Small Business Exits: M&A closed deal data from June

Welcome to the June edition of Small Business Exits, the monthly publication featuring fully anonymized deal data from a selection…

In recent years, Independent Sponsors have emerged as a formidable force in the M&A economy.

Over the last three years, Independent Sponsors have been one of the top three highest growth segments on Axial. 421 Independent Sponsors are actively sourcing on Axial, up from 314 this time last year (+34%).

Given their rise in prominence, Axial surveyed the lower middle market Independent Sponsor community to dig deeper into the model.

The report below sheds light on our findings and is structured in 4 sections:

We are grateful to the Independent Sponsors who provided both data and useful color on what in their eyes are the current challenges and opportunities. The following study is compiled based on 51 of those detailed survey responses. The 19 Independent Sponsors below are quoted in this feature.

The lower middle market’s perception of Independent Sponsors continues to evolve.

According to Josh Sartisky, Partner at Marigny Investments, “Independent Sponsors are becoming a more normal course in broad processes. That said, an Independent Sponsor can mean a lot of things to a lot of people.”

The Independent Sponsor model continues to attract high caliber professionals with an entrepreneurial drive. Prior transaction & operational experience of these individuals is positively shifting the perception of the Independent Sponsor community. According to Corey Obermayer, Partner at Pillar49 Capital, “There is a long tail of part-time or unsophisticated Independent Sponsors that have muddied the waters for some owners and advisors. However, experienced Independent Sponsors are perceived as legitimate options for succession and creative structures with founders.”

Sellers and their M&A advisors are also recognizing Independent Sponsors’ agility and hands-on approach to value creation. They are seen as nimble operators who can navigate complex transactions and create value in companies that might be overlooked by larger players. According to Dennis Huang, Head of Origination at Polychrome, Independent Sponsors “can provide flexible capital and operational expertise, without the typical burdens of PE (long earnout periods) or VC (high exit hurdle rates).”

Market dynamics are playing a critical role in driving the greater acceptance of Independent Sponsors. However, these dynamics are also leading to some hesitation from sellers when it comes to transacting with them. “It is an interesting paradox” comments Kevin Coleman, Founder of Cape Redan. “On one hand, there are fewer buyers in the current market, so sellers welcome Independent Sponsors. On the other hand, capital is expensive and more scarce, which sellers recognize, so they are more skeptical of Independent Sponsors.” To succeed, Kevin suggests that “it is more important than ever for Independent Sponsors to have strong backers and callable capital.”

Ability To Finance Deals

The surveyed Independent Sponsors unanimously agreed that the ability to finance deals is critical for success due to the historic concerns associated with it. According to Neil Schaefer, Managing Partner of Auricle Capital Partners, “There are legacy concerns about Independent Sponsors not being able to raise required financing.”

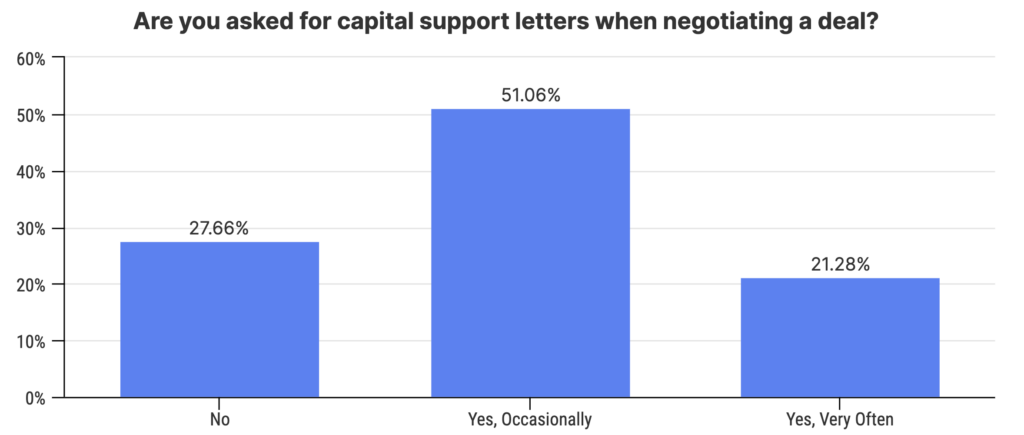

When polled, 72% of survey respondents indicated that they are asked for capital support letters when negotiating a deal, suggesting that the legacy concerns that Neil alludes to are widespread.

