Top 25 Lower Middle Market Investment Banks | Q1 2024

Axial is excited to release our Q1 2024 Lower Middle Market Investment Banking League Tables. To assemble this list, we…

Advisors, Family Offices, Lenders, Private Equity

Tags

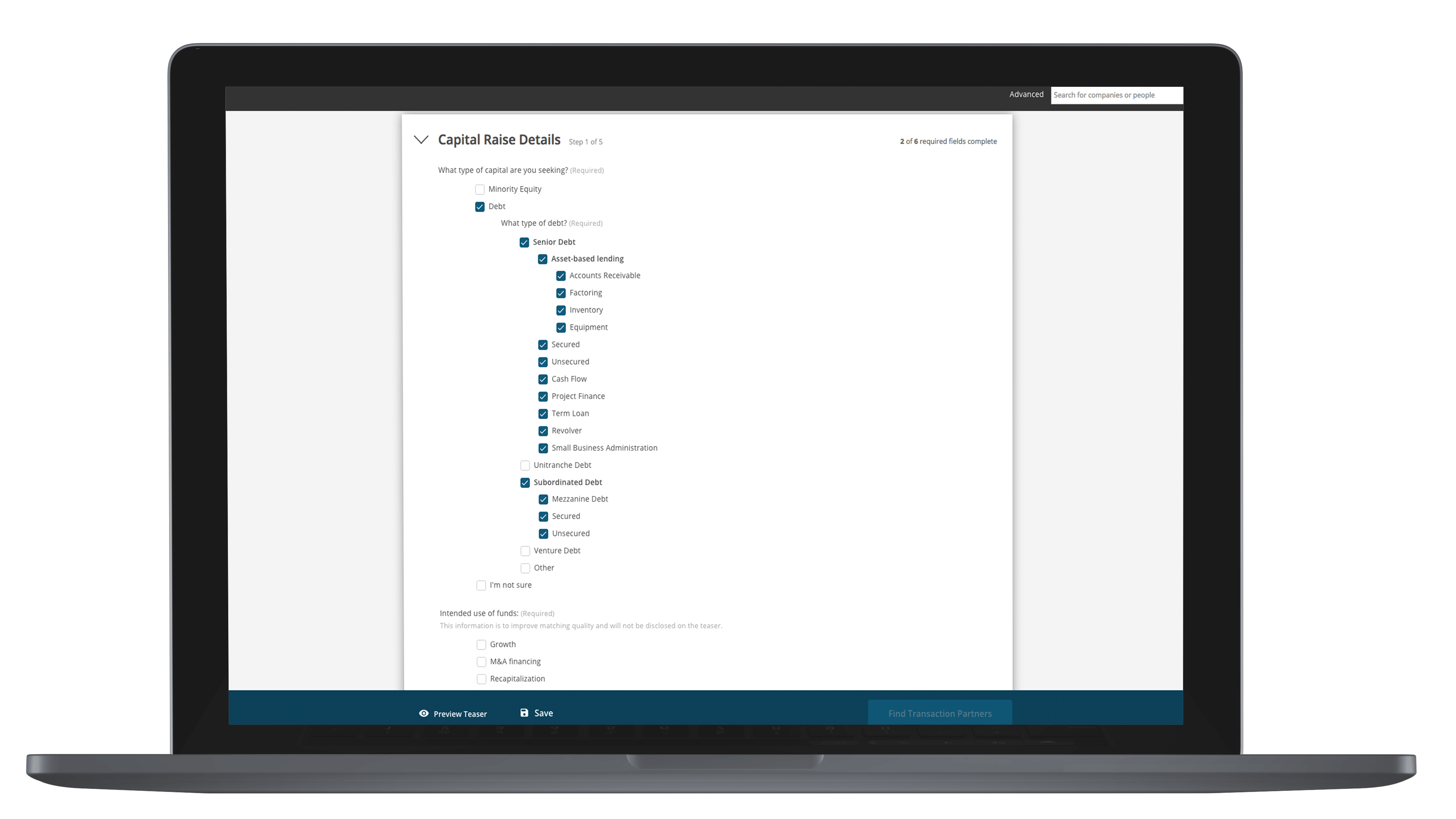

Whether you’re an investment banker looking to raise debt for your client or a private equity firm looking to take on debt to acquire a business, debt plays a critical role in growing companies and unlocking M&A. That being said, there are various types of debt to consider, and at Axial, we wanted to improve how our members considering debt were matched on our network.

That’s why we updated our debt types and debt matching engine to allow for greater precision, so you can connect with most relevant partners.

Some members aren’t familiar with the intricacies of different debt structures. We give capital raisers the option to say they are “not sure” about the kind of debt they need, and give lenders the ability to control whether they want to be recommended to such potential customers.

Senior debt: borrowed money that a company must repay first if it goes out of business. Senior debt is a company’s first level of liabilities, typically secured by some type of collateral.

Unitranche debt: usually used to facilitate a leveraged buyout. It’s a combination of senior and subordinated debt, and it was created to simplify debt structure and accelerate the acquisition process. It’s split between secured and unsecured instruments.

Subordinated debt: also known as junior security, lenders who own subordinated debt are only paid out after senior debt holders are paid in full, so it’s more risky, but are paid before any equity holders.

Venture debt: a form of debt financing for emerging venture-backed companies. Think of it as a way of financing startups that are “in between” more traditional VC financing rounds.

Again, if you are looking for debt and not sure what structure is the best fit for you, simply select “I’m not sure”.

As always, if you have any questions or feedback, I’d love to connect – reach me at [email protected]