The Winning M&A Advisor [Volume 1, Issue 9]

Welcome to the latest issue of The Winning M&A Advisor, the Axial publication that anonymously unpacks data, fees, and terms…

Tags

When we talk to HVAC business owners at Axial, we often find they’re seeking a business valuation for two key reasons:

In this post, we’ll explore both use cases, discuss factors that impact your valuation (like customer contracts and recurring revenue), and explain how you can make changes to improve your HVAC business’s worth.

If you’re a business owner that’s motivated to sell, we recommend that you use an M&A advisor to value your business. Specifically, you want an M&A advisor that has a proven track record of marketing and closing HVAC deals.

These advisors leverage their HVAC industry expertise in two critical ways:

M&A advisors will also help you understand the factors driving your valuation, such as revenue growth rate, customer concentration, scalable operations, and more (which we cover in detail at the end of this article).

Keep in mind that this initial valuation range serves as a starting point for eventual pricing negotiations with interested buyers. The final price paid for your business will often differ from this initial valuation. Factors like market conditions, the deal structure (e.g., less cash upfront in exchange for a higher offer), and whether you’re retaining any ownership stake in the business (either yourself or your employees) will all play a role in determining the final price.

There is no one-size-fits-all approach to HVAC business valuation. Each method examines your company’s value from a different perspective. Generally, M&A advisors use all three methods to triangulate an accurate valuation estimate, ensuring you don’t undersell or oversell your business.

Here are the three most commonly used methods:

This method estimates the value of a business based on its expected future cash flows. It involves forecasting the profits your business will generate and then “discounting” those cash flows back to their present value using a discount rate. The discount rate reflects the risk and predictability of your business’s future profits, adjusting for inflation to indicate how much future profits are worth today.

Your advisor can set the appropriate assumptive growth and discount rates and defend them more effectively based on their experience in your industry. Their expertise allows them to account for the nuances of historical business performance, company-specific factors, and macroeconomic trends, ensuring an accurate analysis.

This analysis benchmarks your company’s valuation against similar businesses in the HVAC industry, considering factors like size, growth, geography, capital structure (including debt levels), and lifecycle stage.

For small businesses, this can be challenging, as valuation data is more readily available for larger, publicly traded companies. To ensure a meaningful comparison, your advisor will carefully select the right set of comparables and adjust for size differences.

This method estimates the value of your business based on the purchase prices of similar, recently closed deals, which may include transactions your advisor has facilitated for other HVAC owners.

However, gathering this information for small businesses can be difficult, as transaction details are often private. Additionally, the recency of these transactions is crucial, as outdated deals may not reflect current market conditions. By working with an advisor who has insider knowledge of past transactions, you can effectively leverage recent deal data to refine your valuation.

Using these methods, your advisor can arrive at an accurate valuation range for your HVAC business, giving both you and your advisor a clearer understanding of what your business could realistically sell for.

EBITDA represents your earnings before interest, taxes, depreciation, and amortization. This metric offers potential buyers a clear snapshot of your business’s core profitability, free from the effects of taxes, financing, and non-operational factors. EBITDA helps buyers gauge cash flow, assess whether your company is suitable for a debt-financed transaction, and compare it more easily to other businesses.

Your EBITDA multiple represents how many times your business’s earnings are multiplied to determine its total value. While EBITDA gives you an earnings figure in isolation, your business is also influenced by industry-specific factors like other companies’ valuations and buyer demand. That’s where your EBITDA multiple comes into play, helping put your earnings into context.

Advisors will often express your business’s value in terms of multiples of EBITDA. This makes it easier to compare valuations across different methods and benchmark against industry averages.

For example, when valuing your business using the three methods discussed above, you might see a breakdown like this:

This represents the EBITDA multiple range for your business, indicating you can expect a sale price between 3.5x and 5x your EBITDA.

Plenty of online guides for HVAC businesses focus on presenting valuations as a multiple of SDE (seller’s discretionary earnings). SDE takes a business’s EBITDA and adds the owner’s salary, perks, and discretionary expenses. This is useful for small, owner-operated businesses because your discretionary earnings can affect profitability to a much greater extent than in a larger business. Generally, valuations are presented as a multiple of EBITDA once a business has grown beyond $1 million in annual profits.

Within Axial’s platform, transaction multiples for HVAC companies have recently ranged from 2.08x to as high as 15.08x. Below is a breakdown of median multiples and ranges by business size:

HVAC businesses generally hold up well, even when macroeconomic conditions soften. When critical systems like heating or cooling fail, repairs can’t wait — making demand in this sector relatively stable, regardless of broader economic trends.

That said, median EBITDA multiples in HVAC are generally lower than in sectors like technology. One reason for this is that scaling an HVAC business requires significant investment in physical infrastructure, equipment, and labor, making it more capital-intensive and slower to grow. Additionally, many HVAC companies are localized and heavily reliant on their owner-operators, which can create perceived risk for buyers and limit scalability.

