At Axial, we’re fortunate to have access to a unique data set of deals closing in the lower middle market.

In today’s article, we asked ourselves the question, “which buyer types close deals on Axial across different deal sizes?”

Axial members focus on deals between $0M – $15M in EBITDA. This article focuses on the lower end of that range, analyzing the buyers for deals between $0M and $3M in EBITDA.

Below, we lay out some answers to this question using Axial platform data, and include a few takeaways that caught our eye from each segment.

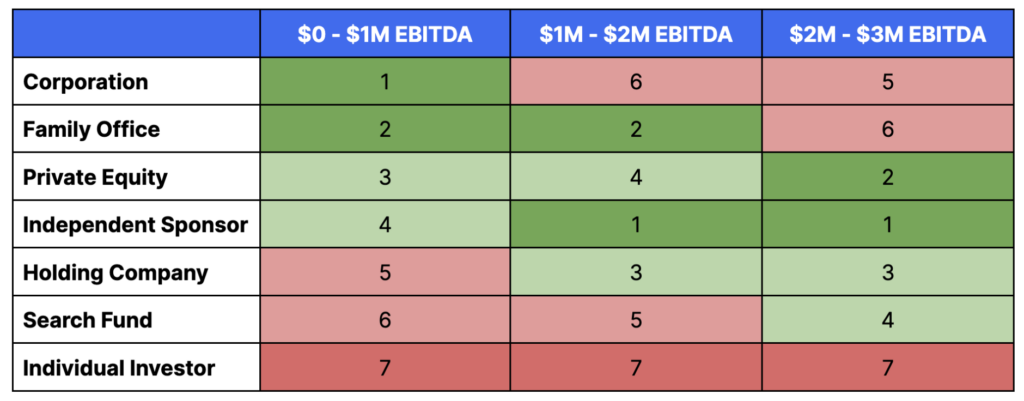

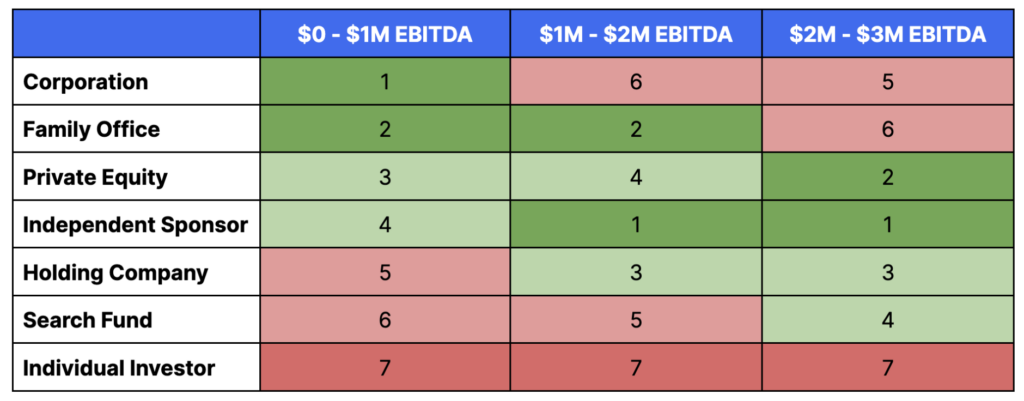

Heatmap

Closed Deal Rankings by Buyer Type and EBITDA Range

Closed Deals by Buyer Type and EBITDA Range

Jan 1, 2021 – present

Source: Axial Platform Data

What caught our eye:

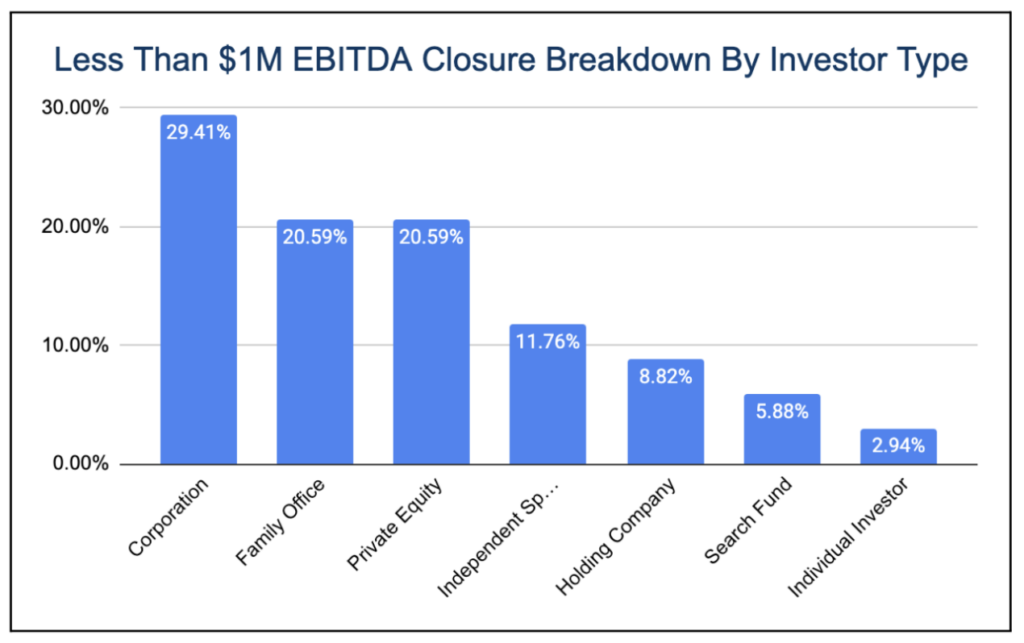

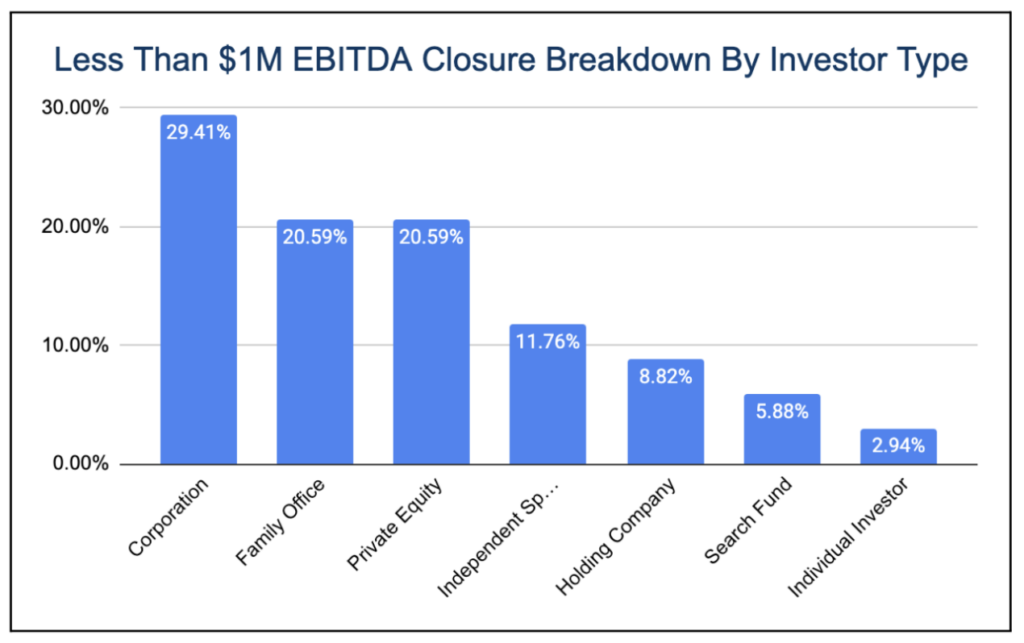

- Corporations are the most prominent buyer of deals on Axial below $1M EBITDA.

