Small Business Exits: May closed deal data

Welcome to the May edition of Small Business Exits, the monthly publication featuring fully anonymized deal data from a selection…

Accountants, attorneys, and advisors are non-negotiable members of most deal teams.

For owners of any M&A experience, an advisor is crucial. They maintain a specialized Rolodex of contacts. They have a breadth of experience selling businesses. They allow a business owner to maintain focus on running the business during a transaction. They are expert negotiators. And they absorb anxiety during the complex and often a stress-inducing process of selling a business.

For owners of lower middle market businesses, it can be difficult to decide which type of advisor is best suited for your business, your unique transaction objectives, and your personal preferences.

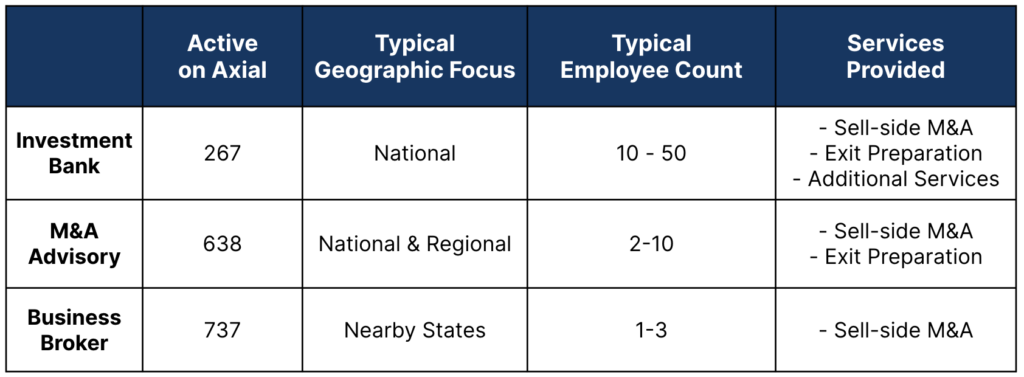

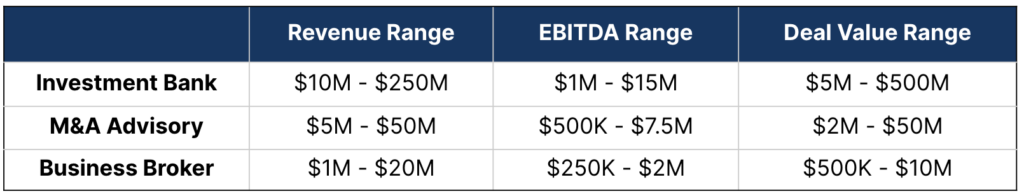

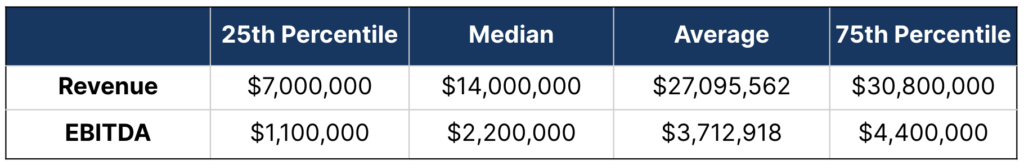

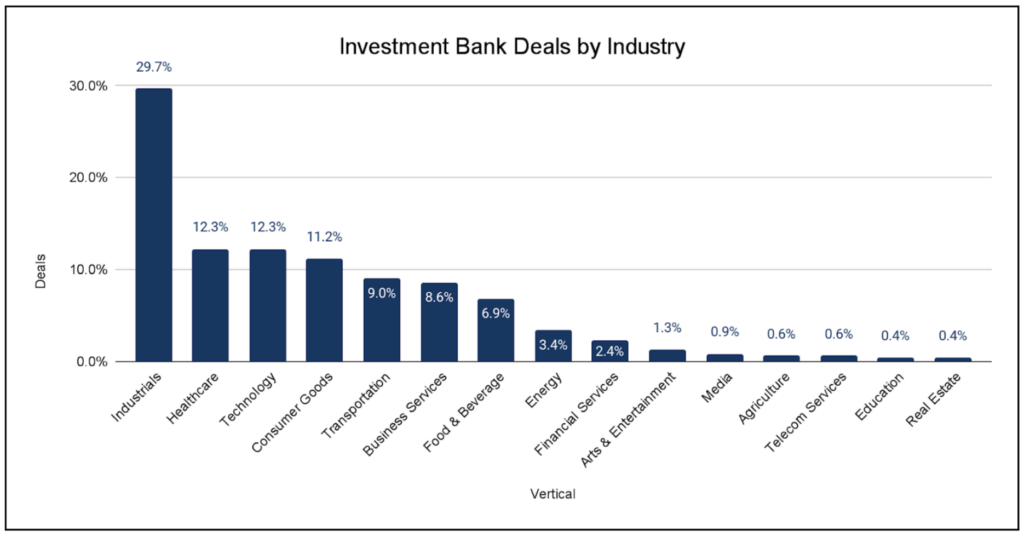

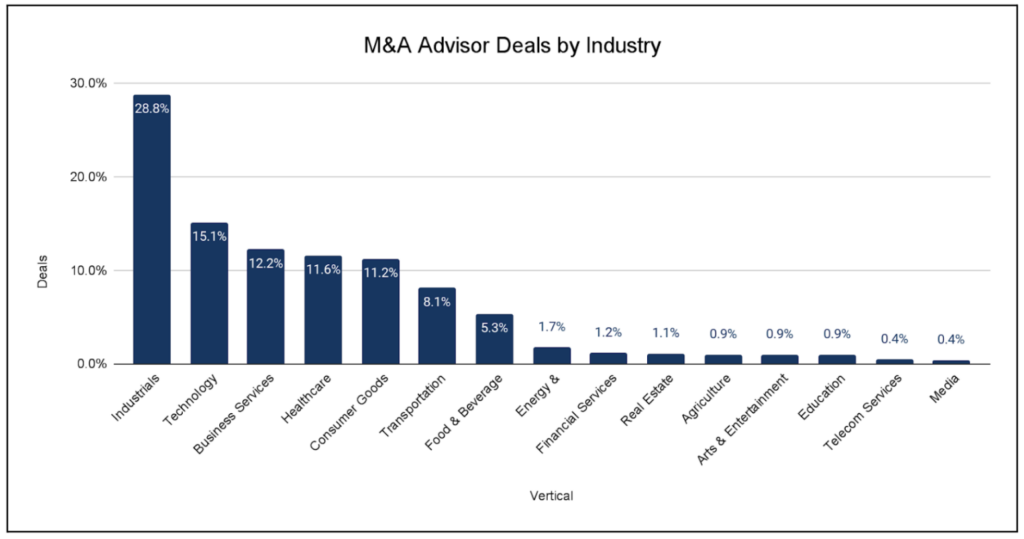