While standout companies with recurring revenue, diversified services, and strong management teams can trade at significantly higher multiples, most small-sized HVAC transactions fall in the 3x to 5x EBITDA range.

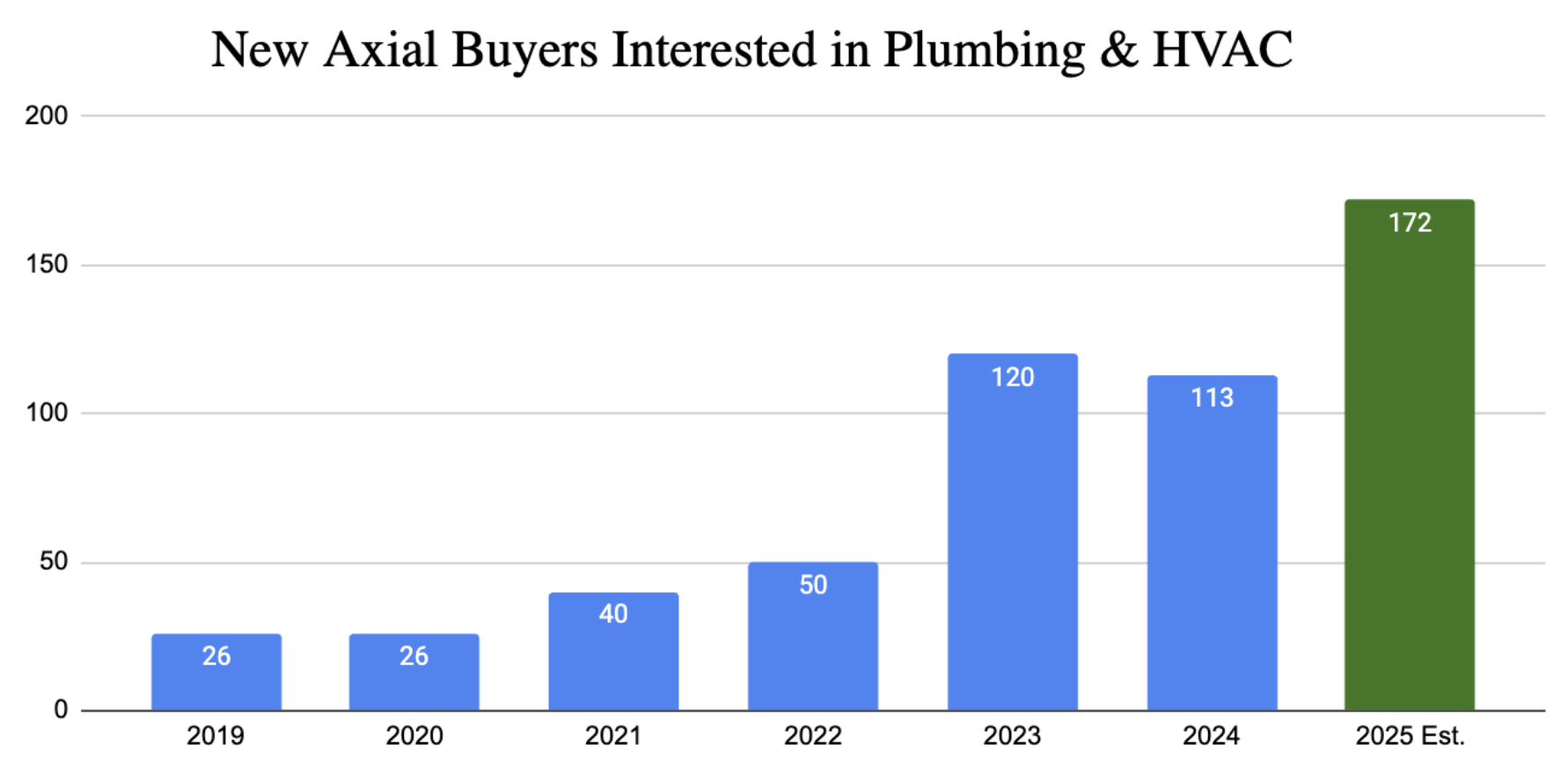

Buyer demand for HVAC companies has surged, with a 550% increase in our network of buyers between 2020 and 2023. Until 2023, boutique investment firms, including independent sponsors and search funds, dominated the buyer landscape. However, starting in 2024, private equity firms began to target HVAC deals, further driving up buyer demand. In 2023, private equity firms accounted for just 8% of HVAC deals within Axial, but by 2024, that number rose to 23%.

As a business owner of an HVAC company, this increase in buyer demand benefits you in two ways:

M&A advisors do more than just value your business. They guide you through the entire M&A process — crafting marketing materials to target ideal buyers, evaluating and negotiating offers, and structuring and closing the deal. Based on surveys from Axial customers, working with an advisor can save you 30+ hours a week in work. Plus, they can boost your final sale price. Data shows M&A advisors can raise your final sale price by 6–25%.