The lack of unpooled capital continues to remain a struggle according to Scott Galletti, Managing Partner at GraceCap Investors. He says, “Independent Sponsors are gaining mental mindshare with business owners and sell-side M&A advisors, but the lack of a dedicated pool of capital can sometimes be an issue they initially struggle with getting their minds around.”

Despite the lack of dedicated commitments, Independent Sponsors are increasingly able to source capital from institutional sources. “More institutional partners are willing to help support Independent Sponsor deals,” says Al Bhakta, Principal at CMG Companies. Limited partners are gravitating towards Independent Sponsors given their lower management fees, and the flexibility that comes with co-investing on a deal by deal basis.

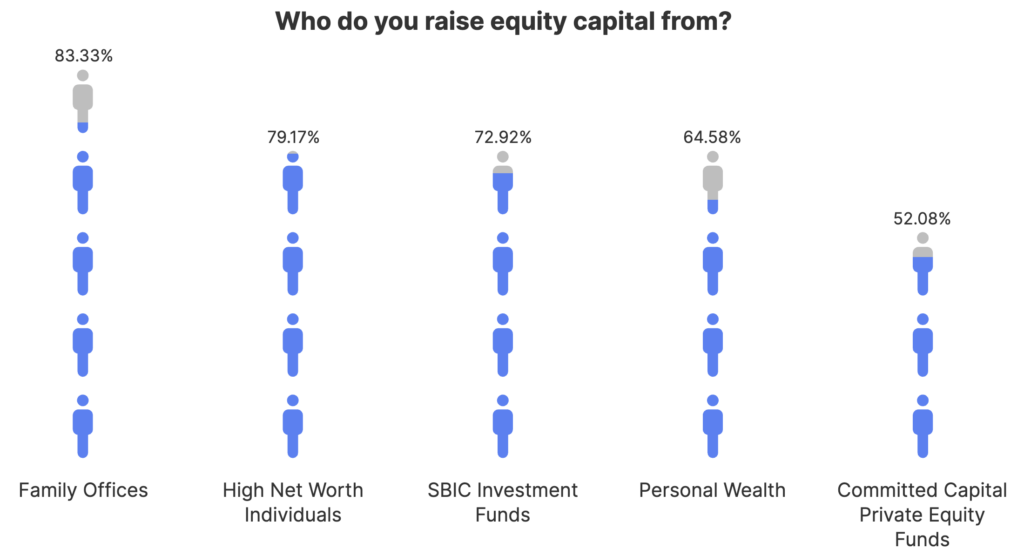

The prominence of institutional capital in the Independent Sponsor community is evident based on survey responses. Family Office and SBIC Investment Funds rank in the top 3 sources of equity financing for Independent Sponsor deals.

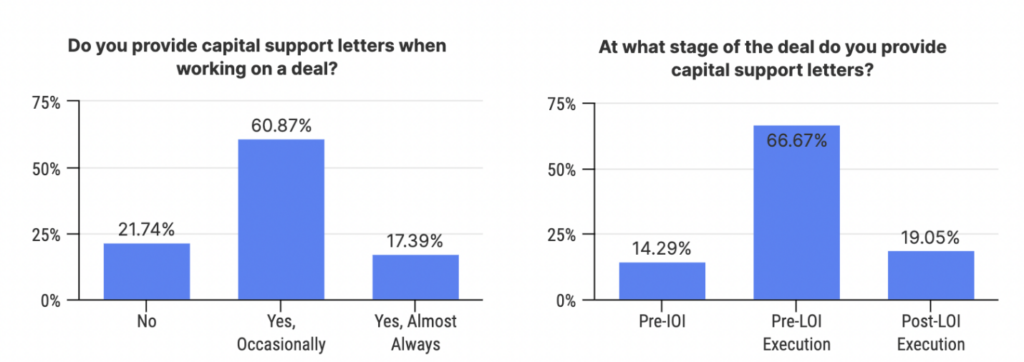

In addition to lining up robust financing, transparent communication with sellers is also crucial. According to Jonathan Slonim, Managing Partner of Ilion Capital Partners, “It’s important to be able to bring a credible approach to financing at or before the LOI phase in order to give confidence. We pride ourselves on only committing to things that we know we can do, but transparency is critical.”’