Corporate buyers accounted for close to 30% of Axial closed deals below $1M in EBITDA. This may be because, when making add-on acquisitions, corporations take strategic synergies into serious consideration alongside the financial attributes of their targets. They often are looking to make an acqui-hire (purchasing a company for its talent), acquire a company for its technology or R&D, or expand into new geographies or customer types. These acquisition rationales can take precedence over or act in concert with an acquisition target’s financial profile.

- Family Offices and Private Equity firms close a lot of sub-$1M EBITDA deals.

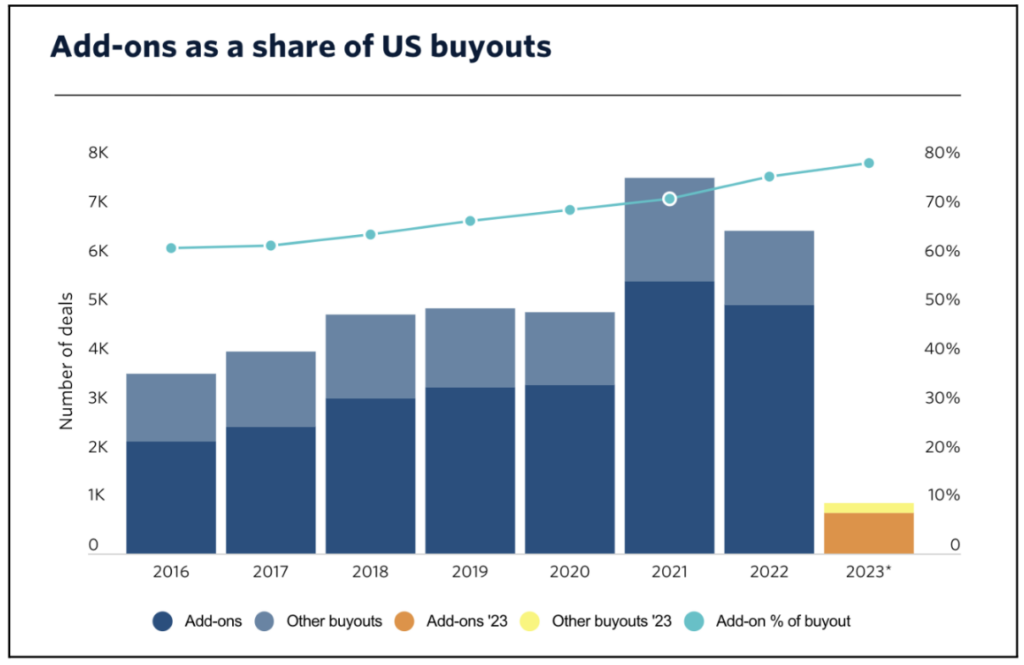

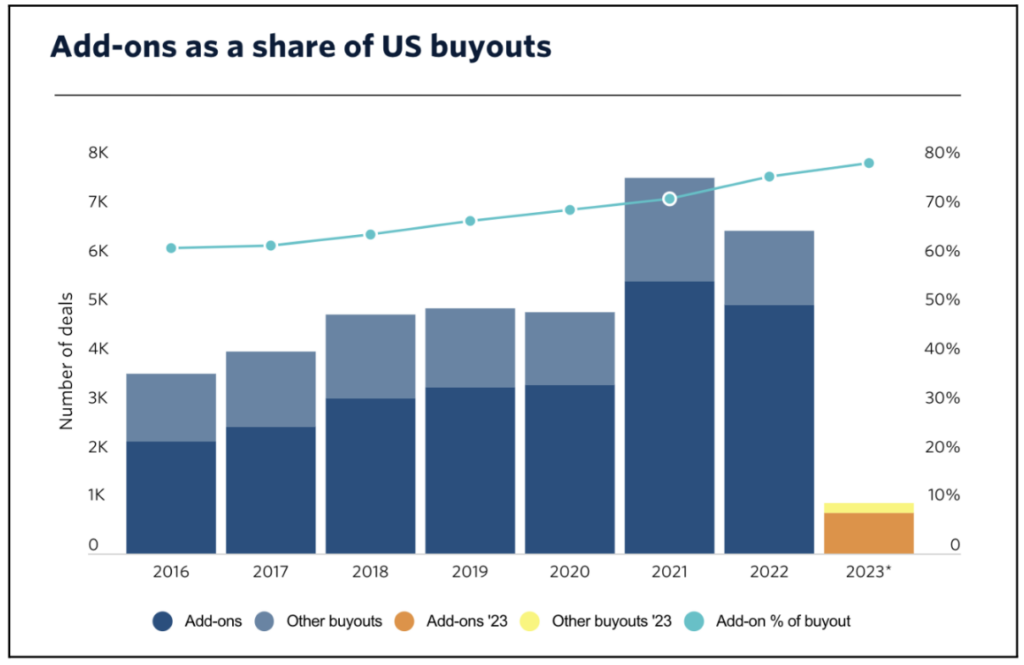

