Small Business Exits: M&A closed deal data from June

Welcome to the June edition of Small Business Exits, the monthly publication featuring fully anonymized deal data from a selection…

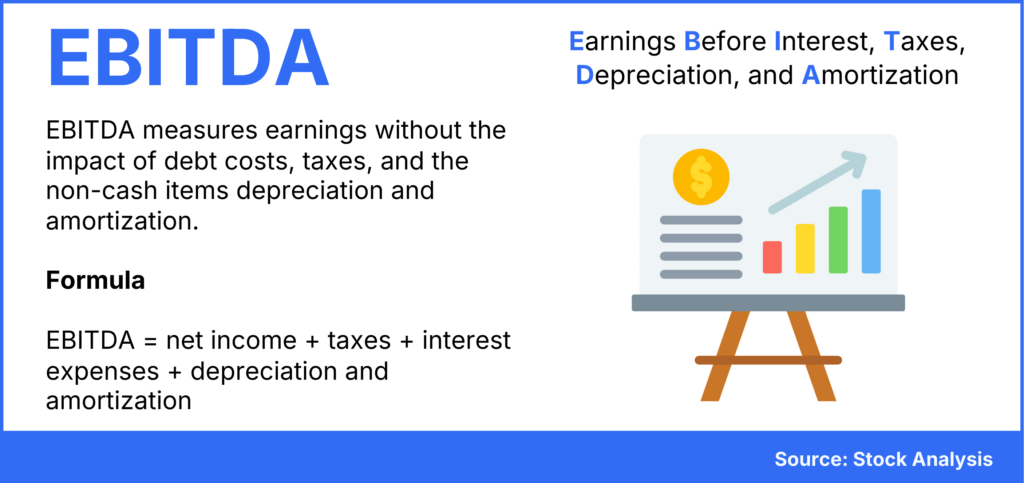

EBITDA is one of the most closely examined metrics in the M&A process.

During negotiations in an M&A deal, buyers and sellers examine several factors to agree on a price that properly captures a company’s value.

EBITDA—which stands for earnings before interest, taxes, depreciation, and amortization—is used to measure company performance. It indicates whether a business is profitable by revealing the amount of its normal operational earnings.

Today’s article touches on the following:

To dive deeper into this topic, see the end of this article to download the ebook. To receive articles like this directly to your inbox, subscribe to Exit Ready below.

–

EBITDA serves multiple purposes beyond the M&A sales process. It’s a key valuation metric for traders, analysts, and portfolio managers, and lenders use it to gauge a company’s ability to meet debt obligations. However, while EBITDA provides a snapshot of financial performance, it doesn’t fully capture a business’s true value or performance.

If you’re considering selling your company, understanding how EBITDA is calculated can help you present your company’s financials in a way that makes your firm’s post-sale cash flow attractive to buyers.

Investors often use EBITDA to evaluate a company’s enterprise value, with buyers generally paying a multiple of EBITDA in M&A exits.

Can’t get enough deal data?

Can’t get enough deal data?Check out Axial’s new monthly publication, Small Business Exits, to review company EBITDA figures from recently closed transactions across various sectors.

There is a misconception that EBITDA is synonymous with cash flow. EBITDA acts as a proxy for pre-tax operational cash flow, offering an estimate of the cash flows that might be expected after an M&A transaction. By excluding depreciation, amortization, debt, and taxes, EBITDA provides a more standardized way for buyers to compare companies within their sectors. It captures a company’s earnings without accounting for capital expenditures or interest, making it a useful, though not precise, approximation of cash flow.

Read More -> Why EBITDA is Not Cash Flow

Adjusted EBITDA accounts for certain non-recurring, non-operational, or unusual expenses or incomes to provide a clearer picture of a company’s true operating performance. These adjustments are made to normalize EBITDA and reflect the company’s core profitability more accurately, especially in the context of an M&A transaction or when assessing the ongoing financial health of the business.

Common adjustments to EBITDA might include:

Adjusted EBITDA is particularly important in M&A transactions because it aims to present a more realistic view of what the company’s earnings might look like under new ownership or in future periods, thereby helping to determine a fair valuation.

Read More -> Deriving Normalized EBITDA for Your Business

For a more in-depth review of the above, please complete the form below to download The Seller’s Guide To Understanding EBITDA eBook.

NOTE: The information in this article and associated ebook does not, and is not intended to, constitute legal advice. All information, content, and materials available on this site are for general informational purposes only.