Like Ilion Capital Partners, many Independent Sponsors are able to increase transparency with sellers by providing capital support letters. In fact, 78% of survey respondents indicated that they proactively provide support letters to sellers in order to instill confidence in their ability to finance deals. Of the respondents who do provide these letters, 67% indicated that they do so prior to the execution of a letter of intent.

Ability To Demonstrate A Track Record

The ability to demonstrate a track record plays a critical role in the driving success of Independent Sponsors. This can be in the form of transaction experience at a prior employer, or a track record of acquisitions in their current entrepreneurial pursuits. According to Nicholas Osborne, Managing Partner of Artinia Group, “Many M&A advisors are familiar and comfortable with the model if you have existing portfolio companies or investing experience to fall back on. Business owners often are not familiar with it and need help to understand what the implications are.” Effectively articulating prior experience is key for Independent Sponsors to build credibility with unfamiliar business owners.

Jonathan Saltzman, Managing Partner of Torque Capital, agrees with this sentiment and comments, “Independent Sponsors that have owned and operated businesses through cycles are preferred partners for their flexibility, stability and resilience.”

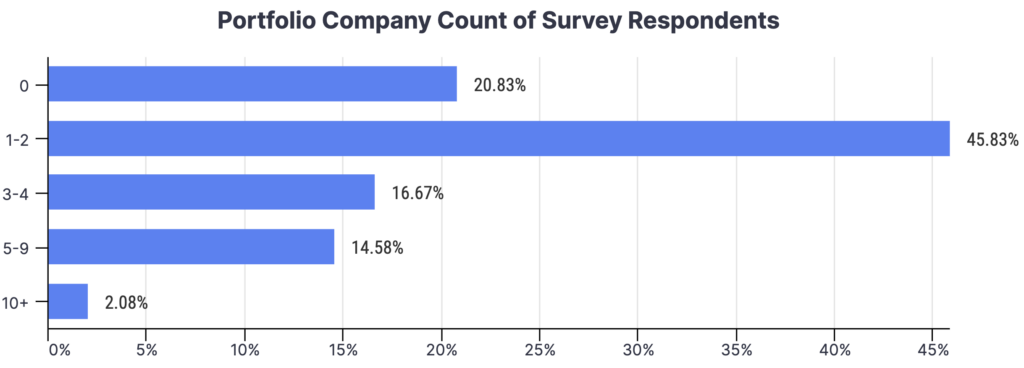

Roughly 80% of surveyed Independent Sponsors have one or more active portfolio companies, which makes it easier for them to create a sense of comfort for business owners & their M&A advisors. However, working towards the first deal can be an uphill battle. Regardless of how many companies have been acquired, it is critical to continue “building relationships, educating sellers, and clearly communicating you are here to get a deal done,” says Ajay Amin, Principal at CMG Companies.

