Axial’s Take – Plumbing & HVAC Millionaires [from WSJ]

A recent Wall Street Journal article highlighted a rising trend of millionaires emerging from skilled trades like plumbing and HVAC,…

Our publishing team at Axial is always aiming to keep readers up to date on industry trends via our various newsletters.

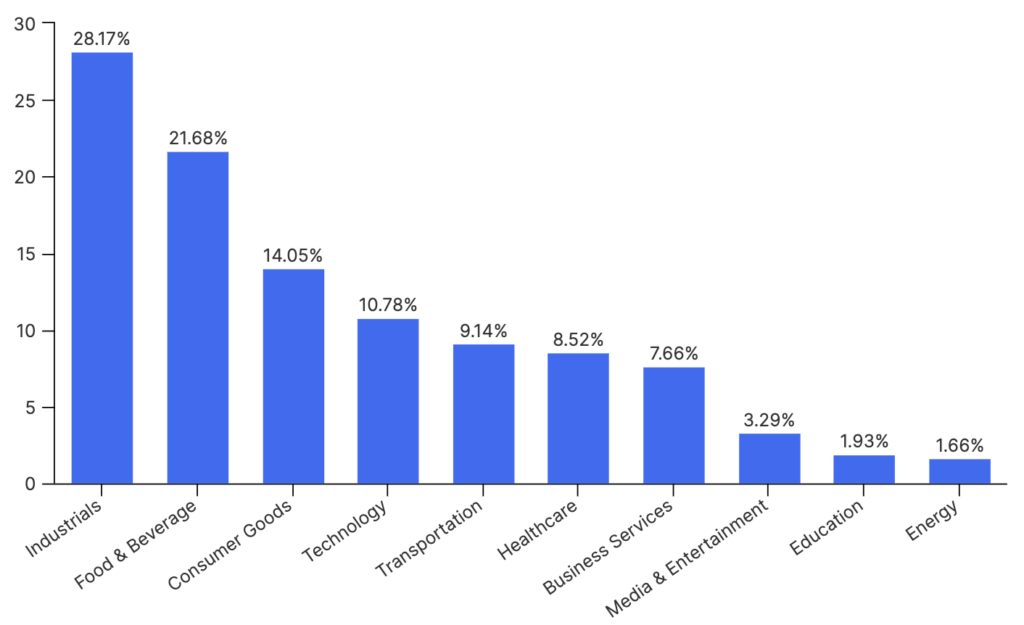

Earlier this quarter, we published a piece on the buyer types that close deals in the $0M – $3M EBITDA range, as well as our Q2 SMB M&A Pipeline that highlights industry trends using Axial platform data.

To complement these pieces, we also understand the importance of collecting and surfacing industry insights from members of Axial.

Today, we’ve aggregated 10 recently published industry reports in top deal flow industries from three of our Investment Banking Partners – Bridgepoint Investment Banking, FOCUS Investment Banking, and Peakstone Group.

These 3 firms are part of Axial’s Investment Banking Partner Program, a merit-based program driven by the quality of a sell-side member’s clients, transaction processes and outcomes on the Axial platform.

So far this year, Axial’s Investment Banking Partners (26 in total) have brought 253 new transactions to market via Axial, resulting in 3,811 signed NDAs from buyers and investors. These Partners have successfully closed 89 deals so far in 2023, according to data shared with Axial.

For additional information on the program, please see the end of this feature.

Enjoy the reports!

Partners enjoy significant additional member benefits, including:

Partners are preferred sources for featured articles and are invited to participate in Axial podcasts and expert member panels.

Axial Advisor Finder connects exit-minded business owners and portfolio company owners with M&A advisors to explore a transaction. Introductions are confidential, double opt-in, and are chosen based on prior transaction history via the Axial platform. Selection is driven by industry transaction experience, transaction size range of the business, and evidence of multiple successful outcomes.

Partners receive a dedicated Axial account manager to streamline deal creation and deal marketing, facilitate deal status updates, and maintain an up-to-date member profile on the Axial platform and public member directory.