We were surprised by the prominence of Family Offices and PE firms closing smaller deals on Axial. Many sellers and sell-side intermediaries think of these groups being most active in the larger deal arena. However, family offices and private equity firms are often on the hunt for add-on acquisitions on behalf of their portfolio companies. In these instances, they can act similar to a corporate buyer, searching for strategic synergies alongside attractive financial profiles. This has become a growing trend as these groups look to create large, high-multiple portfolio companies from smaller initial platform investments.

Source: Pitchbook

Source: Axial Platform Data

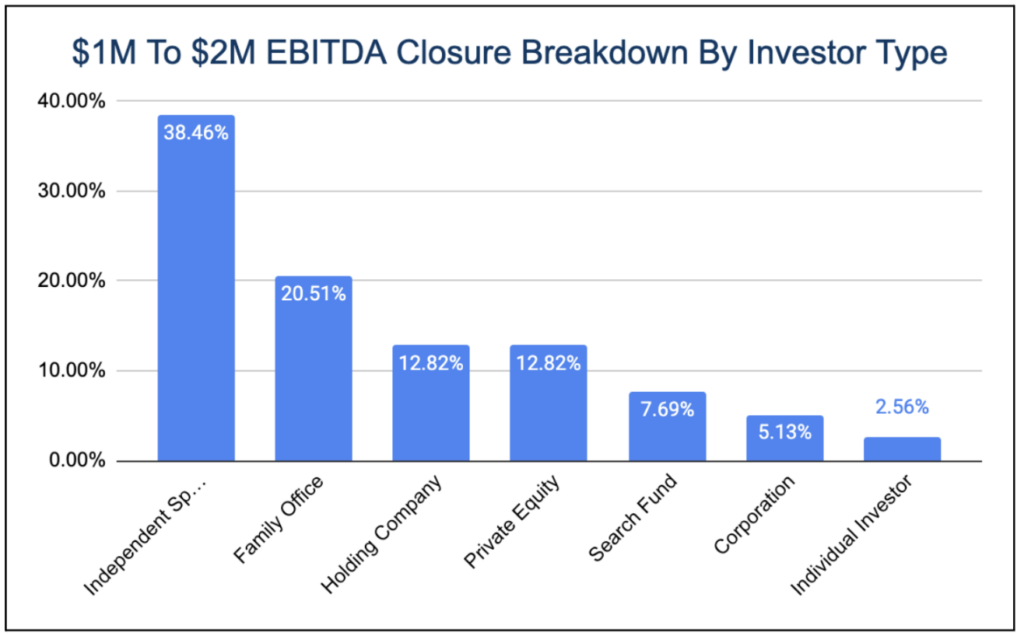

What caught our eye:

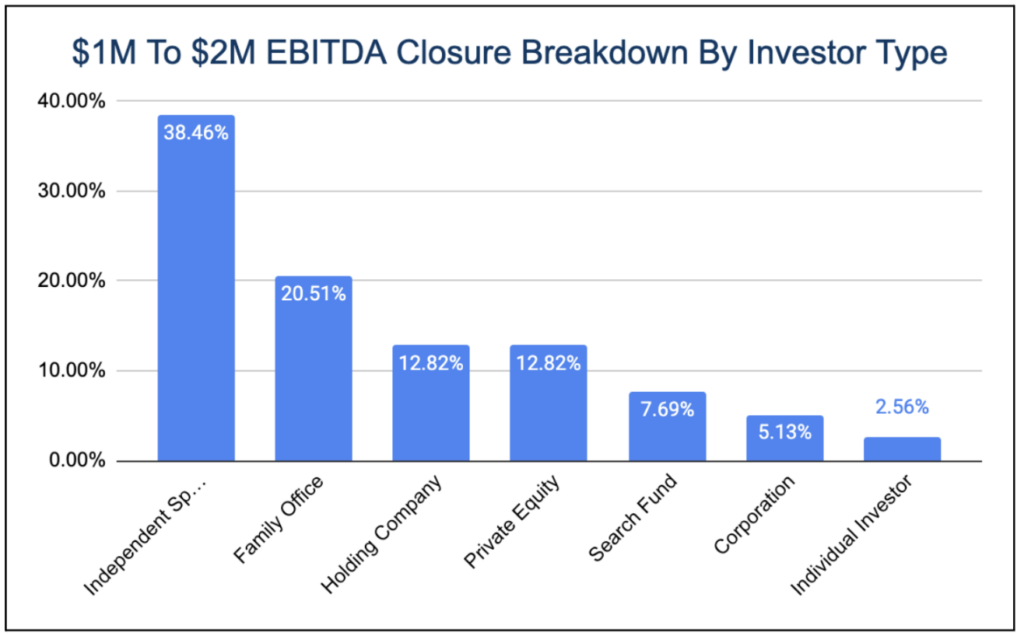

- Independent Sponsors are the most prominent buyer of deals between $1M and $2M EBITDA.

Independent sponsors often look for both platform and add-on acquisitions in the $1M – $2M EBITDA size range. One emerging independent sponsor may look to turn a $1.5M EBITDA acquisition into their first platform investment, while another more established group may target this size range for an add-on to an existing portfolio company in the $2M – $5M EBITDA range.

- Corporations purchase substantially fewer $1M – $2M EBITDA companies on Axial than sub-$1M EBITDA.

Over the last 2.5 years, corporations have represented just over 5% of Axial closed deals in the $1M – $2M EBITDA range, relative to 29% of Axial closed deals below $1M EBITDA.