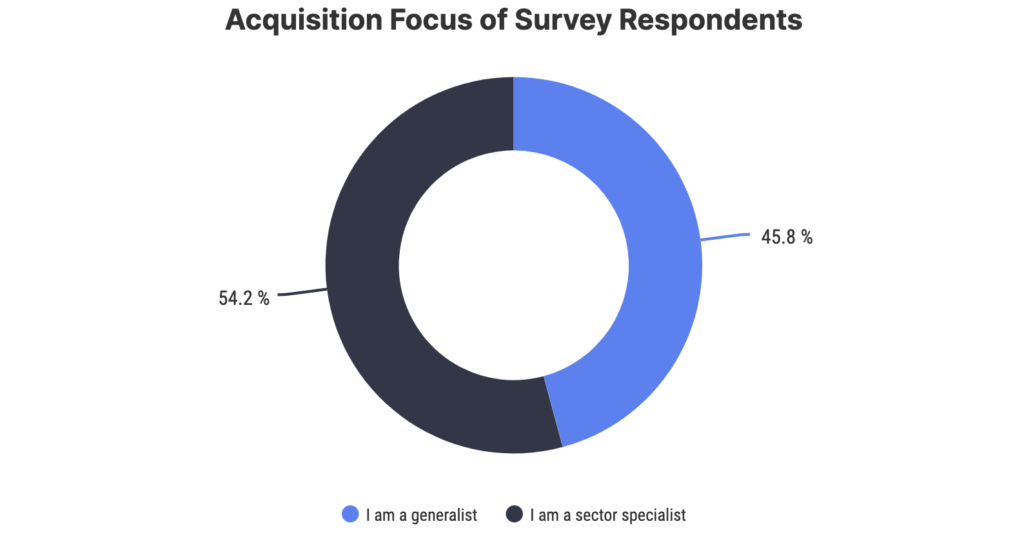

The investment approach of the Independent Sponsor community is a tale of two halves, with 54% indicating a sector specialization and 45% indicating a generalist approach.

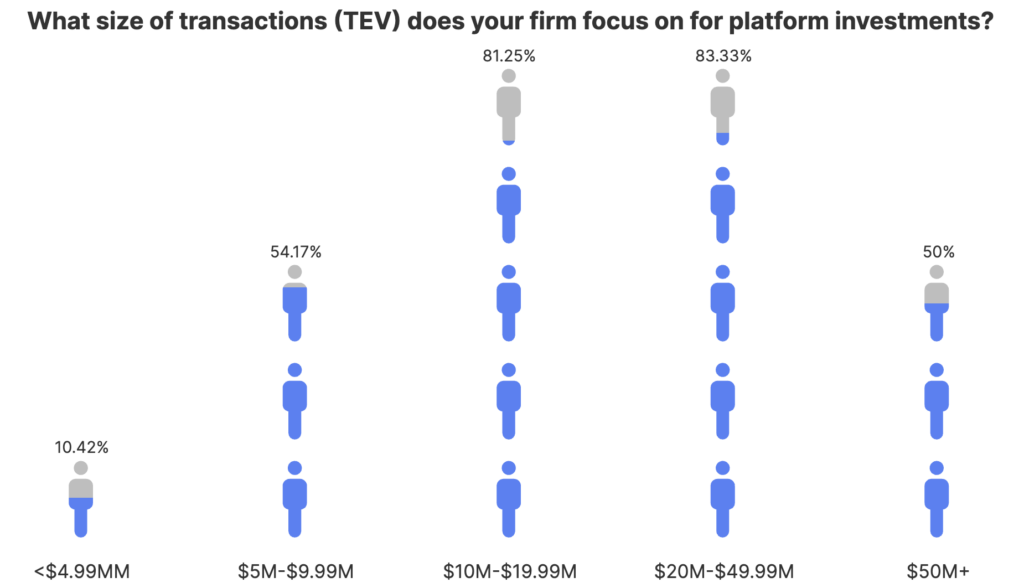

For platform investments, $5M-$50M serves as the broader range of interest for transaction size, and the $10M-$50M TEV threshold serves the optimal deal size with over 80% of Independent Sponsors indicating it as a range of focus for them.