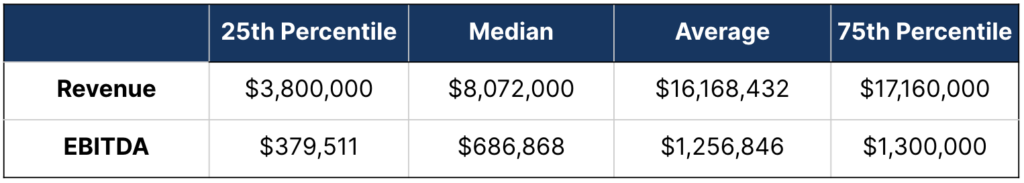

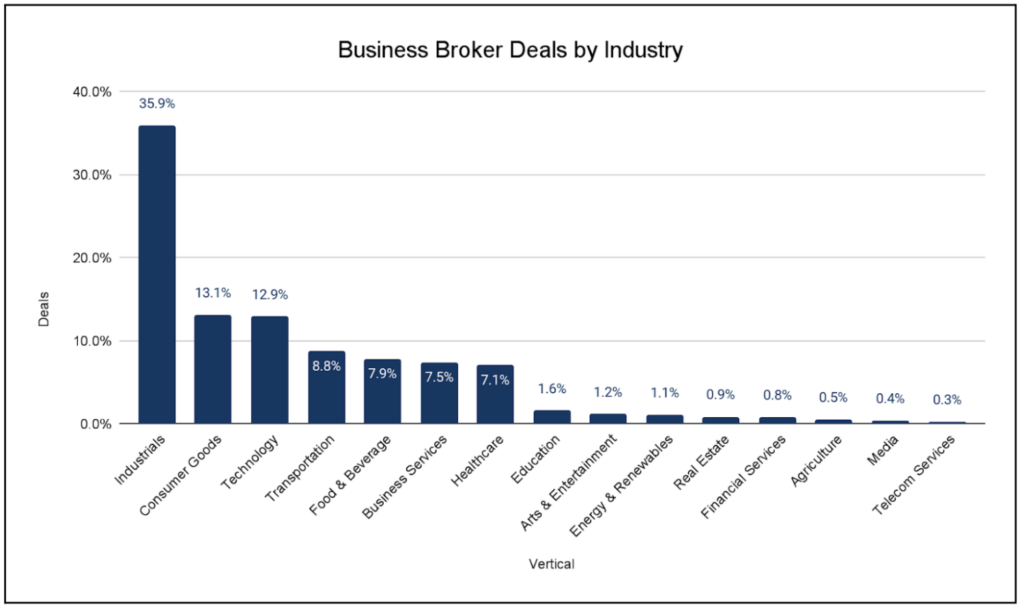

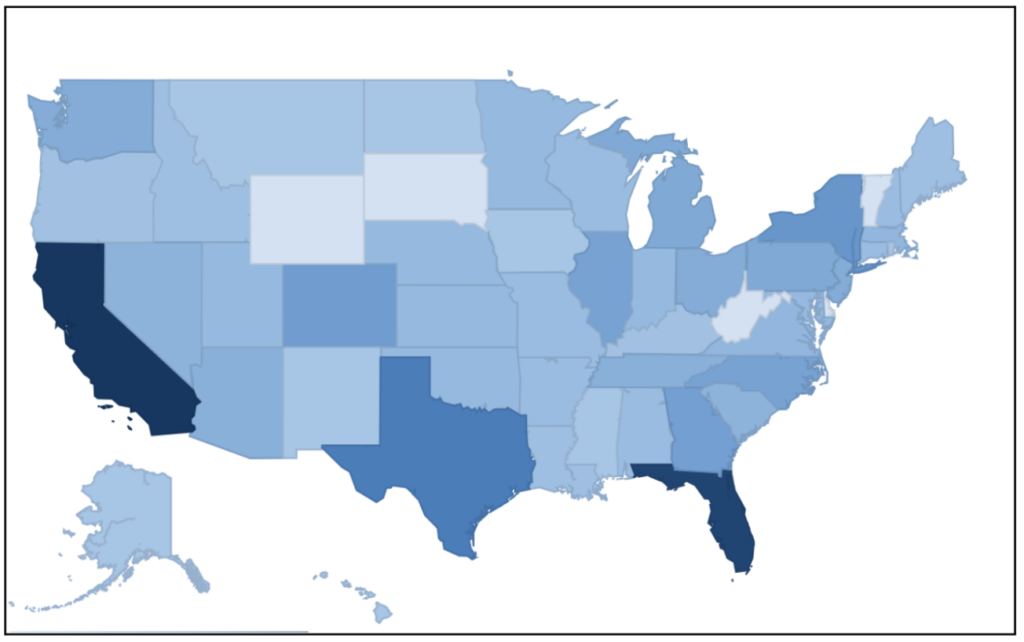

For this reason, we wanted to surface some helpful Axial platform data that highlight some differences between investment banks, M&A advisors, and business brokers.

As part of Axial’s Advisor Finder program, we help business owners evaluate the differences between these firm types, as well as find the best options when it’s time to make a hiring decision.

Find an M&A advisor you can trust with Axial's Advisor Finder