Small Business Exits: M&A closed deal data from June

Welcome to the June edition of Small Business Exits, the monthly publication featuring fully anonymized deal data from a selection…

Specialization has always offered private equity firms an edge in the private capital markets. Bain & Company’s 2022 Global Private Equity Report notes that sector specialization is increasingly overtaking deal structure as a key way to gain and maintain a competitive investment advantage. The SaaS industry, a stereotypical VC investment target, has increasingly come into focus for PE tech investors.

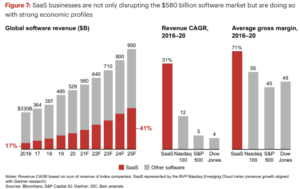

Bain’s report also notes that SaaS companies accounted for 30% of the $580 billion software market in 2021, up from 17% in 2016. Additionally, SaaS companies accounted for 30% of total deal value in 2021.

Source: Bain & Company, 2022 Global Private Equity Report

—

Tech-driven investing has had its booms and busts in the past. As of this writing, the NASDAQ has experienced a 13% drop since December 2021. While public markets might view tech as a volatile investment, the private markets beg to differ. SaaS has played a central role in driving this view. The current macroeconomic climate doesn’t portray a picture of stability for investors. The U.S Federal Reserve hiked rates for the first time since 2018, and Morgan Stanley expects five more rate hikes in 2022. Publicly traded software company valuations are experiencing high volatility. How has all this affected the outlook for software companies in the world of LMM investing?

“Private equity companies are focusing on technology, and EBITDA multiples are through the roof despite the volatility in the public markets,” says Stan Gowisnock, Managing Director at Focus Investment Banking. “Technology and software acquisitions should be very active in the next couple of years due to the growth opportunity of their investments.”

The average SaaS company’s capital structure makes it a very attractive investment in uncertain times. SaaS companies are capital-light, with little need for hard assets and low fixed costs. Additionally, the steady stream of revenue and non cyclical customers make the investment case clear.

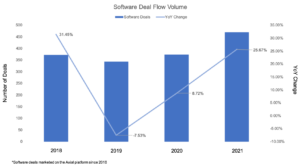

While not fully representative of the entire LMM, data from Axial’s platform indicates that investors have recognized SaaS and Technology’s potential. Software deal volumes grew by 25.67% in 2021, compared to an 8.72% leap in 2020.

Source: Axial, The Top 50 Lower Middle Market Software Private Equity Investors & M&A Advisors

—

Healthtech and fintech accounted for the highest deal activity recorded on the buy and sell-side on the Axial platform. Healthcare software comprised 15.8% of sell-side deals, and fintech accounted for 11.4%. Roughly 80.4% and 70% of these deals in health and fintech respectively focused on products catering to enterprise needs.

This heightened deal activity makes sense when charting SaaS performance compared to other asset classes. Data from Meridian Capital revealed that SaaS outperformed the S&P 500 by 58% in 2020, with communication tools leading the way.

Source: Meridian Capital, Technology, Software, SaaS M&A Trends, Winter 2021

—

Fast forward two years, and these trends are showing no signs of slowing down. “Software and technology firms in the private markets are getting more offers than ever and there is a lot of dry powder that will be utilized in the future to continue to drive these offers,” says Aaron Solganick, CEO of Solganick & Co. “PE firms raised $330 billion and spent $1 trillion last year, which demonstrates the incredible growth in funds that will be directed towards software and technology.”

Solganick also points out the changing nature of financing that firms utilize these days. “Private SaaS capital firms are joining the market, and even traditional banks like Comerica Bank are now financing software deals, which didn’t happen five years ago,” he says. “These new additions to the markets are keeping the price of capital relatively steady.”

Peter Lehrman, founder and CEO of Axial, sums up the state of LMM software and SaaS investing well. “When we started Axial in 2009, there was zero M&A activity on the platform in tech / software,” he says. “Unlike VC, the private equity world still largely shunned the “asset-light” human capital-centric software industry. No hard assets, unpredictable revenues, “we don’t take technology risk,” etc. What an amazing change to witness and to be part of in 10+ short years. Software deals are now a big and growing slice of the lower middle market private equity pie.”

Software deals present investors with challenges thanks to the rapidly evolving nature of the industry. Value creation becomes critical, and SaaS products’ disruptive nature presents multiple opportunities. Add-on strategies, where an investor uses the newly acquired product to enrich the value of existing portfolio companies, are prevalent.

Nat Burgess, Managing Partner at Techstrat, says that portfolio enrichment of this sort trumps merging companies. “Software companies are weapons of mass disruption, so sometimes keeping the company small and adding value to other non-software businesses is more powerful than trying to combine with other companies, thereby diluting the focus of the company,” he says.

Larger forces in the technology world are creating massive opportunities for LMM software companies. Vertical Software Companies (VSCs), as an example, seek to develop deep industrial expertise and progressive growth. Despite being at odds with Silicon Valley’s explosive growth approach, VSCs carved steady niches for themselves.

However, as big tech expands horizontally, VSCs are increasingly looking for SaaS bolt-on acquisitions as perpetual license business models become obsolete. VSCs typically seek companies that increase their ability to offer complementary solutions, cross-sells, and lower customer acquisition costs.

As competition for such acquisitions heats up, valuation multiples have significantly increased. However, they remain lower than what investors would find in the public markets. Burgess says, “Valuations in the private market are based on tangible EBITDA multiples and are not nearly as high as the 20x – 50x revenue valuations in the public markets.”

Indeed, valuation typically depends on buy-side competition more than anything else. Solganick and Gownisock believe that peak valuations might have already occurred. As interest rates are bound to increase, it remains to be seen how they will affect debt packages and whether this will lead to a fall in multiples.

Solganick, for one, does not expect massive devaluations. “Some people say they may come down a little, but nobody expects a crash tomorrow,” he says. Competition to provide debt financing and the attractiveness of SaaS as an investment will likely help maintain valuation levels at slightly off-peak levels.

Evolution and disruption define the software world and it isn’t unreasonable to wonder whether SaaS might be upended by alternative business models. For instance, free-to-use models leverage user data to drive revenues in exchange for free software access.

“The LMM will see those business models emerge,” says Solganick. “However subscription models will be very sticky due to the preference of PE firms for businesses with predictable recurring revenue streams.” As the macro picture continues its volatile ride, SaaS will likely remain a safe haven for LMM investors for the foreseeable future.