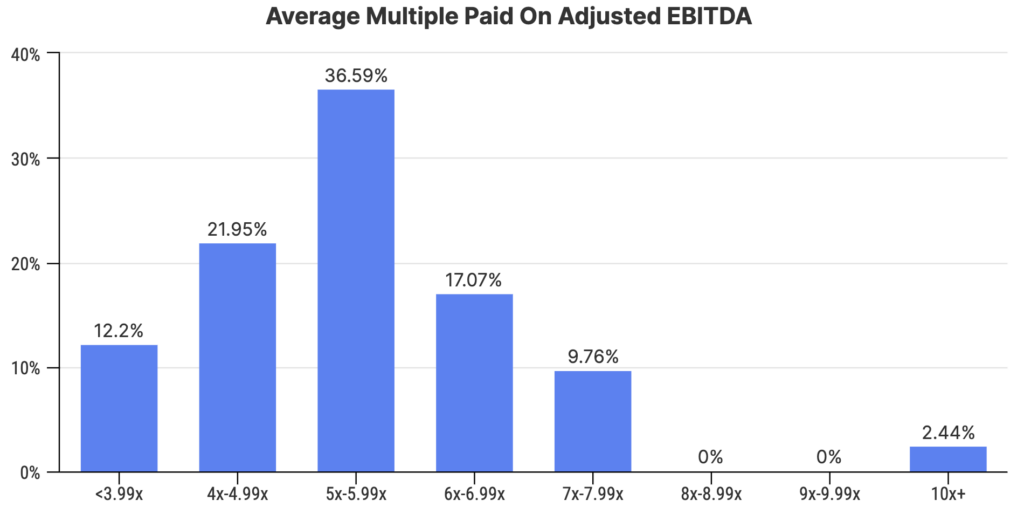

The average multiples paid on adjusted EBITDA range from less than 3.99x to greater than 10x for the sponsors who have completed one or more transactions. However, 75% of Independent Sponsors indicated that they paid an average multiple in the range of 4x-6.99x, suggesting that it is the optimal range.

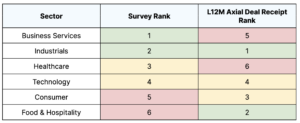

From a sector of interest perspective, Business Services, Industrials, and Healthcare rank as the top 3, followed by Technology, Consumer, and Food & Hospitality. Overlaying these indicated interest areas with Axial platform data suggests that there is a discrepancy between the interest of Independent Sponsors and the deals that were shared with them over the last 12 months.

As seen in the chart below, Business Services ranks as the #1 sector for interest but the #4 sector for the deals received. On the other hand, Consumer and Food & Hospitality rank as #5 and #6 for interest but rank as #2 and #3 for deals received by Independent Sponsors.

While Technology holds steady for both interest and deals received at #4, Healthcare ranks as #3 for sectors of interest but #6 for deals received.

Axial’s survey also suggests that various factors drive the creation of theses in the Independent Sponsor community.

Some firms like Amalgam Capital rely on their domain expertise to determine the sectors they target. Phil Lynch, Managing Director of Amalgam Capital comments, “Where we can make the most impact is where we focus; primarily based on our experiences.” Cascadilly Partners also follows a similar approach. Josh Susser, Founding Partner of Cascadilly Partners, says that the “experience of our firm’s partners guides sector focus.”

|

Investment Focus Driven By Domain Expertise |

|

| “CMG’s approach is to seek tier-one, multi-unit opportunities that have withstood the challenges of multiple economic cycles and emerged even stronger. When considering investment options, we look for brands that have honed their operational efficiency, brand recognition, and customer loyalty. They consistently deliver exceptional products and services, creating a strong competitive advantage in their markets.”

– Ajay Amin, Principal, CMG Companies |

“We focus on B2B software that rely on enterprise sales; as a result, we focus on developer tools, infrastructure software, open source, cybersecurity, and some enterprise application software.”

– Dennis Huang, Head of Origination, Polychrome |

Other sponsors keep a strong pulse on macroeconomic trends for sector selection. “We look for sectors with tailwinds that should drive above-nominal GDP growth, highly predictable revenue business models, and sustainable free cash flow margins (typically >15%)”, comments Ali Evans, CEO of Metamora Growth Partners. Greg Ellena, follows a similar approach at his firm, Palo Verde Search Group. He says, “Our thesis is based on our team’s world view of macro economic trends, attractive industries, and fundamental business parameters.”

|

Investment Focus Driven By Macroeconomic Trends |

|

| “We are actively seeking out sectors that are highly fragmented, yet resilient in the face of economic recessions. These industries should not only offer enticing financial potential upon consolidation but also be propelled by positive sector-specific momentum. A key part of our strategy involves implementing our proven ‘LP First Playbook’. This playbook, with its strategic operational enhancements, has a track record of creating shareholder value by boosting margins and driving revenue growth, further enhancing the attractiveness and profitability of platforms we invest in.”

