LMM Deal Digest: June 2025

Welcome to the Q1 2025 issue of The Advisor Finder Report, a quarterly publication that surfaces the activity occurring on Axial in conjunction with our Advisor Finder offering.

Axial’s Advisor Finder program helps owners identify the most relevant and credible M&A advisors so they can transact successfully.

Advisor Finder utilizes 15 years of platform data to confidentially match business owners with advisors who have proven experience representing similar businesses. New advisors from Axial’s network become eligible for the program based on their platform activity data and relevant experience for a given owner.

Founded in 2019, Outliant is a digital innovation agency specializing in scalable web development, UX/UI design, and marketing solutions for enterprise clients, with a strong focus on franchise and multi-location brands.

In December 2024, Outliant’s founders leveraged Axial’s Advisor Finder program to identify and hire a sell-side advisor. After interviewing three firms, the founders hired Potomac Business Capital on January 27, 2025.

Outliant’s founders were seeking a fast, clean exit to focus on their other business venture, a rapidly growing telehealth business – roughly 10x the size of Outliant. Their priority was a full-cash transaction with no seller financing, earnout, or rollover equity, even if it meant accepting a lower valuation.

Understanding these goals, Todd Taskey of Potomac ran a targeted, pocket-deal process, leveraging an existing relationship and approaching Mountaingate Capital, whose portfolio company Ignite Visibility was already an Outliant client. With clear structure alignment and Potomac’s full transparency up front, the deal closed in just over 60 days after signing the engagement letter.

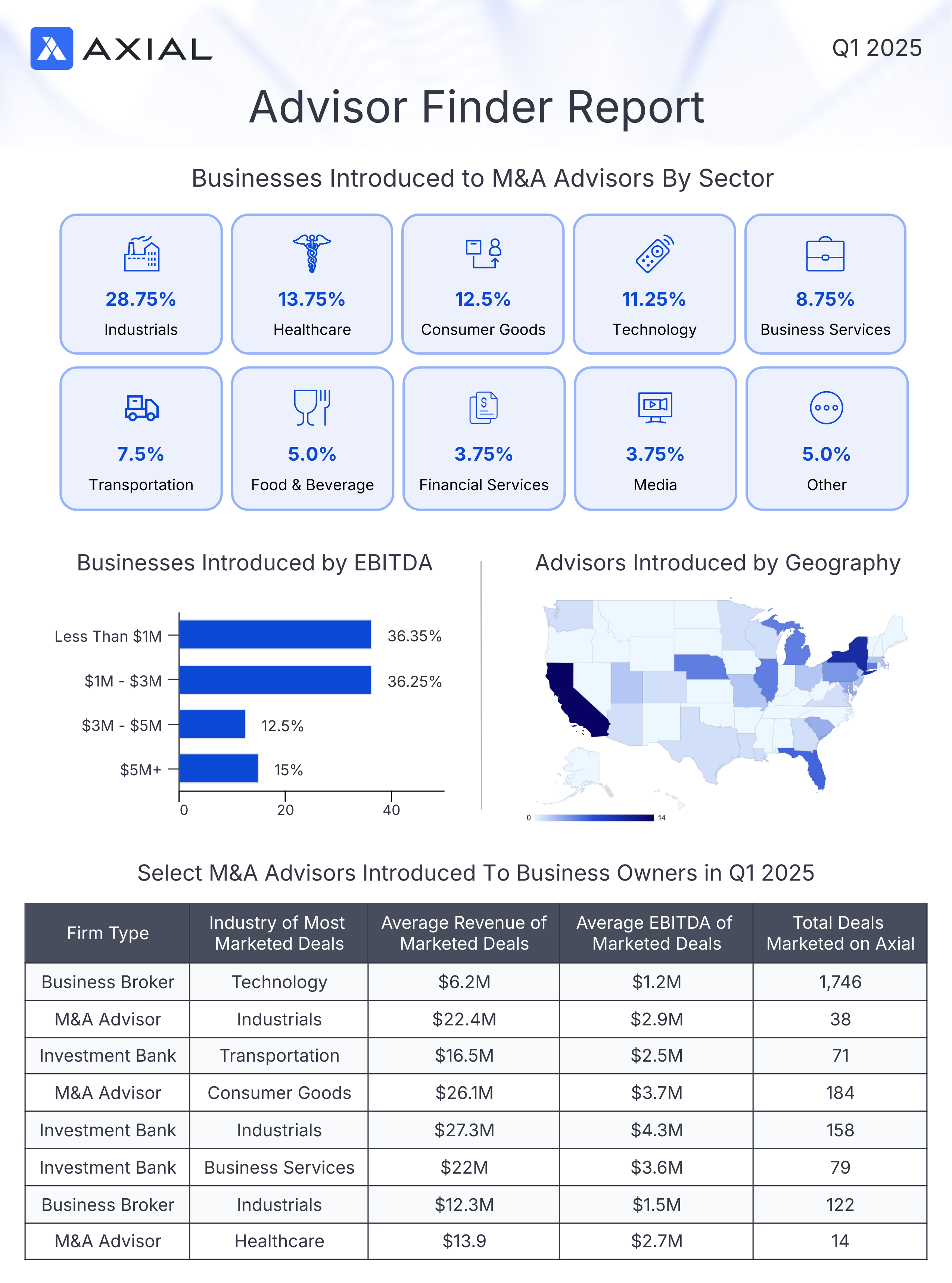

In Q1, 32 new business owners explored a sale or capital raise via Axial, and 27 M&A advisors joined Advisor Finder. There were 80 introductions facilitated between advisors and business owners — the second highest quarterly volume to date. This reflects a steady upward trend, continuing momentum from previous quarters (e.g., 73 in Q4 2024, 70 in Q3 2024). 11 unique industries were represented, with Industrials and Healthcare ranking in the top 2, representing 42.5% of total introductions.

Below, we have created a set of tearsheets that lay out a complete breakdown of Advisor Finder activity in Q1 2025. All data is fully anonymized to protect the confidentiality of the owners and advisors. Feel free to share and incorporate the data into your materials as you see fit.

Exit Ready is the Axial newsletter that distills the best content, tips, and guides designed to educate exit-minded business owners running $5-$100M businesses.

To subscribe, please enter your email below.