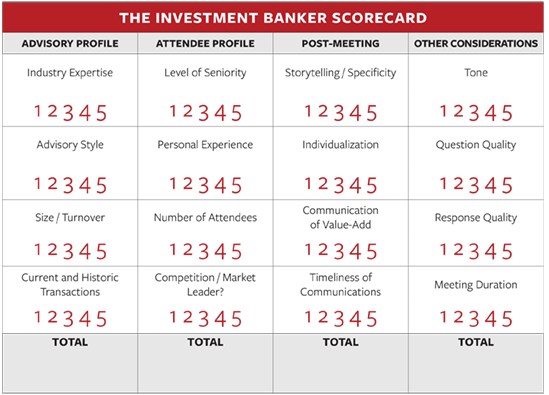

Like most M&A activities, there is no perfect formula for choosing an investment banker or M&A advisor. As CEO, you may know you need an intermediary, but have no guide for navigating the courting process. After hundreds of calls with CEOs, I devised the following scorecard to help you make sense of cultural fit and indicators for future success before signing an agreement with an intermediary group.

Use this scorecard as an internal tool to benchmark one intermediary group from another. After meeting with an investment bank, you can score the bank’s performance in each stage leading up to exclusive engagement. This exercise, if nothing else, can help you discover your preferences and place emphasis on the categories that are most impactful to your business outcomes.

The score for every category should total at least 12, otherwise there is likely not a long-term fit between your company and the bank. As CEO, this scorecard can help you feel confident about picking up the pen and signing an investment banking engagement agreement.

Download as a PDF here.

Here are some questions to consider as you score each investment bank in the categories on the scorecard. (If you’re an intermediary group, you might also use this scorecard to evaluate your own performance with potential clients.)

Advisory Profile

- Industry Expertise

- How well does this group understand my business and the things that impact it on a daily basis?

- Have they ever successfully navigated a transaction in this industry in the past?

- Advisory Style

- How appropriate is their engagement structure for my needs?

- How fair is their fee structure?

- How much time should I anticipate spending with this group per week?

- Size / Turnover

- Does the team have high turnover or limited resources that might affect the success of the transaction?

- Current and Historic Transactions

- What is the firm’s bandwidth to dedicate time/resources to my company, versus another client?

- How many transactions have they intermediated in the past and did those follow the proposed timeline?

Attendee Profile

- Level of Seniority

- Does the firm have a director-level member of the team to dedicate to my transaction?

- Will that person be the main point of contact moving forward?

- Personal Experience

- Is the investment banker sitting across from me personally responsible for successful transactions, or speaking on behalf of the firm?

- How well does he or she provide anecdotal information about experience?

- Number of Attendees

- How many people did they take out of the office to meet with me?

- Competition / Market Leader?

- Has this firm ever worked with a company I compete with?

- How well-regarded are they among the other investment banks in their geography or industry?

Post-Meeting

- Storytelling / Specificity

- How well does the firm understand my company’s story and both past and future plans?

- How confident do I feel that the firm is committed to our specific strategic initiatives?

- Individualization

- Did the bank specialize their outreach to me or address the executive team and me as a group?

- Communication of Value-Add

- How well did the firm or banker communicate the services and value that would be delivered as a result of our exclusive engagement?

- Timeliness of Communications

- How long after the meeting were next steps and expectations delivered back to me?

Other Considerations

- Tone

- Did our two groups achieve peer-voice?

- Does their tone match mine during uncomfortable scenarios or questions?

- Question Quality

- How strong were the questions they asked me?

- Response Quality

- How well did they answer the questions I asked?

- Meeting Duration

- Was the firm respectful of my time and bandwidth?

- Were there inefficiencies before or during the meeting that would potentially be an annoyance or deterrence in the future?