– Thomas Ince, Managing Director, LP First Capital |

“We look for industries with strong secular tailwinds and a strong value proposition, that are fragmented (no dominant players and a lot of acquisition candidates), good cash flow characteristics and a simple industry we can credibly manage”

– Corey Obermayer, Partner, Pillar49 Capital |

Many sponsors also refine their theses by incorporating a growth flywheel strategy after they make their first acquisition. The growth flywheel emphasizes the importance of customer-centricity of acquisition targets and the power of positive customer experiences in driving sustained growth. Incorporating a flywheel strategy can create a virtuous cycle that reduces customer acquisition costs, increases customer lifetime value, and establishes a competitive advantage across portfolio companies.

|

Investment Focus Driven By A Flywheel Strategy |

|

| “We love it when we see companies that serve customers that we know from other parts of our portfolio. That can create a real flywheel for growth.”

– Jonathan Slonim, Managing Partner, Ilion Capital Partners |

“We are focused on picks and shovels of technology and can companies benefit from the Columbia River Partners Flywheel.”

– Nathan Chandrasekaran, Partner, Columbia River Partners |

The surveyed Independent Sponsors unanimously indicated using more than 1 deal sourcing channel to identify potential investment opportunities. Sharing the sentiment of many Independent Sponsors, Dennis Huang of Polychrome says, “It’s still a numbers game. Some platforms like SourceScrub and Axial help uncover companies, but timing is equally important. Greater deal origination requires a wide top of funnel, you always need to have multiple irons in the fire.”

Sell-Side Intermediaries rank as #1 with 83% utilization, while Deal Networks and Proprietary Sourcing rank as #2 and #3 respectively with 77% and 75% of survey respondents utilizing them. Buy-Side Advisors rank as the least popular channel with only 33% adoption by Independent Sponsors.

| Channel | Rank | Percentage of Survey Respondents Who Utilize The Channel |

| Sell-Side Intermediaries | 1 | 83.33% |

| Deal Networks | 2 | 77.08% |

| Proprietary | 3 | 75.00% |

| Buy-Side Advisors | 4 | 33.33% |

The channel of preference varies on a sponsor by sponsor basis, with many respondents being bullish on more than one of them. The anecdotes below highlight some opinions of Independent Sponsors on their channel of preference.

| Sell-Side Intermediaries | Deal Networks | Proprietary |

| “Deal brokers often generate the most results, but it can be quite competitive for the truly differentiated companies. Proprietary outreach and searching can yield the most promising results, but finding the right company at the right time in their development lifecycle can sometimes feel like finding a needle in the haystack.”

– Nicholas Osborne, Managing Partner, Artinia Group |

“Brokered deals tend to close with a higher level of certainty. A purely proprietary deal is a sure sign that the owners were not thinking about selling until you showed up.

What changed all of a sudden? Deal networks like Axial can be a great way to get access to investment banks that might not otherwise be on our radar, and increase our volume of deal flow.” – Jonathan Slonim, Managing Partner, Ilion Capital Partners |

“Proprietary deals generate the best results because you can be as proactive as you want vs having a reactionary approach.”

– Kevin Coleman, Founder, Cape Redan |

| “Brokers generate the best results due to the filtering they do for businesses that are ready to sell.”

– Ken Nguyen, Vice President, Evolution Strategy Partners |

“Deal networks are a great way for a new Independent Sponsor to establish relationships with the intermediary community. Warm referrals from any source generate the best results, usually because the referral is directly to a key decision maker.”

– Luke Phenicie, Founding Partner, Kissel Capital |

“Cold outbound is best. You have to put in the work to have good messaging, but a carefully crafted message to a target you’ve determined is a good fit almost always yields a response.”

– Dennis Huang, Head of Origination, Polychrome |

| “Bankers & Brokers are the most effective. Retaining an intermediary shows commitment from a seller.”

– Josh Sartisky, Partner, Marigny Investments |

“Lower middle market sell side advisors and Axial generate the most deal flow. Axial’s reach is impressive and allows us to see deals we would never otherwise see.”

