M&A Fee Guide 2023-2024

For the third year running, Axial partnered with Firmex and Divestopedia on the annual M&A Fee Guide, the authoritative source…

Pennsylvania native Chris Gallagher grew up watching his grandfather, father, and uncles run The Walter B. Gallagher Company, a gaskets and seals distributor near Philadelphia. Little did he know then, that in 2017, he would take the role of CEO and grow the company not only organically but through numerous acquisitions.

“My goal is to get to $100 million in sales for our company, and I think we’ll get there in the next three to five years,” Gallagher said recently about the business, now renamed Gallagher Fluid Seals, Inc. and based in King of Prussia, PA. “In 2014, we were a $17 million company, and next year we’re forecasting sales of $75 million — and that has come through aggressive M&A.”

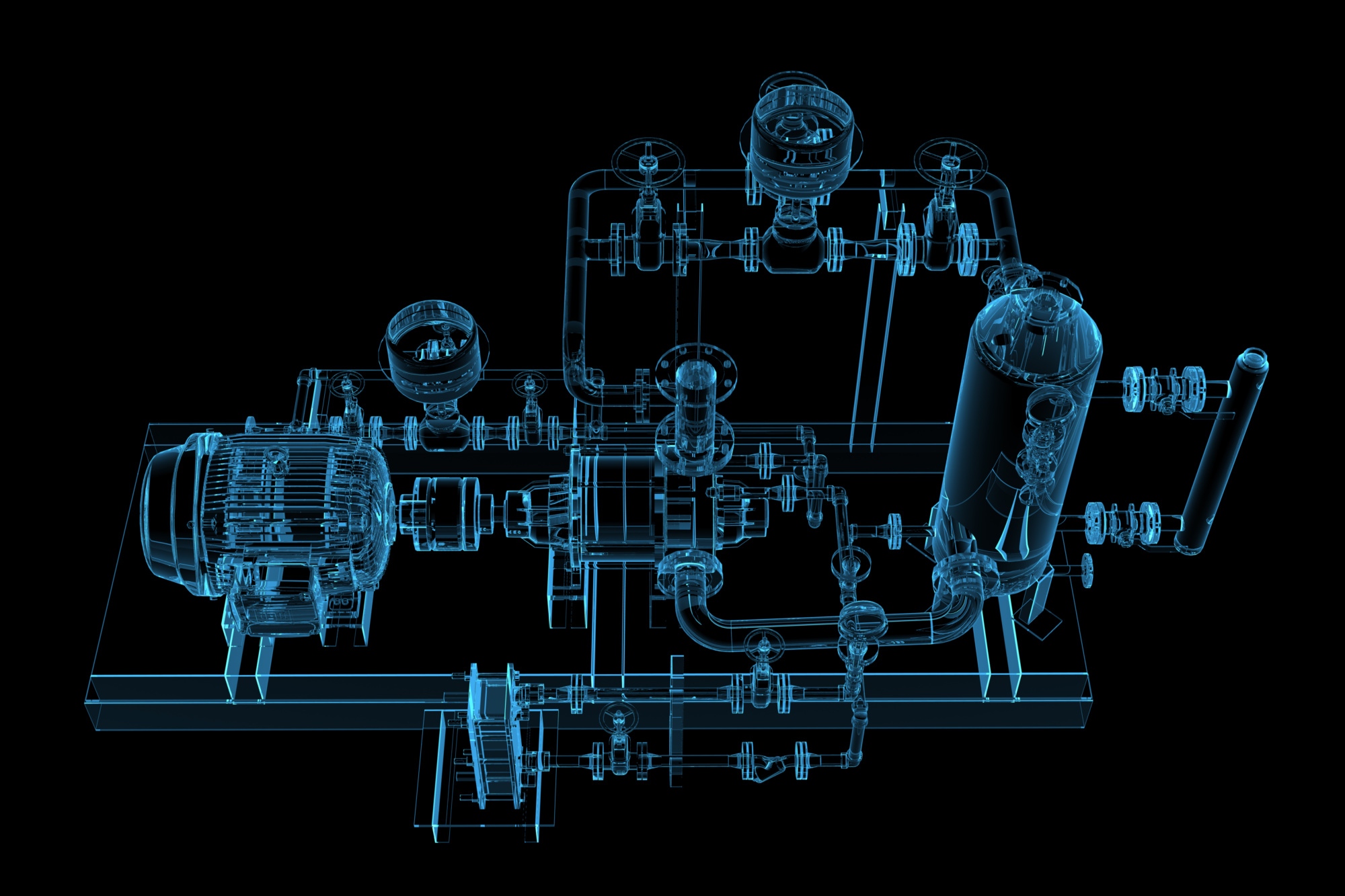

Chris Gallagher clearly conveys momentum. His company has completed multiple acquisitions since he stepped into his chief executive role, including three in 2022 thus far. In January, the business snapped up IES Technical Sales, a Danvers, MA-based provider of high-technology vacuum and semiconductor products. In March, Gallagher bought IEQ Industries, a Grand Rapids, MI-based virtual distributor of pumps and parts for use in commercial and industrial applications, largely for oil and gas production. And on May 13, Gallagher’s company acquired Packing Seals & Engineering, a Fitzgerald, GA-based distributor of gaskets, seals, and other sealing products. And according to Chris Gallagher, there’s more to come.

