor and sold to a buyer within the Axial network, is Core Mechanical Inc., a commercial heating, ventilation, plumbing, and mechanical maintenance services business in Chicago. The owners of Core Mechanical were looking to begin their retirement process. Leading up to entering the M&A process, they had put in a strong operational leader in place, which helped increase their perceived value for buyers.

Core Mechanical partnered with Vesticor Advisors, who expanded their options by connecting them with qualified buyers across multiple networks — including our vetted buyer network on Axial.

In total, they received 375 recommended buyers via Axial, including private equity firms, independent sponsors, holding companies, family offices, corporations, and one individual investor. Together, they whittled down their buyer list based on what Core Mechanical most wanted to achieve with their exit. Six months after going to market, they executed a Letter of Intent with Amalgam Capital. The deal was finalized roughly six months later.

*Pursuit rate: This is a metric that we use at Axial that reflects the ratio of potential buyers that are engaging with a particular business relative to the overall number of buyers who were initially invited by the seller to explore the transaction.

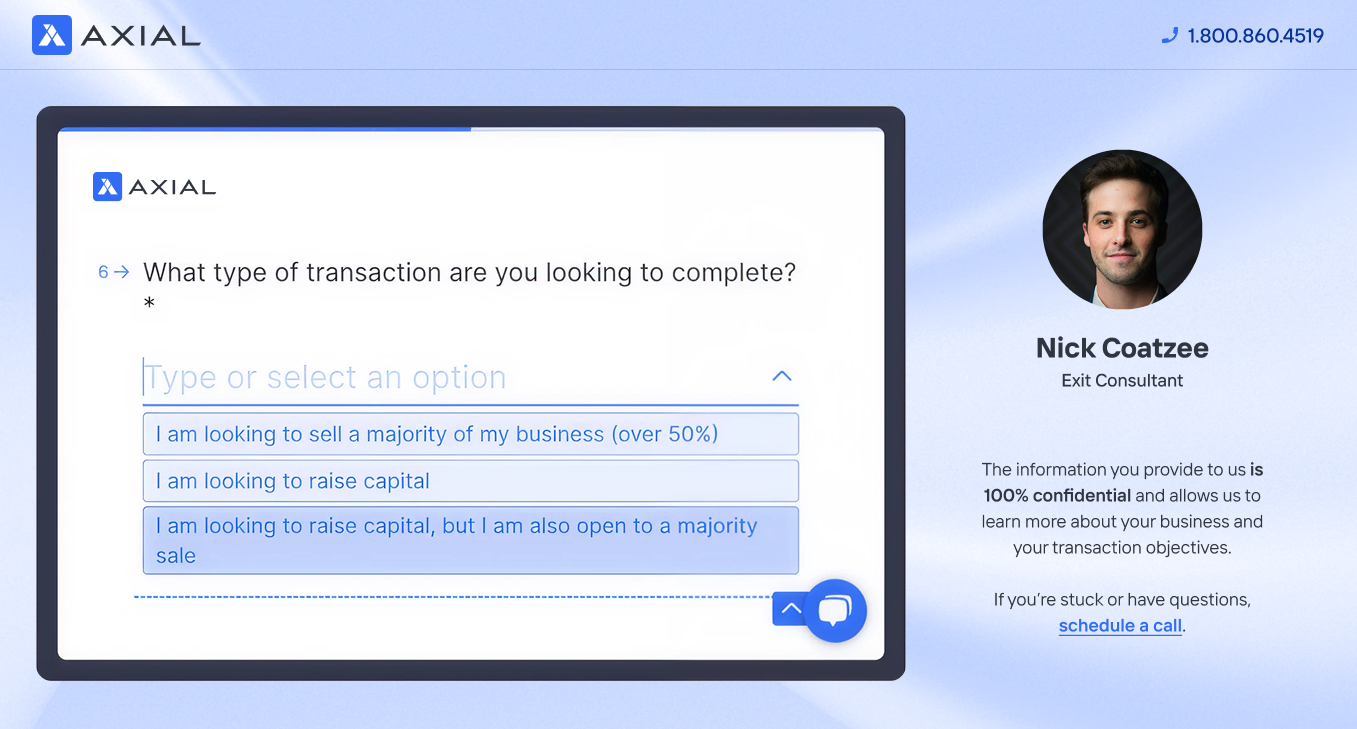

At Axial, we can pair you with M&A advisors who have recent and relevant deal experience.

First, we pair you with an Exit Consultant who gets to know your business and your exit goals.

Your Exit Consultant will leverage Axial’s network of 3,000+ M&A advisors to create a shortlist of candidates with:

We’ll send you a curated list of 3–5 qualified HVAC industry advisors, complete with detailed insights to help you evaluate your options and resources to prepare for meetings with your candidates.

Schedule your free exit consultation today.

At Axial, we offer several resources for small business owners looking to sell their company, learn more about the M&A process, and better understand the value of their business.

Here are just some of the resources that can be helpful to you:

These are just a few of the resources we’ve created for business owners. You can find more here.