Source: Axial Platform Data

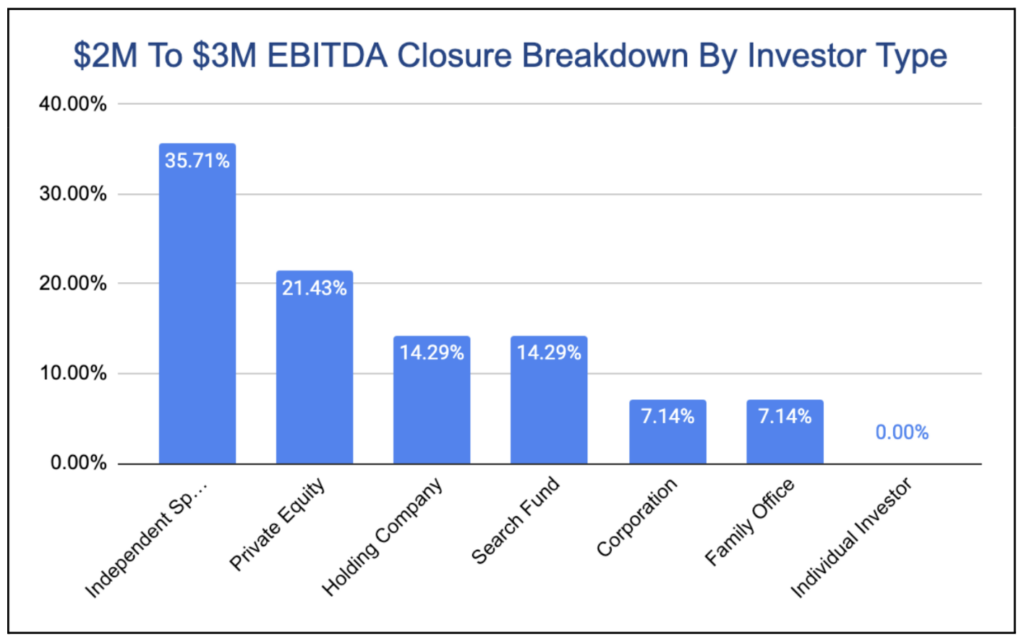

What caught our eye:

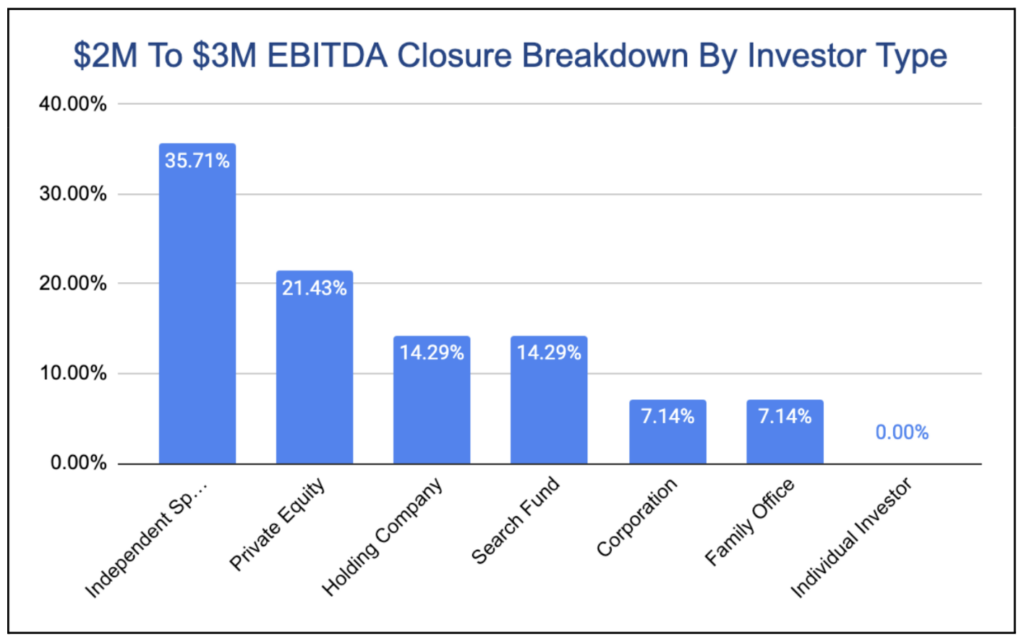

- Independent Sponsors and Private Equity firms occupy the #1 and $2 spots.

Independent sponsors and private equity firms will often look for both platform and add-on opportunities in the $2M – $3M EBITDA range. Independent sponsors occupy the largest share of Axial closed deals in both the $1M – $2M and $2M – $3M EBITDA spaces, while private equity firms have a noticeably larger share in the $2M – $3M EBITDA range than the $1M – $2M EBITDA range.

- Search Funds on display as a reliable buyer of $2M+ EBITDA deals.

Since 2021, Search funds have represented 14.3% of Axial closed deals in the $2M – $3M EBITDA range, relative to 7.7% in the $1M – $2M EBITDA range and 6% below $1M EBITDA. While deals less than $3M EBITDA are the core focus of search funds, a misconception in the market may exist regarding their sole relevance for deals that are in the lower end of that range. Axial’s closure data suggests that these groups are increasingly going toe to toe with family offices and private equity firms for deals in the higher end of that range – and are clearly winning their fair share.