By all accounts, it takes a village to operate and guide a rising star like Gallagher Fluid Seals. But there’s no doubt that Chris Gallagher, now age 42, is leading the charge with his eyes on growth through acquisition. His no-nonsense, straightforward personality has manifested well at the deal-making table and he has a knack for shortening the transaction process.

“My first impression of Chris Gallagher was that he was a genuine person —what you see is what you get,” said Joseph Bichler, former owner of IEQ. “By the end of that hour-and-20-minute meeting, I had a real sense that he was a man of integrity, and that gave me a sense of peace about completing the deal.” Gallagher Fluid Seals, Bichler said, was “the perfect buyer”, and the deal closed in a record two months.

Bichler chose to sell IEQ because he was ready to retire, and wanted someone else to take his six-employee business to the next level and expand on CXI, his company’s not-yet-launched asset management system that enables pump customers to order the right equipment and components, no matter their location. Chris Gallagher, meanwhile, was attracted to IEQ because the business was profitable (last year the company’s sales hit $6 million, Bichler said), had 10 websites used to promote its pumps and parts, and had developed CXI, which could be used for managing not only pumps but other products as well.

To help sell the company, IEQ hired NuVescor, a Michigan-based M&A advisory firm focused on manufacturing, who used the Axial platform to market the project. Almost 100 buyers in total inquired about IEQ, and eventually four active suitors remained. But in the end, Bichler only personally met with Chris Gallagher, and the two connected immediately. Gallagher “pushed hard delivering the first draft of the purchase agreement, and was responsive and timely,” noted Travis Ernst, NuVescor’s managing director. “He was able to move through the diligence process quickly.” Chris Gallagher made a cash offer —which was swiftly accepted— and his company retained all six IEQ employees who continue to run the systems and platforms today.

The Walter B. Gallagher Company launched in 1956, and generated sales of $48,000 in the first year, according to the company’s current website. Walter’s mission was “to found and develop and grow an independent distributor of sealing products that could form a loyal customer base,” said Chris Gallagher about his grandfather. By 1961, the company was incorporated and surpassed its first $1 million in sales. In 1975, Walter’s three sons, including Chris’ father Brian, joined the business, and in 1983, Chris’ uncle Joseph was elected president and chief operating officer.

The company did a handful of acquisitions between 1983 and 1994, and then took a 20-year pause until January 2014, when it purchased Johnson Packings, a seal distributor and gasket fabricator in Massachusetts. With that deal Gallagher inherited 28 new employees and became one of the largest sealing distributors in the United States, the website reported. That deal was “a big swallow,” increasing the company’s sales by 50% overnight, Chris Gallagher said.

Since stepping in as CEO, Gallagher’s desire to grow his business through acquisition has now intensified, and he is seeking deals not only in the fluid seals space but outside the company’s wheelhouse. “IEQ and some other opportunities that we’re pursuing right now represent an intentional diversification of our historical fluid seal focus,” he said.

“It was opportunistic,” Gallagher added about the IEQ deal. “Historically our M&A activity has been focused on pure competitors in our distribution market space.”

Today, Gallagher Fluid Seals is a shadow of its former self. The company now has three divisions —fluid seals, fluid handling, and vacuum and semiconductor —and is heavily data driven. This live data gives personnel updated views of customer interactions and allows them to analyze “historical sales patterns to drive optimal procurement patterns,” which in turn helps company leaders “ensure that investments made in areas of the business are paying off,” Chris Gallagher noted. The business also owns numerous websites — some of which it inherited with IEQ — and Gallagher said he wants the company’s growth to be “more ambitious,” with a focus on digital marketing and e-commerce across all of its divisions.

Chris’ dad, Brian, and his brother Kerry are currently key account managers at the company, and his youngest brother Brett works as a junior marketing analyst. As the organizational structure changes, Chris Gallagher may eventually “step out of the way of things and empower them to take leadership roles,” he said of his two younger brothers. He will soon be transitioning into a role as CEO of Gallagher Industrial Products, the newly formed parent holding company, which could unveil an opportunity for his brother Kerry to lead the fluid seals division at some point, he noted.

To date, despite huge growth in the last decade and likely countless changes ahead, Gallagher Fluid Seals remains true to its core: to be an upstanding business that covets its loyal customers, something his family has always instilled.

“I learned that your reputation as a company, as a brand, takes years and decades to build, and it can be lost in a heartbeat if you cut corners, if you are not ethical and honorable,” Chris Gallagher said. “And I’m very cognizant of that. Anytime that we hit a fork in the road… we’re always going to do the right thing for our customer.”