One recent example of a successfully closed deal, represented by an M&A advisor and sold to a buyer within the Axial network, is Core Mechanical Inc., a commercial heating, ventilation, plumbing and mechanical maintenance services business in Chicago. The owners of Core Mechanical were looking to begin their retirement process. Leading up to entering the M&A process, they had put in a strong operational leader in place, which helped increase their perceived value for buyers.

Core Mechanical partnered with Vesticor Advisors, who expanded their options by connecting them with qualified buyers across multiple networks — including our vetted buyer network on Axial.

In total, they received 375 recommended buyers via Axial, including private equity firms, independent sponsors, holding companies, family offices, corporations, and one individual investor. Together, they whittled down their buyer list based on what Core Mechanical most wanted to achieve with their exit. Six months after going to market, they executed a Letter of Intent with Amalgam Capital. The deal was finalized roughly six months later.

*Pursuit rate: This is a metric that we use at Axial that reflects the ratio of potential buyers that are engaging with a particular business relative to the overall number of buyers who were initially invited by the seller to explore the transaction.

If you’d like to hire an advisor like Vesticor, you can learn how to find the right advisor here.

We also understand that sometimes a business owner may just want a ballpark figure of their company’s value. If that’s you, and you don’t yet want to work with an M&A advisor, then the next best thing would be to use our free business valuation calculator. It uses an industry-specific DCF methodology to help determine your valuation and provide you with a realistic starting point.

There are times when you need to understand your business’s worth, even if you have no immediate plans to sell.

For example, if you’re starting to think about retirement, having a ballpark figure can help guide your planning.

In these cases, the best approach is to work with a certified valuation analyst. These financial experts can use the valuation methods we discussed — often with HVAC industry experience — to provide an accurate assessment of your company’s value. Similar to M&A advisors, they can also explain the factors driving your valuation, which we’ll cover below.

If you choose this route, look for an analyst with one of these certifications:

Unless you have experience in buying and selling HVAC businesses, we generally recommend against conducting your own valuation. Valuing a business isn’t just about plugging numbers into a formula. It requires understanding which assumptions to make about your company.

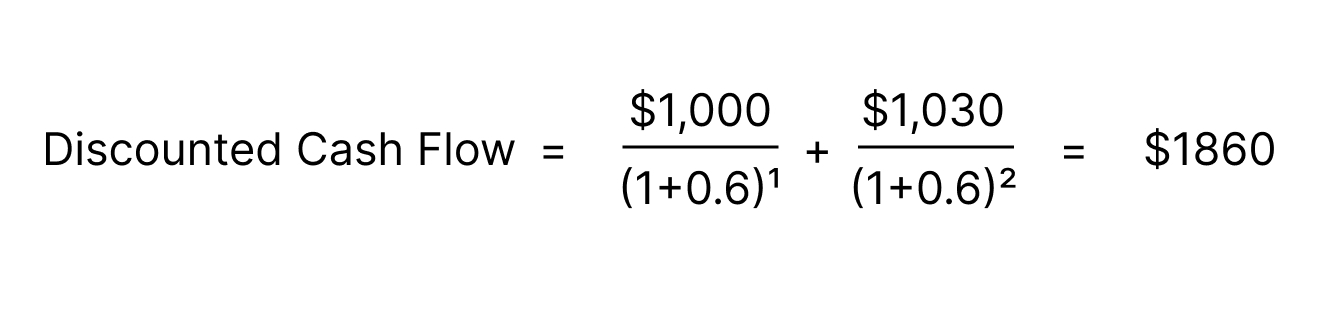

Take a discounted cash flow (DCF) analysis, for example. Imagine you assume your business will only be productive for two more years and have no terminal value — that is, no value beyond those two years. While this is a simplistic example to illustrate how DCF works, it’s not realistic for most companies, especially HVAC businesses.

Your projected cash flow for the first year is $1,000 with a 3% growth rate, meaning the following year’s estimated cash flow would be $1,030. With a 6% discount rate, the discounted cash flow for your business is $1,860.

The formula may seem straightforward, but the inputs are not. A discounted cash flow valuation is only as good as the assumptions that create the valuation’s inputs.

When doing a DCF analysis, you must make assumptions about the discount rate, cash flows, lifespan, and growth rate. If any of these assumptions are off, the result can be misleading.

For example, let’s assume your HVAC company can continue operating with a constant growth rate. If we assume 3% growth and a 6% discount rate, the valuation is $34,333. But if we expect 4% growth and a 5% discount rate, the valuation jumps to $103,000. Those small changes in the growth rate and discount rate can cause the DCF value to triple.

Even if you’re not planning to sell your HVAC company right away, understanding its value can help guide decisions to increase its worth.

We put together a table below covering 15 factors that can impact your HVAC valuation, but we wanted to highlight the 4 most impactful factors you can control to positively impact your valuation:

These four factors focus on scaling revenue, cutting costs, and positioning your business for long-term growth.

At Axial, we offer several resources for small business owners looking to sell their company, learn more about the M&A process, and better understand the value of their business.

Here are just some of the resources that can be helpful to you:

These are just a few of the resources we’ve created for business owners. You can find more here.