– Scott Galletti, Managing Partner, GraceCap Investors |

“Proprietary/relationship driven due to the organic nature of the deal flow to get everyone aligned and comfortable ahead of any economic incentives.”

– Al Bhakta, Principal, CMG Companies |

| “Brokers have sellers who are at least somewhat prepared mentally & financially for a transaction.”

– Greg Ellena, Founder, Palo Verde Search Group |

“Proprietary channel is a must-have to network in the industry, talk to owners and get to know the industry. However, finding a buyer of the right size, team and willingness to sell in a proprietary process is challenging, so most actionable deals are through a broker or online channel.”

– Corey Obermaye, Partner, Pillar49 Capital |

“Proprietary (direct owner outreach) and inbound leads generate the highest quality opportunities because we are able to vet the industry and companies ahead of time.”

– Ali Evans, CEO, Metamora Growth Partners |

The three common challenges associated with getting deals done include lacking focus & differentiation, dealing with first time sellers, and bridging the gap between valuation expectations.

| Lacking Focus & Differentiation | Sellers’ Knowledge of The M&A Process |

Valuation Expectations |

| “Focus – there are so many opportunities that a lack of focus can make you lose track of deep networking or creative solutions that can save or win a transaction”

– Corey Obermaye, Partner, Pillar49 Capital |

“The greatest challenge is the seller’s knowledge of the M&A process. Most sellers have never sold a company before so seemingly normal parts of the process can be a significant issue for them.”

– Ali Evans, CEO, Metamora Growth Partners |

“Inflated valuation expectations and unrealistic adjustments by sellers and bankers are the greatest challenge.”

– Phil Lynch, Managing Director, Amalgam Capital LLC |

| “Definitely differentiation. There are so many new Independent Sponsors in the market, it’s hard for the intermediary community to keep track of them all.”

– Luke Phenicie, Founding Partner, Kissel Capital |

“Sellers new to the M&A process. Concepts considered standard may not seem that way to sellers and need to be addressed as much as possible early in the process.”

– Josh Sartisky, Partner, Marigny Investments |

“Sellers expectations are often guided too high relative to current operating performance”

– Josh Susser, Founding Partner, Cascadily Partners |

Both recently and historically, Axial has helped Independent Sponsors overcome the challenges laid out above through its deal origination platform and content publications.

Axial’s deal origination platform has three critical components that have generated traction within the Independent Sponsor segment. All of these contribute to an added layer of focus and differentiation within Independent Sponsors’ deal searches.

Axial has two core strategies to help bridge the knowledge gap with first time sellers:

In the second half of 2022, Axial launched The Winning LOI series, a bi-monthly publication that surfaces the winning bids of Axial-sourced transactions, with a focus on key deal terms, including financials, multiples, earn-out structures, and deal-specific diligence requirements. All data is fully anonymized to protect the confidentiality of Axial members and transactions. Both sellers and Independent Sponsors can leverage this data to better understand the valuations and deal structures of comparable businesses that recently sold in the market.

Despite the increasingly positive shift in perception of the Independent Sponsor community, there continue to be legacy concerns from sellers related to having relevant experience and raising the required financing. To succeed, it is important to build relationships with credible capital providers as early as possible, and communicate transparently with sellers about your objectives and experiences.

To successfully do both of the items laid out above, it is important for Independent Sponsors to build a well-defined thesis that allows them to make more informed choices, mitigating the impact of biases and emotions. The thesis also serves as a valuable communication tool to help build trust and credibility with potential investors, who can evaluate the sponsor’s thesis to determine if it aligns with their own investment goals.

The thesis also provides a framework for Independent Sponsors to identify and evaluate potential acquisition opportunities. Originating relevant deals is a numbers game, so it is important to utilize multiple channels in order to uncover as many opportunities as possible.

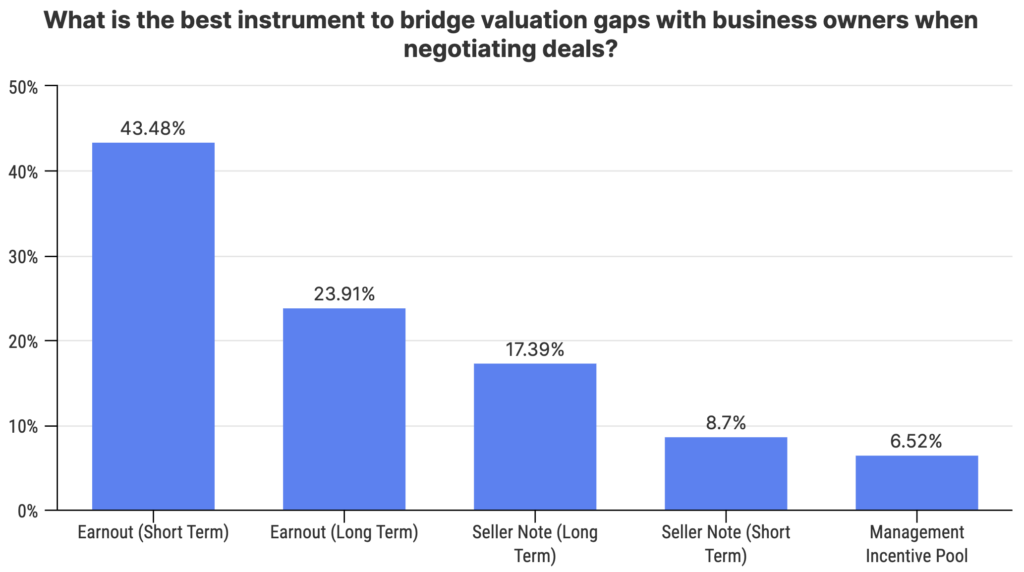

To overcome the challenges with getting deals done, it is critical to address the seemingly normal parts of the M&A process as early as possible with sellers. Bridging the valuation gap is also critical, and it can be done effectively by structuring the deal to include an earn-out, a seller note, or a management incentive pool.

| Earn Out | Seller Note | Management Incentive Pool |

| “If you need to bridge a valuation gap, an earnout may be the only solution. Small sellers are not always familiar with the earnout concept, and their advisors are often not sophisticated. In order to get a seller note or earnout into a deal, there has to be a mutual give and take on valuation and other terms.”

– Jonathan Slonim, Managing Partner, Ilion Capital Partners |

“When a seller has a large amount of capital still in the deal as a seller note, they are very incentivized to think longer term to make a deal work. Earn outs can be too short term in focus and can also sometimes be easily gamed.”

– Scott Galletti, Managing Partner, GraceCap Investors |

“We have a long hold period, and our model requires that we work closely with management. So the more invested management is via equity alongside us, the more aligned we are.”

– Dennis Huang, Head of Origination, Polychrome |

| “An earnout ensures that valuation itself is not focused on just cutting and running, but rather ensuring ongoing stability of the underlying business while then growing the business on top of it. We invest in the core business and it is crucial it remains intact and performing, not just buying the peak.”

– Phil Lynch, Managing Director, Amalgam Capital, LLC |

“As a buyer, we are paying for past performance of the business. The future of the business is in the buyer’s hands. As a result of that reality, it is critical for the seller to have enough skin (seller note) in the game to offset the risk of hidden information. If, for example, the seller misrepresents EBITDA by not writing off bad inventory then the seller note has to provide a reasonable level of security to cover the size of the issue on an annual basis times the purchase multiple. A complimentary definitive agreement + seller note terms are required for this path to be effective.”

– Greg Ellena, Founder, Palo Verde Search Group |

“Equity rollover of active business owners maintains significant upside for them longer term”

– Josh Susser, Founding Partner, Cascadily Partners |

While the best instrument to bridge the valuation gaps varies on a deal by deal basis, the anecdotes above can serve as a helpful guide as to why and how each of them can benefit a deal structure.

Axial is the trusted deal platform serving the lower middle market ($5-$250M TEV).

Over 3,500 advisory firms and 2,000 corporate and financial buyers have joined Axial to efficiently connect with relevant capital partners, source actionable deals, and build new relationships.

Visit the Member Closed Deals page to see selected transactions that have been sourced and closed via Axial.